Smartphone Market Size (2025-2030)

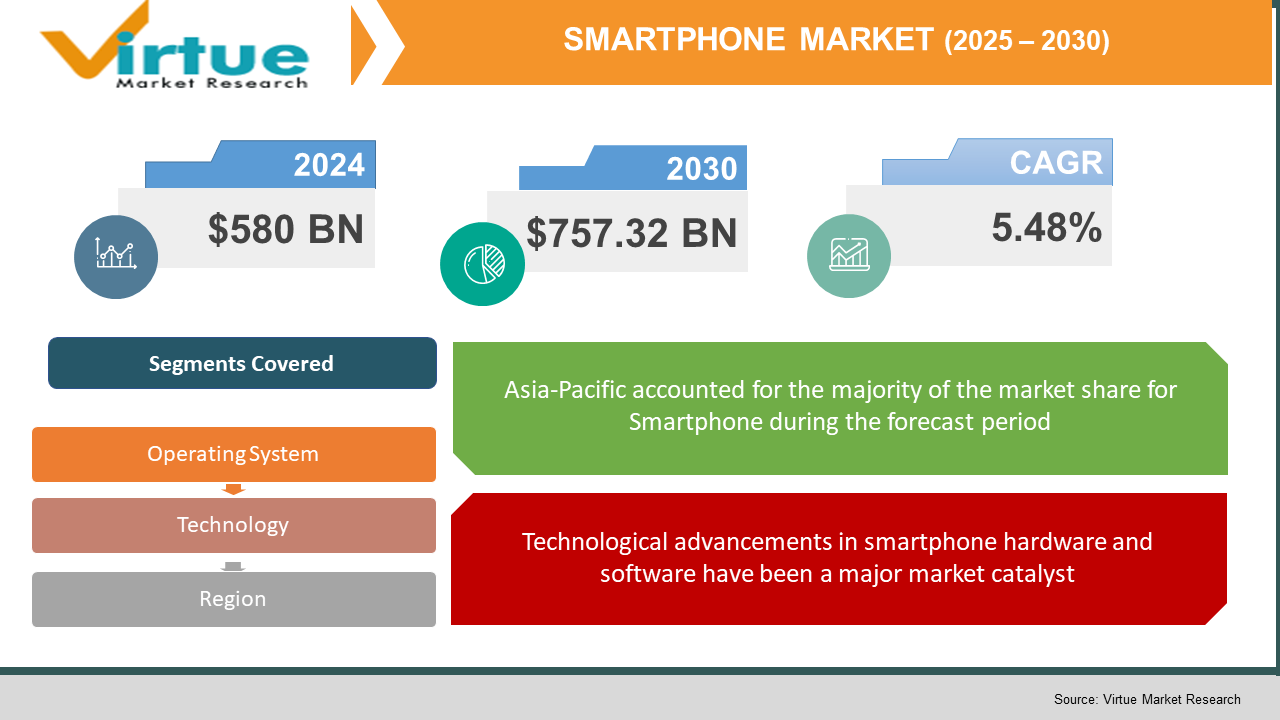

The Smartphone Market was valued at USD 580 billion in 2024 and is projected to reach a market size of USD 757.32 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.48%.

The Smartphone Industry remains one of the most vibrant and fast-evolving sectors of the tech industry. Constant innovation and the rising digital adoption are pushing the global shift toward a mobile-first lifestyle, making smartphones an indispensable part of everyday life. The competition is high for all types, from budget to high-end foldables, and consumer demand for better cameras, faster processors, and better displays informs these decisions. With 5G enhancing its reach and AI integration deepening, the smartphone industry is not just expanding. It is changing how the world communicates, works, and interoperates with technology.

Key Market Insights:

Apple and Samsung continued to dominate the market, combining command over 40% of global smartphone shipments. Apple maintained strong momentum with its premium devices, while Samsung performed well across all price segments.

