Frozen Desserts Market Size (2024-2030)

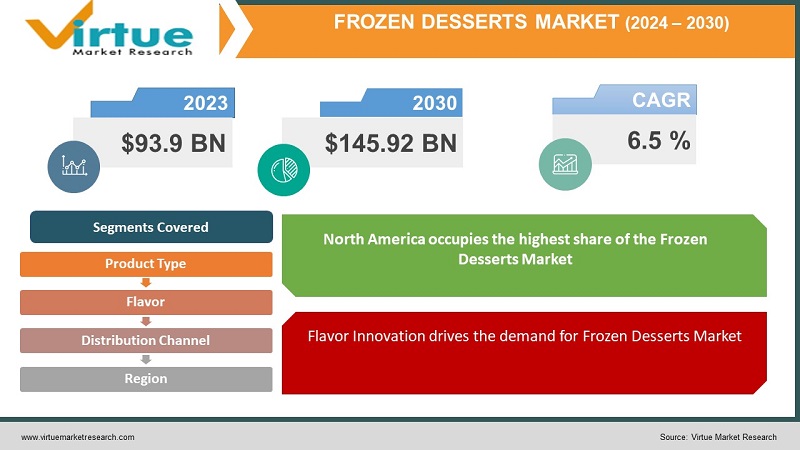

The Global Frozen Desserts Market was valued at USD 93.9 billion and is projected to reach a market size of USD 145.92 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.5 %.

Frozen desserts encompass a wide range of frozen or chilled sweet treats, typically consumed as desserts or snacks. These include various frozen confections, ice creams, frozen yogurts, sorbets, gelato, and other frozen novelties. There is a diverse array of flavors, formulations, and product types, catering to the varied preferences of consumers. The Frozen Desserts Market is expected to grow significantly in the coming years due to flavor innovation, and health and wellness trends. The major well-established key players in the Frozen Desserts Market are Nestlé, Unilever, General Mills, Mars, and Mondelēz International.

Key Market Insights:

Flavor innovation, health and wellness trends, rising disposable income, globalization, and convenience are propelling the Frozen Desserts Market. The market includes a broad selection of frozen dessert products, ranging from traditional ice creams with classic flavors to innovative and specialty items, such as gelato, frozen yogurt, and artisanal creations. The restraints to the Frozen Desserts Market include health concerns, and competition from healthier alternatives. Ongoing innovations have led to the development of more new flavor frozen dessert formulations. North America occupies the highest share of the Frozen Desserts Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Frozen Desserts Market Drivers:

Flavor Innovation drives the demand for Frozen Desserts Market

Flavor innovation in the frozen desserts market influences consumer preferences and attracts a diverse customer base. This innovation extends beyond traditional vanilla and chocolate, offering consumers an array of options. This caters to various tastes and preferences. Companies introduce exotic flavor blends that incorporate ingredients from different cultures or regions. This provides a unique taste experience and also taps into the globalized nature of food preferences. This allows consumers to explore new and exciting flavors. Seasonal offerings, such as limited-time flavors for specific holidays or occasions, create a sense of urgency and anticipation among consumers. This adds a festive touch to frozen desserts. From traditional desserts around the world, manufacturers create frozen treats that reflect the richness of global culinary traditions. This diversifies product offerings and also appeals to consumers seeking authentic and culturally inspired experiences.

Health and Wellness Trends are propelling the Frozen Desserts Market

The health and wellness trend has a significant impact on the frozen desserts market. Consumers are increasingly mindful of their sugar and calorie intake. Consumers seek indulgence without compromising on their dietary goals.Frozen desserts with reduced sugar content and lower calorie counts cater to health-conscious individuals. The rise in plant-based diets and lactose intolerance concerns led to the popularity of non-dairy frozen desserts. Products made with alternative milk sources such as almond, coconut, or soy provide a dairy-free option for such consumers with specific dietary requirements. Incorporating ingredients like probiotics, vitamins, and superfoods enhances the nutritional profile of frozen desserts. Products that offer health benefits beyond traditional indulgence appeal to more consumers.

Frozen Desserts Market Restraints and Challenges

The major challenge faced by the Frozen Desserts Market is health concerns. There is an increased awareness of health issues, including concerns about obesity and related diseases. This leads some consumers to reduce their consumption of high-calorie and sugar-laden frozen desserts. The rising prevalence of lactose intolerance and an increasing number of consumers adopting specific dietary lifestyles, such as veganism, can limit the market for traditional dairy-based frozen desserts.

Frozen Desserts Market Opportunities:

The Frozen Desserts Market has various opportunities in the market. There is a rising trend towards premium and artisanal frozen desserts with unique flavors, high-quality ingredients, and gourmet options. Eco-friendly packaging, responsibly sourced ingredients, and sustainable production methods appeal to environmentally conscious consumers. Other Opportunities in the Frozen Desserts market include Health-conscious innovation, premiumization, global expansion, e-commerce growth, flavor innovation, functional ingredients, customization trends, diversification, and collaborations.

