Blockchain Market Size (2025 – 2030)

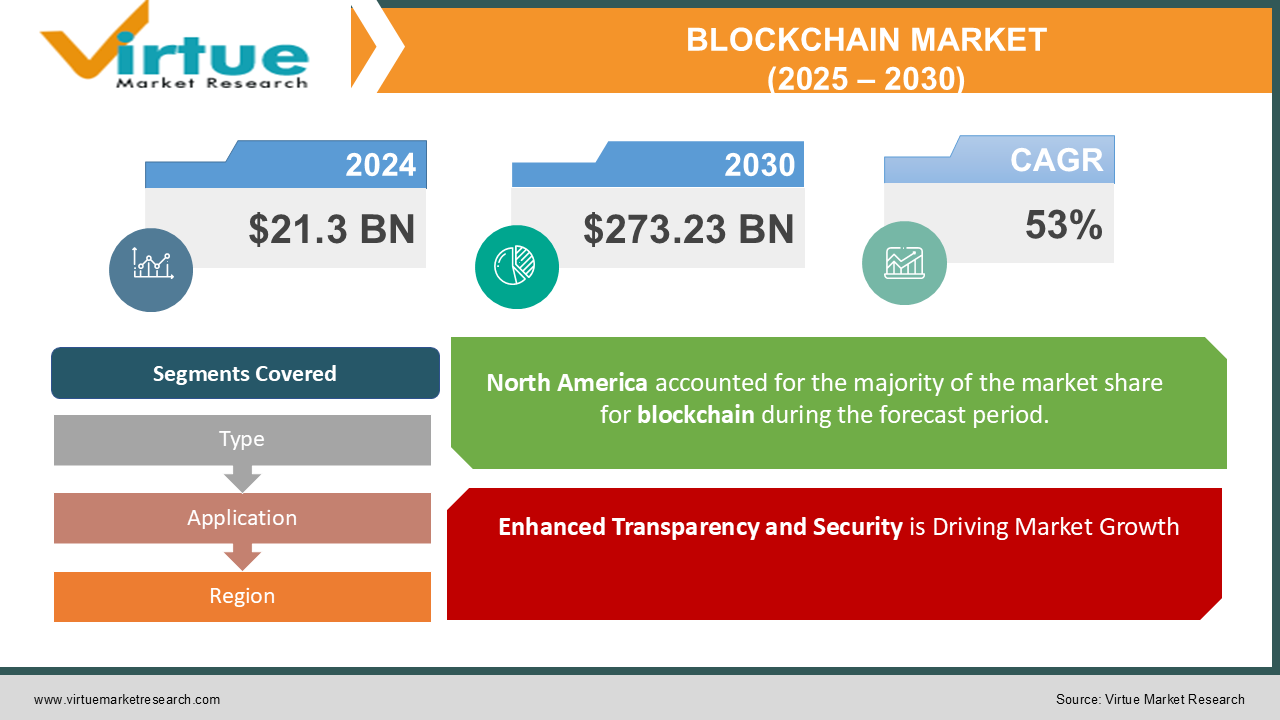

The Global Blockchain Market was valued at USD 21.3 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 53% from 2025 to 2030. The market is expected to reach USD 273.23 billion by 2030.

The Blockchain Market revolves around the implementation of distributed ledger technologies across various industries, such as finance, healthcare, supply chain, and government. This transformative technology offers transparency, security, and efficiency in operations, driving its adoption globally. With increasing interest in decentralized systems, blockchain is witnessing widespread use cases, especially in smart contracts, digital identity management, and cryptocurrency ecosystems.

Key Market Insights

-

Blockchain technology is being increasingly used in healthcare for secure patient data management, with a projected market penetration of 15% by 2030.

-

The Asia-Pacific region has witnessed a surge in blockchain adoption, with a 72% growth in startups focused on blockchain solutions between 2023 and 2024.

-

In 2024, over 60% of blockchain-based applications were built using public blockchain networks like Ethereum and Binance Smart Chain.

-

Governments in over 20 countries have initiated blockchain-based pilot projects for digital identity systems and secure voting mechanisms.

-

Scalability and energy efficiency are major focus areas in blockchain development, with innovations such as Layer 2 scaling solutions and proof-of-stake consensus models.

-

By 2030, blockchain is expected to save businesses up to USD 1 trillion annually through fraud reduction and streamlined processes.

Global Blockchain Market Drivers

Enhanced Transparency and Security is Driving Market Growth:

Blockchain’s decentralized ledger system ensures a high level of transparency, reducing the chances of fraud and corruption. Transactions recorded on blockchain are immutable, providing unmatched security for sensitive data. This has garnered attention in industries like finance, healthcare, and logistics, where trust is paramount. The ability to verify transactions in real-time enhances operational efficiency and reduces dependency on intermediaries. For instance, blockchain-enabled supply chains offer traceability, ensuring product authenticity and combating counterfeit goods. This transparency and security, combined with reduced operational costs, are driving blockchain adoption across sectors.

