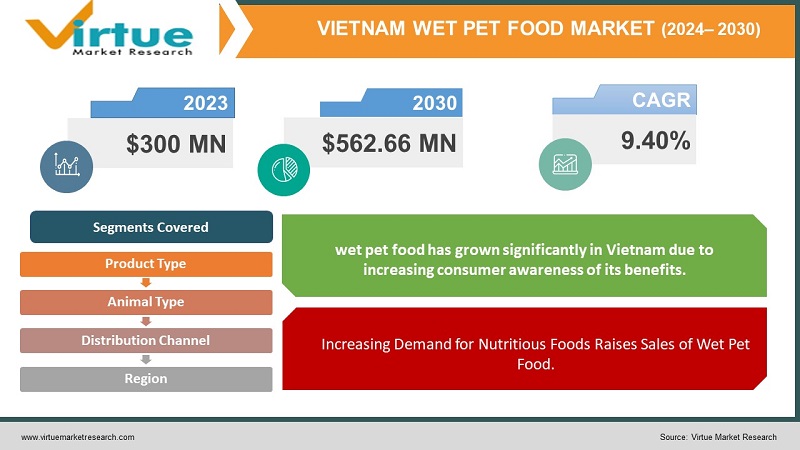

Vietnam Wet Pet Food Market Size (2024-2030)

The Vietnam Wet Pet Food Market was valued at USD 300 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 562.66 million by 2030, growing at a CAGR of 9.40%.

Pet food is a specialized type of nutrition created specifically for companion animals. It comes in various forms, such as dry kibble, canned wet food, raw diets, and specialized formulas designed to address specific health issues. The production of pet food involves the use of proteins, grains, vegetables, and certain preservatives to ensure a longer shelf life. It is used for daily feeding, as well as for training treats, dental health snacks, weight management, and medical diets. Additionally, pet food caters to various life stages, including growth phases like those of puppies and kittens, adult maintenance, and senior care. It provides balanced nutrition customized to the animal's needs, supporting the immune system, improving digestion, and promoting healthy skin and coat.

Key Market Insights:

The market is being driven by several key factors, including the rise in pet ownership, heightened awareness regarding pet nutrition, a shift towards premium products, rapid technological advancements and innovations, the expansion of retail channels, the growing trend of pet humanization, and the adoption of supportive government policies.

Wet pet food features a higher moisture content, approximately 70-80%, making it the softest among the pet food types. It is typically made by processing protein sources or meat ingredients and then combining them with a gravy that includes minerals, vitamins, and grains. After mixing, the product is cooked and sterilized to create the final canned food.

Vietnam Wet Pet Food Market Drivers:

Increasing Demand for Nutritious Foods Raises Sales of Wet Pet Food.

The growing inclination of pet owners to purchase high-quality products for their pets to ensure optimal nutrition and care is a significant driver for the wet pet food market. As the number of nuclear families and couples who own pets rises, this market is expected to expand, with these pet owners often treating their animals as if they were their children.

Wet pet food provides essential nourishment, promotes good health, and supplies necessary protein, contributing to longer and better lives for pets. Additionally, the increase in disposable income is further propelling the market for wet pet food.

The rising demand for pet food presents a considerable opportunity for the wet pet food industry. Moreover, the soft texture of wet pet food is particularly beneficial for pets experiencing dental issues, which is likely to drive an increase in wet pet food consumption during the forecast period.

Cats are considered lucky in Vietnamese culture which drives cat adoption as pets in the country.

In Vietnam, cat ownership has surged in popularity, leading to a significant 28.5% increase in the cat population from 2019 to 2022. This trend is primarily driven by the expanding middle class and a growing preference for cats due to their unique personalities and behaviors. Additionally, cats are regarded as symbols of good fortune in Vietnamese culture, further boosting their adoption as they are believed to bring prosperity to households.

Vietnam Wet Pet Food Market Restraints and Challenges:

Cat population facing threat hinders the market growth.

