Middle East & Africa Frozen Desserts Market Size (2024-2030)

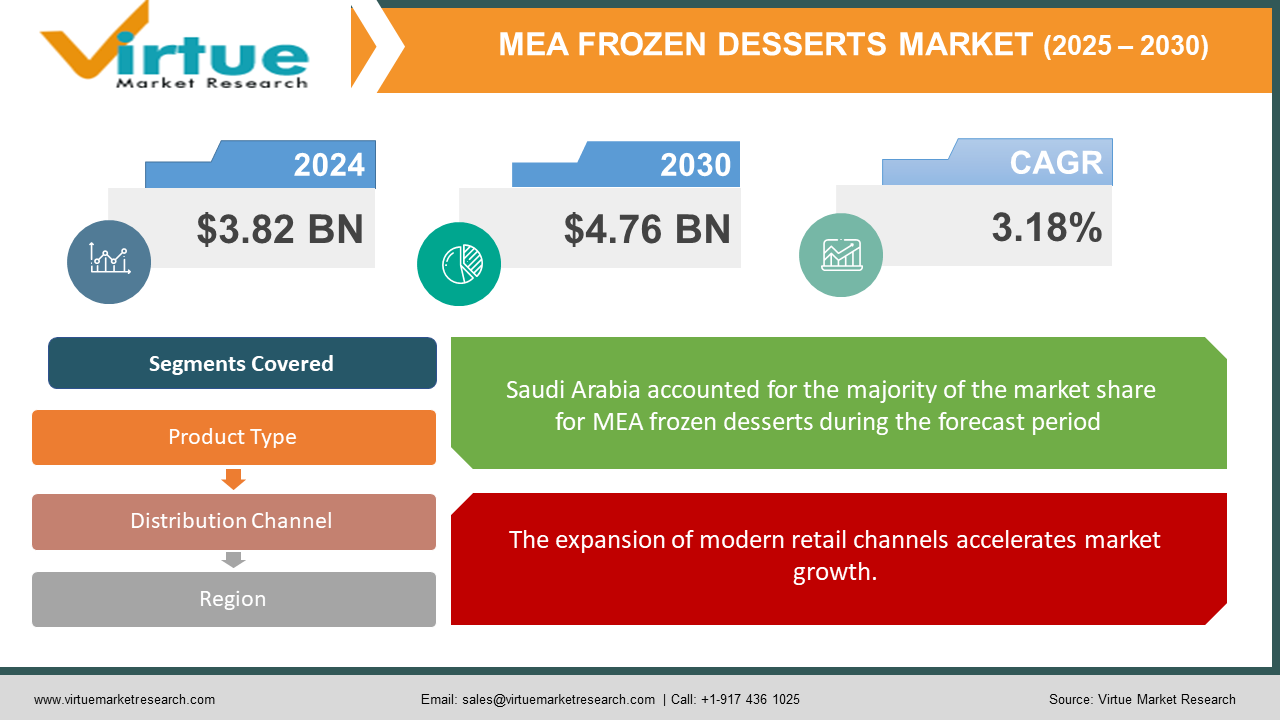

Middle East & Africa frozen desserts market was valued at USD 3.82 billion in 2023 and is projected to reach a market size of USD 4.76 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.18%.

Frozen Desserts feature a variety of healthy treats that tantalize taste buds and provide comfort on a hot day. From classics like crème fraiche and fruit sorbet to new creations like gelato and frozen yogurt, ice cream has something to suit everyone's taste. Rich and velvety ice cream is a casual treat and comes in a variety of flavors, from vanilla and chocolate to exotic flavors like salted caramel and matcha green tea. The sherbet also has a lighter option with fresh fruit sweetness, perfect for those looking for richness and cleansing the palate. Originally found in Italy, gelato has a rich consistency and flavor, making it a luxurious treat for discerning dessert lovers. For the health-conscious, frozen yogurt offers a guilt-free alternative that often comes with tons of toppings, from fresh berries to crunchy granola. Whether served in a mug or baked on a cookie sheet, frozen dessert provides interesting flavors and textures that enchant the senses.

