Compound Feed Market Size (2024 – 2030)

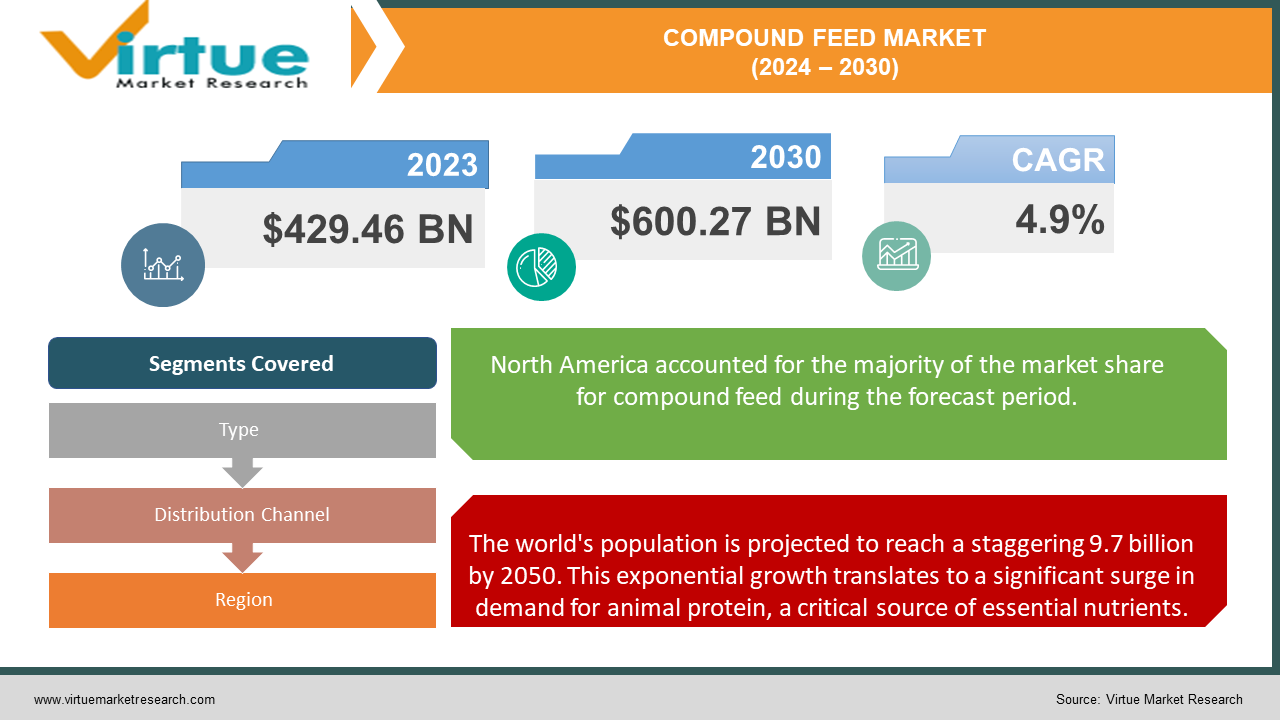

The Global Compound Feed Market was valued at USD 429.46 Billion in 2023 and is projected to reach a market size of USD 600.27 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.9%.

The compound feed market serves as the lifeblood of the global animal agriculture industry. It provides a meticulously formulated blend of essential nutrients that fuels the growth, health, and productivity of livestock and poultry. Compound feed goes beyond being just food for animals. It's a precisely designed nutritional cocktail containing various ingredients like grains, protein sources like soybean meal or fishmeal, vitamins, minerals, and additives. This meticulous formulation ensures animals receive the optimal balance of nutrients required for their specific needs, be it rapid growth, high milk production, or superior egg-laying efficiency. Modern farming practices focus on maximizing efficiency and output. This often involves intensive livestock production systems, where animals are raised in controlled environments and rely heavily on compound feed for their nutritional needs.

Key Market Insights:

Global production of compound feed is estimated to surpass 1 billion tonnes annually. This immense volume underscores the critical role compound feed plays in sustaining animal agriculture.

