North America frozen dessert Market Size (2024-2030)

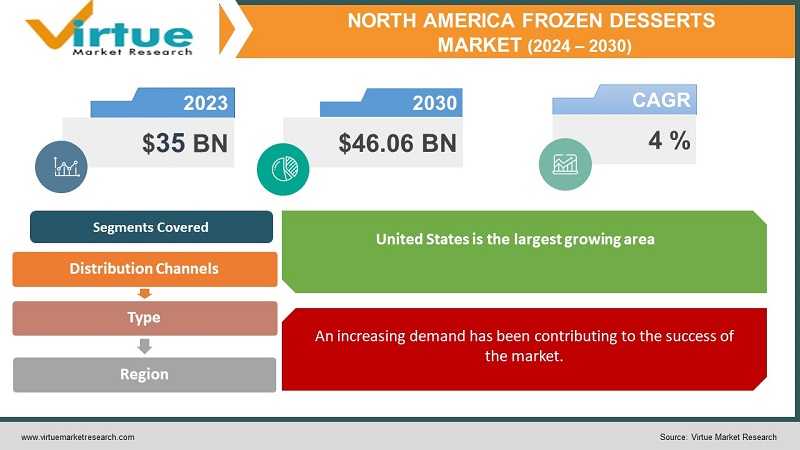

The North American frozen dessert market was valued at USD 35 billion and is projected to reach a market size of USD 46.06 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4%.  Desserts that are created by freezing liquids, semi-solids, and occasionally even solids are known as frozen desserts. Flavored water, fruit puree, milk and cream, custard, or mousse can serve as their foundation. This market has had a considerable presence in the past, owing to consumer demand and the availability of channels. Presently, with online retail and economic growth, this market has undergone a good expansion. In the future, with a growing focus on customization and culinary innovation, this market is set to see an upsurge. During the forecast period, a notable boost is anticipated.

Desserts that are created by freezing liquids, semi-solids, and occasionally even solids are known as frozen desserts. Flavored water, fruit puree, milk and cream, custard, or mousse can serve as their foundation. This market has had a considerable presence in the past, owing to consumer demand and the availability of channels. Presently, with online retail and economic growth, this market has undergone a good expansion. In the future, with a growing focus on customization and culinary innovation, this market is set to see an upsurge. During the forecast period, a notable boost is anticipated.

Key Market Insights:

With sales of 299 million US dollars during the 12 weeks that concluded on August 13, 2023, Nestlé ranked second among frozen novelty brands, behind private label products.

With $911 million in sales, Ben & Jerry's was the top ice cream brand in the US in 2022.

There were around 45.6 million gallons of frozen yoghurt produced in the United States in 2022.

34 micro-ice cream and frozen dessert production facilities with one to four staff each were operating in Canada as of December 2022.

The United States is predicted to have a 14.9% diabetes prevalence by 2025. To tackle this, organizations in the industry have been focusing on healthier alternatives and the reduction of calories in desserts.

North American Frozen Desserts Market Drivers:

An increasing demand has been contributing to the success of the market.

There have been many changes in the standard of living over the years. These lifestyle changes are mainly because of a stable economy. People can afford to buy these products regularly. With a greater number of restaurants, food chains, and other options, people can choose from a lot of choices. Furthermore, maintaining a social lifestyle has become essential. As such, people have started to go out frequently. Besides, dual income is becoming more prevalent. Due to this, many individuals are unable to cook because of their busy schedules. Additionally, many people may not know how to cook. Convenient and go-to options have garnered attention. Frozen desserts are a popular take-out preference. This need has resulted in creating more profits for the market.

Culinary exploration is helping with the expansion of the global frozen desserts market.

The food and beverage industry has been experimenting with many flavors, formulations, and other ingredients to create unique products. Companies in this market have been actively involved in many launches, collaborations, and investments. Innovations regarding healthier alternatives and vegan options have been in trend. Therefore, organizations have been working on these goals to increase their sales. There have been many outlets that are dedicated to a particular flavor, type, or country-specific dessert. Besides, a greater percentage of the population has been showing an interest in trying out different varieties, which is facilitating the development.

North American Frozen Desserts Market Restraints and Challenges:

Health concerns, competition, and seasonal demand are the main issues that the market is currently experiencing.

