5G Market Size (2024 – 2030)

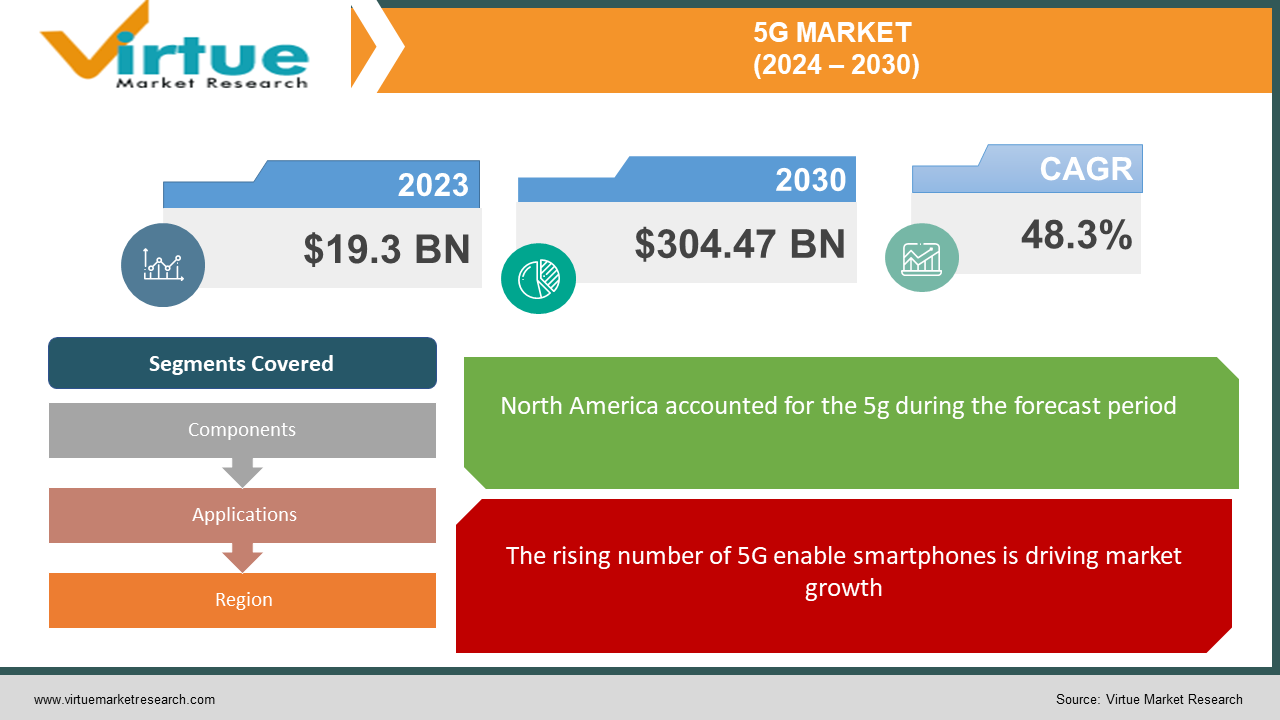

The 5G Market was valued at USD 19.3 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 304.47 billion by 2030, growing at a CAGR of 48.3%.

The fifth generation of wireless cellular technology, known as 5G, presents advancements in upload and download speeds, along with enhanced connectivity and capacity compared to its predecessors. Distinguishing itself notably from the widely adopted 4G networks, 5G stands as a considerably swifter and more dependable option. Its introduction heralds a potential revolution in internet usage, promising significant changes in accessing applications, social platforms, and information repositories. Industries such as autonomous vehicle technology, sophisticated gaming applications, and real-time media streaming, which demand robust, high-speed data connections, are poised to reap substantial benefits from the advent of 5G connectivity.

Key Market Insights:

The market growth is propelled by key drivers such as the increasing demand for high-speed transmission, low network latency, and the surge in connected device trends. Additionally, the proliferation of cloud-based applications has heightened the requirement for sophisticated network technology, further fueling the expansion of the market.