With a projected global population of over 8 billion by 2030, meat consumption is expected to climb by 1.7% annually. This necessitates efficient and productive livestock farming systems relying heavily on compound feed.

Modern farming practices focused on efficiency and output rely heavily on compound feed, leading to a projected market value of USD 2.2 trillion for intensive livestock production by 2027.

The awareness of animal welfare is driving a USD 28.2 billion global animal health market (2023). High-quality compound feed, rich in essential nutrients, plays a crucial role in animal health.

Climate change poses a threat to food security, potentially impacting the availability and affordability of raw materials for feed production. The global food security market is estimated at USD 1.4 trillion (2023), highlighting the interconnectedness of these sectors.

The compound feed industry is addressing sustainability concerns by exploring alternative protein sources like insect protein (projected market value of USD 1.2 billion by 2027) and single-cell protein (market expected to reach USD 5.2 billion by 2025).

An estimated 30% of produced feed globally is wasted. Technologies and practices aimed at minimizing feed waste hold significant economic and environmental benefits.

A growing segment is the organic and functional feed market, catering to animals raised under organic standards or incorporating functional ingredients for specific health benefits. The organic feed market is expected to reach USD 12.4 billion by 2027.

Compound Feed Market Drivers:

The world's population is projected to reach a staggering 9.7 billion by 2050. This exponential growth translates to a significant surge in demand for animal protein, a critical source of essential nutrients.

This growing demand presents a challenge – the "protein gap." Traditional protein sources like meat and fish may not be able to meet the nutritional needs of the expanding population in a sustainable and affordable manner. This is where compound feed steps in. By providing a balanced and efficient source of protein for livestock and poultry, it plays a crucial role in bridging the protein gap and ensuring global food security. Compound feed formulations are meticulously designed to address the specific protein requirements of different animal species. For example, broiler chickens require a high-protein diet to maximize growth rate, while laying hens need a balanced feed with essential nutrients for optimal egg production. This strategic use of compound feed allows farmers to raise animals efficiently, maximizing protein output while minimizing resource consumption. Compound feed production leverages various plant-based protein sources like soybean meal, corn gluten meal, and pea protein. This approach is generally more land-use efficient compared to directly raising livestock for protein. Additionally, by optimizing animal nutrition, compound feed helps reduce feed waste and improve feed conversion ratios (FCR). Lower FCR translates to less feed needed per unit of animal product, minimizing the environmental impact of livestock production.

Modern farming practices are increasingly focused on maximizing efficiency and output. This often involves intensive livestock production systems, where animals are raised in controlled environments with optimized living conditions and feeding regimens.

Compound feed formulations can be tailored to meet the specific needs of each animal type, breed, and even age group. This precise nutrition ensures optimal growth, milk production, or egg-laying efficiency. Balanced feed formulations rich in essential vitamins, minerals, and antioxidants can contribute to improved animal health and reduce the risk of disease outbreaks. This translates to lower mortality rates and higher productivity within livestock populations. Compound feed is typically presented in pellet or mash form, minimizing spillage and waste compared to traditional feeding methods like feeding loose grains. This translates to cost savings for farmers and a more sustainable use of resources. Intensive livestock production systems often involve controlled environments where temperature, humidity, and lighting are optimized for animal comfort and growth. This allows for the implementation of precise feeding schedules with compound feed, ensuring efficient nutrient delivery throughout the day.

Compound Feed Market Restraints and Challenges:

Feed manufacturers encounter a predicament when the prices of raw materials rise. They have two options: they either pass the cost increase on to farmers, which may put pressure on their budgets, or they may absorb it themselves, which might reduce their profit margins. As a result, there may be less of a need for complex feed and a move towards substitute feeding methods. The availability and price of crops used in the creation of compound feed are impacted by climate change, which is a serious threat to world food security. Extreme weather catastrophes such as floods, droughts, and other weather-related disruptions can cause a lack of vital feed ingredients. The rivalry for resources also gets more intense as the world's population grows, which could affect the availability of grains for both human consumption and the production of animal feed and possibly raise food prices.

