Wet Pet Food Market Size (2025 - 2030)

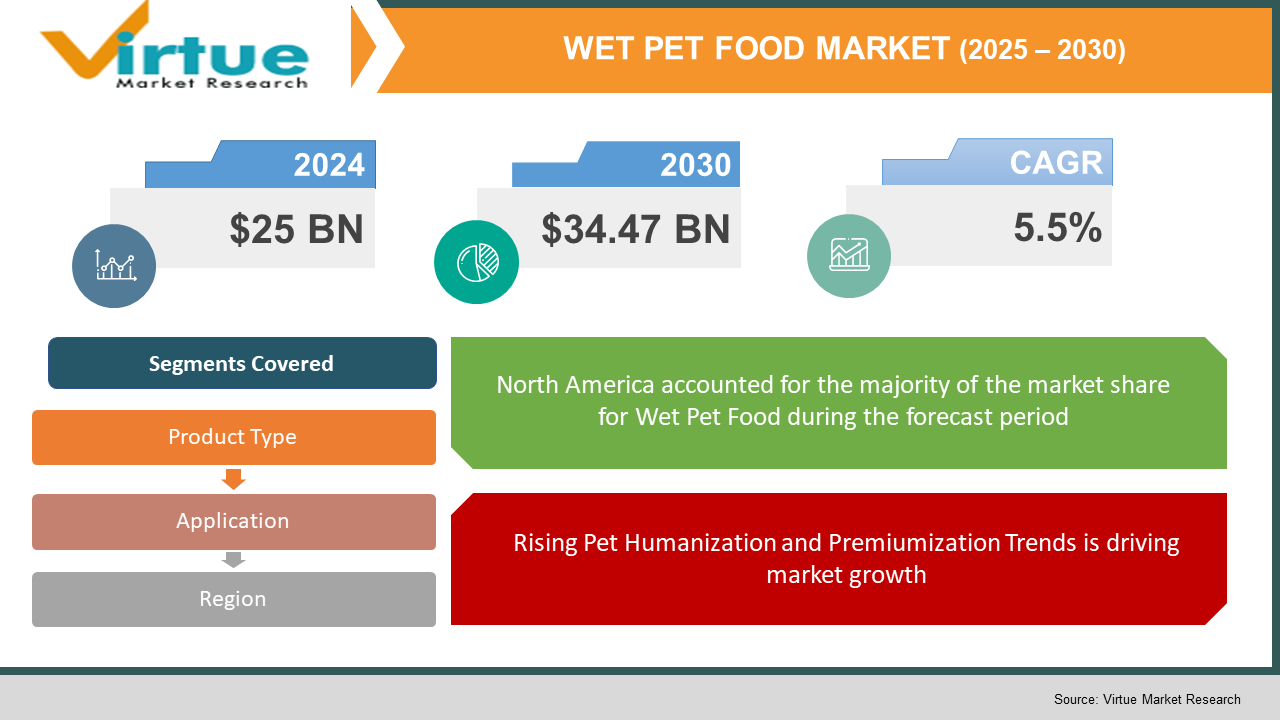

The Global Wet Pet Food Market was valued at USD 25 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. The market is expected to reach USD 34.47 billion by 2030.

Download Free Sample Copy of this Report

Wet pet food consists of high-moisture, palatable pet meals, often packed in cans or pouches, and provides better hydration and essential nutrients compared to dry pet food. The demand for wet pet food is rising due to the increasing pet adoption rates, growing awareness regarding pet health, and the preference for premium, nutritious pet food products. Furthermore, the market benefits from advancements in product formulations and the growing trend of humanization of pets, where pet owners seek food options closely resembling human-grade meals.

Key Market Insights

-

Premiumization trends in pet food have boosted the demand for organic, grain-free, and high-protein wet pet food products, with the premium segment expected to grow at a CAGR of 6.5%.

-

Online sales channels have gained prominence, growing at over 15% CAGR, driven by convenience, subscription-based purchases, and wide availability.

-

Emerging markets like India, Brazil, and South Korea show high potential for market growth, attributed to rising pet ownership and awareness regarding pet health and nutrition. Environmental concerns have led to innovations in sustainable packaging materials, with recyclable and eco-friendly wet pet food containers gaining market acceptance. Functional wet pet food enriched with probiotics, vitamins, and Omega-3 fatty acids is a growing sub-segment as owners look for solutions to improve pet health and longevity.

Unlock Market Insights: Get A FREE Sample Report Today!

Global Wet Pet Food Market Drivers

Rising Pet Humanization and Premiumization Trends is Driving Market Growth:

Pet owners increasingly treat their pets as family members, leading to heightened demand for premium and human-grade food options. The trend of humanization has amplified the focus on wet pet food that mirrors the texture, flavor, and nutritional content of human meals. Moreover, premium brands offering organic, non-GMO, and grain-free options are capitalizing on this growing segment.