The market saw a rebound post-COVID, with over 1.2 billion units shipped worldwide in 2023. Emerging markets like India and Southeast Asia were key growth drivers, as premium and mid-range segments gained traction.

Smartphone Market Drivers:

The accelerating global demand for real-time connectivity, internet access, and digital services continues to drive smartphone adoption.

Smartphone adoption is multiplying enormously because of the augmented demand from the world for real-time connection and online access to digital services. Most online services, e-education, online banking, and e-health services in developed and developing economies are accessed via smartphones. Cheap internet packages and government-re-launched digitalization projects encouraged people in rural and low-income areas to use a smartphone for the very first time. Smartphones, for social media, streaming, remote work, and even commerce, have been significantly integrated into daily lives and are thus proving indispensable. In addition, people now want to upgrade their mobile devices with the 5G rollout, which promises many more possibilities-faster and more seamless mobile experiences. Such peaks in data consumption, on the one hand, and mostly mobile-first strategies being adopted by both companies and governments have ensured that smartphone penetration continues to increase with almost every demographic. With time, when all-in-one tools evolve smart devices into becoming tools, their role in narrowing the digital divide and enabling economic participation becomes more significant.

Technological advancements in smartphone hardware and software have been a major market catalyst.

Smartphone hardware and its software have made great strides technologically and therefore serve as major market catalysts. They have innovated developments in camera quality, battery life, display technology, chipsets, form factors (that is, foldables and flip phones), and many more to ensure competitiveness with other rival corporations. All these are coupled with the introduction of some AI-powered specifications in smart devices such as intelligent photo editing, voice assistants, real-time translation, and suggestions of personalized apps, which are all likely to provide a better user experience. Mobile gaming performance, biometric security (facial and fingerprint recognition), and device incorporation into IoT ecosystems have all advanced the use cases to possibly higher levels. Continuous innovation in smartphones not only attracts tech-hungry consumers but also drives present consumers to upgrade their devices frequently. Distinctiveness, premium feel, but ecosystem compatibility brands are built, such as Apple's seamless integration across the devices and Samsung's One UI experience. Moreover, product differentiation strategies through which a company can implement an offer for budget, mid-range, and flagship phones tailored to different needs are generally applied by companies. When interpreted this way, innovation becomes the leading differentiation factor, with consumers being increasingly motivated not only to buy for necessity but also by aspiration, which provides further reinforcement for growth in the global smartphone market.

Smartphone Market Restraints and Challenges:

One of the major challenges facing the smartphone market is saturation in developed economies such as the U.S., Europe, and parts of East Asia.

Saturation is predominant in the smartphone market within developed economies; particularly, it affects nations such as the U.S., Europe, and parts of East Asia. Smartphone ownership disenfranchised nearly 90 percent of these markets already, leaving little room for adding new customers. Most consumers already own a handheld device, and the upgrade cycle has slowed considerably as the performance and features differ little between old and new models. Consumers are increasingly hesitant to upgrade frequently due to the rising prices of smartphones, especially in the premium product segment. Environmental issues and increasing preferences for refurbished or second-hand devices further contribute to this decline. As a result, brands now have to compete for market share while innovating, establishing trade-in programs, or even tying customers to their ecosystems to keep them from switching. Emerging markets present a pathway for stifling growth for manufacturers trapped under severe price sensitivity and logistical constraints, making long-term expansion a strategic balancing act.

Smartphone Market Opportunities:

The smartphone business holds great opportunities, particularly in emerging economies where penetration levels are still low. For the most part, Africa, Southeast Asia, and rural areas in India still have potential since internet access is increasing, data plans are becoming cheap, and digital literacy is increasing among the general public. The rollout of 5G networks globally is providing opportunities for smartphone makers to launch compatible devices at different price points to encourage consumers to make the switch. Mobile-based financial services, online education, and telemedicine are competing for evolving smartphone demand alongside entertainment and communication. The other major opportunity is the selling of eco-friendly and modular smartphones to consumers interested in sustainability. Another view is that as AI applications rise in number, supported by augmented and virtual reality, and as smartphone capabilities integrate further with the Internet of Things, these extended ecosystems will likewise create opportunities for manufacturers to build more immersive and multipurpose devices. This way, by innovating for both the value-conscious user and the premium user, smartphone companies can strategically grab new user segments and extend their reach.

