Organic Pet Food Market Size (2024 – 2030)

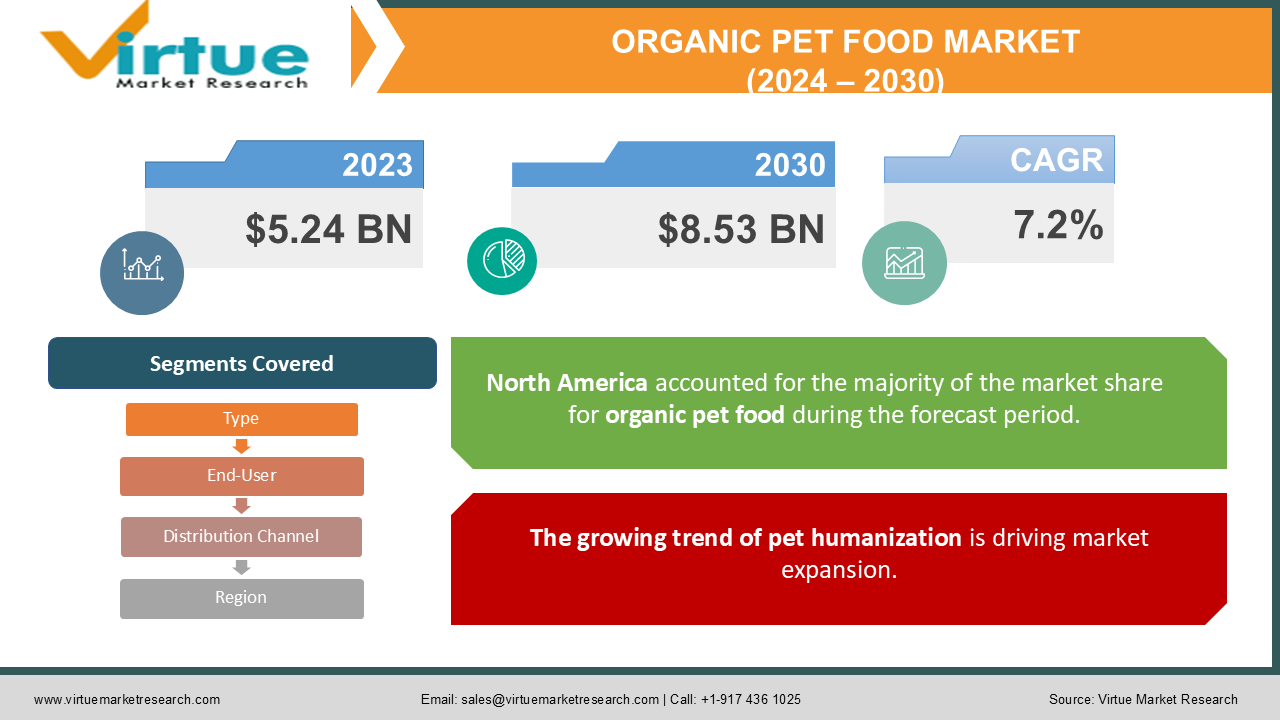

The Organic Pet Food Market was valued at USD 5.24 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 8.53 billion by 2030, growing at a CAGR of 7.2%.

Pet food, designed specifically for consumption by animals, is referred to as animal feed. It is commonly available in supermarkets and pet supply stores, typically customized for different species, such as dog or cat food. This type of pet food is rich in nutrients and includes organic meats, fruits, vegetables, minerals, and vitamins.

Organic pet food provides numerous health benefits, including enhanced immunity, reduced allergies and skin issues, alleviated digestive problems, increased longevity, and maintenance of a healthy weight. Depending on the texture, it is available in various forms such as snacks, treats, kibble, liquid supplements, and pellets. The packaging varies, encompassing bags, pouches, cans, trays, and other types of containers.

Key Market Insights:

Organic pet foods are tailored to meet the specific needs of pets based on their breed and age. In the United States, the most commonly consumed organic pet foods are partially organic, containing varying nutrient levels in compliance with USDA standards.

The pet industry is witnessing rapid expansion in several emerging markets. For example, India has approximately 20 million pet dogs, with their annual food expenditure estimated at around USD 160 million and growing steadily. Additionally, about 19 million other domestic pets are currently in homes, with around 600,000 more being adopted each year.

Organic Pet Food Market Drivers:

The growing trend of pet humanization is driving market expansion.

The trend of "pet humanization" has gained significant momentum in various parts of the world, with consumers increasingly viewing pets as integral members of their families. A growing number of individuals in the United States, China, Europe, and beyond are willing to invest heavily in their pets' well-being. This shift in perspective has extended to pet food, with many consumers prioritizing natural, high-quality options and willing to spend more to secure these products.