Key Market Insights:

- Manufacturers are experimenting with local flavors and ingredients to appeal to a varied range of customer tastes, and this is one of the key factors driving the growth of the MEA frozen dessert market: cultural preferences and flavor innovation. For customers in the MEA area, the growth of contemporary retail channels like supermarkets and convenience stores has greatly improved market accessibility and cost.

- The MEA frozen desserts industry faces challenges from seasonal demand and climate sensitivity as consumption peaks in the summer and falls in the winter. The logistical difficulties associated with preserving the integrity and quality of frozen sweets during storage and delivery further impede market expansion.

Middle East & Africa Frozen Desserts Market Drivers:

The Role of Local Flavors in Shaping Frozen Dessert Trends in MEA Region: A Key Driver of Market Growth.

The MEA region has a rich cuisine and diverse cultural influences. This trend also extends to frozen desserts, where flavors and ingredients play an important role in shaping consumer preferences. The frozen dessert is enriched with local flavors such as saffron, rose water, pistachios, and dates, appealing to the unique taste of regional consumers. In addition, there is a growing trend of innovation, with manufacturers experimenting with different products and ingredients to create products that appeal to different consumer segments.

The expansion of modern retail channels accelerates market growth.

The expansion of modern retail outlets such as supermarkets, hypermarkets, and convenience stores has played an important role in supporting the growth of the MEA frozen desserts market. This retail model increases accessibility and affordability by offering consumers a variety of frozen dessert options, convenient packaging, and promotional offers. Additionally, the rise of international food chains and QSRs has increased the popularity and availability of frozen desserts in the region, increasing access to business and consumption.

Middle East & Africa Frozen Desserts Market Restraints and Challenges:

Seasonal demand and climate sensitivity prove to be challenges in driving the market forward.

The MEA region experiences hot summers and mild winters. This climate change has had an impact on the demand for frozen desserts because consumption peaks in the hot summer months and decreases in the cold season. As a result, manufacturers and retailers face difficulties managing seasonal changes, resulting in overstock and lost revenue. Additionally, maintaining the quality and integrity of frozen desserts during transportation and storage poses logistical challenges, especially in regions where infrastructure and temperature control facilities are inadequate.

Preference for fresh and homemade alternatives hinders market growth.

Despite the convenience and variety of frozen desserts, many consumers in the Middle East and Africa prefer fresh and homemade frozen desserts. Traditional desserts made from fresh fruits, nuts, and dairy products have cultural significance and are considered healthier and more nutritious than frozen counterparts. This preference poses a challenge for manufacturers in capturing market share and fostering consumer acceptance of frozen desserts, particularly among older generations who value tradition and authenticity.

Middle East & Africa Frozen Desserts Market Opportunities:

The Middle East and Africa (MEA) frozen dessert market has many opportunities for growth and innovation. First, the large population of the region, combined with increasing disposable income, has created a favorable environment for frozen dessert consumption. Additionally, the development of healthy food has encouraged the production of low-fat, sugar-free, and vegan frozen desserts to meet the needs of consumers. In addition, the region's diverse culinary tradition offers many innovations and integration of unique ingredients to please a wide range of consumers in many countries. Furthermore, the proliferation of modern stores such as supermarkets, hypermarkets, and online stores has increased the accessibility and visibility of frozen desserts, which were previously unprofitable businesses. Overall, MEA's frozen food market is growing, providing manufacturers with the opportunity to diversify their products, expand their businesses, and use capital to transform customer preferences to drive growth and profitability.

MIDDLE EAST & AFRICA FROZEN DESSERTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

3.18% |

||

|

Segments Covered |

By Product Type, Distribution Channel and Region |

||

|

Various Analyses Covered |

obal, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Almarai Company, Baskin-Robbins (Inspire Brands), General Mills, Unilever, Siwar Foods, Conagra Brands, Turkey Hill Dairy (Peak Rock Capital LLC), Mochidoki, 16 Handles, Mars, Incorporated |

Middle East & Africa Frozen Desserts Market Segmentation:

