Europe Compound Feed Market Size (2024-2030)

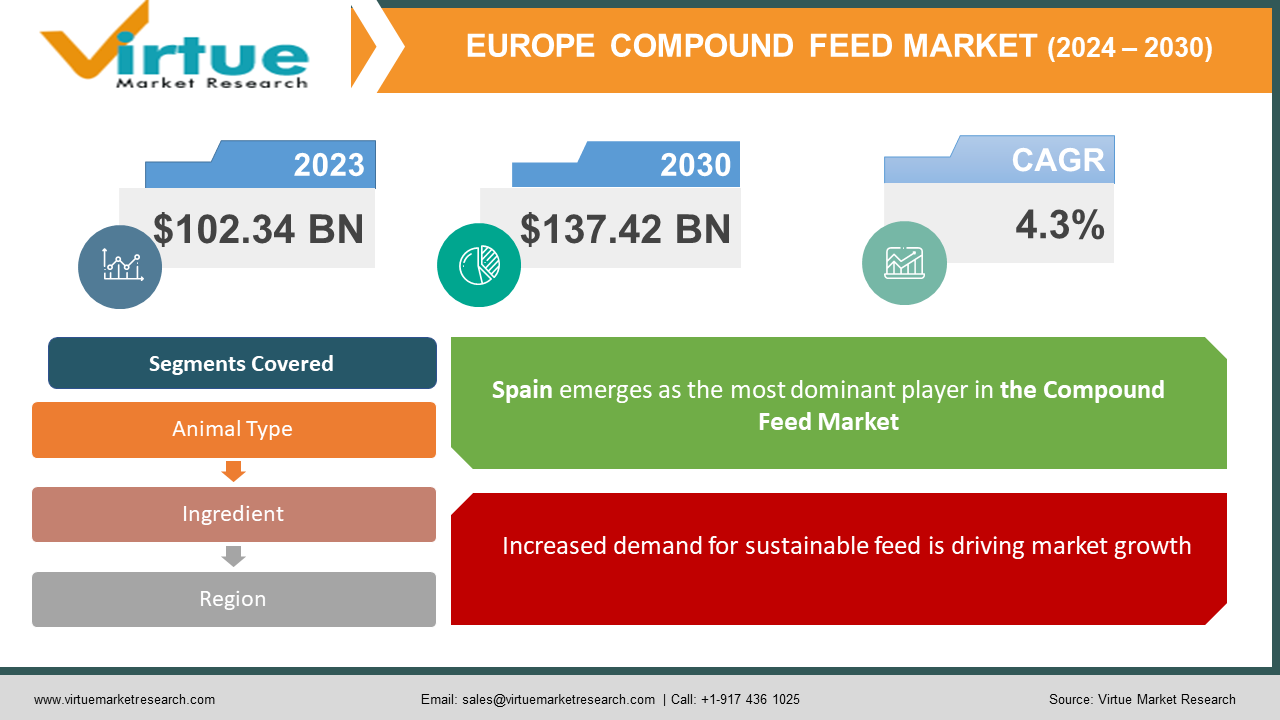

The Europe Compound Feed Market was valued at USD 102.34 Billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 137.42 Billion by 2030, growing at a CAGR of 4.3%.

Compound feed, characterized by its rich composition of compound ingredients, serves to enhance the nutritional profile of animal feed, thereby contributing to the welfare and productivity of livestock and aquaculture. Essentially, it furnishes essential nutrients required by domestic animals and livestock.

Europe ranks as the second-largest producer of compound feed globally, following the Asia-Pacific region. The market demonstrates promising indicators, notably driven by escalating demand for high-protein diets, particularly evident in economies like Russia and Germany, experiencing rapid per capita income growth. Despite this, the compound feed sector is poised to experience significant demand spurred by the global surge in meat consumption, necessitating higher standards for meat quality.

Key Market Insights:

- Soy stands out as a valuable ingredient in feed production owing to its abundant protein content. Nonetheless, escalating import reliance prompts many enterprises to explore alternative plant-based protein sources, with pulses emerging as a viable option. Additionally, the symbiotic rapport between Spanish farmers and feed manufacturers plays a pivotal role in bolstering the industry's prosperity.

- Within the realms of feed production, animal protein processing, and marketing, a cohesive strategic partnership prevails among major swine and poultry producers. This collaborative model yields Spanish animal protein of superior quality at competitive costs, thereby sustaining the competitiveness of hog and poultry exports.

Europe Compound Feed Market Drivers:

Increased demand for sustainable feed is driving market growth

The Compound feed market's Compound Annual Growth Rate (CAGR) is experiencing an upward trajectory driven by consumer concerns regarding feed supply chains. Variability in the impact of feed ingredients, contingent upon their origin and production methods, underscores this trend. Moreover, a heightened awareness of the environmental footprint of the livestock industry is prompting policymakers and retailers to scrutinize this sector closely. Consequently, farmers and feed manufacturers are actively engaged in minimizing environmental impacts throughout the feed production process, aiming for sustainable protein production while managing feed costs.