The pet cat population in Vietnam is under significant threat from the illegal, inhumane, and dangerous cat meat trade, causing widespread fear among cat owners regarding the theft and slaughter of their pets for human consumption. Thousands of pet cats go missing daily due to this rampant theft. In response, the Vietnamese government has implemented stringent measures to prohibit the cat meat trade. Additionally, both governmental and non-governmental organizations are actively promoting cat adoption and educating the public on responsible cat ownership to address the issue.

Vietnam Wet Pet Food Market Opportunities:

The increasing adoption of cats across the country can be attributed to the easy accessibility of pet cat products through both offline and online retail channels, as well as a growing interest in cat cafes and parks. These factors are expected to contribute to a rise in the overall cat population during the forecast period.

VIETNAM WET PET FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.40% |

|

Segments Covered |

By Product Type, animal type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Vietnam |

|

Key Companies Profiled |

Alltech, Charoen Pokphand Group, Schell & Kampeter Inc. (Diamond Pet Foods), Vafo Praha, EBOS Group Limited, Virbac, ADM, Mars Incorporated, DoggyMan H. A. Co., Ltd. and Nestle (Purina). |

Vietnam Wet Pet Food Market Segmentation

Vietnam Wet Pet Food Market Segmetation-By Product Type:

- Dry Food

- Wet Food

- Treat/Snacks

- Others

Wet pet foods contain a high percentage of water, which is mixed with dry ingredients to help pet owners ensure their pets receive adequate hydration. Additionally, older dogs and cats often struggle to digest dry food, further driving the demand for wet pet food. These products are typically rich in essential proteins and amino acids, with non-vegan options such as beef, chicken, turkey, and pork being particularly favored by pets. Surveys indicate that pet owners form a compassionate bond with their pets, motivating them to purchase a variety of treats, including kibble and other options.

As the focus on pet health and wellness intensifies, there is a growing demand for snacks and treats that offer functional benefits beyond mere taste. These include products designed to support dental health, joint health, skin and coat health, digestive health, and weight management. Many pet owners are opting for natural and organic treats, free from artificial colors, flavors, and preservatives. The market reflects this preference with a broad selection of natural and organic products made from high-quality ingredients sourced from reputable suppliers.

Vietnam Wet Pet Food Market Segmetation-By Animal Type:

- Dogs

- Cats

- Birds

- Others

In the Vietnamese pet food market, dogs have historically held a dominant position due to their larger population and higher per capita consumption compared to other pets. As of 2022, dogs accounted for the majority share, with cats and other animals representing 38% and 16.9% of the market, respectively. Dogs are more susceptible to conditions such as diabetes and obesity, necessitating greater quantities of pet food than other pets.

Conversely, cats are the fastest-growing segment in the market, projected to achieve a compound annual growth rate (CAGR) of 10.7% during the forecast period. This growth is largely driven by increasing disposable incomes among pet owners, which is leading to a transition from homemade to commercial cat foods.

Vietnam Wet Pet Food Market Segmetation-By Distribution Channel:

- Specialized Pet Shops

- Online Channel

- Supermarkets and Hypermarkets

- Others Distribution Channel

Pet food sales are predominantly channeled through pet shops and grocery retailers, though there is a noticeable increase in online sales. In the country, non-grocery specialist stores represent 72.8% of pet food sales, while e-commerce accounts for 3.1%. E-commerce is projected to grow at a compound annual growth rate (CAGR) of 7.7% during the forecast period. This growth is driven by heightened health awareness and a rise in mid-priced products purchased by pet owners, contributing to increased pet expenditure.

The easy availability of pet cat products through both physical and online retail stores, along with the growing popularity of cat cafes and parks, are key factors driving the increased adoption and ownership of cats. These trends are expected to significantly boost the overall cat population during the forecast period.

Vietnam Wet Pet Food Market Segmetation-By Region:

In recent years, the demand for wet pet food has grown significantly in Vietnam due to increasing consumer awareness of its benefits. Wet food's higher moisture content aids in keeping pets hydrated and helps prevent urinary tract infections. Additionally, with its lower carbohydrate content, wet food can assist in managing pets' weight. Pet food also offers numerous benefits such as convenience, precise portioning, nutritional completeness, appealing flavors, extended shelf life, diverse textures and tastes, suitability for different life stages, reduced risk of foodborne illnesses, and adaptability for pets with specific health needs.

