Blockchain Technology Market Size (2024 – 2030)

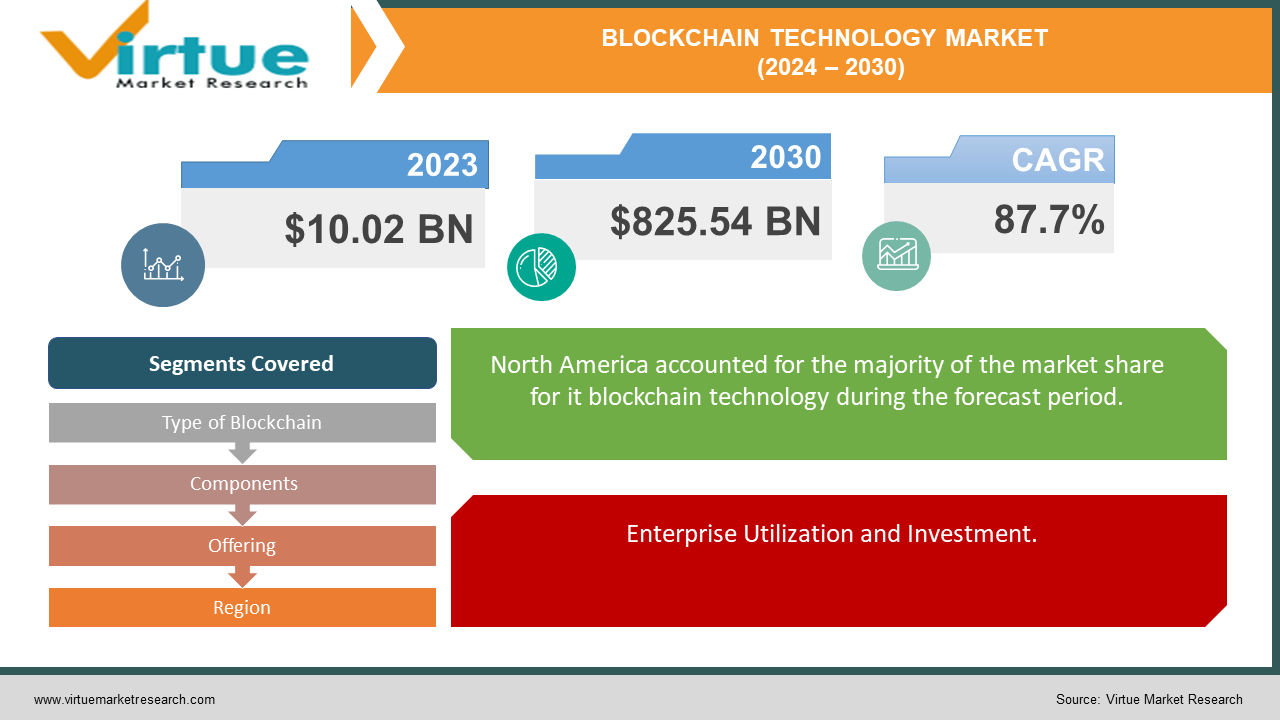

The market for blockchain technology was estimated to be worth USD 10.02 billion in 2023 and is expected to increase to USD 825.54 billion by 2030, with a projected compound annual growth rate (CAGR) of 87.7% from 2024 to 2030.

The blockchain technology market is witnessing unprecedented growth, driven by its increasing adoption across various industries for enhancing security, transparency, and efficiency. In 2023, the market was valued at approximately USD 10.02 billion and is projected to surge to USD 1,431.54 billion by 2030, marking a remarkable compound annual growth rate (CAGR) of 87.7%. Key sectors driving this expansion include banking and financial services, healthcare, and supply chain management, with North America leading in market share due to its robust tech ecosystem and significant investments. As businesses continue to digitalize and seek secure, transparent solutions, blockchain's role becomes increasingly pivotal, heralding a transformative era in technology adoption.

Key Insights:

Over 90% of banks in the United States and Europe have initiated blockchain-related projects, with the banking sector accounting for approximately 29.7% of the blockchain market value.

Nearly 90% of surveyed enterprises report using blockchain technology in some capacity, with 87% planning further investments in blockchain in 2024.