5G wireless mobile services enable a completely mobile and interconnected environment, providing consumers with a wide array of use cases and business models. Furthermore, the accelerated data speeds and minimal latency provided by 5G technology are poised to enhance user experiences across various applications, including Virtual Reality (VR) and Augmented Reality (AR) gaming, seamless video calling, and Ultra-High Definition (UHD) videos, among others. The escalating demand for high-speed data connectivity for integrated Internet of Things (IoT) applications, such as smart home energy management, is anticipated to drive the adoption of these services throughout the forecast period.

5G Market Drivers:

The rising number of 5G enable smartphones is driving market growth

The Compound Annual Growth Rate (CAGR) of the 5G market is significantly influenced by the increasing proliferation of 5G-enabled smartphones. According to a report, over 650 models of 5G smartphones have been introduced, constituting 50% of all 5G devices by form factor. Shipments of 5G devices surged to over 615 million units in 2021, marking a doubling compared to the previous year. There is a notable focus on Smartphone Standalone (SA) capability, including 3CC New Radio (NR) carrier aggregation, which is garnering increased attention. Global smartphone shipments experienced a 6% increase in 2021 compared to 2020. Moreover, there is now a wider array of 5G smartphone models available in the mid-tier pricing segment, accompanied by enhanced device functionalities. This trend indicates broader accessibility of 5G cell phones across various market segments, as more consumers can afford the devices and access the 5G network, thereby propelling the market for 5G.

Various applications such as cloud gaming, AR/VR, autonomous driving, and fixed wireless connectivity exemplify the diverse use cases enabled by 5G. The Radio Access Network (RAN), comprising antennas, radios, baseband (RAN Compute), and RAN software, facilitates exceptional speeds and mobility. Some market players have initiated research on 6G, aiming to leverage pervasive intelligent communication to contribute to a more efficient, human-friendly, and sustainable society.

Operators stand to unlock new revenue streams with 5G. Among the significant industries presenting opportunities for operators in terms of industry digitization with 5G technology, manufacturing, energy, and utilities emerge as pivotal sectors for potential income generation.

Increasing Demand for High-Speed Data Connectivity and the Rising Data Traffic will Drive Market Growth

The standards set forth by 5G are poised to facilitate ultra-HD voice and video capabilities, thereby enabling the development of novel applications reliant on voice communication, such as telepresence. Leveraging 5G's attributes including device density, low latency, security, and enhanced video capabilities, there exists the potential to support value-added communication offerings, notably Rich Communication Services, particularly catering to enterprise needs. Additionally, as streaming services become increasingly indispensable, while 4G networks predominantly support streaming with features like AR/VR, 4k/8k video, and 360-degree videos, the immersive nature and higher data consumption of 5G video content are anticipated to contribute significantly to overall data traffic.

5G Market Restraints and Challenges:

The rapid deployment of 5G technology is accompanied by an elevated risk of cybersecurity attacks. The proliferation of connected devices and computers amplifies the potential for cyber-attacks. Unlike previous technologies, 5G offers direct access to the cellular network, thereby heightening the vulnerability to direct assaults. Attackers may exploit these security vulnerabilities to orchestrate sophisticated attacks. Consequently, the increased deployment of 5G is expected to escalate the range of potential risks, potentially impeding the expansion of the 5G technology market.

5G Market Opportunities:

While the fast deployment of 5G technology raises concerns about cybersecurity attacks due to the growing number of connected devices and computers, there are also significant potential benefits for the global market. Contrary to the anticipated limitations on 5G technology expansion due to increased cybersecurity risks, there is a growing demand for 5G technology across various business verticals. For instance, in the healthcare industry, 5G facilitates heightened connectivity, fostering a new health ecosystem that efficiently addresses patient and provider demands on a large scale, with convenience, accuracy, and cost-effectiveness. Moreover, the integration of 5G connectivity with Artificial Intelligence (AI) and health-related Internet of Things (IoT) devices enables patient monitoring and personalized treatment suggestions, further propelling the demand for 5G technology.

