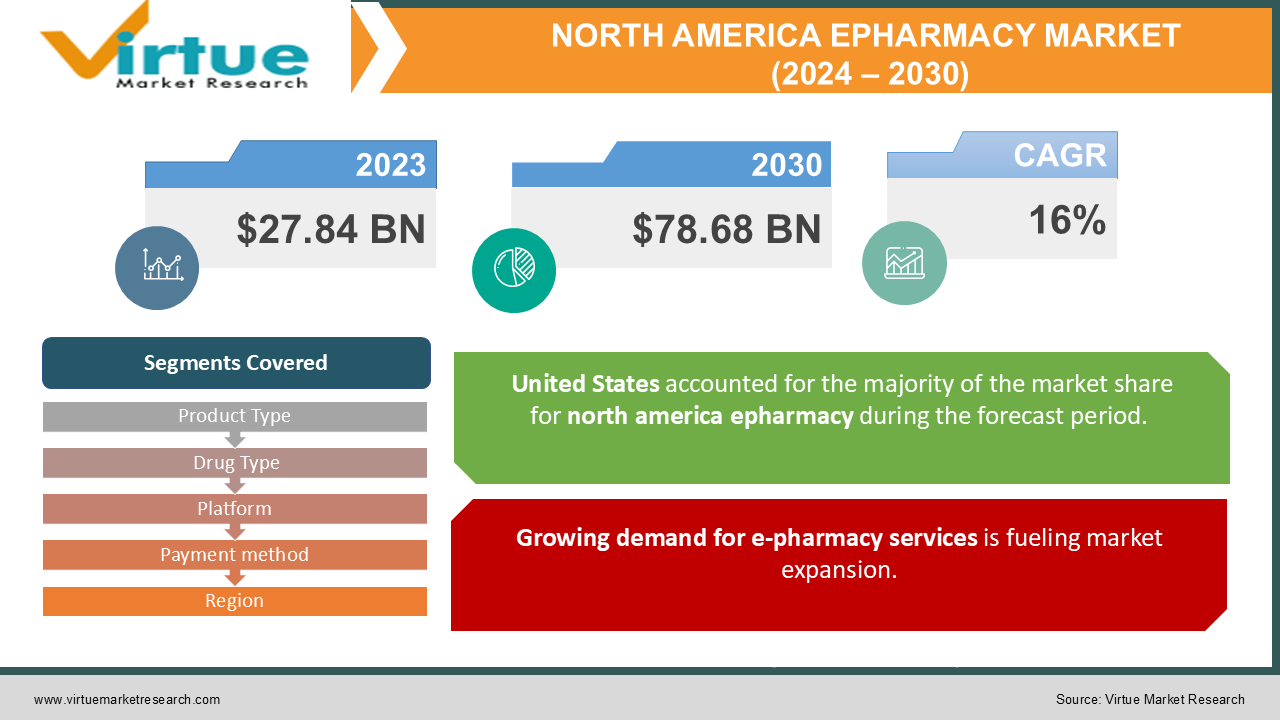

North American e-pharmacy Market Size (2024-2030)

The North American e-pharmacy market was valued at USD 27.84 billion in 2023 and is projected to reach a market size of USD 78.68 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 16%.

The electronic pharmacy is an industry that offers services such as consultations, medicines, information, and insurance online. This market started growing in the early 2000s. Before that, all kinds of medical services were done offline. Currently, this market has seen significant growth. The COVID-19 pandemic has been a big advantage for the market. This market has expanded thanks to digitization. Soon, with the increasing adoption of telehealth services and the availability of the Internet, this business will see a huge boom. Significant growth is expected during the forecast period.

Key Market Insights:

- The global online pharmacy sector has been estimated at US$ 32 billion by the end of 2023. In the United States, forecasts suggest that the number will reach approximately 5.7 billion, cementing its position as one of the largest online pharmacy markets. However, China dominates the pharmaceutical e-commerce industry globally, generating nearly $8.5 billion in revenue.

- According to a survey of US physicians, 65 percent of respondents did not use telehealth before the outbreak of the COVID-19 pandemic. During the peak of the pandemic, 43 percent of physicians saw more than 50 percent of their patients through telehealth technology. In the future, 43 percent estimate they will use telehealth for 10 to 49 percent of appointments.

- According to a 2022 survey in the United States, 23 percent of respondents who have previously experienced a virtual healthcare appointment would prefer that their future appointments for chronic or persistent conditions be entirely or mostly virtual.

- The online pharmacy market in North America is expected to reach USD 45.34 billion in 2023. The revenue is expected to exhibit a compound annual growth rate (CAGR) of 12.41% between 2023 and 2028, leading to a projected market size of USD 81.37 billion by 2028.

- A Western European study of 14,000 people found that one in five people get medicines online without a prescription. To improve this, pharmaceutical companies and other platforms are now spending much of their investment on improving patient awareness of the correct prescriptions.

North American ePharmacy Market Drivers:

Growing demand for e-pharmacy services is fueling market expansion.

