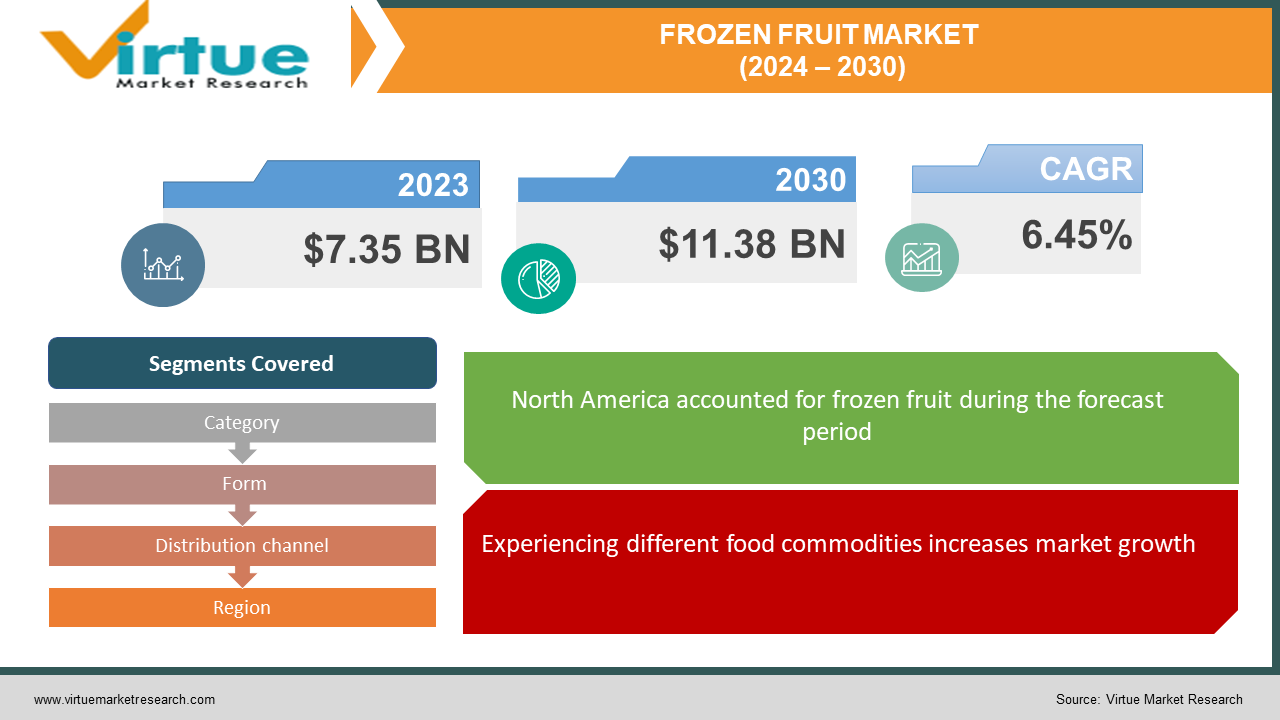

Frozen Fruit Market Size (2024 – 2030)

The Frozen Fruit Market was valued at USD 7.35 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 11.38 billion by 2030, growing at a CAGR of 6.45%.

Storing fruits and vegetables by freezing is a widely practiced preservation technique aimed at inhibiting microbial growth and extending their shelf life in the market. When fruits and vegetables are properly packaged and stored at a temperature of 0°F (-18°C), they remain safe for consumption. Consequently, frozen produce is commonly transported across borders and continents. Freezer technology enables the year-round storage of seasonal foods and meats, ensuring a continuous global supply despite regional availability limitations.

Key Market Insights:

Frozen fruits and vegetables represent food items harvested when they are at their optimum ripeness, subsequently processed, and frozen to maintain their freshness, taste, and nutritional integrity. This preservation technique entails rapidly freezing the produce at extremely low temperatures to thwart the proliferation of microorganisms and enzymes responsible for spoilage.

Frozen Fruit Market Drivers:

Experiencing different food commodities increases market growth.

The growing inclination of customers towards frozen goods, coupled with their desire for expanded knowledge and eagerness to explore various nutritional options, serves as the primary driving force behind the global frozen fruits and vegetables market. With certain fruits and vegetables being limited to specific seasons, freezing them enables access to off-season produce year-round.

Online export of frozen fruit is driving the market growth exponentially.

The market's surge in popularity among consumers, particularly young professionals, can be attributed to the convenience and time-saving benefits offered by the products. The introduction of new product varieties is expected to further enhance opportunities within the global market. In recent years, stable economic growth, particularly within the developing mining industry, has led to an increase in job opportunities, consequently boosting the average income of consumers. Additionally, the widespread adoption of e-commerce and online delivery services, driven by today's fast-paced lifestyle, has prompted eateries and restaurants worldwide to rely on frozen fruits and vegetables to fulfill the demand for exotic dishes. These factors collectively anticipate sustained growth in the global market during the forecast period.

