North America Frozen Fruits Market Size (2024-2030)

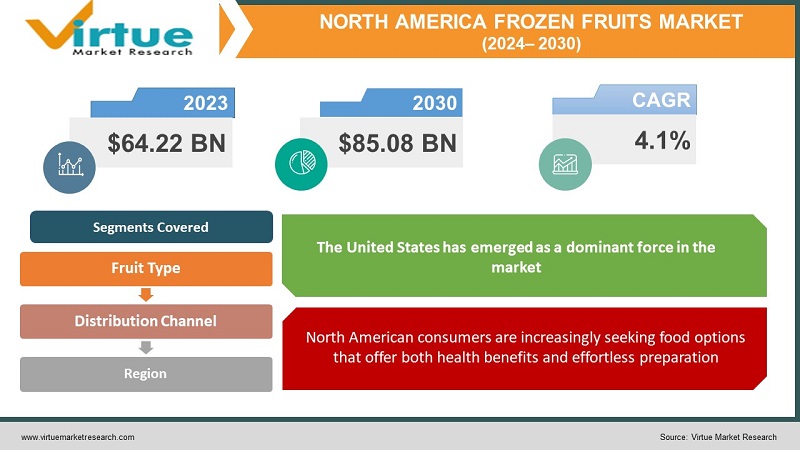

The North America Frozen Fruits Market was valued at USD 64.22 Billion in 2024 and is projected to reach a market size of USD 85.08 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.1%.

The North American frozen fruit market is a robust and evolving segment of the broader frozen food industry. Frozen fruits offer the nutritional benefits of fresh produce with extended shelf-life and on-demand availability, aligning with consumer preferences. Usage ranges from direct consumption as snacks and smoothie ingredients to their incorporation into yogurts, baked goods, confectioneries, and numerous culinary uses. The introduction of novel fruit varieties, convenient packaging formats, and blends tailored to specific uses fuel further market expansion. Supermarkets and grocery stores are dominant sales channels, but growth in online grocery and food service applications offers new avenues. Consumers increasingly prioritize healthy eating habits and seek accessible ways to include fruits in their diets. Frozen fruits offer a year-round solution. The fast pace of modern life means time for food preparation is squeezed. Frozen fruits offer ready-to-use options that save time.

Key Market Insights:

The North American frozen fruits market is a significant player in the global frozen food industry. Hectic lifestyles and a shift towards quick, easy-to-prepare food solutions drive demand for frozen fruits, which offer year-round availability and convenience in various formats. Rising awareness of the importance of fruits in a balanced diet, combined with the perception of frozen fruits as a healthy and minimally processed alternative, fuels the market. Frozen fruits help to reduce food waste by preserving seasonal produce. They appeal to consumers concerned with sustainability and minimizing their environmental footprint. Advances in freezing technologies, creative flavor combinations in frozen fruit mixes, and the development of convenient snacking formats further expand the market's appeal. Mangoes, pineapples, and other tropical fruits are experiencing increased demand driven by a desire for exotic flavors and use in smoothies and desserts. Frozen versions of less common fruits like peaches, cherries, and pomegranates cater to specific culinary applications and the needs of specialty producers. Frozen fruits are widely used in baked goods, ice creams, yogurt, jams, and other sweet treats, adding flavor, texture, and visual appeal. Frozen fruits serve as ingredients in pre-prepared meals, sauces, fillings, and packaged snacks, offering manufacturers cost efficiency and year-round consistency. The rise of frozen fruit snack packs and innovative single-serve formats boost direct consumption.

North America Frozen Fruits Market Drivers:

North American consumers are increasingly seeking food options that offer both health benefits and effortless preparation. Frozen fruits superbly meet this demand in several ways.

