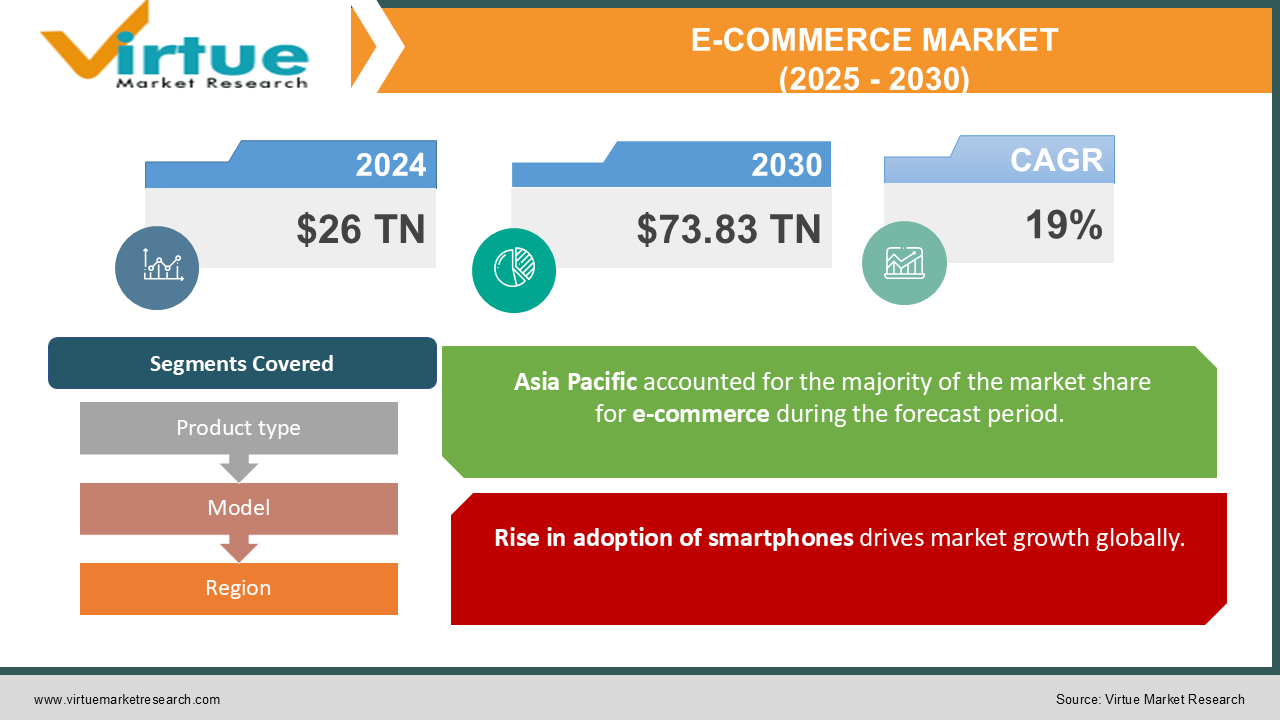

E-Commerce Market Size (2025 – 2030)

The E-Commerce Market was valued at USD 26 trillion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 73.83 trillion by 2030, growing at a CAGR of 19%.

E-commerce, or electronic commerce, refers to the process of purchasing and selling goods or services over the Internet. Through various digital platforms such as websites, online marketplaces, and social media, both individuals and businesses can offer products and services, leveraging digital payment systems and gathering customer information.

Key Market Insights:

-

The widespread use of smartphones and tablets has been particularly influential, enabling customers to make purchases effortlessly from virtually anywhere. Mobile technology, in particular, plays a key role in providing seamless shopping experiences, further driving the shift toward e-commerce.

-

With the advent of voice-activated virtual assistants such as Amazon Alexa, Microsoft Cortana, Apple Siri, Sony Xperia Hello, and Google Assistant, voice commerce has gained momentum.

-

Many e-commerce platforms are now incorporating voice-activated capabilities, enabling users to search for products, place orders, and track deliveries using voice commands. This feature simplifies the shopping process, offering consumers a more convenient, hands-free experience.

-

Additionally, AI-driven technologies like chatbots, predictive analytics, and digital assistants have become integral to enhancing customer service within e-commerce. These intelligent tools provide real-time support, address customer inquiries, and assist in the decision-making process, ultimately improving the overall shopping experience

E-Commerce Market Drivers:

Rise in adoption of smartphones drives market growth globally.

The increasing penetration of the internet and the growing use of smartphones are expected to significantly drive market growth. As internet access and mobile phone usage continue to rise, consumer preferences are increasingly shifting toward online shopping. With digital devices becoming an integral part of daily life, smartphones are anticipated to become the primary platform for online purchases in the coming five years. The global adoption of smartphones and tablets is fueling the expansion of online retail.