COVID-19 Pandemic: Impact Analysis

The COVID-19 lockdowns led to an increase in the pet population, driving a stronger demand for pet food. This surge was partly due to the shift back to office work after the pandemic, which disrupted people's interactions with their pets and resulted in higher abandonment rates.

Latest Trends/ Developments:

May 2023: Nestlé Purina introduced new cat treats under the Friskies "Friskies Playfuls - Treats" brand. These treats, designed for adult cats, come in round shapes and are available in chicken and liver, as well as salmon and shrimp flavors.

May 2023: Vafo Praha, s.r.o. unveiled its new range of Brit RAW Freeze-dried treats and toppers for dogs. These products feature high-quality proteins and minimally processed ingredients, aimed at offering potential health benefits.

May 2023: Vafo Praha, s.r.o. launched a new line of functional snacks for dogs, named Brit Dental Stick. The snacks are available in four varieties, with each package containing seven sticks.

Key Players:

These are the top 10 players in the Vietnam Wet Pet Food Market: -

- Alltech

- Charoen Pokphand Group

- Schell & Kampeter Inc. (Diamond Pet Foods)

- Vafo Praha

- EBOS Group Limited

- Virbac

- ADM

- Mars Incorporated

- DoggyMan H. A. Co., Ltd.

- Nestle (Purina)

Chapter 1. Vietnam Wet Pet Food Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Vietnam Wet Pet Food Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Vietnam Wet Pet Food Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Vietnam Wet Pet Food Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Vietnam Wet Pet Food Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Vietnam Wet Pet Food Market– By Product Type

6.1. Introduction/Key Findings

6.2. Dry Food

6.3. Wet Food

6.4. Treat/Snacks

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2023-2030

Chapter 7. Vietnam Wet Pet Food Market– By Animal Type

7.1. Introduction/Key Findings

7.2. Dogs

7.3. Cats

7.4. Birds

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Animal Type

7.7. Absolute $ Opportunity Analysis By Animal Type , 2023-2030

Chapter 8. Vietnam Wet Pet Food Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Specialized Pet Shops

8.3. Online Channel

8.4. Supermarkets and Hypermarkets

8.5. Others Distribution Channel

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Vietnam Wet Pet Food Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Vietnam

9.1.1. By Country

9.1.1.1. Vietnam

9.1.2. By Distribution Channel

9.1.3. By Product Type

9.1.4. By Animal Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Vietnam Wet Pet Food Market– Company Profiles – (Overview, Animal Type Portfolio, Financials, Strategies & Developments)

10.1 Alltech

10.2. Charoen Pokphand Group

10.3. Schell & Kampeter Inc. (Diamond Pet Foods)

10.4. Vafo Praha

10.5. EBOS Group Limited

10.6. Virbac

10.7. ADM

10.8. Mars Incorporated

10.9. DoggyMan H. A. Co., Ltd.

10.10. Nestle (Purina)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The demand for wet pet food has grown significantly due to increasing consumer awareness of its benefits. Wet food's higher moisture content aids in keeping pets hydrated and helps prevent urinary tract infections. Additionally, with its lower carbohydrate content, wet food can assist in managing pets' weight.

The top players operating in the Vietnam Wet Pet Food Market are - Alltech, Charoen Pokphand Group, Schell & Kampeter Inc. (Diamond Pet Foods), Vafo Praha, EBOS Group Limited, Virbac, ADM, Mars Incorporated, DoggyMan H. A. Co., Ltd. and Nestle (Purina).

The COVID-19 lockdowns led to an increase in the pet population, driving a stronger demand for pet food. This surge was partly due to the shift back to office work after the pandemic, which disrupted people's interactions with their pets and resulted in higher abandonment rates

May 2023: Nestlé Purina introduced new cat treats under the Friskies "Friskies Playfuls - Treats" brand. These treats, designed for adult cats, come in round shapes and are available in chicken and liver, as well as salmon and shrimp flavors

E-commerce is the fastest-growing distribution channel in the Vietnam Wet Pet Food Market.