Furthermore, escalating demand for tailored livestock nutrition is propelling growth in the compound feed market revenue. Livestock's pivotal role in the food chain underscores its significance. However, fluctuations in energy levels and metabolic imbalances pose challenges, potentially leading to various diseases and compromised livestock performance. Common factors contributing to such occurrences include inadequate nutrition, overconsumption, and insufficient physical activity.

Compound feed, comprising a meticulous blend of ingredients, offers a balanced combination of carbohydrates from cereals, fats and proteins from oilseeds, and essential fiber crucial for animal nutrition. The provision of high-quality feed, incorporating grains like corn and barley, has been observed to alter the carcass fat color from yellow to white, thereby enhancing the likelihood of attaining superior-quality meat for commercial purposes.

Europe Compound Feed Market Restraints and Challenges:

A significant challenge to the growth of the compound feed market stems from the lack of knowledge and awareness among small-scale farmers in less developed economies. Additionally, the scarcity of necessary infrastructure and technical expertise, particularly in underdeveloped regions, is anticipated to impede the growth rate of the compound feed market. Furthermore, fluctuations in raw material prices and stringent governmental regulations governing compound feed production are expected to hinder market growth.

Europe Compound Feed Market Opportunities:

The growth of the compound feed market will be propelled by several key factors, including the increasing livestock population, heightened prevalence of animal diseases, and population growth, particularly in developing economies. Additionally, the rising demand for high-quality meat and dairy products worldwide, coupled with the accelerating pace of industrialization and advancements in production techniques, will contribute significantly to market expansion. Government initiatives aimed at bolstering the agricultural sector, coupled with a growing emphasis on adopting high-quality animal feed, and the burgeoning trend of organized livestock farming in developing economies, will further create lucrative growth opportunities for the compound feed market.

EUROPE COMPUND FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Animal type, ingredient, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Charoen Pokphand Foods PCL , Biomin, New Hope Group, Land O' Lakes , Cargill, Inc. , Guangdong HAID Group Co., Ltd. , Kemin Industries, Inc, Tyson Foods, Inc. , ADM Animal Nutrition, De Heus Animal Nutrition |

Europe Compound Feed Market Segmentation:

Europe Compound Feed Market Segmentation By Animal Type:

- Ruminants

- Poultry

- Swine

- Aquaculture

- Other Animal Types

Pig feeds dominate the feed production landscape in Europe, holding the top position among all species. However, the pig feed sector faced significant challenges in 2023, enduring a notable decline of nearly 2.5 million tons. Germany, for instance, encountered reduced pork production stemming from the loss of Asian export markets and negative media scrutiny. Denmark also experienced a substantial decline of -13.6% in pork production during the same period. Meanwhile, Spain, as the largest EU pig feed producer, witnessed a loss of 800,000 tonnes in production due to shifting consumer preferences driven by food price inflation and the erosion of export markets.

Broiler feeds rank second in Europe's feed production landscape. Despite recording a production volume of 54.9 million tons in 2021, broiler feed production experienced a 1.4% decline in 2022, totaling 54.2 million tons. The broiler feed segment was particularly impacted by challenges such as Avian influenza outbreaks and elevated raw material and energy prices during the same period.

The demand for seafood is on a rapid rise, driven by increasing awareness of the health benefits associated with fish consumption. Factors such as rising life expectancy, limited availability of land and water resources for animal feed production, and their increasing allocation towards food and ethanol production are fueling the demand for animal feed within the European meat industry.

Europe Compound Feed Market Segmentation By Ingredient:

- Cereals

- Cakes & Meals

- By-products

- Supplements

The cereals segment emerged as the market leader, capturing a significant share of 35% in terms of revenue, amounting to $73.81 billion. Within developing economies, the growth trajectory of this category is propelled by the extensive consumption of cereals, attributed to their widespread availability and robust nutritional composition compared to other ingredients. Conversely, the oilseed meal segment is experiencing the fastest growth rate, owing to its pivotal role as a primary protein source in animal diets.

Europe Compound Feed Market Segmentation- by Region

- Spain

- United Kingdom

- France

- Germany

- Italy

- Rest of Europe

Spain asserts its dominance in the market, boasting a robust feed industry comprising over 800 feed businesses and employing 11,700 individuals. The country's burgeoning compound feed sector has attracted attention from global industry giants, prompting them to strengthen their presence in the Spanish market. Furthermore, technical advancements in the animal feed sector have propelled market growth. Spain's feed mills predominantly consist of small to medium-sized enterprises, with diverse livestock activities dispersed across the nation. Notably, two-thirds of these entities engage in feed and cattle production for export purposes.