Frozen Fruit Market Restraints and Challenges:

High Costs associated with the benefit of Freezing Equipment hinder market growth.

The considerable expenses linked to acquiring freezing equipment present a notable challenge to the expansion of the global frozen fruits and vegetables market. Additionally, the presence of diverse preservatives in frozen foods, which may have implications for human health, stands as another significant factor anticipated to hinder market growth.

Frozen Fruit Market Opportunities:

In response to the growing demand, a rising influx of frozen fruit manufacturers is entering the market, with newcomers venturing into new market territories. Consequently, the trade of frozen fruits within the industry is becoming progressively international across numerous countries. This expansion is leading to larger and more intricate supply chains, thereby heightening the necessity for fruits to maintain freshness over extended periods, consequently propelling sales of frozen fruits.

FROZEN FRUIT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.45% |

|

Segments Covered |

By Category, Form, Distribution channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kraft Foods (U.S.), Hormel Foods (Hungary), Associated British Foods plc (U.K.), Conagra Brands, Inc (U.S.), Astral Foods (India), The Kraft Heinz Company. (U.S.), Samworth Brothers (U.S.), Wm. Morrison Supermarkets (U.K.), Nestlé (U.S.), General Mills Inc (U.K.) |

Frozen Fruit Market Segmentation: By Category

-

Organic

-

Conventional

The conventional segment currently maintains the leading market share, while the organic segment commands the largest share, driven by the expanding consumer base seeking healthier and cleaner food alternatives. Increasing consumer preferences for more sustainably produced food are propelling the demand for organic frozen fruits. The perceived health benefits of organic frozen fruits, such as higher nutrient content and lower levels of chemical pesticides, make them a preferable choice for health-conscious individuals. Growing interest in organic farming practices, including pure organic farming and integrated organic farming, is further driving the production of organic fruits without the use of harmful fertilizers and pesticides.

Moreover, the dominant market share of conventional frozen fruits is attributed to their affordability and widespread availability in retail stores and supermarkets. This accessibility and cost-effectiveness make them an attractive option for budget-conscious consumers prioritizing their health. However, a notable characteristic of conventionally grown frozen fruits is the utilization of chemicals to enhance crop yield and protect against pests and insects, raising concerns among consumers regarding potential health risks associated with the use of harmful chemical pesticides.

Frozen Fruit Market Segmentation: By Form

-

Whole

-

Diced and Cubed

-

Others

Diced frozen fruits emerge as the top preference, commanding the largest market share and contributing significantly to the growth of the frozen fruit market. Their versatility has fueled their use in various applications, including smoothies, desserts, salads, and yogurt toppings. This adaptability makes diced frozen fruits highly sought-after, driving sales and overall market expansion. Their convenience, by eliminating the need for fruit cutting, appeals particularly to individuals leading busy lifestyles, making them a compelling choice.

Concurrently, the sliced frozen fruit segment secures the second-largest market share, renowned for its suitability in snacks and desserts. These sliced fruits offer consumers an easily consumable option with a delightful taste, streamlining the preparation process by saving time on cutting, cleaning, and preparation. This convenience aligns well with the needs of individuals seeking healthy and nutritious food options amidst hectic schedules.

However, the whole frozen fruit segment occupies a smaller market share as it is less favored. Whole frozen fruits find preference primarily in baking products due to their ability to maintain shape and texture post-freezing.

Frozen Fruit Market Segmentation: By Distribution channel

-

Store based

-

Non-store based

The Store-based segment currently holds the reins in the frozen fruit market, with brick-and-mortar establishments equipped with deep freezers and chest freezers meeting the demand for frozen fruits. These encompass supermarkets, supercenters, warehouse clubs, and convenience stores.

On the other hand, Non-store-based channels are projected to experience the most rapid expansion in terms of Compound Annual Growth Rate (CAGR). The online distribution of frozen fruits has spurred the development of a sophisticated supply chain management system, encompassing aspects such as hygiene, cold-chain management, and cross-contamination management. Advancements in transportation, coupled with reduced delivery times and enhanced product quality management, have played pivotal roles in propelling the growth of this segment.

Frozen Fruit Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America currently dominates the global market for frozen fruits and vegetables, boasting the largest market share and anticipated growth throughout the forecast period. This dominance is largely driven by the region's high levels of disposable income, coupled with fast-paced lifestyles, evolving dietary trends, and a strong preference for convenient, ready-to-eat options among consumers.

