Supply Chain Management Software Market Size (2024 – 2030)

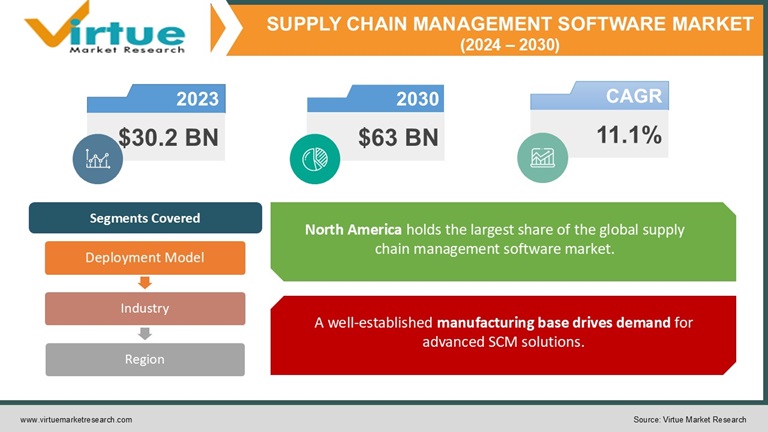

The Global Supply Chain Management Software Market was valued at USD 30.2 billion in 2023 and is projected to reach a market size of USD 63 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 11.1% between 2024 and 2030.

Download Free Sample Copy Of This Report

The Global Supply Chain Management (SCM) Software Market is experiencing rapid growth as businesses increasingly recognize the importance of efficient supply chain operations in a highly competitive and interconnected world. SCM software provides organizations with the tools to manage the flow of goods, services, and information across the entire supply chain, from raw material procurement to final product delivery.

The market is driven by the rising demand for cloud-based solutions, the integration of artificial intelligence and machine learning, and the growing need for real-time data visibility and analytics. Additionally, the surge in e-commerce, globalization of supply chains, and the push for sustainable practices are further fueling the adoption of SCM software.

As companies seek to enhance their operational efficiency, reduce costs, and respond swiftly to market dynamics, the demand for advanced SCM solutions is expected to rise. With continuous advancements in technology, the SCM software market is poised to play a critical role in the future of global commerce, offering businesses the ability to optimize their supply chains, mitigate risks, and improve overall profitability.

Key Market Insights:

- Over 60% of SCM software implementations are cloud-based as of 2023.

- AI-driven solutions are expected to constitute nearly 40% of the market by 2025.

- The Asia-Pacific region is forecasted to experience the fastest growth, with a CAGR of around 13% during the forecast period.

- The e-commerce sector accounted for over 20% of the total demand for SCM solutions in 2023.

Global Supply Chain Management Software Market Drivers:

Increasing Demand for Real-Time Data and Analytics.

One of the primary drivers of the Global Supply Chain Management (SCM) Software Market is the growing demand for real-time data visibility and analytics. In today’s fast-paced business environment, organizations need to make informed decisions quickly to stay competitive. Real-time data and advanced analytics enable businesses to monitor and optimize their supply chains, predict potential disruptions, and respond proactively to changing market conditions.

By leveraging SCM software with integrated analytics capabilities, companies can gain insights into every aspect of their supply chain, from inventory levels to transportation routes, helping them reduce costs, improve efficiency, and enhance customer satisfaction. The ability to access and analyze real-time data has become crucial for organizations looking to maintain a competitive edge, making this a significant driver for the adoption of SCM software.

Rising Adoption of Cloud-Based Solutions.

The rising adoption of cloud-based solutions is another key driver propelling the growth of the Global Supply Chain Management Software Market. Cloud-based SCM software offers numerous advantages over traditional on-premise solutions, including scalability, flexibility, and cost-effectiveness. Businesses of all sizes can now access advanced SCM capabilities without the need for significant upfront investments in hardware and infrastructure.

Moreover, cloud-based solutions enable seamless collaboration among global teams, ensuring that supply chain stakeholders can access critical information from anywhere, at any time. The ability to integrate with other cloud-based applications, such as enterprise resource planning (ERP) systems, further enhances the appeal of these solutions. As more organizations recognize the benefits of cloud technology, the demand for cloud-based SCM software is expected to continue its upward trajectory, driving market growth.

Unlock Market Insights: Get A FREE Sample Report Today!

Global Supply Chain Management Software Market Restraints and Challenges:

The Global Supply Chain Management (SCM) Software Market faces several restraints and challenges that could hinder its growth. One of the primary challenges is the high cost of implementation and maintenance, particularly for small and medium-sized enterprises (SMEs). While large organizations may have the resources to invest in comprehensive SCM solutions, SMEs often struggle with the initial costs and ongoing expenses associated with software upgrades, customization, and technical support.

Additionally, the complexity of integrating SCM software with existing legacy systems can be a significant barrier, especially for businesses with outdated infrastructure. This integration challenge is compounded by the need for specialized skills and training, which can further increase costs and extend implementation timelines. Another notable restraint is the growing concern over data security and privacy.

