North America Frozen Potato Market Size (2024-2030)

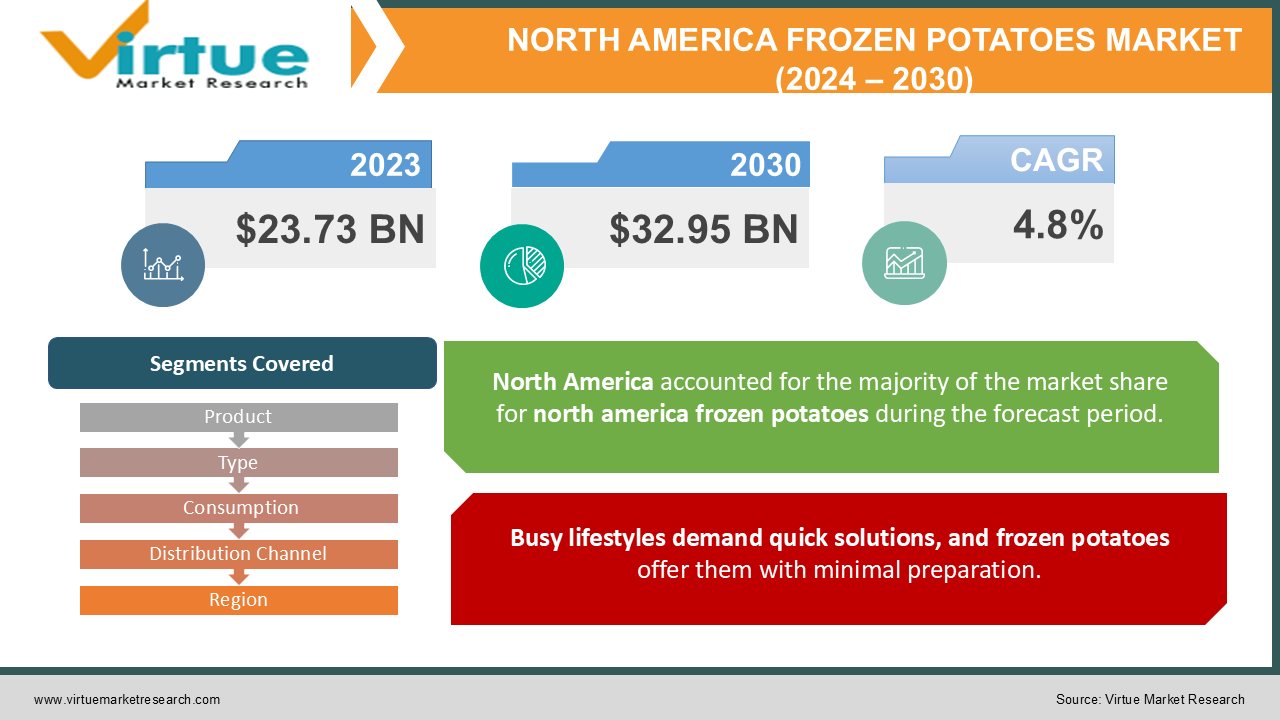

The North American frozen potato market was valued at USD 23.73 billion in 2023 and is projected to reach a market size of USD 32.95 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4.8%.

The North American frozen potato market is a significant player in the food industry, enjoying widespread popularity and driving the region's dominance in the global market. The United States stands as the leader in North America, offering a diverse range of products like French fries, potato wedges, and more. Convenience plays a major role in the market's success, catering to busy lifestyles and offering versatility for various meals and snacks. Advancements in technology have also enhanced the taste and texture of these products, making them a more attractive option.

The growing demand for quick and easy meals, particularly in the fast-food sector, further fuels the market's growth. Looking ahead, the future seems bright for the North American frozen potato market, with a focus on healthier options, exciting flavor innovation, and sustainable practices to meet evolving consumer preferences.