Meanwhile, the Asia Pacific region is poised to experience the swiftest growth in the global market for frozen fruits and vegetables during the forecast period. This growth can be attributed to shifting dietary preferences, a growing working-class population, significant influence from Western food habits, increasing disposable incomes, hectic lifestyles, and a flourishing modern retail landscape, among other contributing factors.

COVID-19 Pandemic: Impact Analysis

The global enforcement of lockdown measures in response to the escalating COVID-19 cases has significantly impacted various industries, leading to widespread disruptions in business operations worldwide. The frozen fruit industry has not been immune to these effects, experiencing a notable decline in demand due to industrial shutdowns prompted by the pandemic and subsequent lockdowns.

Furthermore, heightened concerns regarding safety and product quality have emerged among consumers during this period. The uncertainty surrounding the assurance of safety and brand quality, particularly in the context of frozen fruit products, has contributed to hindrances in market growth. As individuals prioritize safety and seek reassurance regarding product quality, these factors have further dampened demand for frozen fruits amidst the ongoing challenges posed by the pandemic and associated lockdowns.

Latest Trends/ Developments:

-

In June 2022, Delektia, a frozen food company headquartered in Dubai, UAE, entered into a partnership with Medical, a Jordan-based import and consultancy agency, to establish a presence in the Jordanian market.

-

In May 2022, Mira Jhala, a serial entrepreneur, unveiled her fourth startup, FroGo, an online platform specializing in frozen food products and distribution. The business is based in Gurugram, India.

Key Players:

The top players operating in the Frozen Fruit Market are -

-

Kraft Foods (U.S.)

-

Hormel Foods (Hungary)

-

Associated British Foods plc (U.K.)

-

Conagra Brands, Inc (U.S.)

-

Astral Foods (India)

-

The Kraft Heinz Company. (U.S.)

-

Samworth Brothers (U.S.)

-

Wm. Morrison Supermarkets (U.K.)

-

Nestlé (U.S.)

-

General Mills Inc (U.K.)

Chapter 1. Frozen Fruit Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Frozen Fruit Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Frozen Fruit Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Frozen Fruit Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Frozen Fruit Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Frozen Fruit Market – By Category

6.1 Introduction/Key Findings

6.2 Organic

6.3 Conventional

6.4 Y-O-Y Growth trend Analysis By Category

6.5 Absolute $ Opportunity Analysis By Category, 2024-2030

Chapter 7. Frozen Fruit Market – By Form

7.1 Introduction/Key Findings

7.2 Whole

7.3 Diced and Cubed

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Form

7.6 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 8. Frozen Fruit Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Store based

8.3 Non-store based

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Frozen Fruit Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Category

9.1.3 By Form

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Category

9.2.3 By Form

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Category

9.3.3 By Form

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Category

9.4.3 By Form

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Category

9.5.3 By Form

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Frozen Fruit Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Kraft Foods (U.S.)

10.2 Hormel Foods (Hungary)

10.3 Associated British Foods plc (U.K.)

10.4 Conagra Brands, Inc (U.S.)

10.5 Astral Foods (India)

10.6 The Kraft Heinz Company. (U.S.)

10.7 Samworth Brothers (U.S.)

10.8 Wm. Morrison Supermarkets (U.K.)

10.9 Nestlé (U.S.)

10.10 General Mills Inc (U.K.)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The widespread adoption of e-commerce and online delivery services, driven by today's fast-paced lifestyle, has prompted eateries and restaurants worldwide to rely on frozen fruits and vegetables to fulfill the demand for exotic dishes. These factors collectively anticipate sustained growth in the global market during the forecast period.

The top players operating in the Frozen Fruit Market are - Kraft Foods (U.S.), Hormel Foods (Hungary), Associated British Foods plc (U.K.), Conagra Brands, Inc (U.S.), Astral Foods (India), The Kraft Heinz Company. (U.S.), Samworth Brothers (U.S.), Wm. Morrison Supermarkets (U.K.), Nestlé (U.S.), General Mills Inc (U.K.).

The global enforcement of lockdown measures in response to the escalating COVID-19 cases has significantly impacted various industries, leading to widespread disruptions in business operations worldwide. The frozen fruit industry has not been immune to these effects, experiencing a notable decline in demand due to industrial shutdowns prompted by the pandemic and subsequent lockdowns.

The trade of frozen fruits within the industry is becoming progressively international across numerous countries. This expansion is leading to larger and more intricate supply chains, thereby heightening the necessity for fruits to maintain freshness over extended periods, consequently propelling sales of frozen fruits.

The Asia Pacific region is poised to experience the swiftest growth in the global market for frozen fruits and vegetables during the forecast period. This growth can be attributed to shifting dietary preferences, a growing working-class population, significant influence from Western food habits, increasing disposable incomes, hectic lifestyles, and a flourishing modern retail landscape, among other contributing factors.