North America leads the blockchain market, accounting for over 37% of global revenue in 2022, driven by substantial investments and a strong tech ecosystem.

Global Blockchain Technology Market Drivers:

Enterprise Utilization and Investment.

Blockchain technology is seeing widespread utilization among enterprises, with nearly 90% of surveyed businesses already employing blockchain solutions to some extent. Moreover, 87% of these enterprises are planning further investments in blockchain in 2024. This high level of adoption highlights the technology's perceived value in enhancing security, reducing costs, and improving process efficiencies across various business operations.

Regional Market Leadership.

North America currently leads the blockchain technology market, accounting for over 37% of global revenue in 2022. This dominance is attributed to significant investments and a strong technological ecosystem that fosters innovation and adoption. The region's leadership in blockchain is expected to continue, supported by active participation from major tech companies and favorable regulatory environments.

Global Blockchain Technology Market Restraints and Challenges:

Regulatory Uncertainty.

One of the major challenges facing the blockchain technology market is the lack of clear and consistent regulatory frameworks. Different countries have varying approaches to blockchain and cryptocurrencies, leading to a fragmented regulatory environment. This inconsistency can hinder innovation and discourage investment, as companies remain uncertain about the legal implications of their blockchain initiatives. For instance, while some countries like Malta have established blockchain-friendly regulations, others have imposed stringent restrictions, creating an unpredictable landscape for businesses operating internationally.

Scalability Issues.

Scalability remains a significant technical challenge for blockchain technology. Many blockchain networks, particularly public ones like Bitcoin and Ethereum, struggle to process a high volume of transactions quickly and efficiently. This limitation can lead to slower transaction times and higher fees during periods of high demand. As the number of users and applications on these networks grows, the need for scalable solutions becomes more pressing. Innovations such as sharding, off-chain transactions, and new consensus algorithms are being explored to address these scalability issues, but widespread implementation is still in development.

Interoperability Challenges.

The lack of interoperability between different blockchain networks is another critical restraint. With numerous blockchain platforms in existence, each with its protocols and standards, seamless interaction between these systems is difficult. This fragmentation can prevent the efficient exchange of data and value across different blockchain networks, limiting the technology's overall effectiveness and adoption. Efforts are being made to develop interoperability solutions, such as cross-chain communication protocols and standards, but achieving universal compatibility remains a complex and ongoing challenge.

Global Blockchain Technology Market Opportunities:

Expansion in Financial Services.

The financial sector remains one of the most promising areas for blockchain technology. With over 90% of banks in the United States and Europe already exploring or implementing blockchain solutions, there is a significant opportunity to further streamline processes, reduce fraud, and enhance transaction security. Blockchain can revolutionize payments, clearing, and settlement systems, offering faster and more efficient transactions compared to traditional systems. The growth of decentralized finance (DeFi) platforms is also creating new opportunities for financial inclusion and innovation in financial products and services.

Supply Chain Management Enhancements.

Blockchain technology offers immense potential to transform supply chain management by providing increased transparency and traceability. Businesses can utilize blockchain to track the origin and movement of goods, ensuring authenticity and reducing fraud. This is particularly valuable in industries such as food and pharmaceuticals, where safety and authenticity are critical. By implementing blockchain, companies can improve operational efficiency, reduce costs, and enhance consumer trust through verified product histories.

Healthcare and Pharmaceuticals.

The healthcare sector presents a significant opportunity for blockchain technology, particularly in managing patient data and securing medical records. Blockchain can provide a secure, immutable record of patient histories, facilitating better care coordination and reducing the risk of data breaches. Additionally, blockchain can enhance the management of pharmaceutical supply chains, ensuring the authenticity of drugs and preventing counterfeit products from entering the market. These applications can lead to improved patient outcomes and greater efficiency in healthcare delivery.

