Global Digital Payments Market Size (2023 - 2030)

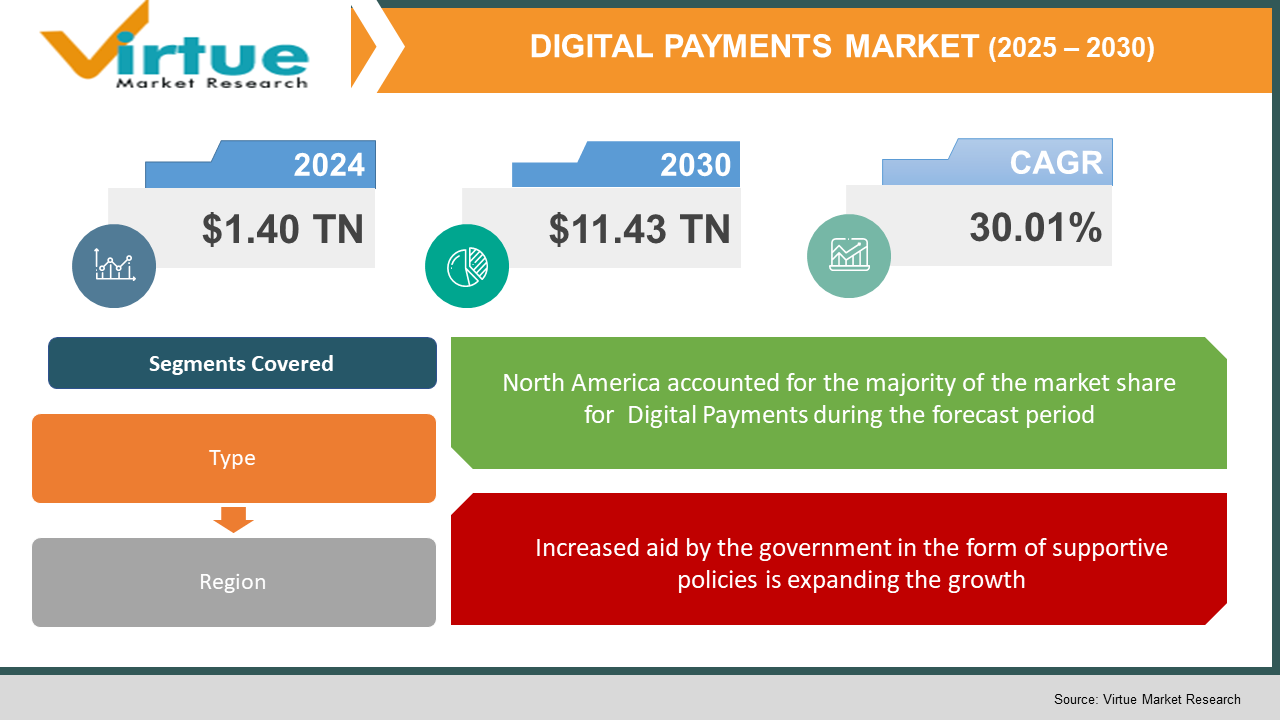

According to estimates, the Global Digital Payments marketplace changed into valued at $1.40 trillion in 2022 and is projected to reach $11.43 trillion through 2030, developing at a CAGR of 30.01% from 2023 - 2030.

The marketplace is anticipated to develop at an extensive fee withinside the coming years owing to the extended quantity of folks that opted for virtual bills all through the pandemic, and the growing consciousness approximately the "Digital India" campaign in which the digitalization of banking offerings has been made less difficult for humans to get right of entry to. The marketplace is likewise fuelled through the growing use of UPI fee options thru each wallet and bank, which has made bills thru the financial institution of clients loads less difficult. The fee pockets answer will maintain to dominate the marketplace withinside the coming years as well, attributable to the boom withinside the frequency in addition to the person base for the answer. The fee pockets answer allows the person to have virtual pockets in which the cash may be without problems transferred from their financial institution without the use of numerous techniques like UPI, internet banking, etc.

Industry Overview:

The digital fee is a technique of doing bills thru the usage of digital or virtual modes. In this situation, the payer and the payee of them use the virtual approach to both ship or obtain the cash. This sort of fee is referred to as the digital fee. According to enterprise standards, a virtual fee is referred to as the most effective cashless transaction done with the assistance of virtual channels. Thus, here most effective the transactions are done through the client and are taken into consideration. The worldwide panorama of bills and transactions is converting swiftly due to the extended quantity of establishments and client propensity in the direction of virtual transformation and the penetration of smartphones.