Moreover, pet owners expect the items they purchase for their pets to meet the same standards they apply to their own purchases. There is a clear preference for fewer artificial ingredients and preservatives, with an increasing demand for organic products that also offer longer shelf life. As the number of households with at least one pet continues to rise globally, the demand for premium pet food—particularly organic options—is anticipated to grow substantially in the coming years.

Organic Pet Food Market Restraints and Challenges:

The high cost of organic pet food products is a significant factor restraining market growth.

Sales of organic pet food are considerably lower than those of conventional options, primarily due to the higher price point associated with organic products. The average cost for conventional pet food is approximately USD 2.28 per pound, while organic pet food typically costs around USD 3.66 per pound. This price disparity is largely attributed to higher production costs for organic foods, which stem from increased labor requirements and the challenges of achieving economies of scale due to a greater variety of operations involved.

The pricing of organic pet food more accurately reflects the expenses associated with cultivation, including labor-intensive practices, chemical management, growing, harvesting, transportation, and storage. Additionally, the costs for first-time certification can be significant, ranging from USD 700 to USD 1,200 per operation, along with other ongoing certification expenses. Consequently, the elevated costs of organic pet food are likely to hinder its market growth.

Organic Pet Food Market Opportunities:

The demand in emerging markets presents significant opportunities for growth.

A rapidly urbanizing middle class is increasingly working, earning more, and acquiring pets, particularly dogs, while postponing parenthood. Moreover, pet ownership is on the rise in Asian countries such as Indonesia, the Philippines, Thailand, and Taiwan. With increasing consumer awareness and a growing disposable income among millennials in these regions, there are numerous lucrative growth opportunities for marketers looking to invest in these emerging markets.

ORGANIC PET FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, End-User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Drools, Archer Daniels Midland Company, Bailey's Bowl, Harrison’s Bird Foods, Benevo, Diamond Naturals, Evanger's, Biopet Pet Care Pty Ltd, Himalaya Wellness , Blues Buffalo, Evanger's Dog & Cat Food Company, Inc. |

Organic Pet Food Market Segmentation: By Type

-

Wet Organic Pet Food

-

Dry Organic Pet Food

The dry organic pet food segment is the largest contributor to the market and is projected to grow during the forecast period. This category includes organic kibbles, pillows, and dental sticks. Traditionally, dry foods have been the most favored choice among pet owners, and they offer several advantages over wet options, which boosts their market sales. For example, dry organic pet foods are generally more cost-effective.

The wet organic pet food segment includes products such as chunks in gravy, chunks in jelly, casseroles, and meatloaf. These foods contain higher moisture content, typically ranging from 60% to 85% of the total weight, alongside lower proportions of dry matter such as protein, fat, carbohydrates, vitamins, and minerals. Additionally, wet organic pet foods often feature high levels of meat and meat by-products. The enhanced palatability of wet organic pet foods significantly contributes to the growth of this segment.

Organic Pet Food Market Segmentation: By End-User

-

Cat

-

Dog

-

Fish

-

Bird

-

Other Animals

The dog segment leads the global pet food market and is expected to continue growing during the forecast period. Mirroring the health and wellness trend in the human food industry, dog food is also experiencing a shift as owners look for ways to indulge their pets. Increasing awareness of dogs' dietary needs has driven demand for higher-quality dog food products. Additionally, the rising popularity of organic foods in the human sector is making its way into the dog food market, contributing to the dog segment's dominant market share.

Meanwhile, the organic fish food market is expanding due to the rising ownership of pet fish, driven by smaller living spaces and a growing desire for soothing home environments. Fish are ideal pets for individuals who appreciate animals but may not have the time or space for larger pets like cats or dogs. As urban migration increases, living spaces are becoming more compact, limiting options for larger pets. Furthermore, watching fish swim is believed to have a calming effect, further enhancing the appeal of pet fish ownership.

Organic Pet Food Market Segmentation: By Distribution Channel

-

Hypermarkets/Supermarkets

-

Pet Shops

-

Online Stores

-

Other Retail Stores

The hypermarkets and supermarkets segment holds the largest market share and is projected to grow during the forecast period. These stores offer a comprehensive range of food products to meet consumers' needs. The organic pet food sector is expanding due to sector consolidation and

efforts to enhance consumer convenience through various grocery outlets and payment methods, driving demand within this segment. Additionally, major supermarkets and hypermarkets like Walmart, FoodHall, and Star Bazaar enable online shopping through mobile apps and provide free home delivery services.