The increasing adoption of online services is helping the growth of the market. After the pandemic, many surveys and other studies have shown statistics of people preferring virtual consultations, medicines, and other health-related services. According to Statista, in 2022, 52 percent of American adults surveyed said they used telemedicine through a live video call with their healthcare provider. Individuals can cover their medical costs at a lower cost because other miscellaneous costs, such as transportation, are zero. People have access to a wider range of medicines from the comfort of their homes. In addition, North America has technological advancements and some top companies operating in the market. The internet connection is quite stable in many areas. Moreover, due to the hectic schedule, the digital mode is more convenient.

An aging population is contributing to market expansion.

According to Statista, in 2022, about 17.3 percent of the U.S. population was 65 or older, an increase from the past few years, and that number is expected to reach 22 percent by 2050. As a result of changing lifestyles, dietary habits, radiation, and other environmental factors, chronic conditions such as diabetes, hypertension, heart disease, and cancer Additionally, certain conditions, such as Parkinson's, Alzheimer's, and paralysis, debilitate individuals. This can make traveling to clinics and hospitals difficult. ePharmacy is an easy option for such people to help them access prescription drugs.

Restraints and Challenges in the e-Pharmacy Market:

Health security, data privacy, internet devices, and late deliveries are the main concerns facing the market.

One of the biggest obstacles in the market is the sale of counterfeit or other non-prescribed drugs. Many cases have been reported where such faulty practices were followed, leading to health hazards. Such conduct endangers public health, leading to serious consequences. Second, data security is another hurdle. Applications contain sensitive information that includes clinical records of patients. Data breaches are done to leak information, causing fraud and consumer losses. Third, several remote, rural, and other backward areas may not have stable marital relationships. Accessibility may thus be limited. In addition, shipments may be delayed, causing health complications. Medicines that are shipped internationally can take a long time.

Opportunities in the e-pharmacy market:

The increasing adoption of electronic devices such as tablets, mobiles, and laptops provides ample opportunities for the market. Few brands are affordable, so a larger percentage of the population has access to them. Telehealth services are integrated with e-pharmacy applications. This allows the patient to receive online consultations and prescriptions. Third, organized order tracking at every step enables transparency. In addition, artificial intelligence and data analysis help with personalized medical recommendations. In addition, global expansion is facilitated along with improved Internet access to remote areas.

NORTH AMERICA E-PHARMACY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

16% |

|

Segments Covered |

By Product Type, Drug Type, Platform, Payement method, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, Mexico, Canada |

|

Key Companies Profiled |

CVS Health, Walgreens , Amazon Pharmacy, Express Scripts Holding Company, OptumRx, Zur Rose Group AG, Medisave, DocMorris, Rowlands Pharmacy, The Kroger Co. |

North American ePharmacy Market Segmentation Analysis

North American ePharmacy Market - By Drug Type:

-

Over-the-counter (OTC) medications

Based on drug type, over-the-counter (OTC) drugs are the largest segment in the North American e-pharmacy market, with a share of around 70%. This is due to convenience, reliability, and growing demand. In addition, the availability of over-the-counter drugs is limited in pharmacies and medical stores. Additionally, the growing use of self-service is fueling the growth of the segment.

In addition, the growing confidence of consumers in authenticity contributes to the development. This makes them a suitable choice for minor ailments such as colds, sore throats, allergies, and more. This category is expected to grow significantly during the forecast period.

Prescription drugs are the fastest-growing due to the increasing prevalence of chronic and other genetic diseases. This requires a prescription from a licensed professional. Additionally, integrations with telehealth platforms and services are fueling growth.

North American ePharmacy Market - By Product Type:

-

Skincare

-

Dental

-

Colds and flu

-

Vitamins

-

Weight loss

-

Others

The skin care segment is one of the largest segments in the North American e-pharmacy market. Many beauty and wellness products have been launched in the last few years. Some of these include moisturizers, sunscreens, anti-aging creams, hand creams, serums, cleansers, etc.

Many social media content creators have spread awareness about the importance of maintaining healthy skin. This caused an increase in the purchase of these products. In addition, the demand for organic skin care products is contributing to the progress.

The cold and flu segment is one of the fastest-growing segments. This is because of the easy prevalence of catching symptoms. This category has seen a rise during the COVID-19 pandemic. In addition, increasing respiratory diseases contribute to the increase.

North American ePharmacy Market - By Platform:

-

App-Based

-

Web-Based

Based on the platform, the app-based segment is the largest and fastest-growing North American e-pharmacy market, with a share of more than 70%. The main reasons are app authenticity, a wider trusting consumer base, order tracking, convenience, user-friendly features, and secure payments.

North American ePharmacy Market - By Payment Method:

-

Cash on delivery

-

Online Payment

Online payment is the most widespread and largest payment method in the North American e-pharmacy market, with a share of around 76%. The reasons are convenience, demand, internet connectivity, availability, seamless transactions, and security. However, cash on delivery is growing the fastest. This is a prominent category in areas that have unstable internet connections.

Additionally, several older individuals find technology complex and confusing. In addition, a smaller percentage of the population is afraid of fraud and hackers and chooses cash on delivery.

