ePharmacy Market Size (2024-2030)

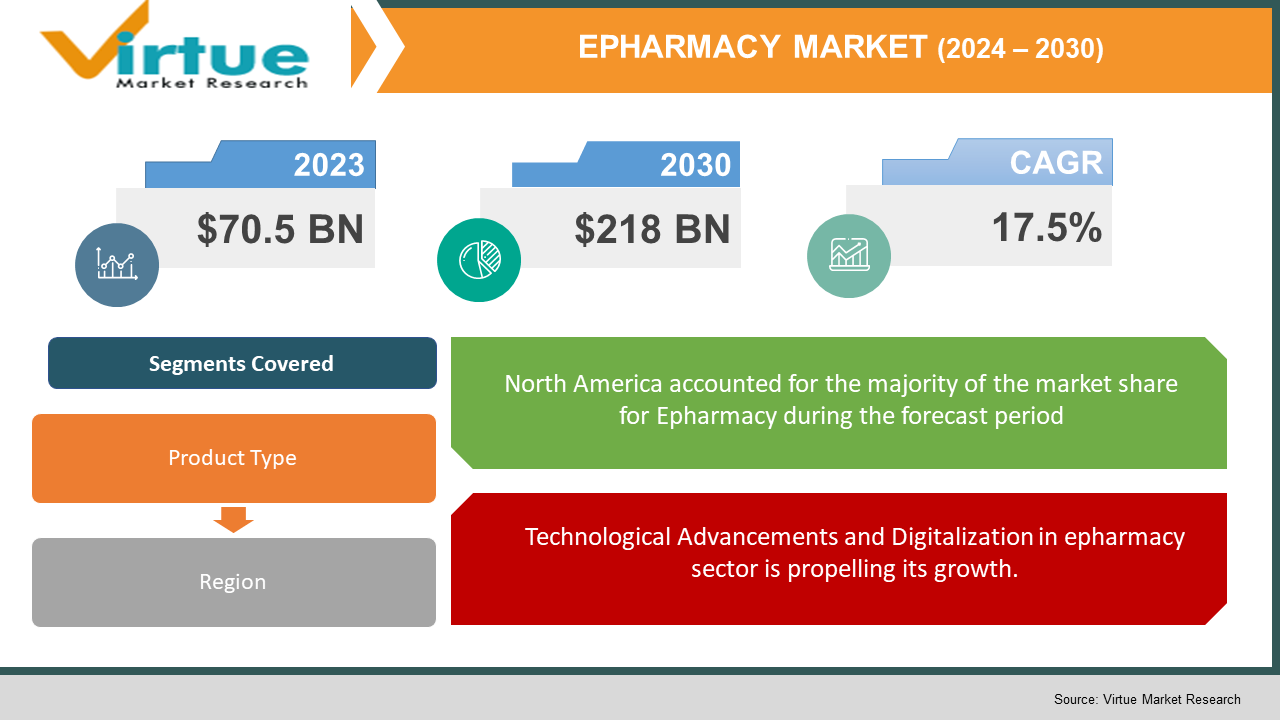

The ePharmacy Market was valued at USD 70.5 Billion in 2023 and is projected to reach a market size of USD 218 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 17.5%.

The ePharmacy market represents a rapidly growing sector within the pharmaceutical industry, leveraging digital platforms to facilitate the purchase and delivery of medications and healthcare products directly to consumers. This online marketplace offers convenience, accessibility, and a wide array of pharmaceutical goods, enabling customers to order prescriptions, over-the-counter medications, wellness products, and healthcare essentials from the comfort of their homes. The market's expansion is fueled by technological advancements, increased internet penetration, and the growing preference for digital solutions, especially in response to factors such as convenience, competitive pricing, and the ability to access healthcare products remotely.

Key Market Insights:

The rise in patent expirations has led pharmaceutical companies to shift from prescription (Rx) to over-the-counter (OTC) strategies. In July 2022, HRA Pharma submitted an application to the FDA for the first OTC birth control pill, Opill, containing only progestin. This transition aims to enhance customer access to these medications. Amid the COVID-19 pandemic, the e-pharmacy market, especially for OTC drugs, experienced substantial growth as consumers avoided clinic visits for minor illnesses due to COVID-19 concerns.

Moreover, India's Drug Technical Advisory Board (DTAB) announced a new OTC drug policy in January 2022, allowing the sale of select medications without prescriptions, including analgesics, cough syrups, and antiseptics. Such governmental initiatives in populous countries are anticipated to significantly drive market growth for OTC product segment.

Online pharmacy sales make up approximately 5 to 10% of the overall global consumer health market.

EPharmacy Market Drivers:

Convenience and Accessibility provided by ePharmacy is continuously increasing the consumer base in this market.

With ePharmacies, individuals can purchase medications and healthcare products online, often from the comfort of their homes. This convenience is particularly appealing to those with mobility issues, individuals in remote areas, or people with busy schedules who find it challenging to visit physical pharmacies during operating hours. Additionally, the ability to browse through a wide range of products, compare prices, read reviews, and receive doorstep delivery adds to the appeal.

