United States Wet Pet Food Market Size (20242030)

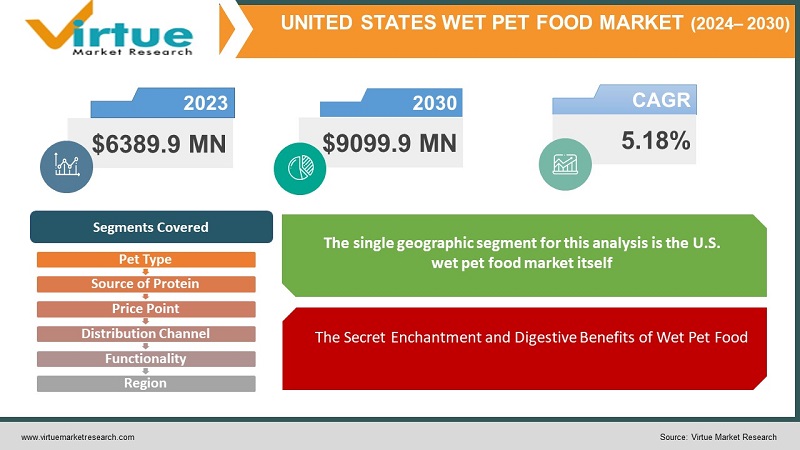

The United States Wet Pet Food Market was valued at USD 6389.9 million in 2023 and is projected to reach a market size of USD 9099.9 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.18%.

The United States has a thriving industry for wet pet food that serves both feline and canine friends. Well-known companies include Purina, which offers a variety of products under the Purina One, Pro Plan, and Fancy Feast names. With a variety of flavors and textures, this wet food appeals to all palates. Another well-known brand of wet dog food is Pedigree, which offers pate, loaf in gravy, and chopped meat in gravy. One of Royal Canin's unique selling points is their age- and breed-specific formulations, which guarantee your pet gets all the nutrition they require. Pets with certain health issues can get what they need at Hill's Science Diet, which offers wet food designed to treat ailments including renal disease, UTIs, and weight loss. Blue Buffalo promotes natural ingredients and offers wet food that is devoid of artificial coloring, flavoring, and preservatives.

Key Market Insights:

More and more pet owners are choosing high-quality pet food made with natural ingredients. When buying pet food, 62% of US pet owners give priority to natural ingredients. This pattern suggests a rising market for Blue Buffalo and similar goods.

Because pet owners are treating their animals like kings and queens, there is a growing market for human-grade ingredients, organic products, and ultra-premium wet food that is formulated to meet health requirements.

Sales of pet food online are increasing. By 2027, the US pet food industry is projected to increase at a compound annual growth rate of 12.4% to reach USD 8.3 billion. This pattern indicates that pet owners are finding it easier to buy wet pet food online.

There is a growing need for human-grade wet food choices because of pet owners treating their animals more like family members. In 2022, pet owners spent a staggering $103.6 billion on their animals, a large amount of which went towards high-end food choices. This development offers a chance for companies who provide wet food made with materials fit for human consumption.

United States Wet Pet Food Market Drivers:

The Secret Enchantment and Digestive Benefits of Wet Pet Food

Wet food is the best option for stimulating your pet's appetite and supporting their digestive system. Wet food has a higher moisture level than dry kibble because it mimics the natural water content of prey species. Equates to a more enticing texture and scent for pets, which may encourage them to eat more and maybe lessen instances of fussy eating and leftover kibble. Wet food is simpler to digest when it has more moisture content, especially for older pets or pets with dental problems. Even though their ability to chew and swallow food may be impaired, the softer texture of wet food needs less effort, ensuring that they get the essential nutrients they need. Better nutrient absorption after enhanced digestibility can eventually benefit your pet's general health and wellbeing.

Wet pet food is becoming more and more humanised and premium, making it a feast for Fido.

Pet owners and their animals are developing an increasingly strong emotional attachment. Pets are now seen as treasured family members rather than just animals. Wet food is in a prime position to benefit from this trend as the desire for high-end pet food alternatives is fuelled by this shift in perception. In response, top manufacturers are creating wet food formulas that reflect the nutritional choices of people who are concerned about their health. Natural components are quickly becoming a major selling factor as they don't include artificial chemicals or preservatives. The protein sources that are used are frequently modified to include better meats, such as chicken or salmon. To satisfy pet owners who only want the best for their furry family members, the majority of forward-thinking firms are even branching out into the world of human-grade substances. The humanization movement is reflected in the premiumization of wet food, which enables pet owners to feed their friends foods that correspond with their own nutritional principles.