Increasing Adoption in Smart Contracts and Decentralized Finance (DeFi) is Driving Market Growth:

The proliferation of smart contracts and DeFi applications is one of the key growth drivers for the blockchain market. Smart contracts, which automate the execution of agreements, reduce the need for intermediaries and lower transaction costs. DeFi platforms leverage blockchain technology to provide financial services such as lending, borrowing, and trading without traditional banking institutions. Between 2020 and 2024, the total value locked (TVL) in DeFi protocols grew by over 1,200%, highlighting significant interest from users globally. This trend is expected to continue, with innovations like tokenized assets and decentralized exchanges gaining traction.

Regulatory Support and Strategic Investments is Driving Market Growth:

Governments and regulatory bodies worldwide are increasingly recognizing the potential of blockchain technology, implementing policies to encourage its adoption. Countries like China, the UAE, and Estonia have launched national blockchain strategies to boost technological innovation. Additionally, venture capital investments in blockchain startups surged to USD 33 billion in 2024, further accelerating the market’s growth. Partnerships between technology companies and traditional businesses, aimed at integrating blockchain solutions, are another key driver that showcases the technology's versatility and scalability.

Global Blockchain Market Challenges and Restraints

Scalability and Energy Concerns is restricting market growth:

Despite its potential, blockchain technology faces scalability challenges, especially in public blockchain networks. This is particularly evident in popular networks like Ethereum, where gas fees often spike during peak usage periods. Additionally, the energy-intensive nature of proof-of-work consensus mechanisms used by some blockchain systems has raised concerns about environmental sustainability. For instance, Bitcoin mining consumes more electricity annually than some countries, making it unsustainable for widespread adoption. Addressing these scalability and energy efficiency concerns remains crucial for blockchain's long-term success.

Regulatory Uncertainty and Lack of Standardization is restricting market growth:

The absence of clear and unified regulatory frameworks across countries poses a significant challenge to blockchain adoption. While some nations have embraced blockchain-friendly policies, others remain cautious, primarily due to concerns over cryptocurrency-related fraud and money laundering. This lack of standardization makes it difficult for businesses to adopt blockchain solutions confidently, especially in cross-border operations. Additionally, regulatory restrictions on initial coin offerings (ICOs) and tokenized assets limit fundraising opportunities for blockchain startups. Establishing consistent global standards and resolving jurisdictional conflicts is necessary to unlock the full potential of blockchain technology.

Market Opportunities

The blockchain market presents substantial growth opportunities driven by technological advancements and evolving use cases across industries. One of the most promising opportunities lies in integrating blockchain with artificial intelligence (AI) and IoT to create smart ecosystems. This combination can revolutionize sectors such as healthcare, where IoT devices can collect real-time patient data and blockchain can securely store and share this information with authorized parties. Another area of opportunity is the tokenization of assets, enabling fractional ownership of real estate, art, and other high-value assets. Tokenization not only democratizes investments but also enhances liquidity in traditionally illiquid markets. Blockchain also has immense potential in government initiatives, including secure voting systems, land registry management, and digital identities. For instance, Estonia’s e-residency program has demonstrated the potential of blockchain in providing secure and transparent governance solutions. Additionally, the rise of non-fungible tokens (NFTs) opens up new revenue streams in the creative and entertainment industries, offering content creators unique ways to monetize their work. As blockchain technology continues to evolve, businesses that adopt and innovate early will have a competitive advantage in this rapidly expanding market.

BLOCKCHAIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

53% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM, Microsoft, Oracle, Ethereum Foundation, Ripple Labs, Binance, Coinbase, ConsenSys, R3, Hyperledger |

Blockchain Market Segmentation - By Type

-

Public Blockchain

-

Private Blockchain

-

Consortium Blockchain

-

Hybrid Blockchain

Public blockchains are the most dominant product type, accounting for approximately 50% of the market share in 2024. Their open and decentralized nature, combined with widespread use in cryptocurrencies and DeFi platforms, makes them the preferred choice for various applications.

Blockchain Market Segmentation - By Application

-

Financial Services

-

Healthcare

-

Supply Chain and Logistics

-

Government

-

Retail and E-commerce

The financial services segment dominates the application landscape, contributing to over 35% of market revenue. Blockchain’s ability to reduce transaction costs, enhance security, and improve transparency has revolutionized the financial sector, especially in payments, remittances, and trading.

Blockchain Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the blockchain market, contributing over 40% of the global revenue in 2024. The region’s dominance can be attributed to the early adoption of blockchain technology by financial institutions, tech giants, and startups. The U.S., in particular, has witnessed substantial investments in blockchain research and development, with major players like IBM and Microsoft spearheading innovations. Additionally, favorable regulatory frameworks and initiatives such as blockchain-based supply chain pilots further bolster the market in North America.

