European frozen fruit Market Size (2024-2030)

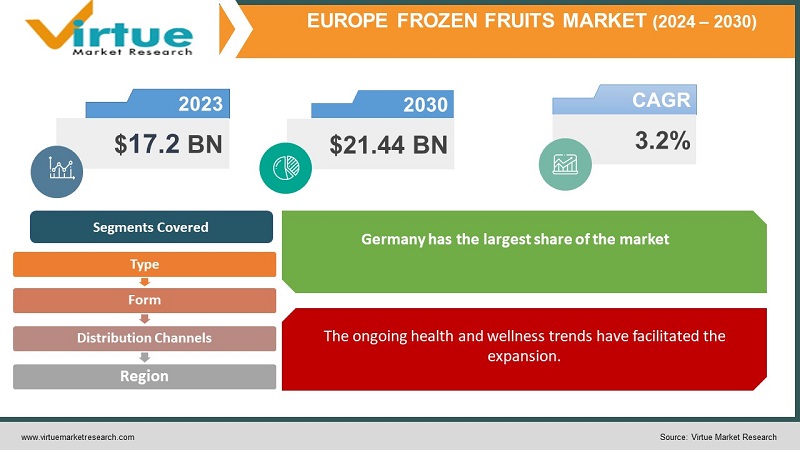

The European frozen fruit market was valued at USD 17.2 billion and is projected to reach a market size of USD 21.44 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.2%.

Fruits that have been flash-frozen at the height of ripeness to retain their nutrients are known as frozen fruits. Because the fruit's water expands as it freezes, shattering the cells and releasing natural sugars, it is frequently softer and sweeter than fresh fruit. Additionally, the flavor of frozen fruit may change somewhat from that of fresh fruit. The market for frozen fruits has had a considerable presence in Europe in the past. Consumer demand was the main factor behind this. Presently, with increasing product diversity and key players, this market has seen good growth. In the future, with a growing focus on global operations, sustainability, and e-commerce, this industry is anticipated to witness an elevation.

Key Market Insights:

About 35% of the frozen fruit business is accounted for by Europe.

In 2023, the processed and frozen fruit industry will generate US$64.54 billion in revenue in Europe. The market is anticipated to expand at 7.19% each year (CAGR 2023–2028).

The frozen berry market in Europe is anticipated to develop steadily at a rate of about 4% to 5% each year.

With 41% of all frozen berry imports coming from Germany, frozen strawberries are the most popular frozen fruit product.

About 13.6 million metric tons of plastic packaging trash were produced in Europe, most of it from single-use food product packaging, such as frozen fruit. To tackle this, organizations in the market have been prioritizing eco-friendly packaging techniques and recyclable materials that have minimal impact on the environment.

Europe Frozen Fruits Market Drivers:

The ongoing health and wellness trends have facilitated the expansion.

Over the last decade, the prevalence of various chronic illnesses has seen a rise. People have started to realize the importance of their physical and mental health. As such, many of them are constantly on the lookout for options that provide nutrition and immunity to the human body. Diet is an important factor that contributes to the health of an individual. People have started to balance their diets as per their needs. Gyms and other working-out places have gained prominence. Many trainers over here recommend frozen fruits as a popular choice. These fruits are used in various smoothies, smoothie bowls, and salads. Few of them consume these fruits as workout meals. This change in eating habits has increased the production process. The daily incorporation of this food product has been generating more income for this industry.

Busy lifestyles have been driving the demand.

There have been a lot of changes in the way people live. Dual income has become the new norm. With this, hectic schedules have become common. People are unable to find time for cooking. These fruits are a convenient option as they save a lot of time and are fulfilling. They can be consumed as whole fruits or in any other form. Furthermore, many options are available throughout the year. Apart from this, meetings for social and business purposes have increased. Therefore, a greater number of food outlets offer various dishes that have frozen fruits in them.

Frozen Fruits Market Restraints and Challenges:

Nutritional changes and storage conditions are the main issues that the market is currently experiencing.

Frozen fruits are subjected to freezing to achieve the required taste and quality. This process can remove the water content, resulting in moisture loss. Additionally, essential nutrients like vitamins, minerals, and other antioxidants are also dissolved. Besides, rancid flavor can be developed due to oxidation. This can affect the flavor. Secondly, they contain many preservatives to increase their shelf life. Few of the chemicals used can be carcinogenic, meaning they might increase the risk of cancer. They can also lead to high sugar and blood pressure levels. Thirdly, these fruits have high levels of trans fat, which elevates the threat of cardiovascular diseases. Moreover, they can contribute to unhealthy weight gain as they contain high amounts of carbohydrates and fat. Furthermore, appropriate temperature and other conditions are required for the processing of these fruits. Inadequate resources and improper procedures can damage the fruit.