The technological improvements in smartphones, virtual fee cards, and POS at retail terminals are fueling the marketplace's increase. The fast upward thrust in phone penetration throughout emerging economies, in the main withinside the Asia-Pacific region, is anticipated to affect the marketplace's increase positively. The creation of cellular wallets global, in which a client is requested to feature cash to the utility and use it later inside or outdoor of the merchant (if applicable), is swiftly propelling the adoption of virtual fee offerings. Even though card-primarily based transactions command an extensive proportion of the non-coins transactions marketplace, which stood at 72% in 2020 (Capgemini), the increase is stagnating with the emergence of local and nearby schemes, consisting of EuPay, EPI, and Verve Card, which might be challenging the cardboard marketplace globally. Governments are taking the initiative to introduce virtual fee solutions.

COVID-19 impact on the Global Digital Payments Market Report

The outbreak of the COVID-19 pandemic has commenced to reason a shift withinside the Digital Payment Market. The client's conduct is reworking at a quick tempo attributable to the growing want to save you from the unfold of the virus. Hence, they may be choosing contactless transactions and are using virtual wallets. According to a survey through the MasterCard Corporation, around 79% of clients use contactless fees globally to hold safety. There is likewise a discount in transactions due to the whole shutdown of the hospitality, aviation, travel, and entertainment industries. It may also bog down the call for digital fee solutions. Globally, COVID-19 has imposed extensive boundaries on humans' lives. This has also altered bills made and pushed through a way of life changes. Digital fees soared as the phrase unfolds thru family, friends, and campaigns global. Therefore, throughout the spectrum, humans observed methods to live, work, transact and find out the uses of digital transactions. The digital fee has been offering the spine for humans to get the right of entry to their price range as they want it amidst the pandemic.

The extensive recognition of virtual fee techniques is anticipated to reinforce post-COVID-19 and play an extensive position withinside the long-time period marketplace scenario. With coins being a capability provider for the virus, regulatory bodies and governments discourage its use. For instance, coins used in Britain have halved in current days following the government-imposed lockdown, and crucial top shops are an increasing number of averting coins transactions. Various cellular fee carriers withinside the marketplace is anticipated to attention to growing their person base all through this era and returns post-COVID-19 scenarios, attributable to which carriers are supplying benefits, and offers, and waiving their charges on the usage of their offerings.

MARKET DRIVERS:

The digital payments market is poised for growth driven by cost-effectiveness, ease of use, and increased adoption.

The primary digital payments drivers are price performance and ease of use gain of digital payments in comparison to the ordinary banking system, growing penetration of digital gadgets, clean get entry to the excessive speed net offerings are anticipated to enhance the marketplace all through the forecast period. However, the growing hazard of statistics breaches and cyber-assaults on banking servers may also abate the digital payments marketplace forecast. Moreover, the technological improvement along with the integration of the blockchain era is similarly strengthening the worldwide digital payments marketplace.

Increased aid by the government in the form of supportive policies is expanding the growth.

A rising quantity of presidency tasks and supportive rules via way of means of the critical and kingdom authorities concerning selling the increase of the marketplace mainly in APAC area will widen the scope of increase to a great extent. The digital charge is one of the number one increase imperatives for countries in this area. Therefore, extended awareness via way of means of the authorities will create several opportunities. Furthermore, the elements along with growing urbanization, industrialization, and developing quantity of cellphone customers globally have similarly contributed to the general marketplace enlargement all through the forecast period. Additionally, developing several charge interfaces on an everyday foundation and growing non-public disposable profits are anticipated to pressure the marketplace's increase rate.

MARKET RESTRAINTS:

The high threat of protection regarding the non-public statistics of purchasers and excessive perception withinside the brick-and-mortar version is taken into account to be the primary threats for the increase of the digital payments market.

Consumers nonetheless accept as true with withinside the brick-and-mortar version on the subject of the transaction associated with their finances. Still, the bulk of the populace believes in going to banks and transacting their financials. So, the consumer perception in brick and mortar is taken into consideration to be the largest restraint for the digital payments marketplace. Most financial institutions and economic establishments are spending plenty of their cyber protection however they want to be out in front, going after the fraudsters and minimizing risks. The majority of the customers are nonetheless now no longer inclined to take chances doing the transactions on line that's taken into consideration to be the largest restraint for the increase of the digital payments marketplace.