BLOCKCHAIN TECHNOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

87.7% |

|

Segments Covered |

By Type of Blockchain, Components, Offering, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM, Microsoft, Accenture, Oracle, Deloitte, Ripple Coinbase, ConsenSys, Bitfury, Binance, Chainalysis, Blockstream |

Blockchain Technology Market Segmentation: By Type of Blockchain

-

Public

-

Private

-

Hybrid

In the dynamic landscape of the global blockchain technology market, each type of blockchain - public, private, and hybrid - brings its own set of advantages and considerations. Among these, the hybrid blockchain stands out as particularly effective due to its versatility and balanced approach. Combining elements of both public and private blockchains, hybrid blockchains offer a flexible solution that addresses the diverse needs of various industries and businesses. They provide the transparency and decentralization of public blockchains, allowing for secure and tamper-proof transactions, while also offering the control and privacy features associated with private blockchains. This unique combination makes hybrid blockchains well-suited for applications requiring a blend of transparency, security, and scalability, making them increasingly popular in sectors such as finance, supply chain management, and healthcare, where data privacy and regulatory compliance are paramount concerns.

Blockchain Technology Market Segmentation: By Components

-

Application & Solution

-

Infrastructure & Protocols

-

Middleware

Within the realm of market segmentation by components in the blockchain technology sector, infrastructure and protocols emerge as particularly potent drivers of innovation and efficiency. Infrastructure and protocols serve as the backbone of blockchain networks, providing the foundational framework upon which applications and solutions are built. By focusing on enhancing the underlying infrastructure and refining the protocols governing blockchain transactions, organizations can unlock a multitude of benefits, including improved scalability, interoperability, and security. Investing in infrastructure and protocols fosters the development of robust blockchain ecosystems that can support a diverse array of applications and use cases, ranging from decentralized finance (DeFi) to supply chain management and beyond. Furthermore, advancements in infrastructure and protocols drive standardization efforts within the industry, promoting collaboration and interoperability among different blockchain platforms and networks. As such, prioritizing investments in infrastructure and protocols enables organizations to lay a solid foundation for sustainable growth and innovation in the ever-evolving landscape of blockchain technology.

Blockchain Technology Market Segmentation: By Offering

-

Platform

-

Services

In the segmentation of the blockchain technology market by offering, platforms stand out as the most impactful component. Blockchain platforms provide the fundamental tools and frameworks necessary for developing and deploying decentralized applications (DApps) and smart contracts. These platforms offer developers a comprehensive suite of services, including software development kits (SDKs), application programming interfaces (APIs), and robust consensus mechanisms, facilitating the creation of innovative solutions across various industries. By leveraging blockchain platforms, organizations can expedite the development process, reduce time-to-market, and achieve greater interoperability and scalability. Additionally, blockchain platforms often incorporate features such as identity management, data encryption, and governance mechanisms, enhancing security and trust in decentralized ecosystems. With the proliferation of platform offerings catering to different use cases and industry verticals, businesses can choose the platform that best aligns with their specific requirements, accelerating their journey towards blockchain adoption and digital transformation. Thus, investing in blockchain platforms empowers organizations to harness the transformative potential of distributed ledger technology, driving efficiency, transparency, and innovation in the global marketplace.

Blockchain Technology Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The market share distribution by region in the blockchain technology sector reveals a nuanced global landscape. North America leads with 32%, driven by its robust ecosystem and supportive regulatory environment, while Europe closely follows with 26%, showcasing its commitment to innovation and regulatory clarity. Asia-Pacific captures a significant 22%, propelled by rapid economic growth and technological advancement, while South America and the Middle East and Africa collectively contribute 10%, signaling emerging interest amid unique challenges. Together, these regions paint a dynamic picture of blockchain adoption, highlighting diverse opportunities and contributions to the evolving global landscape of decentralized solutions.

COVID-19 Impact Analysis on the Global Blockchain Technology Market:

The COVID-19 pandemic has had a multifaceted impact on the global blockchain technology market, reshaping priorities and accelerating certain trends within the industry. While the initial uncertainty led to cautious spending and project delays in some sectors, the crisis also underscored the importance of resilient and transparent systems, driving increased interest in blockchain solutions. Industries such as healthcare, supply chain management, and finance have witnessed heightened demand for blockchain applications, as organizations seek to enhance data security, streamline processes, and ensure continuity amidst disruptions. Additionally, the pandemic has spurred collaborations and innovation within the blockchain ecosystem, leading to the rapid development of new use cases and partnerships to address emerging challenges. Looking ahead, as the world transitions to a post-pandemic era, blockchain technology is poised to play a pivotal role in driving digital transformation, resilience, and trust across various sectors, shaping the future of global commerce and governance.