Compound Feed Market Opportunities:

Advances in animal nutrition research and big data analytics enable the creation of highly customized feed formulations that precisely meet the nutritional requirements of different livestock species and stages of growth. This can optimize nutrient utilization, improve animal health, and enhance production efficiency. The integration of automation technologies such as smart feeders and sensor-based feeding systems can optimize feed delivery, minimize waste, and improve data collection on animal feeding behavior. This data can then be used to further refine feeding systems and optimize animal performance. AI has the potential to revolutionize the compound feed industry by analyzing vast datasets on animal health, nutrition, and environmental factors. This can help predict potential health issues, recommend adjustments to feed formulations and optimize overall farm management practices.

COMPOUND FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargil, NC., ADM , Charoen Pokphand Foods PCL , New Hope Group , Land O’Lakes, Nutreco N.v., JAPFA Com feed Indonesia , Godrej Agrovet Limited, For Farmers N.v., Hueber Feeds, LLC , Nor Feed , Arasco |

Compound Feed Market Segmentation: By Type

-

Cereal Grains

-

Cakes & Meals

-

Animal Byproducts

-

Supplements (Vitamins, Minerals, Amino Acids, etc.)

Cereal grains primarily corn, wheat, and barley hold the lion's share of the compound feed market. Cereal grains are widely cultivated and readily available, making them a cost-effective source of energy for animals. Their global abundance translates to price stability and consistent feed production costs for manufacturers. Cereal grains provide a good balance of carbohydrates, protein, and fiber, forming the basis of a balanced diet for livestock and poultry. Cereal grains can be easily processed into different forms like whole grains, crushed grains, and pellets, allowing for customization of feed based on animal species and age. This versatility makes them adaptable to various feeding systems.

While cereal grains dominate the market, the cakes and meals segment is experiencing the fastest growth. Cakes and meals derived from oilseeds such as soybean and sunflower offer a concentrated source of protein compared to cereal grains. This is particularly important for animals with higher protein requirements like young animals, breeding stock, and high-yielding dairy cows. Processing techniques used in creating cakes and meals can enhance the digestibility of certain nutrients present in the raw materials. This improved nutrient utilization translates into efficient feed conversion and better animal performance.

Compound Feed Market Segmentation: By Distribution Channel

-

Integrated Producers

-

Independent Feed Manufacturers

-

Cooperatives

-

Retailers

-

Online Platforms

Integrated Producers are large, vertically integrated companies that handle the entire feed production chain, from sourcing raw materials to manufacturing, distribution, and even farm management services. They often operate their own network of feed mills and distribution centers delivering feed directly to farms. Integrated producers have a significant cost advantage due to economies of scale and control over the entire supply chain. They can source raw materials efficiently manage production processes effectively and distribute directly to their network of farms minimizing reliance on external players.

The fastest-growing distribution channel in the compound feed market is online platforms. Experts predict that the online segment will experience a growth rate of around 8-10% in the coming years outpacing the overall market growth. The growing internet penetration in rural areas, particularly in developing economies is opening new avenues for farmers to access information and purchase agricultural supplies online. Online platforms offer farmers the convenience of buying feed from anywhere at any time. Additionally, these platforms can provide transparent pricing information and allow for price comparisons between different manufacturers.

Compound Feed Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

The United States and Canada together make up North America, which has grown to be a major player in the compound feed industry. The agricultural sector in this region is well-established and technologically advanced, and it places a major emphasis on livestock production and animal nutrition, which accounts for its supremacy. Due to the country's extensive commercial livestock operations and the existence of significant feed makers, the United States in particular has led the compound feed market. The demand for premium compound feeds has increased as a result of the region's strict laws and quality standards pertaining to food safety and animal welfare.

The market for compound feeds with the quickest rate of growth is the Asia-Pacific area, which is dominated by nations like China, India, and Japan. The demand for animal-based products has increased due to the region's rapid population development, rising disposable incomes, and shifting dietary preferences. As a result, effective and dependable compound feed solutions are required. Among the primary contributors to the growth of the Asia-Pacific market, China stands out. Compounded by the nation's enormous livestock population and growing urbanization, compound feeds are in high demand. The government's efforts to advance sustainable practices and modernize the agriculture industry have also helped the compound feed business in the area to flourish.