Middle East & Africa Frozen Desserts Market Segmentation by Product Type

- Ice Cream

- Frozen Yogurt

- Sorbets

- Gelato

- Frozen Novelties

- Others

The ice cream segment accounts for the largest share of this market. Ice cream has a long-standing appeal to consumers of all ages and is offered in a variety of flavors and types, from traditional varieties to premium and artisanal ice creams. Its creamy texture and pleasant taste make it a favorite dessert choice of many consumers, especially in hot weather. In addition, its versatility is also one of the reasons for its dominance in the MEA market, as ice cream can be consumed, combined with other desserts, or added to milkshakes, sundaes, and floats. Frozen yogurt is the fastest-growing category due to the health benefits this product provides. The majority of frozen yogurt is made with live probiotic cultures, which have been shown to strengthen the immune system, decrease blood pressure, and promote gastrointestinal health. Potassium, which helps lower the risk of heart disease and stroke, is abundant in frozen yogurt. Compared to equivalent portions of ice cream and gelato, frozen yogurt has higher levels of phosphorus, which can strengthen bones and help remove waste from the kidneys.

Middle East & Africa Frozen Desserts Market Segmentation by Distribution Channels

- Supermarkets & Hypermarkets

- Online Retail

- Convenience Stores

- Others

Supermarkets and hypermarkets are the largest growing delivery channels. These businesses make buying easier for customers by providing a wide range of choices. Customers may assess the products visually to ascertain their quality, quantity, expiration dates, and other details. They may get the answers to their inquiries from the merchant. This strategy allows for haggling by customers as well. People who are uncomfortable using the Internet often use this path. In addition, these waterways are accessible in nearly every neighborhood, which facilitates accessibility. Online retail is the fastest-growing channel. Because of its wide range of products, e-commerce is becoming more and more popular. Both domestic and foreign solutions are accessible to them. Second, this is a practical solution due to its ease. Online shoppers may place orders for goods and have them delivered straight to their front door. Furthermore, this channel's expansion has been accelerated by the COVID-19 pandemic. Customers also receive several frequent discounts and incentives.

Middle East & Africa Frozen Desserts Market Segmentation: Regional Analysis

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The United Arab Emirates (UAE) is the largest market for frozen desserts in the Middle East and Africa. The frozen dessert market in the UAE is characterized by the country's affluent population and diverse cuisine, leading to a high demand for quality and unique options. Consumers in the UAE are looking for tasty treats such as artisanal ice cream, gourmet gelato, and specialty frozen yogurt. The market is influenced by international food chains and luxury hotels that offer a variety of frozen foods to suit different tastes and preferences. The frozen dessert market in Saudi Arabia is the fastest-growing, driven by the young population and increasing disposable income. Traditional flavors like ice cream and frozen yogurt are widely used, along with rich, creamy textures. Health-conscious consumers are still driving demand for healthier alternatives, leading to the popularity of low-fat and fat-free varieties made from natural ingredients. Israel’s frozen dessert market is characterized by innovation and diversity, focusing on quality ingredients and artisanal production techniques. Dairy products like ice cream and frozen yogurt are popular options, and there are also dairy-free and vegan foods made from other ingredients like soy, almond, and coconut milk. Egypt's frozen dessert market is driven by strong demand for regional favorites such as ice cream and gelato, especially during the hot summer season. Local confectioners and street vendors offer a wide variety of desserts and toppings, making consumers more interested in indulgent and affordable treats.

COVID-19 Impact Analysis on the Middle East & Africa Frozen Desserts Market:

The COVID-19 pandemic has had a major impact on the Middle East and Africa's (MEA) frozen dessert market, changing consumer behavior and business dynamics. Quarantines, social distancing measures, and economic uncertainty during the global pandemic have led to chain disruptions and changes in consumption patterns. Although the demand for frozen desserts remains stable due to their convenience, purchasing channels have changed based on online platforms and home delivery services. Additionally, health and safety concerns have led the frozen dessert industry to focus on hygiene and innovative packaging that meets sustainable needs. Despite challenges, the pandemic spurred new ways to meet consumers' needs, with companies developing new products, healthy options, and convenient packaging solutions. As the region slowly recovers from the pandemic, the Middle East and Africa's frozen dessert market is expected to rebound, driven by high demand, economic recovery, and ongoing innovation to meet changing consumer needs.