North American ePharmacy Market - By Region:

-

United States

-

Canada

-

Mexico

Based on region, the United States is the largest growing segment in the North American e-pharmacy market, with a gross share of 40%. This is due to technological dominance, economic stability, the presence of key companies, a growing population, an increasing number of chronic diseases, availability, infrastructure, and demand.

States like New York, California, and Massachusetts are the notable ones. According to the latest analysis, US e-pharmacy market is expected to grow from USD 21 billion in 2022 to USD 86 billion in 2030 at a CAGR of 19.3%. Canada is the fastest-growing region in this market, with a share of around 32%. This is due to government initiatives, fast-growing companies, global expansion, collaboration, better internet connectivity, a growing population, disease prevalence, and technological advancements.

COVID-19 Impact Analysis on the North American ePharmacy Market:

The virus outbreak had a positive impact on the market. Lockdowns, social isolation, and movement restrictions were the new norm. Thanks to these rules and regulations, online sales have seen a boom. To prevent contracting the virus, people began to seek out telehealth services if a healthcare visit was not essential. Many e-pharmacy apps have seen an increase in prescription orders. State funds were focused on applications in the healthcare sector. This further strengthened the market. The COVID kits were purchased through various online home testing websites. Households using e-pharmacies increased 2.5 times during the lockdown. After the pandemic, the digitization trend continued to help the market expand.

The latest trends and developments:

Companies in this industry seek to increase their market share using a variety of tactics, including alliances, investments, and acquisitions. Along with keeping prices competitive, businesses pay a lot to push existing technologies and find new ones. This also led to more expansion.

One of the recent trends is improvisation regarding digital payments. This refers to the exchange of money without any contact. Online transactions are secured by various encryption methods. Initiatives are being taken to facilitate online transactions in remote areas. Digital wallets from many top companies have been added with many user-friendly features supporting ease of use.

Key Players:

-

CVS Health

-

Walgreens

-

Amazon Pharmacy

-

Express Scripts Holding Company

-

OptumRx

-

Zur Rose Group AG

-

Medisave

-

DocMorris

-

Rowlands Pharmacy

-

The Kroger Co.

- In November 2020, Amazon announced two new pharmacy offerings to help customers conveniently purchase prescription drugs. Amazon Pharmacy, a new store on Amazon, allows customers to complete their entire pharmacy transaction on their computer or mobile device through the Amazon app.

- In September 2020, UnitedHealth Group, the largest health insurance company in the United States, acquired DivvyDose, a start-up that helps patients with chronic diseases deliver their medications in pre-sorted packages. The aim was to facilitate patients' access to medicines.

- In June 2020, Walmart paid $200 million to buy key assets from CareZone, a Seattle-based health technology startup. CareZone provides health and medication management services to its customers through mobile applications. The startup also runs an e-commerce platform called CareFlow, where it delivers drugs sorted by prescription dosages. The main purpose of the acquisition was the administration of prescription drugs for each member of the family.

Chapter 1. North American ePharmacy Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type s

1.5. Secondary Product Type s

Chapter 2. North American ePharmacy Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North American ePharmacy Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North American ePharmacy Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North American ePharmacy Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North American ePharmacy Market– By Product Type

6.1. Introduction/Key Findings

6.2. Skincare

6.3. Dental

6.4. Colds and flu

6.5. Vitamins

6.6. Weight loss

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Product Type

6.9. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North American ePharmacy Market– By Platform

7.1. Introduction/Key Findings

7.2. App-Based

7.3. Web-Based

7.4. Y-O-Y Growth trend Analysis By Platform

7.5. Absolute $ Opportunity Analysis By Platform , 2024-2030

Chapter 8. North American ePharmacy Market– By Drug Type

8.1. Introduction/Key Findings

8.2. Over-the-counter (OTC) medications

8.3. Prescription drugs

8.4. Y-O-Y Growth trend Analysis Drug Type

8.5. Absolute $ Opportunity Analysis Drug Type, 2024-2030

Chapter 9. North American ePharmacy Market– Payment method

9.1. Introduction/Key Findings

9.2. Cash on delivery

9.3. Online Payment

9.4. Y-O-Y Growth trend Analysis Payment method

9.5. Absolute $ Opportunity Analysis Payment method , 2023-2030

Chapter 10. North American ePharmacy Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.1.4. Rest of North America

10.1.2. By Product Type

10.1.3. By Platform

10.1.4. Drug Type

10.1.5. Payment method

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. North American ePharmacy Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1. CVS Health

11.2. Walgreens

11.3. Amazon Pharmacy

11.4. Express Scripts Holding Company

11.5. OptumRx

11.6. Zur Rose Group AG

11.7. Medisave

11.8. DocMorris

11.9. Rowlands Pharmacy

11.10. The Kroger Co.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The North American e-pharmacy market was valued at USD 27.84 billion and is projected to reach a market size of USD 78.68 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 16%.

Increasing demand and an aging population are the main drivers propelling the North American e-pharmacy market

Based on product type, the North American e-pharmacy market is segmented into skincare, dental, cold and flu, vitamins, weight loss, and others

The United States is the most dominant region for the North American e-pharmacy market.

CVS Health, Walgreens, and Amazon Pharmacy are the key players operating in the North American e-pharmacy market