The market is witnessing favorable trends, notably driven by escalating demand for high-protein diets, particularly evident in the rapidly growing per capita income markets of Russia and Germany. Concurrently, the compound feed industry is poised to experience significant demand spurred by the global surge in meat consumption, necessitating higher standards for meat quality. Poland remains the largest European Union (EU) chicken producer, contributing nearly 20 percent of all EU chicken production.

Despite economic challenges, the European meat market remains resilient, maintaining a positive outlook. The most substantial growth in meat consumption is anticipated in Germany, France, Spain, and the United Kingdom, attributed to shifting dietary patterns, population dynamics, and economic expansion.

COVID-19 Pandemic: Impact Analysis

The COVID-19 outbreak caused substantial disruption in the market, characterized by widespread lockdowns that led to chronic disruptions in production, demand, and manufacturing capabilities across various industries. These disruptions, in turn, resulted in heightened cost prices of raw materials. Furthermore, strict restrictions on export-import facilities and reduced demand for compound feed, driven by financial constraints among growers, impeded market expansion. The pandemic also precipitated a downturn in the consumption and demand for animal-based products due to concerns regarding virus transmission through poultry and other animal products.

Latest Trends/ Developments:

The Europe compound feed market is witnessing consolidation among feed manufacturers and suppliers. Mergers, acquisitions, and partnerships are common strategies to expand market presence, optimize supply chains, and enhance product portfolios.

Moreover, consumer concerns over antibiotic resistance are influencing feed formulation practices. There is a growing preference for antibiotic-free and reduced-antibiotic diets, leading to increased use of alternative feed additives and natural growth promoters.

Furthermore, digital technologies such as IoT (Internet of Things) and data analytics are being leveraged for precision livestock farming. Smart feeding systems and real-time monitoring of feed quality and consumption are becoming integral parts of modern livestock operations.

Key Players:

These are the top 10 players in the Europe Compound Feed Market:-

- Charoen Pokphand Foods PCL

- Biomin

- New Hope Group

- Land O' Lakes

- Cargill, Inc.

- Guangdong HAID Group Co., Ltd.

- Kemin Industries, Inc

- Tyson Foods, Inc.

- ADM Animal Nutrition

- De Heus Animal Nutrition

In April 2022, Cargill made a significant investment of USD 50 million in R&D facilities located in China, near Elk River, Minnesota, and in a facility based in the Netherlands, Europe. These investments are aimed at advancing research and development efforts in animal nutrition and feed formulations.

Chapter 1. Europe Compound Feed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Compound Feed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Compound Feed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Compound Feed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Compound Feed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Compound Feed Market– By Animal Type

6.1. Introduction/Key Findings

6.2. Ruminants

6.3. Poultry

6.4. Swine

6.5. Aquaculture

6.6. Other Animal Types

6.7. Y-O-Y Growth trend Analysis By Animal Type

6.8. Absolute $ Opportunity Analysis By Animal Type , 2024-2030

Chapter 7. Europe Compound Feed Market– By Ingredient

7.1. Introduction/Key Findings

7.2 Cereals

7.3. Cakes & Meals

7.4. By-products

7.5. Supplements

7.6. Y-O-Y Growth trend Analysis By Ingredient

7.7. Absolute $ Opportunity Analysis By Ingredient , 2024-2030

Chapter 8. Europe Compound Feed Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Animal Type

8.1.3. By Ingredient

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Compound Feed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Charoen Pokphand Foods PCL

9.2. Biomin

9.3. New Hope Group

9.4. Land O' Lakes

9.5. Cargill, Inc.

9.6. Guangdong HAID Group Co., Ltd.

9.7. Kemin Industries, Inc

9.8. Tyson Foods, Inc.

9.9. ADM Animal Nutrition

9.10. De Heus Animal Nutrition

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Compound feed market's Compound Annual Growth Rate (CAGR) is experiencing an upward trajectory driven by consumer concerns regarding feed supply chains. Variability in the impact of feed ingredients, contingent upon their origin and production methods, underscores this trend.

The top players operating in the Europe Compound Feed Market are - Charoen Pokphand Foods PCL, Biomin, New Hope Group, Land O' Lakes, Cargill, Inc., Guangdong HAID Group Co., Ltd., Kemin Industries, Inc., Tyson Foods, Inc., ADM Animal Nutrition, and De Heus Animal Nutrition.

The COVID-19 outbreak caused substantial disruption in the market, characterized by widespread lockdowns that led to chronic disruptions in production, demand, and manufacturing capabilities across various industries

The scarcity of necessary infrastructure and technical expertise, particularly in underdeveloped regions, is anticipated to impede the growth rate of the compound feed market. Furthermore, fluctuations in raw material prices and stringent governmental regulations governing compound feed production are expected to hinder market growth

The market is witnessing favorable trends, notably driven by escalating demand for high-protein diets, particularly evident in the rapidly growing per capita income markets of Russia and Germany.