SMARTPHONE MARKET REPORT COVERAGE:

|

REPORT METRIC A |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.48% |

|

Segments Covered |

By Operating system, technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Apple, Samsung, Xiaomi, OPPO, Vivo, Huawei, Realme, Motorola, OnePlus, and Google |

Smartphone Market Segmentation:

Smartphone Market Segmentation: By Operating System

- Android

- iOS

- Others

The smartphone market is primarily dominated by two major operating systems: Android and iOS, with Android leading globally due to its availability across a wider range of price points and brands. On the other hand, iOS remains exclusive to Apple devices but takes over in the high-end of the segment, especially in North America, Europe, and affluent urban areas around the world. Coupled with that feature of ecosystem lock-in, regular updates, and privacy, the operating system has built a solid following among professionals and creators. The "Others" segment, which includes HarmonyOS, KaiOS, and Linux-based systems, comprises a small subsection of the smartphone market. These systems are often used for very specific groups of users or areas of the world (e.g., KaiOS for feature phones across Africa and parts of India). Over the forecast period, Android is expected to continue holding the maximum share while iOS is expected to show moderate growth as the demand in developing markets for used or older iPhone models is on the rise. Key innovative areas that would drive differentiation and competitive advantage are in app ecosystems and user experiences.

Smartphone Market Segmentation: By Technology

- 4G Smartphones

- 5G Smartphones

- Innovative Form Factors

Technological advancement is the segment shaping the future of smartphones. 4G is still considerably popular in many developing nations, although the consumer preferences are readily moving toward 5G support as the network infrastructure becomes more globally expanded. By the year 2030, the vision is that 5G will completely overtake the technology segment, driven by the demand for high-speed connectivity along with ultra-low latency and seamless streaming or gaming experiences. The declining costs of some of the new 5 G-enabled models have shown an increase in uptake in regions including India, Southeast Asia, and Latin America. Meanwhile, innovative form factors like foldables, flip phones, and rollable displays are reshaping the smartphone experience. Market leaders who venture into this space include Samsung, Huawei, and Motorola, pioneering multitasking, compactness, and creative form functionality. Even though they are still a premium segment, foldable phones are anticipated to become more mainstream as prices drop along with improvements in durability. The tech-driven segmentation shows how smartphones are changing not just in performance but also in form, purpose, and lifestyle integration.

Smartphone Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The Asia-Pacific region continues to be the largest market for smartphones globally, buoyed by the very large population base in countries such as China and India. The region is benefiting from increasing 5G penetration, rising internet penetration, and strong local manufacturing capabilities, which together support domestic consumption and exports to global markets. On the other hand, North America is very much a premium smartphone market, driven by frequent upgrade cycles, consumer loyalty, and a mature ecosystem laid around the iOS and Android platforms. In Europe, demand is concentrated in the mid to high-end segment, putting increasing emphasis on sustainability and longevity of devices. In the Middle East and Africa, digital access is rapidly expanding, fast-tracking young and tech-savvy populations into mass smartphone adoption; however, price sensitivity is still of great importance. In South America, urbanization, online retailing, and the demand for affordable Android-based devices are some factors contributing to steady growth in smartphone adoption. All of these regions have a distinct role in the evolving dynamics of the global mobile handset space.