COVID-19 Impact Analysis on the Blockchain Market

The COVID-19 pandemic served as a powerful catalyst for the widespread adoption of blockchain technology across various sectors. Supply chain disruptions, a significant challenge during the pandemic, highlighted the urgent need for enhanced transparency and traceability. Blockchain technology emerged as a solution, particularly in logistics and inventory management, enabling real-time tracking of goods and ensuring the integrity of supply chains. This adoption proved essential in reducing delays and inefficiencies, particularly in the distribution of essential goods such as medical supplies and vaccines. In the healthcare sector, blockchain became a crucial tool for secure and efficient data sharing. During the global vaccine distribution effort, organizations relied on blockchain to facilitate the secure transfer of patient and vaccine-related data, ensuring privacy and reducing the risk of fraud. The ability to securely share critical data in real-time proved invaluable during the pandemic, emphasizing blockchain’s potential in healthcare beyond the crisis. The pandemic also accelerated the growth of cryptocurrency markets. Amidst economic uncertainty, investors increasingly turned to decentralized, inflation-resistant assets like Bitcoin and Ethereum, further solidifying blockchain’s role in the financial sector. The crisis also highlighted the demand for more robust and secure digital identity solutions. As remote work became the norm, blockchain technology was utilized to create secure, decentralized digital identity systems, ensuring that employees could safely access enterprise systems without compromising security. In essence, the COVID-19 crisis demonstrated blockchain's ability to enhance resilience and efficiency in critical operations. The pandemic acted as a real-world test for the technology, revealing its potential to address challenges related to transparency, security, and operational efficiency across various industries. As a result, blockchain is expected to continue evolving and driving innovation in a post-pandemic world.

Latest Trends/Developments

The blockchain market is undergoing a series of transformative shifts. Layer 2 scaling solutions, particularly rollups, are gaining significant traction as they tackle the scalability issues that have historically hampered public blockchains. These solutions enhance transaction throughput and reduce costs, making blockchain more accessible and efficient for a broader range of applications. Another major trend is the rise of central bank digital currencies (CBDCs). Over 100 countries are currently exploring blockchain-based sovereign digital currencies, highlighting the growing recognition of blockchain’s potential in reshaping national monetary systems. CBDCs could revolutionize the way money is issued, exchanged, and controlled, offering enhanced security and efficiency in financial transactions. Simultaneously, blockchain’s integration with Web3 technologies is redefining the internet. Web3, which emphasizes decentralization, user privacy, and data control, is being built on blockchain's foundational principles. This transformation is empowering users to have greater ownership over their digital assets, personal data, and online identities, shifting the balance of power away from centralized entities. In addition to these developments, blockchain is playing an increasingly significant role in sustainability initiatives. It is being utilized in areas such as carbon credit tracking, renewable energy trading, and supply chain transparency, helping industries reduce their environmental impact. Blockchain’s transparency and immutability make it an ideal tool for tracking carbon emissions and ensuring the authenticity of renewable energy transactions. Together, these trends demonstrate that blockchain is becoming a core technology for the future digital economy. As scalability, central bank innovation, decentralization, and sustainability continue to evolve, blockchain is well-positioned to drive future economic, environmental, and technological progress.

Key Players

-

IBM

-

Microsoft

-

Oracle

-

Ethereum Foundation

-

Ripple Labs

-

Binance

-

Coinbase

-

ConsenSys

-

R3

-

Hyperledger

Chapter 1. Blockchain Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Blockchain Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Blockchain Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Blockchain Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Blockchain Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Blockchain Market – By Type

6.1 Introduction/Key Findings

6.2 Public Blockchain

6.3 Private Blockchain

6.4 Consortium Blockchain

6.5 Hybrid Blockchain

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Blockchain Market – By Application

7.1 Introduction/Key Findings

7.2 Financial Services

7.3 Healthcare

7.4 Supply Chain and Logistics

7.5 Government

7.6 Retail and E-commerce

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Blockchain Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Blockchain Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 IBM

9.2 Microsoft

9.3 Oracle

9.4 Ethereum Foundation

9.5 Ripple Labs

9.6 Binance

9.7 Coinbase

9.8 ConsenSys

9.9 R3

9.10 Hyperledger

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Blockchain Market was valued at USD 21.3 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 53% from 2025 to 2030. The market is expected to reach USD 273.23 billion by 2030.

Key drivers include enhanced transparency and security, increasing adoption of smart contracts and DeFi, and regulatory support with strategic investments.

Segments include types (public, private, consortium, and hybrid blockchains) and applications (financial services, healthcare, supply chain, government, retail, and e-commerce).

North America is the most dominant region, contributing over 40% of the global blockchain market revenue in 2024.

Leading players include IBM, Microsoft, Oracle, Ethereum Foundation, Ripple Labs, Binance, Coinbase, ConsenSys, R3, and Hyperledger