United States Wet Pet Food Market Restraints and Challenges:

There are obstacles in the US wet pet food business. Cost is still a major concern; wet food is sometimes more expensive than dry kibble. This might be a deal-breaker for pet owners on a tight budget, especially those who have several furry pets. The expense of materials, manufacturing, and packaging that are unique to wet food is reflected in the higher price. There are storage-related challenges as well. When wet food is opened, it must be refrigerated to prevent deterioration, unlike dry kibble, which has a long shelf life. If this is neglected. Compared to dry kibble, the larger package for wet food requires more room. Wet food is viewed as untidy and bothersome by certain pet owners. Those who value a clean eating environment may be turned off by the possibility of spills and stains. Meal prep is more involved when refrigeration is required as opposed to just scooping dry kibble. There is a persistent misunderstanding that dry food provides more nourishment. This may be a result of the notion that because dry food is concentrated, it has more nutrients. However a comprehensive and well-balanced diet may be given to dogs using high-quality wet food. Limited availability can also be a barrier for people who would rather buy pet food in person, especially at smaller brick-and-mortar businesses.

United States Wet Pet Food Market Opportunities:

The wet pet food business in the United States is booming. Pet owners are looking for novel flavors, textures, and features, thus innovation is essential. Wet food that caters to certain needs, such as senior pet formulas, grain-free alternatives, or weight management options, has the potential to draw in new clients. Insect-based components, for example, are novel sources of protein that can expand market diversity. Convenient features that solve storage and mess issues, such as single-serve portion packs or easy-open lids, may be tailored to busy lives. The growth of e-commerce makes it possible for subscription services to take off, providing pet owners with a steady supply of high-quality food by bringing freshly prepared wet food right to their homes. Pet owners who care about sustainability are becoming more and more of a force, and companies may create environmentally friendly packaging by employing recycled or biodegradable materials. Customers that care about the environment will find this appealing, and it presents a socially conscious business image. Finally, working with veterinarians is a powerful strategy. Veterinarians can recommend high-quality wet food options tailored to specific pet health needs, driving sales and building brand trust for wet pet food. Targeted online marketing campaigns and social media engagement can also help build stronger brand loyalty by allowing brands to connect directly with pet owners. Educational content emphasizing the benefits of wet food can address misconceptions and encourage wider adoption.

UNITED STATES WET PET FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.18% |

|

Segments Covered |

By PET Type, Source of Protein , Price Point Distribution Channel ,Functionality and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA |

|

Key Companies Profiled |

Chewy, Colgate-Palmolive Company, Freshpet, General Mills Inc., JustFoodForDogs, Mars Petcare Inc., Merrick Pet Care, Nestlé Purina PetCare, Royal Canin, The J.M. Smucker Company, Wellness Pet Food |

United States Wet Pet Food Market Segmentation:

United States Wet Pet Food Market Segmentation: By Pet Type:

- Dogs

- Cats

Dog owners have more options in the U.S. wet pet food industry because of breed variances. The market is segmented depending on the kind of pet. Although there is a market for cat wet food, the super-premium wet food category is expanding at the highest rate. This category is made with components of human quality and offers unique protein sources and health advantages to meet the demands of both cats and dogs.

United States Wet Pet Food Market Segmentation: By Source of Protein:

- Animal-Based Protein

- Plant-Based Protein

Given that cats and dogs are carnivores, it is evident that animal-based choices dominate the U.S. market for wet pet food when segmented based on protein sources. Plant-based protein sources are becoming more popular, despite being a niche market, among pet owners who are looking for alternatives or have dietary limitations.

United States Wet Pet Food Market Segmentation: By Price Point:

- Mass Market

- Premium

- Super-Premium

In the US wet pet food industry, price isn't the only factor to consider. The mass market group continues to be the largest due to affordability, while the super-premium category is growing at the quickest rate. Pet owners are demonstrating a willingness to pay extra for high-quality ingredients, alternatives that are suitable for humans, and customized formulae that cater to the unique health requirements of their furry friends. This pattern implies that pet owners value quality more than just the lowest cost.

United States Wet Pet Food Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Pet Stores

- Online Retailers

There is a change in the ways by which American wet pet food is distributed. The largest market share is still held by traditional supermarkets and hypermarkets, but internet retailers are expanding at the quickest rate. This increase is driven by the convenience of internet purchasing, an increased selection of wet food alternatives, and possibly cheaper costs.

United States Wet Pet Food Market Segmentation: By Functionality:

- Complete and Balanced Diets

- Treats and Toppers

Two primary categories emerge when the U.S. wet pet food industry is divided into functional segments: treats and toppers for supplemental feeding, and comprehensive and balanced diets for daily meals. Both are still significant, but the super-premium segment which includes both kinds of functionality is the real growth engine. With options for whole meals or unique treats, quality ingredients, and targeted health advantages, this category gives pet owners the best of both worlds.

United States Wet Pet Food Market Segmentation: By Region:

The single geographic segment for this analysis is the U.S. wet pet food market itself. Although there may be regional differences in consumer preferences within the nation, this analysis focuses on identifying the national trends and opportunities that characterize the U.S. wet pet food market.