Rising disposable incomes, especially in developed regions like North America and Europe, enable pet owners to invest in high-quality products. Additionally, manufacturers are leveraging this trend to innovate, introducing gourmet flavors and region-specific wet pet food variants to cater to unique customer preferences.

Health and Nutritional Benefits of Wet Pet Food is Driving Market Growth:

Wet pet food provides superior hydration due to its high moisture content, making it a popular choice for pets with specific dietary or health needs, such as urinary tract issues or dehydration. The increased awareness among pet owners regarding these health benefits has significantly driven its adoption.

Furthermore, wet food’s soft texture makes it ideal for pets with dental issues, such as senior dogs or cats. With product formulations increasingly enriched with functional ingredients like Omega-3 fatty acids, antioxidants, and vitamins, the category appeals to pet owners prioritizing their pets' long-term health.

Expanding Distribution Channels and E-Commerce Growth is Driving Market Growth:

The rapid expansion of online retail platforms, coupled with the emergence of subscription-based services, has facilitated the accessibility of wet pet food products. Leading e-commerce platforms provide consumers with options to browse, compare, and purchase from a wide range of wet pet food brands.

Subscription models, offering regular deliveries of pet food tailored to individual preferences, have gained immense traction, especially among millennial pet owners. Brick-and-mortar stores are also evolving, with specialty pet food stores and supermarkets introducing exclusive wet pet food products to enhance consumer choices.

Global Wet Pet Food Market Challenges and Restraints

High Cost of Wet Pet Food is restricting market growth:

The cost of wet pet food is significantly higher than its dry counterparts, primarily due to its specialized packaging, high-quality ingredients, and processing techniques. This premium pricing can act as a barrier, especially in price-sensitive markets such as India and parts of Southeast Asia. The perishability of wet pet food also adds to the logistics and storage costs, further inflating its retail price. For budget-conscious pet owners, the high price point may deter regular purchases, slowing market penetration in economically challenged regions or among large pet-owning households.

Environmental Concerns Surrounding Packaging is restricting market growth:

The packaging used for wet pet food, such as aluminum cans and plastic pouches, has raised environmental concerns due to its contribution to waste. Increasing consumer awareness regarding sustainability and the environmental impact of non-biodegradable materials poses a significant challenge to manufacturers.

Regulatory pressures in several regions are pushing brands to adopt eco-friendly practices. However, transitioning to biodegradable or recyclable packaging involves higher costs, impacting profitability. Additionally, inconsistent recycling infrastructure in emerging markets exacerbates the issue, limiting the adoption of sustainable packaging solutions on a global scale.

Global Wet Pet Food Market Opportunities

The wet pet food market is poised to capitalize on significant growth opportunities driven by emerging trends and evolving consumer preferences. One of the most prominent opportunities lies in the rising demand for functional and therapeutic pet food, tailored to address specific health concerns such as obesity, joint problems, and digestive issues. Functional wet pet food fortified with probiotics, glucosamine, and other supplements is gaining traction as pet owners increasingly prioritize preventative healthcare.

Furthermore, there is untapped potential in emerging market, where rising disposable incomes, urbanization, and increased pet ownership are fostering growth in premium pet food segments. Brands investing in region-specific product development, such as culturally preferred flavors and ingredients, are likely to gain a competitive edge.

Sustainability presents another major opportunity, with manufacturers developing biodegradable packaging and adopting ethical sourcing of ingredients to align with eco-conscious consumer values. Collaborations with veterinarians, animal nutritionists, and pet influencers can further strengthen brand loyalty and consumer trust, solidifying the position of wet pet food in the broader pet food industry.

GLOBAL WET PET FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mars Petcare, Nestlé Purina, Hill’s Pet Nutrition, The J.M. Smucker Company, Blue Buffalo, Royal Canin, Weruva International, Wellness Pet Company, Freshpet Inc., Cesar |

Segmentation Analysis

Wet Pet Food Market - By Product Type:

-

Grain-Free Wet Pet Food

-

Grain-Inclusive Wet Pet Food

-

Organic Wet Pet Food

-

Functional Wet Pet Food

Grain-free wet pet food leads the market due to its rising popularity among pet owners concerned about allergies and intolerances in their pets. This segment accounted for over 40% of product sales in 2024.

Wet Pet Food Market - By Application:

-

Cats

-

Dogs

-

Other Pets

The cat segment dominates the application category, contributing to more than 55% of market revenue. Cats’ natural dietary preferences for moist, protein-rich meals drive the demand for wet pet food tailored to their needs.