Key Market Insights:

The North American frozen potato market reigns supreme in convenience. Busy lifestyles and the desire for quick meals make them a popular choice. Their versatility allows them to be incorporated into various meals and snacks, catering to diverse needs. Advancements in technology have significantly improved their taste and texture, making them a more attractive option compared to fresh potatoes. This, coupled with the growing demand for quick and easy meals, particularly in the fast-food sector, fuels the market's growth. However, the market is evolving to meet changing consumer preferences. As health consciousness rises, there's a surge in healthier options like reduced fat and organic varieties. Additionally, exciting new flavors are constantly emerging to cater to adventurous palates.

Sustainability is also becoming a growing priority, prompting manufacturers to adopt eco-friendly packaging and sourcing methods. Understanding these key insights can empower stakeholders within the North American frozen potato market to make informed decisions regarding product development, marketing strategies, and future investment opportunities. By focusing on convenience, versatility, health, flavor innovation, and sustainability, companies can effectively navigate the evolving market and secure their position in this ever-growing industry.

North American Frozen Potato Market Drivers:

Busy lifestyles demand quick solutions, and frozen potatoes offer them with minimal preparation.

In today's fast-paced world, convenience reigns supreme. Dual income has become the new norm. As such, people find very little time and therefore go for convenient food options. Frozen potatoes offer a time-saving solution, requiring minimal preparation compared to fresh alternatives. This caters perfectly to busy individuals and families seeking quick and easy meal options.

From breakfast to burgers, frozen potatoes seamlessly integrate into various meals and snacks.

Frozen potatoes boast remarkable versatility, seamlessly integrating into various meals and snacking occasions. From breakfast hash browns to French fries accompanying burgers, their adaptability makes them a valuable addition to any pantry. This diverse use case broadens their appeal and market reach.

Improved technology delivers tastier and texturally superior frozen potatoes, rivaling fresh options.

There have been many improvements to bland and mushy frozen potatoes. Advancements in freezing technology have significantly improved both taste and texture, making them more comparable to fresh potatoes. This enhanced dining experience fuels consumer acceptance and market growth.

The reliance of quick-service restaurants on frozen potatoes ensures consistent market growth.

The popularity of fast food and quick-service restaurants (QSRs) plays a significant role in driving the frozen potato market. Investments in such places are also on the rise due to economic growth. These establishments heavily rely on frozen potato products, ensuring consistent demand and contributing to market size.

Healthier options and exciting flavors cater to changing consumer demands.

The market is adapting to meet evolving consumer preferences, particularly in the realm of health. Reduced-fat, organic, and other health-conscious options are gaining traction to cater to the growing demand for healthier dietary choices. Additionally, the market is witnessing an exciting rise in innovative flavors, catering to adventurous palates and keeping consumer interest piqued.

North American Frozen Potato Market Restraints and Challenges:

While the North American frozen potato market enjoys growth, it isn't without obstacles. Health concerns linger as a large portion of the market remains conventional, high in sodium, unhealthy fats, and carbohydrates, potentially deterring health-conscious consumers.

Pricing fluctuations pose another challenge, as the market is susceptible to potato price swings due to weather and crop yields, impacting production costs and ultimately influencing consumer prices, potentially discouraging purchases, and hindering market stability.

Additionally, intense competition exists from fresh and refrigerated potatoes, other frozen vegetables, and alternative convenience foods like rice and pasta, demanding continuous innovation and differentiation strategies from frozen potato manufacturers to maintain their market share.

Finally, sustainability concerns regarding non-biodegradable packaging materials and the environmental impact of potato farming pose challenges. Addressing these concerns through sustainable sourcing and eco-friendly packaging practices is crucial for maintaining consumer trust and ensuring the long-term viability of the market. By acknowledging and tackling these restraints and challenges, the North American frozen potato market can navigate its future with greater resilience and ensure continued success in the evolving food industry.

North American Frozen Potato Market Opportunities:

The North American frozen potato market presents fertile ground for growth and expansion, driven by evolving consumer preferences. Capitalizing on the growing health-conscious trend, manufacturers can expand their offerings of low-fat, organic, and nutrient-rich options. Additionally, catering to adventurous palates through flavor innovation and customization, with options like ethnic-inspired flavors or limited-edition seasonal offerings, can create excitement and brand loyalty.