COVID-19 Impact Analysis on the United States Wet Pet Food Market:

The COVID-19 epidemic had a mixed effect on the wet pet food business in the United States. Positively, lockdowns were accompanied by a spike in pet adoption and expenditure. Because wet food is more palatable and convenient, having more people at home might result in an increase in wet food sales. Online sellers of wet pet food benefited from the pandemic's e-commerce boom, which expanded their product assortment and made it easier for customers to make purchases. Increased health consciousness at this time may have contributed as well, with pet owners placing a higher priority on the health of their animals. Given that wet food is seen to aid in digestion and hydration, this focus may have led to a rise in demand for it. The pandemic, however, also brought difficulties. Global supply chain disruptions affected the availability and perhaps the cost of components used in the manufacturing of wet food. The pandemic-induced economic slowdown may have led some pet owners on a tight budget to choose less expensive dry food choices.

Recent Trends and Developments in the United States Wet Pet Food Market:

Pet owners now want luxury wet food alternatives with human-grade ingredients, organic formulas, and grain-free options because they treat their animals like kings. With intriguing tastes, textures, and features like insect-based protein for environmentally aware pet owners, innovation keeps things interesting. Subscription businesses that bring freshly prepared, portioned wet food right to customers' doorsteps appeal to busy lives. Brands that use recycled materials to create eco-friendly packaging are also embracing sustainability. Through targeted marketing and instructive information, the internet world directly connects pet owners with companies, and social media helps to increase brand loyalty. Working together with veterinarians enables them to provide premium wet food recommendations that are suited to individual pet health requirements, increasing sales and fostering consumer confidence in wet food as the better nutritional alternative.

Key Players:

- Chewy

- Colgate-Palmolive Company

- Freshpet

- General Mills Inc.

- JustFoodForDogs

- Mars Petcare Inc.

- Merrick Pet Care

- Nestlé Purina PetCare

- Royal Canin

- The J.M. Smucker Company

- Wellness Pet Food

Chapter 1. United States Wet Pet Food Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. United States Wet Pet Food Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. United States Wet Pet Food Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. United States Wet Pet Food Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. United States Wet Pet Food Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. United States Wet Pet Food Market– By Pet Type

6.1. Introduction/Key Findings

6.2. Dogs

6.3. Cats

6.4. Y-O-Y Growth trend Analysis By Pet Type

6.5. Absolute $ Opportunity Analysis By Pet Type, 2024-2030

Chapter 7. United States Wet Pet Food Market– By Source of Protein

7.1. Introduction/Key Findings

7.2. Animal-Based Protein

7.3 Plant-Based Protein

7.4. Y-O-Y Growth trend Analysis By Source of Protein

7.5. Absolute $ Opportunity Analysis By Source of Protein , 2024-2030

Chapter 8. United States Wet Pet Food Market– By Price Point

8.1. Introduction/Key Findings

8.2. Mass Market

8.3. Premium

8.4. Super-Premium

8.5. Y-O-Y Growth trend Analysis By Price Point

8.6. Absolute $ Opportunity Analysis By Price Point , 2024-2030

Chapter 9 . United States Wet Pet Food Market– By Functionality

9 .1. Introduction/Key Findings

9.2. Complete and Balanced Diets

9.3. Treats and Toppers

9.5. Y-O-Y Growth trend Analysis By Functionality

9.6. Absolute $ Opportunity Analysis By Functionality , 2024-2030

Chapter 10 . United States Wet Pet Food Market– By Distribution Channel

10 .1. Introduction/Key Findings

10.2. Supermarkets and Hypermarkets

10.2. Specialty Stores

10.3. Online Retailers

10.4. Y-O-Y Growth trend Analysis By Distribution Channel

10.5. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. United States Wet Pet Food Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. U.S.A

11.1.1. By Country

11.1.1.1. U.S.A

11.1.2. By Pet Type

11.1.3. By Source of Protein

11.1.4. Price Point

11.1.5. Functionality

11.1.6. Distribution Channel

11.1.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. United States Wet Pet Food Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1. Chewy

12.2. Colgate-Palmolive Company

12.3. Freshpet

12.4. General Mills Inc.

12.5. JustFoodForDogs

12.6. Mars Petcare Inc.

12.7. Merrick Pet Care

12.8. Nestlé Purina PetCare

12.9. Royal Canin

12.10. The J.M. Smucker Company

12.11. Wellness Pet Food

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The United States Wet Pet Food Market size is valued at USD 6389.9 million in 2023.

The worldwide United States Wet Pet Food Market growth is estimated to be 5.18% from 2024 to 2030.

United States Wet Pet Food Market segmentation covered in the report is By Pet Type (Dogs, Cats); By Source of Protein (Animal-Based Protein, Plant-Based Protein); By Price Point (Mass Market, Premium, Super-Premium); By Distribution Channel (Supermarkets and Hypermarkets, Specialty Pet Stores, Online Retailers); By Functionality (Complete and Balanced Diets, Treats and Toppers) and by region

Anticipate ongoing premiumization with components of human grade and useful advantages. An increase in plant-based protein sources, environmentally friendly packaging, and customized meal plans that are delivered right to your door can be anticipated.

The US wet pet food business was affected by the COVID-19 epidemic in a variety of ways. The market's sustained expansion was probably aided by the surge in pet ownership and the e-commerce boom, even in the face of short-term obstacles like supply chain interruptions.