As SCM software often involves the sharing of sensitive information across global networks, the risk of cyberattacks and data breaches becomes a critical issue. Companies must invest in robust security measures, which can be costly and resource-intensive.

Moreover, the rapid pace of technological advancements means that businesses must continuously adapt to new features and updates, creating a constant need for investment and adjustment. These factors collectively pose significant challenges to the widespread adoption of SCM software.

Global Supply Chain Management Software Market Opportunities:

The Global Supply Chain Management (SCM) Software Market is ripe with opportunities, particularly as technological innovations continue to reshape the industry. One of the most promising opportunities lies in the integration of artificial intelligence (AI) and machine learning (ML) into SCM solutions. These technologies can enhance predictive analytics, automate routine tasks, and optimize decision-making processes, allowing companies to anticipate demand fluctuations, manage inventory more efficiently, and mitigate risks with greater precision.

Another significant opportunity is the growing emphasis on sustainability within supply chains. As businesses increasingly prioritize environmental, social, and governance (ESG) criteria, SCM software providers have the chance to develop solutions that help companies track and reduce their carbon footprint, manage resources more responsibly, and comply with evolving regulations.

Additionally, the expansion of e-commerce and globalization has led to more complex supply chains, creating a demand for sophisticated SCM tools that can handle multi-channel operations and cross-border logistics. Emerging markets, particularly in Asia-Pacific and Latin America, present further growth potential as businesses in these regions invest in modernizing their supply chain infrastructure. By capitalizing on these opportunities, SCM software providers can not only drive market growth but also play a pivotal role in shaping the future of global supply chains.

SUPPLY CHAIN MANAGEMENT SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.1% |

|

Segments Covered |

By Deployment Model, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SAP SE, Oracle Corporation, IBM Corporation, Infor, JDA Software Group, Inc., Manhattan Associates, Inc., Epicor Software Corporation, Kinaxis Inc., Coupa Software Inc., Blue Yonder Group, Inc. |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

SEGMENTATION ANALYSIS

Global Supply Chain Management Software Market Segmentation: By Deployment Model

-

On-premises

-

Cloud-based

-

Hybrid

In 2023, based on market segmentation by Deployment Model, Cloud-based Occupies the highest share of the Global Supply Chain Management Software Market. Cloud-based solutions offer significant advantages for businesses in terms of scalability, cost-effectiveness, rapid deployment, accessibility, and regular updates. These solutions can easily scale up or down to meet changing business needs without requiring substantial upfront investments in hardware or infrastructure. This flexibility allows companies to adjust their resources based on demand, optimizing operational efficiency.

Additionally, cloud-based models often feature lower initial costs and can be more economical in the long run, particularly benefiting smaller businesses that may have limited budgets. The rapid deployment of cloud-based software enables businesses to implement solutions quickly, reducing time-to-market and allowing them to capitalize on benefits sooner. Accessibility is another key advantage, as cloud-based software can be accessed from anywhere with an internet connection, facilitating improved collaboration and enabling remote work.

Furthermore, cloud providers typically offer frequent updates and upgrades, ensuring that businesses consistently have access to the latest features and functionalities without the need for manual installations or upgrades. These benefits collectively make cloud-based solutions an attractive option for organizations seeking to enhance their agility, cost-efficiency, and overall operational effectiveness.

Global Supply Chain Management Software Market Segmentation: By Industry

-

Manufacturing

-

Retail

-

Healthcare

-

Logistics

In 2023, based on market segmentation by Industry, Manufacturing Occupies the highest share of the Global Supply Chain Management Software Market. Manufacturers often face complex supply chains involving numerous suppliers, components, and production steps, making effective management crucial.

SCM software is instrumental in navigating these complexities by providing tools to streamline and optimize operations. It aids in inventory management by offering advanced capabilities for inventory planning, forecasting, and optimization, helping to prevent stockouts and excess inventory. Quality control is another critical area where SCM software adds value, as it enables manufacturers to implement robust quality control measures and track product quality throughout the supply chain.

Additionally, SCM software plays a significant role in cost reduction by streamlining processes, minimizing waste, and improving overall operational efficiency, which can lead to enhanced profitability. Regulatory compliance is also a key consideration, with many manufacturing sectors facing stringent regulations. SCM software helps ensure compliance by providing features to manage and document regulatory requirements, thereby reducing the risk of non-compliance. Together, these capabilities enable manufacturers to maintain smooth operations, enhance product quality, control costs, and adhere to regulatory standards, ultimately driving operational success and competitiveness.

Global Supply Chain Management Software Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

What's Next for Your Market? Get a Snapshot with FREE Sample Report

North America Occupies the highest share of the Global Supply Chain Management Software Market in 2023. North America’s robust demand for SCM software is driven by several key factors. The region boasts a well-established manufacturing sector, which significantly contributes to the high demand for advanced SCM solutions to manage complex supply chains efficiently.