COVID-19 Impact Analysis on the Smartphone Market:

The first couple of months in the year 2020 saw serious dislocations of global smartphone production and supply chains caused by lockdowns, factory closings, and logistics delays, as most sharply felt in manufacturing hubs like China and South Korea. Consumers' demand, however, slumped significantly along the lines of declining economically motivated purchases of non-essential items, resulting in a marked decline in global purchases. Remote work, online education, and digital communication soon made smartphones indispensable as tools for connecting people. Households that lack access to laptops or PCs have even more dependence on their mobile devices. The pandemic also fast-tracked the adoption of e-commerce, digital payments, and telehealth of which heavily depend on the use of smartphones. Late in 2020 and early in 2021, the market saw a robust recovery, driven by pent-up demand, reasonably priced models exclusive to online sales, and heightened interest in mid-to-entry-level smartphones. All in all, COVID-19 redefined consumer priorities, making smartphones more than just luxuries, but rather necessities in the new digital-normal.

Latest Trends/ Developments:

Artificial intelligence integration, foldable designs, and sustainability efforts are paving the way for innovations in the coming smartphone market. Recently, top brands such as Samsung, Xiaomi, and Motorola have been launching their AI smartphones that include features like real-time transcription, intelligent photo editing, and productivity tools driven by models like Gemini and Copilot. Foldable smartphones are evolving at speed-thinner and more durable models are now entering the market-mainstream, and the latest rumor flying around Samsung is of a tri-fold device that may be making its appearance soon. At the affordability end, 5G is also becoming increasingly accessible, much like the introduction of economical 5 G-supported mobile phones for less than or equal to 10,000 Indian Rupees in the price-sensitive market of India. Sustainability, meanwhile, is featuring as an emerging big theme with companies exploring modular designs, recyclable materials, and extended life spans for devices, driven by consumer demand and regulatory pressure. Finally, geopolitical and economic dynamics have put India in a good position to become one of the major manufacturing hubs for brands seeking to diversify their supply chains while moving production out of China. In other words, these innovations will ultimately lead to an even smarter, greener, and more inclusive future smartphone.

Key Players:

- Apple

- Samsung

- Xiaomi

- OPPO

- Vivo

- Huawei

- Realme

- Motorola

- OnePlus

Chapter 1. Smartphone Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Technology

1.5. Secondary Technology

Chapter 2. SMARTPHONE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SMARTPHONE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SMARTPHONE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Smartphone of Suppliers

4.5.2. Bargaining Risk Analytics s of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SMARTPHONE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SMARTPHONE MARKET – By Operating System

6.1 Introduction/Key Findings

6.2 Android

6.3 iOS

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Operating System

6.6 Absolute $ Opportunity Analysis By Operating System , 2025-2030

Chapter 7. SMARTPHONE MARKET – By Technology

7.1 Introduction/Key Findings

7.2 4G Smartphones

7.3 5G Smartphones

7.4 Innovative Form Factors

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology , 2025-2030

Chapter 8. SMARTPHONE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Technology

8.1.3. By Operating System

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Operating System

8.2.3. By Technology

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Operating System

8.3.3. By Technology

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Operating System

8.4.3. By Technology

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Operating System

8.5.3. By Technology

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SMARTPHONE MARKET – Company Profiles – (Overview, Operating System Portfolio, Financials, Strategies & Developments)

9.1 Apple

9.2 Samsung

9.3 Xiaomi

9.4 OPPO

9.5 Vivo

9.6 Huawei

9.7 Realme

9.8 Motorola

9.9 OnePlus

9.10 Google

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Smartphone Market was valued at USD 580 billion in 2024 and is projected to reach a market size of USD 757.32 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.48%.

The smartphone market is driven by rising internet penetration and growing 5G adoption. Increasing demand for AI-enabled features and affordable devices also fuels market growth.

Based on Service Provider, the Smartphone Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers.

Asia-Pacific is the most dominant region for the Smartphone Market.

Apple, Samsung, Xiaomi, OPPO, Vivo, Huawei, Realme, Motorola, OnePlus, and Google are the key players in the Smartphone Market.