However, as technology evolves, many retailers face challenges in delivering a seamless and engaging customer experience across multiple platforms. In response, leading retailers have developed dedicated mobile apps and e-commerce platforms to improve consumer engagement. Others remain optimistic that mobile users will easily transition to their existing online shopping

environments. Additionally, brands across various e-commerce platforms are exploring virtual shopping experiences and experimenting with augmented and virtual reality retail. Within the expansive metaverse—a 3D virtual environment—consumers can interact with products without the constraints of physical location, breaking down geographical barriers and offering new ways to engage with brands worldwide.

E-Commerce Market Restraints and Challenges:

Cybersecurity concerns pose a significant challenge to the growth of the e-commerce market.

E-commerce transactions often involve the exchange of sensitive personal and financial information, making them prime targets for cyberattacks, data breaches, and identity theft. As such, businesses must prioritize strong cybersecurity measures to safeguard customer data and preserve trust. For example, secondary analysis reveals that Account Takeover (ATO) incidents surged by 131% in the second half of 2022 compared to the first half of 2021, and this trend of e-commerce fraud continues to pose a significant challenge in 2023. Given these increasing cybersecurity threats, the need for enhanced security is expected to act as a major restraint on market growth over the forecast period.

E-Commerce Market Opportunities:

Social media and influencer marketing present significant opportunities for growth within the e-commerce market.

Social media platforms have emerged as powerful marketing tools, enabling e-commerce businesses to expand their reach and directly engage with a wider audience. Influencer marketing, in which popular social media figures promote products and brands, has proven to be an effective strategy for driving e-commerce growth by capitalizing on the trust and authority these influencers have with their followers. A notable example of this trend is the June 2022 partnership between Walmart and Roku, Inc., which aimed to transform TV streaming into a new e-commerce shopping destination. Through this collaboration, Walmart became the exclusive retailer enabling viewers on Roku, America's leading TV streaming platform, to purchase featured products directly, with fulfillment handled by Walmart. This partnership highlights how the growing expansion of internet connectivity worldwide is playing a crucial role in fueling the growth of the e-commerce market.

E-COMMERCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

19% |

|

Segments Covered |

By Product type, Model, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Apple Inc., Flipkart Internet Pvt. Ltd, Amazon.com Inc., Groupon Inc., Best Buy Co. Inc., Costco Wholesale Corp. , eBay Inc., Shopify Inc., Ebates Performance Marketing Inc. ,Inter IKEA Systems B.V. |

E-Commerce Market Segmentation: By Model

-

Business-to-Consumer

-

Business-to-Business

-

Consumer-to-Consumer

-

Others

Business-to-business (B2B) e-commerce currently holds the largest share of the market. This model involves commercial transactions between businesses through digital platforms, facilitating the exchange of goods, services, or information. B2B e-commerce has become increasingly popular for several reasons. These transactions typically involve bulk orders and standardized products, which streamline the purchasing process and reduce operational costs.

B2B e-commerce is also known for its convenience. Companies can access global online business platforms without being constrained by geographic limitations, broadening their market reach and boosting sales potential. This easy access to a global marketplace is a key factor driving market expansion. Additionally, B2B e-commerce fosters transparency and data-driven decision-making. It allows for multi-criteria analysis and reporting of purchases and supplier operations, enabling businesses to make more informed, cost-effective choices. This transparency strengthens business relationships and helps forge long-term strategic alliances, further contributing to growth in the industry.

E-Commerce Market Segmentation:By Product Type

-

Home Appliances

-

Fashion

-

Footwear and Accessories

-

Books

-

Cosmetics

-

Groceries

-

Others

The home appliances sector currently holds the largest share of the e-commerce market. This segment has benefited significantly from the growth of online shopping, allowing consumers to conveniently browse, compare, and purchase home appliances from the comfort of their homes, eliminating the need for in-store visits. With the increasing availability of mobile apps and user-friendly websites, consumers can easily search for and select products, while businesses can leverage data-driven insights from consumer behavior to promote market growth.

As technology becomes more integrated into daily life, modern households are increasingly reliant on a variety of appliances, ranging from smart refrigerators and advanced washing machines to smart speakers. This reliance is further driving the demand for home appliances, with consumers seeking out a wide range of options and competitive prices online, which helps them make informed purchasing decisions.

In contrast, the fashion products segment is expected to experience the highest compound annual growth rate (CAGR) over the forecast period. Fashion e-commerce includes a broad spectrum of products, such as clothing, footwear, accessories, and beauty items. The convenience of shopping online, coupled with the vast selection of products and the trend-driven nature of fashion, has contributed to the rapid expansion of online fashion retail. For example, Myntra has projected that the Indian fashion e-commerce market will reach $30 billion in the next five years, with approximately one-third of India’s fashion market being transacted online or through digital channels during this period.

E-Commerce Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia Pacific region exhibits a clear dominance in the global e-commerce market, driven by factors such as rapid urbanization and rising disposable income. As more individuals migrate to

urban areas and experience higher levels of income, the demand for online shopping has surged, significantly influencing market growth. E-commerce businesses in the region are capitalizing on this trend by offering a wide range of products and services that cater to the specific preferences of local consumers.