5G MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

48.3% |

|

Segments Covered |

By Components, Applications, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ericsson, Nokia Networks, Deutsche Telekom AG, Huawei Technologies Co. Ltd., AT&T Inc., China Mobile Limited, Qualcomm Inc., KT Corporation, Orange S.A., Verizon Communications Inc. |

5G Market Segmentation - By Components

-

Phantom Cell

-

Device-To-Device Communication

The device-to-device communication segment has emerged as the dominant force in the market, contributing to 80.4% of market revenue, equivalent to 5.5 Billion USD in 2023. This dominance is attributed to several advantages inherent in device-to-device communication, including enhanced spectrum and energy efficiency, improved cellular coverage, and optimized resource consumption. The increasing prevalence of D2D communication is significantly driving market expansion. The growing necessity for device-to-device (D2D) communication in emerging technologies is fueled by rapid infrastructure growth, ongoing digitization efforts, the rise of autonomous computing, and collaborative device functionalities.

Conversely, the phantom cell sector has witnessed substantial growth rates. Calls originating from this sector often utilize fake numbers as caller IDs, making it challenging to identify the caller. Despite this, upon answering the call, individuals are typically transferred to a call center worker who endeavors to promote products or services, following a brief yet noticeable wait period.

5G Market Segmentation - By Applications

-

Consumer Electronics

-

Automotive

-

Retail

-

Energy

-

Utility

-

Healthcare

The healthcare segment has asserted its dominance in the market in the year 2023, primarily propelled by the escalating adoption of telemedicine and robotic surgery practices. This upward trajectory in the market is attributed to several factors, including the surge in telecommunications innovation, the integration of wearable medical devices empowered by 5G technology, the rapid downloading capabilities of 5G technology for large patient data files, and the accessibility of cost-effective sensors.

5G Market Segmentation- By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The North American 5G market region is poised to maintain its dominance in the global market. This is largely attributed to increased investments by businesses to roll out 5G services in key nations such as the United States and Canada, thereby driving market expansion.

Meanwhile, the Asia-Pacific 5G market holds the second-largest market share, with significant investments in 5G technologies, particularly in China. The Chinese government, along with telecom operators and suppliers, is actively investing in the deployment of 5G infrastructure, leading to a surge in market expenditure. Notably, China boasts several renowned 5G telecom infrastructure providers and anticipates a substantial portion, estimated at 40–50%, of mobile consumers utilizing 5G services. The nation is also making significant strides in network convergence, virtualization, and slicing technologies. Moreover, China's 5G market commands the largest market share in the region, while the Indian 5G market stands out as the fastest-growing market in the Asia-Pacific region.

COVID-19 Pandemic: Impact Analysis

The global COVID-19 pandemic has had a profound impact on businesses worldwide. However, this challenge is not insurmountable. Variations in the extent and duration of the impact are evident across different countries and industries. Forecasts suggest a minimal impact on Communication Service Provider’s (CSP) revenue for the fiscal year, attributing this to a shift in network usage from office to personal premises, alongside increased internet traffic and adoption of remote collaboration tools.

CSP revenues may decline by 3.5%, primarily due to decreases in enterprise mobile and fixed services, while consumer services remain resilient. In developed markets, there's an anticipation of sluggish 5G capital expenditure in 2020, with a projected rebound in 2021. Conversely, in developing economies, spectrum auctions might be postponed due to economic repercussions.

Across industries, there's a common interest in leveraging 5G technology, driven by the need for social distancing, containment measures, and remote work arrangements. These factors have prompted enterprises to reconsider their operating models amidst workspace disruptions.

Latest Trends/ Developments:

-

In June 2023, a strategic collaboration was forged between AT&T, Inc. and Cisco Systems, Inc., aimed at bolstering business connectivity to meet the demands of a mobile-dependent workforce. Their joint efforts will deliver SD-WAN connectivity alongside 5G and broadband services, ensuring optimized experiences for businesses of all sizes.