One of the biggest barriers to the market is increasing health consciousness. Frozen desserts contain a high number of calories, sugar, and unhealthy fats. This increases the incidence of chronic illnesses like diabetes, heart disease, high blood pressure, etc. Additionally, the huge amount of oil added as well as the presence of milk powder elevate the prevalence of bad cholesterol. Moreover, they contain a lot of artificial additives and other ingredients that pose cancer risks. Few formulations might contain allergens, which can cause repercussions and harmful reactions in the human body. Secondly, there has been a growing popularity of veganism. This involved the incorporation of plant-based diets. These desserts are rich in dairy products like milk, cheese, and eggs. Therefore, they are subjected to intense competition from other competitors who launch vegan-free products. However, adhering to the manufacturing of plant-based food products might be difficult for smaller and emerging firms since all the ingredients used are very expensive. Furthermore, they are usually preferred in the summer season. This is because the consumption of frozen items during the winter can lead to colds, coughs, and other illnesses. As such, sales can fluctuate, causing losses for the company.

North American Frozen Desserts Market Opportunities:

The personalization of food products has been providing the market with infinite possibilities. This involves formulating the items as per the needs of an individual. Secondly, vegan options are being emphasized. Dairy-free options and other alternatives like soy, almond, and oats have been gaining prominence. Additionally, low-calorie desserts are being prioritized owing to rising health awareness. Furthermore, concentration on e-commerce has been profiting the market. Through this channel, a global customer base is achieved.

NORTH AMERICA FROZEN DESSERTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United States, Canada, Mexico |

|

Key Companies Profiled |

Nestlé, Unilever, The Hershey Company, General Mills (Häagen-Dazs), Blue Bell Creameries, Wells Enterprises (Blue Bunny), Mars, Incorporated, Halo Top (Wells Enterprises), Turkey Hill Dairy, Dreyer's Grand Ice Cream Holdings, Inc. |

North American Frozen Desserts Market Segmentation:

North American Frozen Desserts Market Segmentation: By Type:

- Frozen Yogurt

- Ice Cream

- Frozen Cakes

- Others

Based on type, the ice cream segment is the most dominant, with a rough share of 60% in 2023. The primary reason for this is the variety of flavors available. Additionally, they are a popular choice for individuals with sweet teeth because of their taste. Besides, they are easily available through a lot of channels and are affordable. Furthermore, experimentation with different varieties has been accelerating the growth rate. Frozen yogurts are the fastest-growing category. These food products have been in demand in this country because of their cultural significance for many decades. Moreover, they are associated with a lot of health benefits. They contain probiotics, vitamins, and minerals, which are essential for functioning. As such, being a health-conscious option, they have been in demand. Furthermore, they are an ideal choice for lactose-intolerant people, as few varieties have any milk products in them.

North American Frozen Desserts Market Segmentation: By Distribution Channels:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

In 2023, supermarkets and hypermarkets are the largest category of distribution channels, with a total share exceeding 50%. This is because of its historic significance. Customers may easily access the food products required because a greater number of these shops are present in each locality. This allows visual inspection of the items to confirm their contents, expiration dates, and other crucial facts, as well as direct communication between the consumer and the store. Furthermore, a lot of people who are not familiar with the internet choose to buy their items in person. In this market, online retail is the distribution channel that is growing at the fastest rate. The main reason for this is convenience. Food products are delivered to the clients' homes. Apart from this, they also have greater access to a greater variety of flavors, both domestic and foreign. Additional perks offered to clients by online apps include discounts, free delivery, subscription boxes, and membership advantages. This helps in the reduction of costs significantly. Moreover, the category has grown as a result of the growing trend of digitization.

North American Frozen Desserts Market Segmentation: Regional Analysis:

- United States

- Canada

- Mexico

In this market, the United States is the largest growing area. This country has about a 42% share currently in 2023. The population's preference for a diverse array of food items is the main cause of this. Consequently, there are more bakeries, fast-food restaurants, hotels, and other establishments. Secondly, the economy of this area is steady. This promotes greater funding for the food and beverage sector, which in turn encourages new product releases and joint ventures to expand the market. Furthermore, this region has major companies involved in the market that operate globally. Prominent companies include Nestle, Unilever, Blue Bell Creameries, General Mills, and many more. This increases trade activities significantly, thereby contributing to greater revenue. The region with the fastest growth is Canada. This region makes up around 33% of the total. This is mainly because of the distribution channels, especially e-commerce. Sales rise as a result of this. Moreover, the mass production of desserts has facilitated the growth. This increases the quantity of goods that are brought to market. Aside from this, the rise is being aided by the increasing population looking out for different options, which has been augmenting the demand.