Additionally, businesses in North America are often at the forefront of adopting new technologies, including SCM software, reflecting a culture of technological advancement and innovation. This trend is further supported by the strong presence of major SCM software providers headquartered in the region, offering competitive solutions that cater to diverse industry needs.

Furthermore, increasing regulatory pressures, particularly around supply chain transparency and sustainability, are compelling organizations to invest in SCM software to ensure compliance and enhance operational visibility. As businesses face stringent regulations and a growing emphasis on sustainable practices, SCM software becomes a crucial tool for navigating these challenges while optimizing supply chain operations. Together, these factors highlight North America's strategic position in the SCM software market, driven by its advanced technology adoption, significant manufacturing base, and regulatory landscape.

COVID-19 Impact Analysis on the Global Supply Chain Management Software Market.

The COVID-19 pandemic had a profound impact on the Global Supply Chain Management (SCM) Software Market, accelerating the adoption of digital solutions as companies faced unprecedented disruptions. The pandemic exposed vulnerabilities in global supply chains, including delays, shortages, and unpredictable demand patterns, prompting businesses to seek more resilient and agile supply chain strategies. As a result, there was a surge in demand for SCM software that could provide real-time visibility, enhance collaboration, and enable data-driven decision-making. The shift to remote work further fueled the need for cloud-based SCM solutions, as organizations required seamless access to supply chain data and the ability to manage operations from anywhere.

Additionally, the pandemic highlighted the importance of risk management and contingency planning, leading companies to invest in advanced analytics and AI-powered tools to predict and mitigate future disruptions. However, the economic uncertainty caused by COVID-19 also led to budget constraints for some businesses, particularly small and medium-sized enterprises, which slowed down their adoption of SCM software. Despite these challenges, the long-term impact of the pandemic has been a greater emphasis on supply chain digitization, positioning the SCM software market for continued growth as businesses prioritize resilience and adaptability in a post-pandemic world.

Latest trends / Developments:

The Global Supply Chain Management (SCM) Software Market is witnessing several key trends and developments that are reshaping the industry. One of the most significant trends is the increasing integration of artificial intelligence (AI) and machine learning (ML) into SCM software, enabling predictive analytics, demand forecasting, and automation of routine tasks, which enhance efficiency and decision-making.

Another major development is the growing adoption of blockchain technology to improve transparency and traceability across the supply chain, ensuring secure and verifiable transactions. The rise of Internet of Things (IoT) devices is also transforming the SCM landscape by providing real-time data on inventory, transportation, and environmental conditions, allowing for more accurate tracking and management.

Additionally, there is a notable shift towards cloud-based SCM solutions, driven by the need for flexibility, scalability, and remote accessibility, especially in the wake of the COVID-19 pandemic. Sustainability has also become a critical focus, with companies seeking SCM software that supports environmentally friendly practices, such as optimizing routes to reduce carbon emissions.

Lastly, the demand for personalized and customer-centric supply chain solutions is growing, as businesses aim to enhance the customer experience by ensuring timely and accurate deliveries. These trends are driving innovation and setting the stage for the future of SCM software.

Key Players:

-

SAP SE

-

Oracle Corporation

-

IBM Corporation

-

Infor

-

JDA Software Group, Inc.

-

Manhattan Associates, Inc.

-

Epicor Software Corporation

-

Kinaxis Inc.

-

Coupa Software Inc.

-

Blue Yonder Group, Inc.

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Supply Chain Management Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Supply Chain Management Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Supply Chain Management Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Supply Chain Management Software Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Supply Chain Management Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Supply Chain Management Software Market – By Deployment Model

6.1 Introduction/Key Findings

6.2 On-premises

6.3 Cloud-based

6.4 Hybrid

6.5 Y-O-Y Growth trend Analysis By Deployment Model

6.6 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 7. Supply Chain Management Software Market – By Industry

7.1 Introduction/Key Findings

7.2 Manufacturing

7.3 Retail

7.4 Healthcare

7.5 Logistics

7.6 Y-O-Y Growth trend Analysis By Industry

7.7 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 8. Supply Chain Management Software Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Model

8.1.3 By Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Model

8.2.3 By Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Model

8.3.3 By Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Model

8.4.3 By Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Model

8.5.3 By Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Supply Chain Management Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 SAP SE

9.2 Oracle Corporation

9.3 IBM Corporation

9.4 Infor

9.5 JDA Software Group, Inc.

9.6 Manhattan Associates, Inc.

9.7 Epicor Software Corporation

9.8 Kinaxis Inc.

9.9 Coupa Software Inc.

9.10 Blue Yonder Group, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Supply Chain Management Software market is expected to be valued at US$ 30.2 billion.

Through 2030, the Global Supply Chain Management Software market is expected to grow at a CAGR of 11.1%.

By 2030, the Global Supply Chain Management Software Market is expected to grow to a value of US$ 63 billion.

North America is predicted to lead the Global Supply Chain Management Software market.

The Global Supply Chain Management Software Market has been segmented By deployment model, industry, and Region.