Frozen Fruits Market Opportunities:

Veganism has been providing the market with many possibilities. This is the practice of incorporating plant-based diets. Frozen fruits can be included in vegan diets as they contain no dairy or animal products. During the pandemic, a heightened awareness about our environment and the cruelties faced by the animal industry was highlighted. Hence, the number of vegans increased, thereby profiting from this industry. Secondly, product innovations in the culinary industry have been aiding the boost. Chefs in this market have been working on the creation of unique flavors using exotic fruits. A larger audience by making investments in internet platforms is possible, and hence, companies in the market have been emphasizing the need for online channels to increase their sales worldwide.

EUROPE FROZEN FRUITS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.2% |

|

Segments Covered |

By Type, Form, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Ardo Group, Dole Food Company, Crop's NV, SunOpta Inc., Greenyard NV, Bonduelle SCA, Welch Foods Inc., Findus Group (Nomad Foods), Hain Celestial Group, Nestlé S.A. |

Europe Frozen Fruits Market Segmentation:

Europe Frozen Fruits Market Segmentation: By Type:

- Berries

- Strawberries

- Blueberries

- Raspberries

- Blackberries

- Others

- Citrus Fruits

- Oranges

- Lemons

- Limes

- Grapefruits

- Others

- Tropical Fruits

- Pineapples

- Mangoes

- Papayas

- Avocados

- Others

- Others

Based on the type of fruit, the tropical category is the largest, holding a share exceeding 40% in 2023. The main reason is because they are usually available in many seasons. This makes availability easier. Besides, since many fruits have been consumed for centuries, they have cultural and historical significance. This increases the demand drastically. Moreover, they are used by the food and beverage industry frequently in many of their dishes. Apart from this, their unique taste and nutritional profiles contribute to their success. However, the berry segment is the fastest-growing. Strawberries, blueberries, and raspberries are the major fruits that have been on the market as popular choices. Countries like Germany, Poland, and Italy are the leading areas globally in terms of exports and imports. These fruits help strengthen the economy of Europe. Besides, changing consumer preferences have been responsible for the acceleration. These berries are mainly used in smoothies and other beverages. Smoothie has gained a lot of attention due to its unique taste. The increasing availability of these fruits has been fueling the demand.

Europe Frozen Fruits Market Segmentation: By Form:

- Whole Fruits

- Slices and Dices

- Purees and Pastes

Based on form, the whole fruit category is the largest. This is mainly because of the convenience. Consumers choose this as a go-to option for direct consumption. The taste and flavor that these fruits impart make them an ideal choice. Secondly, this option is versatile. Hence, they can be converted into various forms, increasing the revenue for this segment. Moreover, they tend to have a longer shelf life, making preservation easier. Furthermore, the visual appeal of these fruits helps drive more customers to purchase them. Purees & pastes segments are the fastest-growing. The increasing focus on diets and a healthy lifestyle has been responsible for this. Many frozen fruits of this form are included in beverages which help with reducing illness, weight loss, glowing skin, etc. The trend of digitalization has been creating an increase in sales of various drinks, desserts, and sauces, where this segment is used extensively.

Europe Frozen Fruits Market Segmentation: By Distribution Channels:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

Based on distribution channels, supermarkets and hypermarkets are the largest. This is because it is readily available and easily accessible. In neighborhoods, there are more of these places, due to which customers can find it easier to obtain the necessary products. This enables direct communication between the customer and the business owner as well as a visual assessment of the merchandise to verify contents, expiration dates, and other crucial details. In addition, some who opt to purchase their goods in person do not have access to the Internet or are not familiar with its use. The distribution channel in this industry, which is expanding at the fastest rate, is online retail. This is primarily due to convenience. Food items are brought to the residences of the customers. Additionally, a wider range of flavors, both native and foreign, can be easily enjoyed by people. Online orders also come with free delivery and discounts, making them an ideal, cost-effective solution.

Europe Frozen Fruits Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Based on region, Germany has the largest share of the market, with a rough share of 21% in 2023. The main reason for this is consumer demand. With an increasing population, a greater number of customers have been showing an increased interest in leading a healthy lifestyle. To fit in with this trend, there are enormous supermarkets, convenience stores, and e-commerce channels in this region. As such, availability is easier. This market also has a huge share in import and export trade activities, contributing to more profits. This country adheres to stringent quality standards because of various rules and certifications. Therefore, a broader consumer base tends to purchase the fruits from this area. Furthermore, many important companies are involved in this industry. Certainly, here are the company names of the top players in the German frozen fruit market. Frosta AG, EDEKA ZENTRALE AG & Co. KG, Rewe Group, and Iglo GmbH are the prominent ones. They have a good virtual and global presence. The United Kingdom is the fastest-growing region, with an approximate share of 18%. Similar to Germany, there is a growing health-consciousness trend amongst the public, making them choose options that promote a healthy lifestyle. Tesco, Sainsbury's, Asda, and Morrisons are popular retail chains that stock a wide range of frozen fruits of local and international flavors. Accessibility is thus very easy. Besides, the culinary industry has been increasing the use of these items in various desserts, beverages, and food products. Apart from this, the strong presence of this company in export activities has been responsible for its success. This activity has been helping to strengthen the economy in this region and improve trade relations as well.