Demanding jobs, juggling family schedules, and the fast pace of modern life leave less time for elaborate meal preparation. People seek solutions that minimize time spent on grocery shopping and cooking. Despite a busy lifestyle, there's a growing resistance to compromising on health. Consumers want foods that are nutritious, fresh-tasting, and support their well-being goals. No longer just a niche interest, the desire to eat healthfully permeates broader demographics, fueled by greater awareness of the link between diet and long-term health. Overly processed packaged foods lose favor, leaving people seeking ways to incorporate whole or minimally processed ingredients into their diets. Frozen at peak ripeness and often requiring minimal processing, they deliver a burst of vitamins, fiber, and antioxidants without the need to wash, chop, or worry about spoilage. Consumers have grown accustomed to global grocery aisles. Frozen fruits allow access to beloved berries, tropical varieties, or favorite summer fruits even in the depths of winter. Frozen fruits come in formats tailored to different uses. Whole berries for smoothies, diced for muffins, pre-made purées for sauces – offering convenience for diverse culinary needs. For perishable fresh fruits, spoilage is a concern. Frozen fruits extend shelf life significantly, appealing to the desire for both thriftiness and reducing environmental impact through less food waste.

Beyond the individual health benefits, frozen fruits have earned a reputation as culinary allies for both home cooks and the wider food industry.

Unlike fresh fruit, frozen varieties offer a known baseline of sweetness, ripeness, and texture. This consistency is invaluable in commercial food production, where product uniformity, even across seasons, is essential. No longer limited by seasonality, chefs, bakers, and home cooks gain access to diverse fruit flavors any time of year. This expands their ability to incorporate unique fruits into desserts, sauces, and even savory dishes. Particularly when fresh fruits are out-of-season, frozen can be a more cost-effective solution. This economic factor influences everything from restaurant menus to packaged food production. The longer shelf life of frozen fruit compared to highly perishable fresh produce reduces waste – an advantage for food businesses and home consumers alike. Frozen fruits arrive in various pre-prepped formats (whole, sliced, pureed). This eliminates time-consuming preparation steps, particularly valuable in busy restaurant kitchens and commercial food manufacturing. Home and professional baking gains new dimensions. Frozen berries are ubiquitous, but also unusual varieties of frozen fruit purees open a world of flavor experimentation and year-round consistency. Frozen fruits allow chefs to showcase seasonal flavors on their menu year-round. They underpin unique desserts, creative sauces for both sweet and savory dishes, and vibrant, flavor-infused beverages. We see an explosion of products using frozen fruits. Jams, yogurts, ice creams, packaged bakery items – frozen fruits are the backbone ensuring flavor consistency and cost control. The availability of both common and less familiar frozen fruits inspires home cooks. Recipes that might have been impossible with limited fresh options become achievable.

North America Frozen Fruits Market Restraints and Challenges:

Insecticides, fertilizers, manpower, and other input costs for agriculture have all gone up recently. Unpredictable weather patterns brought on by climate change increase costs even further because they may negatively affect crop yields.

The cost of labor, insecticides, fertilizers, and other agricultural inputs has increased recently. Climate change-related unpredictable weather patterns drive up expenses even more because they might have a detrimental impact on crop harvests. Rapid freezing is an energy-intensive procedure that has grown more costly, as has the cost of labor and packaging supplies. This financial load is made worse by inflationary pressures. Specialized storage and transportation infrastructure are needed to keep the cold chain running smoothly from processing plants to retail locations. An additional considerable layer of expense is added by fuel prices, chilled storage, and general logistical complexity. In the end, consumers pay more because of these increased supply chain expenses. Manufacturers of frozen fruit frequently cut corners or lower package sizes to stay competitive and economical, which makes frozen fruit a less desirable alternative than fresh food. Fruit harvests are seriously at risk from extreme weather events like floods, droughts, and unexpected frosts. In a large fruit-growing region, for instance, a late freeze can significantly lower output, causing shortages and price instability. Fruit crops are susceptible to illnesses and pests that can wipe out entire plantations or orchards. A localized epidemic may result in bottlenecks in the supply chain and raise the cost of particular fruit varieties. Raw material flows can be hampered by export prohibitions, import taxes, or trade disputes. This may limit the range of fruits available to consumers and cause uncertainty for producers of frozen fruit. For the sector, securing a steady supply of raw materials is a constant concern. The overall appeal of frozen fruit products may be impacted if manufacturers are forced to use less desirable or lower-quality fruits due to shortages. A growing number of customers value fresh, minimally processed goods highly. Even while freezing preserves nutrients, frozen fruits are sometimes thought of as less appetizing than their fresh counterparts.