Technological Advancements and Digitalization in epharmacy sector is propelling its growth.

The advancement of technology and the increasing digitization of healthcare services have significantly contributed to the growth of ePharmacies. Improved internet connectivity, the proliferation of smartphones, and the development of secure online platforms have facilitated the growth of e-commerce in the pharmaceutical industry. Moreover, the integration of telemedicine services with ePharmacy platforms has further enhanced accessibility to healthcare consultations, prescriptions, and medication delivery. These technological advancements have not only simplified the process of purchasing medications but also increased transparency, safety, and efficiency in the distribution of pharmaceutical products.

EPharmacy Market Restraints and Challenges:

Regulatory Compliance in various region might hinder the growth of epharmacy market.

One major challenge in the ePharmacy market is adhering to varying regulations across different regions. Laws governing the sale and distribution of pharmaceuticals can be complex and differ greatly between countries or even states within a country. E-pharmacies must navigate these regulations while ensuring the authenticity, safety, and legality of the products they sell. Compliance with these regulations adds complexities to operations and may require significant investments in technology and legal expertise.

Trust and Security is crucial in ePharmacy industry, failure in which could pose challenges for businesses and consumers.

Building and maintaining trust among consumers is crucial for ePharmacies. Concerns regarding the authenticity of medications, data privacy, and secure transactions are significant. Customers need assurance that the medicines they purchase online are genuine and safe for consumption. Moreover, the security of personal and financial information shared during online transactions is paramount. E-pharmacies must invest in robust security measures and transparent policies to alleviate these concerns and foster trust among consumers.

EPharmacy Market Opportunities:

The ePharmacy market presents significant opportunities driven by evolving consumer preferences, technological advancements, and the increasing adoption of digital healthcare solutions. With the growing demand for convenient and accessible healthcare services, the ePharmacy sector offers avenues for expansion by providing a seamless platform for purchasing medications, wellness products, and healthcare essentials online. Leveraging mobile applications, AI-driven solutions, and telemedicine integration, ePharmacies can further enhance customer experiences, improve medication adherence, and expand their reach to underserved populations, tapping into a rapidly growing market seeking efficient, personalized, and digitally-enabled healthcare solutions.

EPHARMACY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.5% |

|

Segments Covered |

By Product Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

CVS Health Corporation (CVS Pharmacy), Walgreens Boots Alliance, Inc. (Walgreens), Amazon Pharmacy, Walmart Inc. (Walmart Pharmacy), Ro Pharmacy, 1mg, Netmeds, Medlife, PharmEasy |

EPharmacy Market Segmentation:

EPharmacy Market Segmentation: By Product Type:

- Prescription Medications

- Over-the-Counter (OTC) Medications

- Health and Wellness Products

- Medical Devices and Equipment

- Pet Medications and Healthcare Products

The largest segment by product type is the Over-the-Counter (OTC) Medications segment having market share of 59% in 2023. OTC medications encompass a broad range of easily accessible products that consumers can purchase without a prescription. This segment's popularity stems from its wide consumer base, spanning individuals seeking quick remedies for common health issues like headaches, colds, allergies, and minor ailments. The ease of access and relatively lower barriers to purchase contribute to its prominence in the ePharmacy market. The fastest-growing segment is the Health and Wellness Products category anticipated to grow at a rate of 5.6%. This segment's rapid growth is attributed to the increasing consumer awareness and focus on preventive healthcare and well-being. Customers are actively seeking products like vitamins, supplements, skincare items, and natural remedies to maintain and enhance their overall health. The rising interest in self-care and wellness lifestyles, coupled with a growing preference for online shopping convenience, has significantly boosted the demand for health and wellness products in the ePharmacy market.

EPharmacy Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

In 2023, North America tends is the largest region in the ePharmacy market holding market share of 40%. Primarily, it’s driven by a high level of internet penetration, advanced healthcare infrastructure, a tech-savvy population, and a strong focus on convenience in healthcare services. The region also has well-established regulatory frameworks that, while stringent, provide a level of trust and assurance to consumers in online pharmaceutical purchases. A robust logistics and distribution network further supports the growth of ePharmacies, allowing for efficient delivery of medications and healthcare products to customers across various states and provinces within the region. The Asia Pacific region stands out as the fastest-growing region in the ePharmacy market. This growth is propelled by rapidly expanding internet penetration, a surge in smartphone adoption, increasing healthcare awareness, and a growing middle-class population seeking convenient and cost-effective healthcare solutions. Supportive government initiatives and advancements in technology have facilitated the widespread acceptance and adoption of ePharmacy services across the region, leading to a significant surge in online medicine purchases and healthcare product consumption.

COVID-19 Impact Analysis on the EPharmacy Market:

The COVID-19 pandemic significantly accelerated the growth of the ePharmacy market, triggering a surge in demand as consumers sought safe and convenient avenues to access medications and healthcare products while adhering to social distancing measures. The pandemic-induced lockdowns and restrictions amplified the adoption of online platforms for purchasing pharmaceuticals, driving a notable shift towards e-commerce in the healthcare sector. Moreover, concerns about visiting physical pharmacies coupled with the need for continuous medication refills propelled the uptake of ePharmacy services, leading to increased acceptance and reliance on digital platforms for prescription fulfillment and healthcare needs.