Convenience remains key, and exploring opportunities to further enhance it by offering pre-seasoned or pre-cooked products, or even value-added options like potato-based meal kits, can attract busy consumers seeking quick and easy meal solutions.

Addressing environmental concerns is crucial, and adopting sustainable practices throughout the supply chain, from using eco-friendly packaging to implementing responsible sourcing strategies, demonstrates commitment to environmental responsibility. Finally, leveraging the growing popularity of e-commerce by establishing online stores, partnering with online retailers, and exploring direct-to-consumer subscription models can open up new avenues for reaching customers and securing market share in the ever-evolving food landscape.

NORTH AMERICA FROZEN POTATO MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United States, Canada, Rest of North America |

|

Key Companies Profiled |

McCain Foods, Lamb Weston Holdings Inc., J.R. Simplot Company, The Kraft Heinz Company, Aviko Group, Agristo NV, Farm Frites International B.V., Nomad Foods Ltd., General Mills, Inc., Tyson Foods, Inc. |

North American Frozen Potato Market Segmentation:

North American Frozen Potato Market Segmentation: By Product Type:

- French Fries

- Hash Browns

- Shaped Potatoes

- Mashed Potatoes

- Others

The most dominant segment in the North American frozen potato market by product type is French fries, which account for a significant portion of the market share due to their widespread popularity as a convenient and versatile side dish or snack. The fastest-growing is the hash brown segment. For frozen hash browns to maintain their texture and form during cooking, they are usually partially cooked before freezing. For simpler handling, they are occasionally formed into patties and frozen. Hash browns from frozen are minimal in calories and carbs. They can be kept in the fridge for up to four days.

North American Frozen Potato Market Segmentation: By End User:

- Residential

- Commercial

- Institutional

The commercial segment is the largest growing end user. This is attributed to the increasing demand and growth of QSRs across many nations. Quick service restaurants (QSRs), fast food franchises, and hotels employ frozen potatoes and similar items. Because these items are simple to use and require little preparation time, they are widely accepted in the business world.

In addition, a lot of caterers choose to use frozen food because of its convenience and the effects of climate change, which encourage the usage of frozen food items and support the expansion of the frozen potato industry.

The residential sector is the fastest-growing segment within the North American frozen potato market by end users, encompassing individuals and families purchasing these products for home consumption. This segment benefits from the convenience and versatility of frozen potatoes, making them a popular choice for busy lifestyles.

North American Frozen Potato Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

The dominant segment of the North American frozen potato market by distribution channel is supermarkets and hypermarkets, which offer a wide variety of products to consumers. However, the online retailer segment is experiencing the fastest growth, driven by the increasing popularity of e-commerce and convenient online purchasing options.

North American Frozen Potato Market Segmentation: Regional Analysis:

- USA

-

Canada

- Mexico

The US reigns supreme in the North American frozen potato market. It boasts the largest market share, fuelled by the nation's demand for convenient foods and the strong presence of major frozen potato manufacturers. While French fries, hash browns, and other classic options remain popular, there's also a growing demand for innovative flavors and healthier alternatives. Distribution is dominated by supermarkets and hypermarkets, with convenience stores and discount retailers also playing significant roles. Mexico represents the fastest-growing market in North America. This growth is attributed to rising disposable income and increasing urbanization. Mexican consumers are inclined towards spicier flavors and unique potato product varieties compared to their northern neighbors. While traditional grocery stores still hold relevance in Mexico, modern supermarkets and convenience stores are increasingly shaping distribution patterns.

COVID-19 Impact Analysis on the North American Frozen Potato Market:

The outbreak of the virus had a mixed impact on the North American frozen potato market. While it presented challenges, it also opened doors to new opportunities. Initially, the pandemic disrupted supply chains due to lockdown measures and labor shortages, leading to difficulties in obtaining potatoes and transporting finished products. Additionally, the temporary closure of restaurants significantly reduced commercial demand for frozen potatoes.