North America Frozen Fruits Market Opportunities:

Frozen fruits eliminate the risks associated with fresh produce spoilage and price fluctuations. Businesses can budget more effectively and avoid losses due to wastage. Access to frozen fruit enables year-round use of specific fruits, even when they are out of season. This is especially beneficial for smoothie chains, bakeries, and producers of fruit-based products. Using pre-cut and frozen fruits reduces labor costs and preparation time in commercial settings. Businesses can optimize kitchen efficiency and resource use. The quick-freezing process locks in the vitamins, minerals, and antioxidants of fruits at peak ripeness. This allows consumers to enjoy nutritional benefits even outside a fruit's growing season. Frozen fruits are available in pre-portioned bags, making it easier for consumers to manage intake and avoid overconsumption or spoilage common with fresh fruits. Frozen fruits reduce preparation time and offer a healthy ingredient for smoothies, oatmeal, yogurt parfaits, and other home-cooked meals. They appeal to busy consumers seeking nutritious and accessible meal solutions. Frozen fruits can cater to a range of popular diets, including vegan, plant-based, gluten-free, and those focused on whole foods. Introducing mixes with less common fruits like acai, goji berries, dragon fruit, etc., can attract consumers seeking variety and exciting new flavors. Developing frozen fruit products with added health-boosting ingredients like probiotics, protein powders, or adaptogens can create unique offerings in the functional foods space. Frozen fruit bites, fruit-and-nut mixes, and other snackable formats offer a healthier alternative to traditional processed snacks and can gain traction with on-the-go consumers. Convenient single-serve packages, resealable pouches, and visually appealing packaging can enhance the consumer experience.

NORTH AMERICA FROZEN FRUITS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By Fruit Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United States, Canada, and Rest of North America |

|

Key Companies Profiled |

Dole Food Company, J.M. Smucker Company, Wyman's of Maine, SunOpta, Conagra Brands, Bonduelle, Pinnacle Foods, Cascadian Farm Organic, Grimmway Farms |

North America Frozen Fruits Market Segmentation:

North America Frozen Fruits Market Segmentation: By Fruit Type -

- Berries

- Tropical Fruits

- Stone Fruits

- Citrus Fruits

- Other Fruits

With 45% of the market, berries dominate. In the frozen fruit industry, berries hold the highest price. This is because of their acceptance, adaptability, and alleged health advantages. Strawberries are the main participants in this market because of their sweetness and versatility in recipes ranging from smoothies to desserts. Antioxidant-rich blueberries are a favorite for snacking, baking, and smoothies. Tart and colorful raspberries are commonly used in baked dishes, sauces, and preserves. There are expanding markets for other berries as well, like cranberries and blackberries. Tropical fruits, which account for about 30% of the market. The market for tropical fruits is expanding significantly due to factors including the desire for unique flavors and a growing interest in international cuisines. popularity of juices and smoothies with tropical flavors. These fruits are always available in frozen formats, even when they're not in season. Mangoes, pineapples, papayas, and coconuts are important tropical fruits that are becoming more and more well-known for their distinct flavor characteristics. Stone fruits account for about 15% of the market. Stone fruits are less widespread in consumer markets than berries and tropical fruits, but they still hold a significant proportion due to their use in jams, yogurt, compotes, and other products. They are well-liked as toppings and fillings. The market share of citrus fruits is approximately 5%. Since there are so many Fresh Options available, the market share of citrus fruits is down. Customers frequently like their citrus fruits fresh. You can utilize frozen citrus in smoothies, drinks, and several cooking applications. Oranges, lemons, and limes are important citrus fruits for cooking and drinks. The market share of other fruits is roughly 5%. This category includes frozen fruit selections that are less popular and provide room for creativity.