Latest Trends/ Developments:

One prevailing trend in the ePharmacy market is the integration of telehealth services. Many ePharmacy platforms are incorporating telemedicine functionalities, enabling consumers to consult healthcare professionals virtually, receive prescriptions, and order medications seamlessly within the same digital ecosystem. This trend reflects the convergence of healthcare services and e-commerce, offering patients a comprehensive and convenient healthcare experience.

An essential development in the ePharmacy market involves the emphasis on personalized medication management and adherence solutions. Innovations in technology, such as AI-driven tools and smart devices, are being leveraged to provide personalized medication reminders, dosage schedules, and tailored adherence programs. This development aims to improve patient outcomes by addressing medication adherence challenges, enhancing patient engagement, and ultimately fostering better health management through ePharmacy platforms.

Key Players:

- CVS Health Corporation (CVS Pharmacy)

- Walgreens Boots Alliance, Inc. (Walgreens)

- Amazon Pharmacy

- Walmart Inc. (Walmart Pharmacy)

- Ro Pharmacy

- 1mg

- Netmeds

- Medlife

- PharmEasy

In September 2022, Walmart Canada and Canada Health Infoway forged a partnership. This collaboration facilitated the integration of Infoway's electronic prescribing service, PrescribeIT, into 14 Walmart Canada pharmacies across Ontario, Alberta, Saskatchewan, and New Brunswick. Expansion to more locations is slated by the year's end.

Chapter 1. GLOBAL EPHARMACY MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL EPHARMACY MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL EPHARMACY MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL EPHARMACY MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL EPHARMACY MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL EPHARMACY MARKET – By Product Type

6.1. Introduction/Key Findings

6.2. Prescription Medications

6.3. Over-the-Counter (OTC) Medications

6.4. Health and Wellness Products

6.5. Medical Devices and Equipment

6.6. Pet Medications and Healthcare Products

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type , 2023-2030

Chapter 7. GLOBAL EPHARMACY MARKET - By Geography – Market Size, Forecast, Trends & Insights

7.1. North America

7.1.1. By Country

7.1.1.1. U.S.A.

7.1.1.2. Canada

7.1.1.3. Mexico

7.1.2. By End-User

7.1.3. By Product Type

7.1.5. Countries & Segments - Market Attractiveness Analysis

7.2. Europe

7.2.1. By Country

7.2.1.1. U.K.

7.2.1.2. Germany

7.2.1.3. France

7.2.1.4. Italy

7.2.1.5. Spain

7.2.1.6. Rest of Europe

7.2.2. By End-User

7.2.3. By Product Type

7.2.4. Countries & Segments - Market Attractiveness Analysis

7.3. Asia Pacific

7.3.1. By Country

7.3.1.1. China

7.3.1.2. Japan

7.3.1.3. South Korea

7.3.1.4. India

7.3.1.5. Australia & New Zealand

7.3.1.6. Rest of Asia-Pacific

7.3.2. By End-User

7.3.3. By Product Type

7.3.4. Countries & Segments - Market Attractiveness Analysis

7.4. South America

7.4.1. By Country

7.4.1.1. Brazil

7.4.1.2. Argentina

7.4.1.3. Colombia

7.4.1.4. Chile

7.4.1.5. Rest of South America

7.4.2. By End-User

7.4.3. By Product Type

7.4.4. Countries & Segments - Market Attractiveness Analysis

7.5. Middle East & Africa

7.5.1. By Country

7.5.1.1. United Arab Emirates (UAE)

7.5.1.2. Saudi Arabia

7.5.1.3. Qatar

7.5.1.4. Israel

7.5.1.5. South Africa

7.5.1.6. Nigeria

7.5.1.7. Kenya

7.5.1.7. Egypt

7.5.1.7. Rest of MEA

7.5.2. By End-User

7.5.3. By Product Type

7.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL EPHARMACY MARKET – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 CVS Health Corporation (CVS Pharmacy)

9.2. Walgreens Boots Alliance, Inc. (Walgreens)

9.3. Amazon Pharmacy

9.4. Walmart Inc. (Walmart Pharmacy)

9.5. Ro Pharmacy

9.6. 1mg

9.7. Netmeds

9.8. Medlife

9.9. PharmEasy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The ePharmacy Market was valued at USD 70.5 Billion in 2023 and is projected to reach a market size of USD 218 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 17.5%.

Convenience and Accessibility provided by ePharmacy along with Technological Advancements and Digitalization are drivers of EPharmacy market.

Based on product type, the EPharmacy Market is segmented into Prescription Medications, Over-the-Counter (OTC) Medications, Health and Wellness Products, Medical Devices and Equipment, Pet Medications and Healthcare Products.

North America is the most dominant region for the EPharmacy Market.

Ro Pharmacy, 1mg, Netmeds, Medlife, PharmEasy are few of the key players operating in the EPharmacy Market.