Additionally, advancements in mobile technology, the rapid increase in smartphone usage, and the availability of affordable mobile data plans are enabling more people, even in remote or less accessible areas, to shop online with ease. Major e-commerce players like Alibaba, JD.com, Amazon, and others are heavily investing in the region, driving innovation and contributing to a dynamic and rapidly evolving marketplace.

The Middle East & Africa (MEA) e-commerce market is also poised for significant growth in the forecasted year. The region's digital transformation of traditional industries is accelerating the adoption of e-commerce. Key sectors, such as retail, healthcare, and education, are increasingly embracing digital solutions, leading to the integration of e-commerce into their business models.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has had a significant positive impact on the e-commerce market, accelerating its growth. With lockdowns and social distancing measures in place, consumers increasingly turned to online platforms to meet their shopping needs, leading to a surge in demand across various product categories, such as groceries, electronics, and apparel. Moreover, the pandemic encouraged many individuals who had previously not shopped online to explore e-commerce for the first time, resulting in a substantial rise in new online shoppers and a broader customer base for e-commerce businesses.

In addition, the pandemic spurred the emergence of new e-commerce models and trends. For example, there was a notable increase in the popularity of online food delivery services, subscription-based business models, and digital marketplaces that connected local businesses with consumers. These innovations not only expanded the e-commerce market but also created new avenues for growth, further contributing to the industry's resilience and continued expansion.

Latest Trends/ Developments:

Technological advancements, such as branded shopping apps, 5G connectivity, and social shopping features, are enhancing the mobile shopping experience. These innovations provide consumers with greater convenience, enabling them to shop effortlessly via their mobile devices. For retailers, these advancements are unlocking new opportunities to increase sales, improve conversion rates, foster customer loyalty, and gather valuable consumer data for targeted marketing.

Market News

-

April 2024: Super Plastronics Pvt. Ltd (SPPL) launched its own e-commerce platform, with the goal of selling over 100,000 products annually through its Android and iOS-friendly website. This move is part of the company's broader strategy to expand its online presence and cater to a growing base of digital consume

-

April 2024: Alibaba Group Holding Ltd, the leading Chinese e-commerce company, announced that it would invest in a South Korean online shopping platform. This strategic investment aims to strengthen Alibaba's competitive position in South Korea by merging Dongdaemun's fashion offerings with the country’s largest fashion wholesale marketplace. The partnership is expected to boost Alibaba's sales in South Korea and other regional markets.

-

March 2024: Flipkart, a major Indian e-commerce platform, revealed plans to enter the quick commerce industry. The company is set to introduce ultra-fast 10-15 minute deliveries in key cities like Bengaluru, Delhi (NCR), and Hyderabad, marking its expansion into the rapidly growing sector of instant delivery services.

Key Players:

These are top 10 players in the E-Commerce Market :-

-

Apple Inc.

-

Flipkart Internet Pvt. Ltd.

-

Amazon.com Inc.

-

Groupon Inc.

-

Best Buy Co. Inc.

-

Costco Wholesale Corp.

-

eBay Inc.

-

Shopify Inc.

-

Ebates Performance Marketing Inc.

-

Inter IKEA Systems B.V.

Chapter 1. E-Commerce Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. E-Commerce Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. E-Commerce Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. E-Commerce Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. E-Commerce Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. E-Commerce Market – By Model

6.1 Introduction/Key Findings

6.2 Business-to-Consumer

6.3 Business-to-Business

6.4 Consumer-to-Consumer

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Model

6.7 Absolute $ Opportunity Analysis By Model, 2025-2030

Chapter 7. E-Commerce Market – By Product Type

7.1 Introduction/Key Findings

7.2 Home Appliances

7.3 Fashion

7.4 Footwear and Accessories

7.5 Books

7.6 Cosmetics

7.7 Groceries

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Product Type

7.10 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 8. E-Commerce Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Model

8.1.3 By Product Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Model

8.2.3 By Product Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Model

8.3.3 By Product Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Model

8.4.3 By Product Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Model

8.5.3 By Product Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. E-Commerce Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Apple Inc.

9.2 Flipkart Internet Pvt. Ltd.

9.3 Amazon.com Inc.

9.4 Groupon Inc.

9.5 Best Buy Co. Inc.

9.6 Costco Wholesale Corp.

9.7 eBay Inc.

9.8 Shopify Inc.

9.9 Ebates Performance Marketing Inc.

9.10 Inter IKEA Systems B.V.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The evolution of consumer purchasing behaviors has greatly contributed to the growth of e-commerce. As a result of time constraints, the demand for a streamlined shopping experience, and the convenience of online shopping, more consumers are turning to digital platforms.

The top players operating in the E-Commerce Market are - Apple Inc., Flipkart Internet Pvt. Ltd., Amazon.com Inc. and Groupon Inc.

The COVID-19 pandemic has had a significant positive impact on the e-commerce market, accelerating its growth.

Technological advancements, such as branded shopping apps, 5G connectivity, and social shopping features, are enhancing the mobile shopping experience. These innovations provide consumers with greater convenience, enabling them to shop effortlessly via their mobile devices.

The Middle East & Africa (MEA) e-commerce market is also poised for significant growth in the forecasted year.