Economic uncertainty further dampened growth in certain market segments as consumers prioritized essential goods over convenience food options. However, the pandemic also presented unforeseen opportunities. Panic buying early in the pandemic led to a temporary spike in retail demand due to the long shelf life and convenience of frozen potatoes.

Increased home cooking due to stay-at-home restrictions also fueled demand for frozen potatoes as a convenient side dish or ingredient. Furthermore, the surge in online grocery shopping presented new avenues for reaching consumers, particularly in the residential segment.

Overall, the pandemic's mixed impact highlights the need for adaptability within the market. Manufacturers who can secure their supply chains, embrace online platforms, and diversify their product offerings are well-positioned for success in the evolving landscape. Additionally, the pandemic's acceleration of health-conscious and sustainable practices presents long-term opportunities for manufacturers who can adapt and cater to these evolving consumer preferences.

Latest Trends/ Developments:

The North American frozen potato market is constantly evolving to keep pace with changing consumer demands and preferences. One exciting trend gaining traction is the emergence of plant-based ingredients, from plant-based coatings for fries to entirely plant-based potato alternatives made from vegetables like cauliflower. Additionally, consumers are seeking functional ingredients and fortification, leading to the introduction of frozen potato products enriched with vitamins, minerals, or even protein for added health benefits.

Catering to adventurous palates, the market is also witnessing a rise in ethnic and regional flavors, featuring spices from diverse cuisines and globally inspired dips and sauces. Sustainability remains a top priority, prompting manufacturers to implement eco-friendly practices, including sustainable packaging, responsible sourcing, and waste reduction strategies.

Finally, the popularity of subscription boxes and meal kits presents new opportunities for partnerships, allowing manufacturers to offer pre-portioned frozen potato products as convenient and flavorful components within complete meal solutions. By staying ahead of these evolving trends and adapting to consumer preferences, frozen potato manufacturers can ensure their continued success in this dynamic market.

Key Players:

- McCain Foods

- Lamb Weston Holdings Inc.

- J.R. Simplot Company

- The Kraft Heinz Company

- Aviko Group

- Agristo NV

- Farm Frites International B.V.

- Nomad Foods Ltd.

- General Mills, Inc.

- Tyson Foods, Inc.

Chapter 1. North America Frozen Potato Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Frozen Potato Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Frozen Potato Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Frozen Potato Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Frozen Potato Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Frozen Potato Market– By Product Type

6.1. Introduction/Key Findings

6.2. French Fries

6.3. Hash Browns

6.4. Shaped Potatoes

6.5. Mashed Potatoes

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Frozen Potato Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Online Retail

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. North America Frozen Potato Market– By End User

8.1. Introduction/Key Findings

8.2. Residential

8.3. Commercial

8.4. Institutional

8.5. Y-O-Y Growth trend Analysis By End User

8.6. Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 9. North America Frozen Potato Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By End User

9.1.3. By Distribution Channel

9.1.4. product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Frozen Potato Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. The Kraft Heinz Company

10.2. McCain Foods

10.3. Lamb Weston Holdings Inc.

10.4. J.R. Simplot Company

10.5. Aviko Group

10.6. Agristo NV

10.7. Farm Frites International B.V.

10.8. Nomad Foods Ltd.

10.9. General Mills, Inc.

10.10. Tyson Foods, Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North American frozen potato market was valued at USD 23.73 billion in 2023 and is projected to reach a market size of USD 32.95 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4.8%.

. Convenience, versatility, taste and texture advancements, fast food demand, and evolving preferences are driving the market

Based on distribution channels, the market is divided into supermarkets and hypermarkets, convenience stores, and online retailers

The United States is the most dominant region for the North American frozen potato market, driven by its large population, high demand for convenience foods, and strong presence of major manufacturers

McCain Foods, Lamb Weston Holdings Inc., J.R. Simplot Company, The Kraft Heinz Company, Aviko Group, Agristo NV, Farm Frites International B.V., Nomad Foods Ltd., General Mills, Inc., and Tyson Foods Inc. are the major players