FROZEN DESSERTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product Type, Flavor, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Unilever, General Mills, Mars, Incorporated, Mondelēz International, Inc., Blue Bell Creameries, The Häagen-Dazs Company, Conagra Brands, Wells Enterprises, Inc., Froneri (joint venture between Nestlé and R&R Ice Cream), Turkey Hill Dairy |

Frozen Desserts Market Segmentation

Frozen Desserts Market Segmentation: By Product Type:

- Ice Cream

- Frozen Yogurt

- Sorbet

- Gelato

- Frozen Custard

- Frozen Novelties

In 2023, based on market segmentation by Product Type, Ice cream occupies the highest share of the Frozen Desserts Market. This is due to its popularity. The growth can be attributed to its wide variety of flavors, versatility, and widespread consumer appeal across different demographics. Ice cream traditionally has been one of the most popular and widely consumed frozen desserts globally.

However, Frozen yogurt is also the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 15%. This is due to its perception of being a healthier alternative to traditional ice cream. Frozen yogurt caters to health-conscious consumers, offering lower fat content and often featuring probiotics. The customizable nature of frozen yogurt, allows consumers to add their choice of toppings. These features contributed to its popularity and rapid growth.

Frozen Desserts Market Segmentation: By Flavor:

- Vanilla

- Chocolate

- Fruit Flavors (strawberry, mango, etc.)

- Nut Flavors

- Specialty Flavors (unique or seasonal flavors)

In 2023, based on market segmentation by Flavor, the Vanilla and Chocolate segment occupies the highest share of the Frozen Desserts Market. This is mainly due to its enduring popularity and widespread consumer appeal. Vanilla and chocolate remain classic and universally loved flavors.

However, the Fruit Flavors (e.g., Strawberry, Mango) are the fastest-growing segment during the forecast period. This is mainly due to the growing trend towards healthier and more natural choices. Fruit-flavored frozen desserts, especially popular and exotic fruits like strawberry and mango, have gained traction. Consumers seeking refreshing and fruity options contribute to the growth of Fruit Flavors segment.

Frozen Desserts Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail (e-commerce)

- Foodservice (restaurants, cafes, etc.)

In 2023, based on market segmentation by Distribution Channel, the Supermarkets and hypermarkets segment occupies the highest share of the Frozen Desserts Market. This is mainly due to its wide variety of frozen dessert products, catering to the convenience and preferences of a diverse consumer base.

Specialty stores, such as ice cream parlors or boutique shops, offer a unique and curated experience. They do not have the mass reach of supermarkets, but they often attract consumers seeking premium and artisanal frozen treats.

However, the Convenience stores are the fastest-growing segment during the forecast period. This is mainly due to the convenience factor and impulse purchases for the on-the-go frozen desserts, such as ice cream bars and novelties.

The online retail channel has seen significant growth, especially for specialty and premium frozen desserts, due to convenience, a wide range of choices, and the ability to reach consumers in various locations.

Food service establishments have significant growth, especially in the consumption of frozen desserts within dining-out experiences. Restaurants, cafes, and dessert-focused outlets offer a unique environment for consumers to enjoy frozen treats with a larger dining experience.

Frozen Desserts Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Frozen Desserts Market. This growth is due to the combination of consumer preferences, a diverse product range, and the presence of well-established brands. The North American market has a diverse consumer base with a penchant for various frozen desserts, including traditional favorites like ice cream. There is a growing interest in premium and health-conscious options. North America is a technologically advanced region with continuous innovation to meet evolving consumer demands. Premium and artisanal frozen desserts, as well as those catering to specific dietary preferences (such as non-dairy or low-sugar options), are prominent in this region. Sustainability, health-conscious choices, and unique flavor profiles are prevalent trends in this region. Consumers are increasingly looking for organic options and flavors that offer a balance between indulgence and nutritional value.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the rising disposable incomes, urbanization, and a shift in dietary habits influenced by Westernization. The adoption of frozen yogurt, gelato, and other non-traditional frozen desserts is on the rise. Health-conscious alternatives, novel flavor combinations, and the convenience of ready-to-eat frozen desserts are gaining popularity.

COVID-19 Impact Analysis on the Global Frozen Desserts Market:

The COVID-19 pandemic had a significant impact on the Frozen Desserts Market. The pandemic disrupted global supply chains due to lockdowns and restrictions. This affected the sourcing of raw materials and ingredients for frozen desserts. This led to potential shortages and increased production costs. With lockdowns and restrictions in place, many food service outlets such as restaurants, cafes, and ice cream parlors experienced closures or reduced operational capacity. This significantly impacted the sales of frozen desserts. The heightened awareness of health and wellness during the pandemic increased interest in healthier frozen dessert options, including those with reduced sugar, plant-based ingredients, and functional benefits. The pandemic accelerated the adoption of retail-packaged frozen desserts available in supermarkets and grocery stores.