COVID-19 Impact Analysis on the North American Frozen Desserts Market:

The outbreak of the virus hurt the market. Lockdowns, social isolation, and movement restrictions were the new normal. This led to a temporary shutdown of food outlets. Besides, there were a lot of disruptions in the supply chain, transportation, and other logistics. This affected the import-export trade. An economic downfall was observed. Additionally, the pandemic highlighted the importance of having good physical health. People started relying on home-cooked meals. Many people lost their jobs due to uncertainty and financial restraints. This led to a decrease in sales. Moreover, with most of the funding being shifted towards healthcare applications, all launches, investments, and collaborations were delayed or postponed. Furthermore, a smaller section of the population started trying new hobbies, which included baking and cooking. Home-made products could have moderate ingredients, avoiding the risk of diseases and illness from junk and bakery products. According to a report by The Print, ice cream sales were reduced by 50% during the pandemic. However, post-pandemic, the market picked up gradually. Online retail became a boon. Upliftment of rules and relaxation of regulations helped with commercialization.

Latest Trends/ Developments:

The organizations operating in this market are driven to attain a greater market share through the use of various tactics, including collaborations, acquisitions, and investments. Additionally, businesses are investing a lot of money to enhance current formulations while keeping prices competitive. This has led to an even greater enlargement.

Prioritization is being given to initiatives that advance sustainability. Manufacturing facilities are searching for recyclable and environmentally acceptable packaging materials instead of using conventional materials as environmental concerns grow. This step has made it easier to gain a larger consumer base.

Key Players:

- Nestlé

- Unilever

- The Hershey Company

- General Mills (Häagen-Dazs)

- Blue Bell Creameries

- Wells Enterprises (Blue Bunny)

- Mars, Incorporated

- Halo Top (Wells Enterprises)

- Turkey Hill Dairy

- Dreyer's Grand Ice Cream Holdings, Inc.

In May 2023, in Canada, the Nestlé-owned brand Häagen-Dazs introduced a new range of vegan ice cream. Three flavors are available in the new line of oat-based frozen desserts: caramel fudge chip, vanilla raspberry truffle, and chocolate peanut butter. One of the fastest-growing subsets of plant-based milk is oat milk. It's the ideal milk for many situations because it's exceptionally creamy, free of animal cruelty, and suitable for people with allergies.

In January 2022, the largest ice cream manufacturer in the world, Unilever, introduced its new 2022 portfolio options across four of its frozen novelty and packaged ice cream brands: Talenti® Gelato & Sorbetto, Breyers®, Magnum ice cream®, and Klondike®. These innovative creations, which went on sale in major stores across the country in January and February 2022, include a reimagined take on traditional American flavors, surprising flavor combinations that come together perfectly, and the extension of fan-favorite lines, healthier options, and non-dairy options.

In March 2022, So Delicious Dairy Free unveiled a new range of frozen treats that are available in pint and cone sizes and are created using Wondermilk from the firm. There are five varieties of So Delicious Wondermilk Frozen Dessert Pints: Vanilla, Chocolate Cocoa Chip, Buttery Pecan, Cookies & Crème, and Strawberry. The non-GMO organization has approved the frozen desserts' vegan certification. The process of making So Delicious Wondermilk involves combining soy, coconuts, and oats.

Chapter 1. North America Frozen Desserts Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Frozen Desserts Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Frozen Desserts Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Frozen Desserts Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Frozen Desserts Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Frozen Desserts Market– By Type

6.1. Introduction/Key Findings

6.2. Frozen Yogurt

6.3. Ice Cream

6.4. Frozen Cakes

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. North America Frozen Desserts Market– By Distribution Channels

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Specialty Stores

7.4. Convenience Stores

7.5. Online Retail

7.6. Y-O-Y Growth trend Analysis By Distribution Channels

7.7. Absolute $ Opportunity Analysis By Distribution Channels , 2024-2030

Chapter 8. North America Frozen Desserts Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channels

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Frozen Desserts Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Nestlé

9.2. Unilever

9.3. The Hershey Company

9.4. General Mills (Häagen-Dazs)

9.5. Blue Bell Creameries

9.6. Wells Enterprises (Blue Bunny)

9.7. Mars, Incorporated

9.8. Halo Top (Wells Enterprises)

9.9. Turkey Hill Dairy

9.10. Dreyer's Grand Ice Cream Holdings, Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The North American frozen dessert market was valued at USD 35 billion and is projected to reach a market size of USD 46.06 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4%.

Increasing demand and culinary exploration are the main factors propelling the North American Frozen Desserts Market.

Based on Distribution Channels, the North American Frozen Desserts Market is segmented into Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, and Online Retail.

The United States is the most dominant region for the North American Frozen Desserts Market.

Nestlé, Unilever, and The Hershey Company are the key players operating in the North American Frozen Desserts Market.