-

June 2023 saw the merger of Vodafone UK and Three UK, creating a top-tier 5G network across Europe renowned for its reliability, extensive coverage, and high-speed data connectivity.

-

T-Mobile USA Inc. and the City of Bellevue joined forces in June 2023 to introduce a network-based Cellular Vehicle-to-Everything (C-V2X) technology. This collaboration, coupled with T-Mobile's robust 5G network, facilitates real-time communication between traffic infrastructure, road users, and vehicles.

-

Also in June 2023, BT Group Plc partnered with Lyca Mobile to offer Lyca customers cost-effective mobile connectivity through access to 4G and 5G radio networks.

-

April 2023 marked the announcement of a partnership between Deutsche Telekom AG and Amazon Web Services. This collaboration, part of the Integrated Private Wireless on AWS program, aims to integrate AWS cloud computing services with LTE and 5G-based private wireless solutions from Deutsche Telekom AG's campus network portfolio.

-

September 2022 saw the launch of the 5G rollout in India, accompanied by Quectel Wireless Solutions' announcement of their readiness to introduce 5G devices to the Indian market. Quectel unveiled three 5G modules - RM510Q-GL, RM50xQ, and RG50xQ - all based on Qualcomm chipsets.

Key Players:

These are the top 10 players in the 5G Market: -

-

Ericsson

-

Nokia Networks

-

Deutsche Telekom AG

-

Huawei Technologies Co. Ltd.

-

AT&T Inc.

-

China Mobile Limited

-

Qualcomm Inc.

-

KT Corporation

-

Orange S.A.

-

Verizon Communications Inc.

Chapter 1. 5G Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. 5G Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. 5G Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. 5G Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. 5G Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. 5G Market – By Components

6.1 Introduction/Key Findings

6.2 Phantom Cell

6.3 Device-To-Device Communication

6.4 Y-O-Y Growth trend Analysis By Components

6.5 Absolute $ Opportunity Analysis By Components, 2024-2030

Chapter 7. 5G Market – By Application

7.1 Introduction/Key Findings

7.2 Consumer Electronics

7.3 Automotive

7.4 Retail

7.5 Energy

7.6 Utility

7.7 Healthcare

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. 5G Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Components

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Components

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Components

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Components

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Components

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. 5G Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ericsson

9.2 Nokia Networks

9.3 Deutsche Telekom AG

9.4 Huawei Technologies Co. Ltd.

9.5 AT&T Inc.

9.6 China Mobile Limited

9.7 Qualcomm Inc.

9.8 KT Corporation

9.9 Orange S.A.

9.10 Verizon Communications Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market growth is propelled by key drivers such as the increasing demand for high-speed transmission, low network latency, and the surge in connected device trends. Additionally, the proliferation of cloud-based applications has heightened the requirement for sophisticated network technology, further fueling the expansion of the market.

The top players operating in the 5G Market are - Ericsson, Nokia Networks, Deutsche Telekom AG, Huawei Technologies Co. Ltd., AT&T Inc., China Mobile Limited, Qualcomm Inc., KT Corporation, Orange S.A., and Verizon Communications Inc.

Variations in the extent and duration of the impact are evident across different countries and industries. Forecasts suggest a minimal impact on Communication Service Provider’s (CSP) revenue for the fiscal year, attributing this to a shift in network usage from office to personal premises

In October 2022, Fibocom, a prominent Chinese manufacturer specializing in communication devices, unveiled its FX170(W) Series, representing a new era of 5G Sub-6GHz and mmWave Modules. Powered by the Snapdragon X65 5G Modem-RF System, these modules deliver a wireless communication experience comparable to fiber optics, boasting enhanced network coverage, accelerated throughput, and expanded functionality.

The Asia-Pacific 5G market holds the second-largest market share, with significant investments in 5G technologies, particularly in China. The Chinese government, along with telecom operators and suppliers, is actively investing in the deployment of 5G infrastructure, leading to a surge in market expenditure.