Wet Pet Food Market - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the global wet pet food market, accounting for 40% of the market share in 2024. The region benefits from a high pet ownership rate, well-established retail networks, and the premiumization of pet food. Consumers in the U.S. and Canada are particularly inclined towards premium and functional wet pet food, with major players heavily investing in product innovation and marketing campaigns. The growth of e-commerce and subscription services in North America further fuels market expansion.

COVID-19 Impact Analysis on the Wet Pet Food Market

The COVID-19 pandemic had a profound impact on the global wet pet food market, reshaping consumer behavior and distribution channels. During the pandemic, pet ownership surged as people sought companionship while spending more time at home due to lockdowns. This surge in pet adoption led to a significant increase in demand for pet food, particularly premium products like wet pet food, as new pet owners became more attuned to their pets' health and well-being. However, the pandemic also introduced challenges, particularly in the supply chain.

Transportation restrictions, factory shutdowns, and labor shortages disrupted production and distribution, leading to temporary shortages of certain pet food products. Despite these setbacks, manufacturers adapted quickly by prioritizing local supply chains to reduce dependency on international logistics, which were heavily affected by import-export limitations. As brick-and-mortar stores faced limitations, online sales became an essential channel for pet food purchases. E-commerce platforms saw a sharp rise in demand, with consumers increasingly turning to digital platforms to fulfill their pet food needs. This shift in buying behavior led pet food companies to strengthen their online presence and invest in digital marketing strategies. Despite the challenges posed by the pandemic, the global wet pet food market demonstrated resilience and even growth.

The combination of rising pet ownership and a growing trend of pet humanization—where pets are viewed as integral family members—helped maintain strong demand. The pandemic underscored the importance of pets in people's lives, resulting in sustained investment in premium pet food products. This period marked a pivotal moment for the pet food industry, with e-commerce and local supply chains becoming more central to its future development.

Latest Trends/Developments

The wet pet food market is experiencing rapid evolution, driven by several key trends that are shaping its growth. One of the most prominent trends is the rise of customized pet diets. Pet owners are increasingly seeking tailored food options based on specific factors such as breed, age, and health conditions.

Subscription-based models are gaining popularity, offering personalized meal plans that cater to the unique needs of individual pets, ensuring their nutritional requirements are met. Sustainability is also a major focus in the industry, with manufacturers prioritizing eco-friendly packaging solutions and exploring alternative, plant-based protein sources. These efforts aim to reduce the environmental footprint of pet food production.

Additionally, the integration of smart technology in pet feeding is on the rise, with innovations like automated feeders that are compatible with wet pet food, allowing pet owners greater convenience and control over their pets’ feeding schedules.

Another key trend is the growing demand for transparency in labeling. Pet owners are becoming more conscious of what goes into their pets' food, seeking detailed information about ingredient sourcing and nutritional content. This has prompted many brands to adopt clean-label practices, ensuring that the ingredients and processes used in production are clearly communicated to consumers.

Finally, regional flavors and formulations tailored to local dietary preferences are providing opportunities for niche players. By catering to specific regional tastes and preferences, brands are able to carve out unique market segments and build a stronger connection with consumers. These trends collectively reflect the evolving priorities of pet owners and their increasing focus on personalized, sustainable, and transparent pet care solutions.

Key Players

Chapter 1. GLOBAL WET PET FOOD MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL WET PET FOOD MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL WET PET FOOD MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL WET PET FOOD MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL WET PET FOOD MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL WET PET FOOD MARKET– BY Product Type

6.1. Introduction/Key Findings

6.2. Grain-Free Wet Pet Food

6.3. Grain-Inclusive Wet Pet Food

6.4. Organic Wet Pet Food

6.5. Functional Wet Pet Food.

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. GLOBAL WET PET FOOD MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Cats

7.3. Dogs

7.4. Other Pets

7.5. Y-O-Y Growth trend Analysis By APPLICATION

7.6. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL WET PET FOOD MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Product Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Product Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Product Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Product Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL WET PET FOOD MARKET – Company Profiles – (Overview, Product Type Product Type s Portfolio, Financials, Strategies & Development

9.1. Mars Petcare

9.2. Nestlé Purina

9.3. Hill’s Pet Nutrition

9.4. The J.M. Smucker Company

9.5. Blue Buffalo

9.6. Royal Canin

9.7. Weruva International

9.8. Wellness Pet Company

9.9. Freshpet Inc.

9.10. Cesar

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wet Pet Food Market was valued at USD 25 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. The market is expected to reach USD 34.47 billion by 2030.

Key drivers include the rising trend of pet humanization, growing awareness of the health benefits of wet pet food, and the expansion of e-commerce and subscription models.

The market is segmented by product type(grain-free, grain-inclusive, organic, functional) and application (cats, dogs, other pets).

North America is the most dominant region, holding over 40% of the market share in 2024.

Leading players include Mars Petcare, Nestlé Purina, Hill’s Pet Nutrition, Blue Buffalo, and Royal Canin.