Latest Trends/ Developments:

The latest trends and developments in the blockchain technology market reflect a maturing industry poised for widespread adoption and innovation. One notable trend is the growing interest in decentralized finance (DeFi), which leverages blockchain technology to revolutionize traditional financial services, offering greater accessibility, transparency, and efficiency. Additionally, non-fungible tokens (NFTs) have surged in popularity, enabling unique digital assets to be tokenized and traded securely on blockchain platforms, opening up new avenues for creators, collectors, and investors. Interoperability solutions are also gaining traction, addressing the challenge of siloed blockchain networks by enabling seamless communication and asset transfer between different protocols. Moreover, sustainability and environmental considerations are increasingly shaping the conversation, driving the development of eco-friendly blockchain solutions and the adoption of proof-of-stake (PoS) consensus mechanisms to reduce energy consumption. As the industry continues to evolve, collaborations between traditional enterprises and blockchain startups are on the rise, fostering innovation and mainstream adoption across various sectors, from supply chain management and healthcare to gaming and entertainment. These trends underscore the transformative potential of blockchain technology in reshaping industries, economies, and societies, paving the way for a more decentralized, transparent, and inclusive future.

Key Players:

-

IBM

-

Microsoft

-

Accenture

-

Oracle

-

Deloitte

-

Ripple

-

Coinbase

-

ConsenSys

-

Bitfury

-

Binance

-

Chainalysis

-

Blockstream

Chapter 1. Blockchain Technology Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Blockchain Technology Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Blockchain Technology Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Blockchain Technology Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Blockchain Technology Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Blockchain Technology Market – By Type of Blockchain

6.1 Introduction/Key Findings

6.2 Public

6.3 Private

6.4 Hybrid

6.5 Y-O-Y Growth trend Analysis By Type of Blockchain

6.6 Absolute $ Opportunity Analysis By Type of Blockchain, 2024-2030

Chapter 7. Blockchain Technology Market – By Components

7.1 Introduction/Key Findings

7.2 Application & Solution

7.3 Infrastructure & Protocols

7.4 Middleware

7.5 Y-O-Y Growth trend Analysis By Components

7.6 Absolute $ Opportunity Analysis By Components, 2024-2030

Chapter 8. Blockchain Technology Market – By Offering

8.1 Introduction/Key Findings

8.2 Platform

8.3 Services

8.4 Y-O-Y Growth trend Analysis By Offering

8.5 Absolute $ Opportunity Analysis By Offering, 2024-2030

Chapter 9. Blockchain Technology Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Blockchain

9.1.3 By Components

9.1.4 By By Offering

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Blockchain

9.2.3 By Components

9.2.4 By Offering

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Blockchain

9.3.3 By Components

9.3.4 By Offering

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Blockchain

9.4.3 By Components

9.4.4 By Offering

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Blockchain

9.5.3 By Components

9.5.4 By Offering

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Blockchain Technology Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 IBM

10.2 Microsoft

10.3 Accenture

10.4 Oracle

10.5 Deloitte

10.6 Ripple

10.7 Coinbase

10.8 ConsenSys

10.9 Bitfury

10.10 Binance

10.11 Chainalysis

10.12 Blockstream

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market for blockchain technology was estimated to be worth USD 10.02 billion in 2023 and is expected to increase to USD 825.54 billion by 2030, with a projected compound annual growth rate (CAGR) of 87.7% from 2024 to 2030.

The primary drivers of the global blockchain technology market include increased demand for transparent and secure transactions, growing adoption of decentralized finance (DeFi), and the proliferation of blockchain applications across diverse industries.

The key challenges facing the global blockchain technology market include regulatory uncertainty, scalability limitations, interoperability issues, and concerns regarding privacy and security.

In 2023, North America held the largest share of the global blockchain technology market.

IBM, Microsoft, Accenture, Oracle, Deloitte, Ripple, Coinbase, ConsenSys, Bitfury, Binance, Chainalysis, Blockstream are the main players.