COVID-19 Impact Analysis on the Compound Feed Market:

Social distancing measures and worker illness led to labor shortages at feed mills and farms, hindering the production and distribution of compound feed. Restrictions on movement and logistical challenges due to border closures made it difficult to transport raw materials for feed production and deliver finished feed to farms. Initial anxieties led to panic buying of essential goods, including animal feed. This surge in demand, coupled with disrupted supply chains, caused price volatility for raw materials used in compound feed production. Higher feed prices could strain farmers' budgets, leading them to reduce their livestock populations or switch to cheaper, potentially less nutritious feed alternatives. The impact of COVID-19 on the compound feed market varied significantly across different regions. Developed economies with robust safety nets and financial support for farmers were more resilient compared to developing economies where disruptions were more severe.

Latest Trends/ Developments:

A growing understanding of the gut microbiome's role in animal health is driving the development of functional feed additives. These additives, such as prebiotics and probiotics, promote a healthy gut environment, enhancing digestion, nutrient absorption, and overall animal well-being. Innovative technologies like automated feeders with in-feed sensors and real-time monitoring systems allow for the precise delivery of customized feed rations to individual animals within a herd or flock, maximizing feed efficiency and resource utilization. Concerns about deforestation and the environmental footprint of traditional protein sources like soy are driving the exploration of alternative protein sources for animal feed. Insects, algae, and single-cell proteins are being investigated as viable and sustainable options. Advances in fermentation technologies hold promise for the production of sustainable protein sources for animal feed. Microorganisms can be fermented on various feedstocks, yielding high-quality protein with a significantly lower environmental footprint compared to traditional options. The use of bacteriophages, viruses that specifically target and kill harmful bacteria, is gaining interest as a potential alternative to antibiotics. This approach offers a targeted and potentially more sustainable solution for managing bacterial infections in animals.

Key Players:

-

Cargil, NC.

-

ADM

-

Charoen Pokphand Foods PCL

-

New Hope Group

-

Land O’Lakes

-

Nutreco N.v.

-

JAPFA Com feed Indonesia

-

Godrej Agrovet Limited

-

For Farmers N.v.

-

Hueber Feeds, LLC

-

Nor Feed

-

Arasco

Chapter 1. Compound Feed Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Compound Feed Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Compound Feed Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Compound Feed Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Compound Feed Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Compound Feed Market – By Type

6.1 Introduction/Key Findings

6.2 Cereal Grains

6.3 Cakes & Meals

6.4 Animal Byproducts

6.5 Supplements (Vitamins, Minerals, Amino Acids, etc.)

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Compound Feed Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Integrated Producers

7.3 Independent Feed Manufacturers

7.4 Cooperatives

7.5 Retailers

7.6 Online Platforms

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Compound Feed Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Compound Feed Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargil, NC.

9.2 ADM

9.3 Charoen Pokphand Foods PCL

9.4 New Hope Group

9.5 Land O’Lakes

9.6 Nutreco N.v.

9.7 JAPFA Com feed Indonesia

9.8 Godrej Agrovet Limited

9.9 For Farmers N.v.

9.10 Hueber Feeds, LLC

9.11 Nor Feed

9.12 Arasco

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Globally, there is a growing population with increasing disposable income, leading to a surge in demand for animal protein sources such as meat, eggs, and dairy. This translates to a need for larger and more productive livestock populations, which in turn drives demand for high-quality compound feed.

The reliance on grains like corn, soybean meal, and other commodities makes the compound feed industry susceptible to price volatility. These fluctuations can significantly impact production costs for feed manufacturers, potentially impacting farm profitability and overall market stability.

Cargill, NC, ADM, Charoen Pokphand Foods PCL, New Hope Group, Land O’Lakes, Nutreco N.v., JAPFA Com Feed Indonesia, Godrej Agrovet Limited, For Farmers NV, Hueber Feeds, LLC, Nor Feed, Arasco.

North America has emerged as the most dominant player in the MEA smart irrigation market, commanding an impressive 40% share.

Asia-Pacific emerges as the fastest-growing region in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.