Latest Trends/ Developments:

There is a growing consumer interest in plant-based diets. This led to an increase in non-dairy frozen desserts made from ingredients like almond, coconut, and soy. There is an introduction of innovative formats such as mochi ice cream, ice cream sandwiches with unconventional cookies, and other creative frozen novelties. There is an increased emphasis on sustainable practices, including eco-friendly packaging, responsibly sourced ingredients, and efforts to reduce the environmental impact of production. The rise of local and artisanal frozen dessert brands focuses on regional flavors, small-batch production, and a connection to the local community.

Key Players:

- Unilever

- General Mills

- Mars, Incorporated

- Mondelēz International, Inc.

- Blue Bell Creameries

- The Häagen-Dazs Company

- Conagra Brands

- Wells Enterprises, Inc.

- Froneri (joint venture between Nestlé and R&R Ice Cream)

- Turkey Hill Dairy

Market news:

- In July 2022, Mochidoki, a premium ice cream shop in New York, introduced an innovative Jasmine Boba flavor. Inspired by the refreshing qualities of Taiwanese bubble tea, the milky and floral ice cream features a chewy boba mochi exterior, offering a unique and culturally inspired frozen treat.

- In October 2022, Hindustan Unilever's Kwality Walls brand introduced Gulab Jamun flavored ice cream in India, incorporating the taste of mithai along with fruits and nuts for the festive season.

- In January 2022, Mondelēz International, Inc. unveiled Oreo Frozen Desserts, including bars, cones, sandwiches, and trays. The bars and cones feature Oreo pieces with a coating made from crushed Oreo wafer pieces, while the sandwiches consist of two large Oreo wafers.

- In January 2022, Unilever USA launched 19 new frozen treats across Breyers, Klondike, Magnum ice cream, and Talenti Gelato & Sorbetto brands.

Chapter 1. GLOBAL FROZEN DESSERTS MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL FROZEN DESSERTS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL FROZEN DESSERTS MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL FROZEN DESSERTS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL FROZEN DESSERTS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL FROZEN DESSERTS MARKET– BY PRODUCT TYPE

6.1. Introduction/Key Findings

6.2. Ice Cream

6.3. Frozen Yogurt

6.4. Sorbet

6.5. Gelato

6.6. Frozen Custard

6.7. Frozen Novelties

6.8. Y-O-Y Growth trend Analysis By Product Type

6.9. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. GLOBAL FROZEN DESSERTS MARKET– BY FLAVOR

7.1. Introduction/Key Findings

7.2. Vanilla

7.3. Chocolate

7.4. Fruit Flavors (strawberry, mango, etc.)

7.5. Nut Flavors

7.6. Specialty Flavors (unique or seasonal flavors)

7.7. Y-O-Y Growth trend Analysis By FLAVOR

7.8. Absolute $ Opportunity Analysis By FLAVOR , 2024-2030

Chapter 8. GLOBAL FROZEN DESSERTS MARKET– BY Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and Hypermarkets

8.3. Convenience Stores

8.4. Specialty Stores

8.5. Online Retail (e-commerce)

8.6. Foodservice (restaurants, cafes, etc.)

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.8. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. GLOBAL FROZEN DESSERTS MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By FLAVOR

9.1.3. By Product Type

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By FLAVOR

9.2.3. By Distribution Channel

9.2.4. By Product Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By FLAVOR

9.3.3. By Product Type

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By FLAVOR

9.4.3. By Product Type

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By FLAVOR

9.5.3. By Product Type

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL FROZEN DESSERTS MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Unilever

10.2. General Mills

10.3. Mars, Incorporated

10.4. Mondelēz International, Inc.

10.5. Blue Bell Creameries

10.6. The Häagen-Dazs Company

10.7. Conagra Brands

10.8. Wells Enterprises, Inc.

10.9. Froneri (joint venture between Nestlé and R&R Ice Cream)

10.10. Turkey Hill Dairy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Frozen Desserts Market was valued at USD 93.9 billion and is projected to reach a market size of USD 145.92 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.5 %.

Flavor innovation and health and wellness trends are the market drivers of the Global Frozen Desserts Market.

Ice Cream, Frozen Yogurt, Sorbet, Gelato, Frozen Custard, Frozen Novelties (ice cream bars, popsicles, etc. are the segments under the Global Frozen Desserts Market by Product Type.

North America is the most dominant region for the Global Frozen Desserts Market.

Nestlé, Unilever, General Mills, Mars, and Mondelēz International are the key players in the Global Frozen Desserts Market.