North America Frozen Fruits Market Segmentation: By Distribution Channel -

- Hypermarkets and supermarkets

- Convenience Stores

- Online-based retail

- Food service sector

- Other

Hypermarkets and supermarkets (45–50%) own the biggest portion of the market because of their extensive product range, affordable prices, and ability to provide customers with a single point of shopping. With market shares of 15–20%, Convenience Stores fulfill the needs of impulsive purchases, consumption while traveling, and prompt access to lesser amounts of frozen fruits. Online-based retail (10–15%) with door-to-door delivery, a wider selection of products, and price comparison tools, this quickly growing market—which was spurred on by the pandemic—has grown in popularity and drawn in a large number of millennials and Gen Z customers. Establishments like cafes, restaurants, juice bars, and smoothie chains are included in the food service sector (20–25%). They depend on reliable large-scale suppliers and frequently favor specific frozen fruit forms. Other Channels hold 5 to 10% of the market share. These channels encompass specialty stores, direct-to-consumer sales, farmers' markets, and independent grocery stores, playing a smaller but significant role within niche markets. In North America, supermarkets and hypermarkets undoubtedly dominate the frozen fruit business. Customers value the time and effort savings associated with being able to buy frozen fruits in addition to all their other food needs. When it comes to frozen fruit, supermarkets usually have a wider selection of brands, forms (IQF, block, etc.), types, and conventional and organic options. Online grocery shopping is becoming more and more popular due to the pandemic, since it provides convenience and the option for frozen goods to be delivered directly to customers. When buying frozen fruit, consumers are increasingly combining online and offline channels. Alternatively, they may do their web research before making an in-store purchase.

North America Frozen Fruits Market Segmentation: Regional Analysis:

- US

- Canada

- Mexico

The US dominates the North American market, accounting for approximately 75-80% of the overall share. The fast-paced lifestyle of many US consumers, coupled with a growing appreciation for the health benefits of fruits, drives the demand for convenient and readily available frozen fruit options. The US has a robust frozen food infrastructure, with widespread availability in retail channels, facilitating easy consumer access to frozen fruits. The multicultural makeup of the US population leads to a broad range of uses for frozen fruits, from traditional desserts to unique fusion dishes. Canada holds the second-largest share in the market, estimated at around 15-20%. Canadians, like their US counterparts, are increasingly seeking healthy and convenient food choices, boosting the frozen fruits segment. The popularity of smoothies and other healthy beverages drives the usage of frozen fruits, especially berries. A growing trend towards supporting local agriculture could benefit the growth of the Canadian frozen fruit market, focusing on domestically sourced produce. Mexico holds a smaller, but rapidly expanding share of approximately 5-10% of the market. Mexico's expanding middle class drives a greater demand for processed and convenience-oriented foods, including frozen fruits. Smoothies and fruit-based juices are increasingly popular beverages in Mexico, creating a niche for frozen fruit ingredients. Mexico currently exhibits the greatest potential for rapid growth within the North American frozen fruit market. Factors like its evolving consumer demographic, expanding middle class, and increasing adoption of healthier food choices create fertile ground for greater frozen fruit consumption in the coming years.