COVID-19 Impact Analysis on the European Frozen Fruits Market:

The pandemic had a mixed impact on the market. With the new normal being lockdowns, social isolation, and movement restrictions, there were a lot of supply chain disruptions in the supply chain, transportation, and logistics. Import-export trade activities were affected by this. An economic downfall was observed. There was a lack of labor to carry out end-to-end operations. On the other hand, the virus highlighted the importance of good physical health. People started to consume more fruits and vegetables. However, a significant percentage of people were relying on normal fruits due to their higher nutritional content. Online retail became a boon for growth. Individuals were able to order their required necessities without stepping out. This created an upsurge in the enlargement. According to Statista, in Spain, over half of the polled consumers stated they purchased online more frequently during this period. Post-pandemic, the market has been concentrating on innovations to increase revenue.

Latest Trends/ Developments:

The companies in this industry are motivated to increase their market share by utilizing a range of strategies, such as joint ventures, acquisitions, and investments. Businesses are also spending a lot of money to improve existing channels while maintaining competitive rates. This has resulted in an even larger expansion.

Organic fruits have gained prominence. They are cultivated without the aid of pesticides or chemicals. They are known to have higher nutritional value. Consumers have been spending money on organic options for a healthy lifestyle. As such, companies have been prioritizing the development of organic fruits to augment the market.

Key Players:

- Ardo Group

- Dole Food Company

- Crop's NV

- SunOpta Inc.

- Greenyard NV

- Bonduelle SCA

- Welch Foods Inc.

- Findus Group (Nomad Foods)

- Hain Celestial Group

- Nestlé S.A.

In October 2023, Huelva, Spain-based Surexport, which grows and distributes raspberries, blackberries, blueberries, and strawberries, acquired Flor de Doñana, AG Group in Morocco, and Solana Fruits in Portugal. The extremely deliberate add-on purchases would strengthen Surexport's dominant position in a highly fragmented market, increase its capacity for production in key regions, enhance its line of products, and promote year-round product availability to cater to the major European retailers.

In September 2022, to promote the NHS Healthy Start program on 4.6 million packets of the company's frozen fruit products, Iceland teamed up with Del Monte. Government vouchers worth £4.25 a week are given to low-income pregnant women and parents of children under four as part of the NHS Healthy Start program. According to data from the NHS Business Services Authority, if the NHS Healthy Start program were fully enrolled, around 130,000 families in need would get additional benefits worth tens of millions of pounds annually.

Chapter 1. Europe Frozen Fruits Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Frozen Fruits Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Frozen Fruits Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Frozen Fruits Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Frozen Fruits Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Frozen Fruits Market– By Type

6.1. Introduction/Key Findings

6.2. Berries

6.2.1. Strawberries

6.2.2. Blueberries

6.2.3. Raspberries

6.2.4. Blackberries

6.2.5. Others

6.3. Citrus Fruits

6.3.1. Oranges

6.3.2. Lemons

6.3.3 Limes

6.3.4. Grapefruits

6.3.5. Others

6.4. Tropical Fruits

6.4.1. Pineapples

6.4.2. Mangoes

6.4.3. Papayas

6.4.4. Avocados

6.4.5. Others

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Frozen Fruits Market– By Form

7.1. Introduction/Key Findings

7.2 Whole Fruits

7.3. Slices and Dices

7.4. Purees and Pastes

7.5. Y-O-Y Growth trend Analysis By Form

7.6. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 8. Europe Frozen Fruits Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and Hypermarkets

8.3. Specialty Stores

8.4. Convenience Stores

8.5. Online Retail

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 9. Europe Frozen Fruits Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By type

9.1.3. By form

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Frozen Fruits Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Ardo Group

10.2. Dole Food Company

10.3. Crop's NV

10.4. SunOpta Inc.

10.5. Greenyard NV

10.6. Bonduelle SCA

10.7. Welch Foods Inc.

10.8. Findus Group (Nomad Foods)

10.9. Hain Celestial Group

10.10. Nestlé S.A.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The European frozen fruit market was valued at USD 17.2 billion and is projected to reach a market size of USD 21.44 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.2%.

The ongoing health and wellness trends and busy lifestyles are the main factors propelling the European Frozen Fruits Market

Based on Distribution Channels, the Europe Frozen Fruits Market is segmented into Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, and Online Retail

Germany is the most dominant region for the European Frozen Fruits Market.

Ardo Group, Dole Food Company, and Crop's NV are the key players operating in the European Frozen Fruits Market.