Pet stores also cater to a diverse array of animal accessories and supplies, including dry food, wet food, treats, and snacks. These establishments are highly popular in developed countries, and specialized pet shops are gaining traction among discerning consumers due to their offerings of various branded, natural organic pet food products suitable for all types of pets. The availability of a wide range of animal supplies, pet accessories, and services further fuels the demand for pet shops.

Organic Pet Food Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America holds the largest share of the global organic pet food market, with demand rapidly increasing due to heightened consumer awareness of the positive effects on pet health. The United States is expected to make the most significant contribution to the North American market. The trend of pet adoption among millennials is anticipated to further drive market growth. According to the American Pet Products Association (APPA), approximately 38% of people in the United States own cats, with an average of two cats per household. Additionally, dogs remain the most popular pets in the region, prompting key players to focus on offering dog food to capture a larger market share.

Europe is also projected to experience growth during the forecast period, holding a substantial portion of the market share and benefiting from increasing pet ownership. The trend of pet adoption is strong across Europe, and the rising preference for healthy pet foods is a primary factor driving market expansion. Europe is recognized as a key market for high-quality organic pet food, with nearly 80 million households owning at least one pet, according to the European Pet Food Industry Organization (FEDIAF). The Industry Association of Pet Care Manufacturers highlights Germany as a major market for organic pet food, with 34.3 million pets and a significant population of affluent consumers.

COVID-19 Pandemic: Impact Analysis

The pet food market has recently faced a dual impact on product demand, largely due to lockdown measures implemented in various countries in response to the COVID-19 pandemic. The onset of the pandemic presented packaging manufacturers with numerous challenges that were initially thought to be temporary. These challenges included disruptions in the supply chain, shortages of raw materials crucial for production, labor shortages, and fluctuating pricing dynamics that could result in increased costs for final products. Additionally, logistical issues such as shipping complications further complicated the situation.

Latest Trends/ Developments:

February 2023 - Fera Pet Organics launched two new supplements for cats and dogs: Calming Support and Liver Support. The company states that these products are formulated with specific probiotic strains to enhance animal health and are backed by scientific research.

February 2023 - AlphaPet Ventures, a leading digital brand platform for premium pet food in Europe, acquired the Herrmann's Manufaktur brand from Herrmann GmbH. This acquisition of a market leader in organic wet food reinforces AlphaPet's strategic expansion of its premium brand platform.

Key Players:

These are top 10 players in the Organic Pet Food Market:-

-

Drools

-

Archer Daniels Midland Company

-

Bailey's Bowl

-

Harrison’s Bird Foods

-

Benevo

-

Diamond Naturals, Evanger's

-

Biopet Pet Care Pty Ltd

-

Himalaya Wellness

-

Blues Buffalo

-

Evanger's Dog & Cat Food Company, Inc.

Chapter 1. Organic Pet Food Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organic Pet Food Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organic Pet Food Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organic Pet Food Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organic Pet Food Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organic Pet Food Market – By Type

6.1 Introduction/Key Findings

6.2 Wet Organic Pet Food

6.3 Dry Organic Pet Food

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Organic Pet Food Market – By End User

7.1 Introduction/Key Findings

7.2 Cat

7.3 Dog

7.4 Fish

7.5 Bird

7.6 Other Animals

7.7 Y-O-Y Growth trend Analysis By End User

7.8 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Organic Pet Food Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Hypermarkets/Supermarkets

8.3 Pet Shops

8.4 Online Stores

8.5 Other Retail Stores

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Organic Pet Food Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End User

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End User

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End User

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End User

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End User

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Organic Pet Food Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Drools

10.2 Archer Daniels Midland Company

10.3 Bailey's Bowl

10.4 Harrison’s Bird Foods

10.5 Benevo

10.6 Diamond Naturals, Evanger's

10.7 Biopet Pet Care Pty Ltd

10.8 Himalaya Wellness

10.9 Blues Buffalo

10.10 Evanger's Dog & Cat Food Company, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Organic pet food is composed of natural vitamins, proteins, amino acids, fatty acids, and minerals, excluding preservatives, artificial flavors, and genetically modified ingredients.

The top players operating in the Organic Pet Food Market are - Drools, Archer Daniels Midland Company, Bailey's Bowl, Harrison’s Bird Foods and Benevo.

The pet food market has recently faced a dual impact on product demand, largely due to lockdown measures implemented in various countries in response to the COVID-19 pandemic.

With increasing consumer awareness and a growing disposable income among millennials in these regions, there are numerous lucrative growth opportunities and trends for marketers looking to invest in these emerging markets.

Europe is also projected to experience growth during the forecast period, holding a substantial portion of the market share and benefiting from increasing pet ownership.