COVID-19 Impact Analysis on the North American Frozen Fruits Market:

COVID-19's late-2019 debut shocked the world's supply chains and consumer behavior. Although not immune to these shocks, the frozen fruit business in North America underwent a complex interplay of opportunities and problems. Fears of running out of fresh produce and panic shopping contributed to a spike in demand for frozen fruits in the early stages of the pandemic. This led to brief shortages and changes in some products' prices. Travel bans and lockdowns hampered the supply of raw materials from important fruit-growing regions. The difficulties of international trade were increased by border restrictions and logistical obstacles. Due to social distancing laws and worker safety concerns, labor shortages in farms and processing plants may influence production capacity. The demand from the food service industry, an important market for frozen fruits, was greatly diminished by the closure of cafes, restaurants, and hotels. The epidemic increased interest in nutritious and immunity-boosting foods. Perceived as a source of vital vitamins and antioxidants, frozen fruits profited from this movement. The rise of internet food shopping was spurred by the pandemic. This made frozen fruits more accessible, especially for customers who are hesitant to visit busy stores. Some customers were more open to frozen options due to worries about food safety and possible shortages of fresh produce, which might have changed their long-term buying patterns.

Latest Trends/ Developments:

The North American frozen fruits market is dynamic, with evolving consumer preferences and technological advancements driving exciting changes. Consumers increasingly scrutinize ingredient lists, demanding simpler, natural, and minimally processed products. This translates to a growing preference for frozen fruits with no added sugar, artificial preservatives, or colors. Consumers want to know the origin of their food. Technologies like blockchain are being explored to trace the journey of frozen fruits from farm to fork, building trust and satisfying the demand for transparency. The organic segment within frozen fruits continues to expand, driven by concerns around pesticides and a desire for unprocessed food. This trend aligns with the broader growth of the organic food industry. Exotic and nutrient-packed fruits like acai, dragon fruit, goji berries, and others have gained popularity in mixes and smoothies. These tap into the desire for functional food and global flavors. Responding to concerns about sugar intake, the industry is developing products with no added sugar and using natural sweeteners like fruit concentrates in frozen fruit blends. The rise of vegan, vegetarian, and flexitarian diets creates a significant demand for frozen fruits in plant-based desserts, snacks, and prepared meals. Post-pandemic, there's increased interest in foods that support immune health. Frozen fruits rich in vitamin C, antioxidants, and fiber are positioned favorably in this context. Frozen fruit bites, single-serve pouches with innovative blends, and pre-portioned smoothie kits cater to the on-the-go consumer and offer a convenient and healthy snack option.

Key Players:

- Dole Food Company

- J.M. Smucker Company

- Wyman's of Maine

- SunOpta

- Conagra Brands

- Bonduelle

- Pinnacle Foods

- Cascadian Farm Organic

- Grimmway Farms

Chapter 1. North America Frozen Fruits Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Frozen Fruits Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Frozen Fruits Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Frozen Fruits Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Frozen Fruits Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Frozen Fruits Market– By Fruit Type

6.1. Introduction/Key Findings

6.2. Berries

6.3. Tropical Fruits

6.4. Stone Fruits

6.5. Citrus Fruits

6.6. Other Fruits

6.7. Y-O-Y Growth trend Analysis By Fruit Type

6.8. Absolute $ Opportunity Analysis By Fruit Type , 2024-2030

Chapter 7. North America Frozen Fruits Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Hypermarkets and supermarkets

7.3. Convenience Stores

7.4. Online-based retail

7.5. Food service sector

7.6. Other

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. North America Frozen Fruits Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Fruit Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Frozen Fruits Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Dole Food Company

9.2. J.M. Smucker Company

9.3. Wyman's of Maine

9.4. SunOpta

9.5. Conagra Brands

9.6. Bonduelle

9.7. Pinnacle Foods

9.8. Cascadian Farm Organic

9.9. Grimmway Farms

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The busy lifestyles of many North Americans create a strong demand for convenient and time-saving food options. Frozen fruits offer ready-to-use ingredients for smoothies, snacks, and quick meal preparation.

Weather events, crop yields, and input costs (fertilizers, labor, etc.) can lead to fluctuating prices for fresh fruits – impacting frozen fruit production costs.

Dole Food Company, J.M. Smucker Company, Wyman's of Maine, SunOpta, Conagra Brands, Bonduelle, and Pinnacle Foods

The US currently holds the largest market share, estimated at around 75%.

Mexico exhibits the fastest growth, driven by its increasing population, and expanding economy