Latest Trends/ Developments:

The frozen food market in the Middle East and Africa (MEA) region is witnessing significant growth and development. First, there is a growing demand for alternative health options among health-conscious consumers. This trend has led to the introduction of low-fat, sugar-free, and dairy-free options in the market, catering to health-conscious individuals without compromising on taste. In addition, the interest in premium frozen dessert products is increasing due to consumers' ever-increasing desire for quality frozen dessert products. Artisanal ice creams, gourmet gelato, and specialty frozen yogurt are growing in popularity, offering unique flavors and new combinations that customers will surely approve of. Additionally, the frozen desserts market is increasingly focused on sustainability and safety as manufacturers use eco-friendly packaging and production practices. As consumers become more environmentally conscious, sustainability is becoming a key differentiator for brands in the MEA frozen dessert market, driving innovation and business growth.

Key Players:

- Almarai Company

- Baskin-Robbins (Inspire Brands)

- General Mills

- Unilever

- Siwar Foods

- Conagra Brands

- Turkey Hill Dairy (Peak Rock Capital LLC)

- Mochidoki

- 16 Handles

- Mars, Incorporated

- In May 2023, Siwar Foods signed a private label and distributor agreement with French company Sarl So Mochi to market and distribute a range of Mochi ice cream in the Middle East, starting with the launch in the Kingdom of Saudi Arabia.

- In July 2022, Mochidoki, a premium ice cream shop, introduced an innovative Jasmine Boba flavor. Inspired by the refreshing qualities of Taiwanese bubble tea, the milky and floral ice cream features a chewy boba mochi exterior, offering a unique and culturally inspired frozen treat.

- In March 2022, Baskin-Robbins, which operates under Inspire Brands, expanded its presence in the United Arab Emirates by opening its 1000th store in the Middle East, North Africa, and Australia combined. The outlet opened at Dubai Hills Mall, and Baskin-Robbins hosted a public ice cream party at Ain Dubai to mark the event.

- In January 2022, Unilever launched 19 new frozen treats across Breyers, Klondike, Magnum ice cream, and Talenti Gelato & Sorbetto brands.

Chapter 1. Middle East & Africa Frozen Dessert Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East & Africa Frozen Dessert Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East & Africa Frozen Dessert Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East & Africa Frozen Dessert Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East & Africa Frozen Dessert Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East & Africa Frozen Dessert Market– By Product Type

6.1. Introduction/Key Findings

6.2. Ice Cream

6.3. Frozen Yogurt

6.4. Sorbets

6.5. Gelato

6.6. Frozen Novelties

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Product Type

6.9. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Middle East & Africa Frozen Dessert Market– By Distribution Channels

7.1. Introduction/Key Findings

7.2. Supermarkets & Hypermarkets

7.3. Online Retail

7.4. Convenience Stores

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channels

7.10. Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 8. Middle East & Africa Frozen Dessert Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Product Type

8.1.3. By Distribution Channels

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East & Africa Frozen Dessert Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Almarai Company

9.2. Baskin-Robbins (Inspire Brands)

9.3. General Mills

9.4. Unilever

9.5. Siwar Foods

9.6. Conagra Brands

9.7. Turkey Hill Dairy (Peak Rock Capital LLC)

9.8. Mochidoki

9.9. 16 Handles

9.10. Mars, Incorporated

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Middle East & Africa frozen desserts market was valued at USD 3.82 billion in 2023 and is projected to reach a market size of USD 4.76 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.18%.

The segments under the Middle East & African frozen desserts market based on distribution channels are supermarkets & hypermarkets, online retail, convenience stores, and others

United Arab Emirates (UAE) is dominant in the Middle East & African frozen dessert markets.

Almarai Company, Baskin-Robbins (Inspire Brands), General Mills, Unilever, and Siwar Foods are the major players in the Middle East & Africa frozen desserts market.

The COVID-19 pandemic has had a major impact on the Middle East and Africa's (MEA) frozen dessert market, changing consumer behavior and business dynamics. Quarantines, social distancing measures, and economic uncertainty during the global pandemic have led to chain disruptions and changes in consumption patterns. Although the demand for frozen desserts remains stable due to their convenience, purchasing channels have changed based on online platforms and home delivery services.