DIGITAL PAYMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

30.01% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Paypal Holdings Inc., Visa Inc., Mastercard Incorporated, Amazon.Com Inc., and Alphabet Inc. |

This research report on the Global Digital Payments Market Report has been segmented and sub-segmented based on type, services, and region.

Digital Payments Market - By Type

- Credit unions

- Co-operative Banks

- Consumer Bank

The purchaser banks phase collected the biggest percentage withinside the digital payments marketplace. The big growth withinside the purchaser banks phase is relatively attributed to the growing top-line revenue, value reductions, and moderating risks. They trust in serving their contributors as their center value, as a result, they, first of all, serve the contributors of their bodily branches and now shifting absolutely into digitization.

Digital Payments Market - By Region

- North America

- Europe

- Asia-Pacific

- Rest of the world

North America is anticipated to dominate the marketplace during the forecast period. Preserving a patron for a lifetime is one of the primary desires of a maximum of the monetary institutions. Hence, primary American banks together with Bank of America and others are adopting key developmental techniques together with product launches and others so that they can keep the patron and patron information to touch their current patron for enhancing their income. North America become valued at $376.2 billion in 2021, and is projected to reach $721.3 billion by 2030.

The worldwide digital payments market is pushed through rising international locations in Asia-Pacific together with China, India, and Japan. The digital payments possibilities in those numerous international locations in Asia-Pacific are because of the growing adoption of smartphones and projects which consists of patron training applications and media promotions for cell banking have brought about this uptrend in Asia-Pacific. The Asia-Pacific local marketplace become valued at $69.9 billion in 2021, and is projected to reach $153 billion by 2030.

Global Digital Payments Market Share by Company

Globally, one-of-a-kind vital businesses are providing virtual presentment and price answers. The key businesses are operating relentlessly to offer answers which can be useful for events worried withinside the industry. Remarkably, the important thing businesses are also exploring the scope of virtual prices to perceive the developments which can change the destiny of digital bills.

- Paypal Holdings Inc.

- Visa Inc.

- Mastercard Incorporated

- Amazon.Com Inc.

- Alphabet Inc.

NOTABLE HAPPENINGS IN THE GLOBAL DIGITAL PAYMENTS MARKET IN THE RECENT PAST:

- Acquisition: June 2022 - PayPal Holdings Inc. prolonged and declared growing its credit score services to consist of an enterprise credit score card for small enterprise owners. Issued through WebBank, The PayPal Business Cashback Mastercard is the primary enterprise credit score card through PayPal. With no annual rate together with cashback on all purchases and not using a rewards income caps or expiration.

- Collaboration: June 2022 - Ninth Summit of the Americas, Mastercard, and DFC declared the joint software in reaction to the Call to Action for Northern Central America delivered through the Vice president in May 2021. The Call to Action is constructed to deepen monetary inclusion in El Salvador, Guatemala, and Honduras, for this reason, developing financial possibilities for small agencies and individuals.

- Product Launch: March 2022 - Visa initiated brand new software to assist creators together with musicians, filmmakers, style designers, and artists to make bigger and accelerate their small agencies' use of non-fungible tokens (NFTs). The operation is called Visa Creator Program'. The initiative will assist next-technology entrepreneurs to use and apprehend NFTs.

Chapter 1. DIGITAL PAYMENTS MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DIGITAL PAYMENTS MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-110 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. DIGITAL PAYMENTS MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. DIGITAL PAYMENTS MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. DIGITAL PAYMENTS MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DIGITAL PAYMENTS MARKET– By Payment Type

6.1. Mobile Payment

6.2. Online Payment

6.3. Point of Sale (POS) Payment

Chapter 7. DIGITAL PAYMENTS MARKET– By Deployment Type

7.1. On-premise

7.2. Cloud-based

Chapter 8. DIGITAL PAYMENTS MARKET– By Industry Vertical

8.1. BFSI (Banking, Financial Services, and Insurance)

8.2. Retail and E-commerce

8.3. Healthcare

8.4. Government and Public Sector

8.5. Telecommunication and IT

8.6. Transportation and Logistics

8.7. Others

Chapter 9. DIGITAL PAYMENTS MARKET– By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. Middle-East and Africa

Chapter 10. DIGITAL PAYMENTS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Company 1

10.2. Company 2

10.3. Company 3

10.4. Company 4

10.5. Company 5

10.6. Company 6

10.7. Company 7

10.8. Company 8

10.9. Company 9

10.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900