North America Craft Beer Market Size (2024-2030)

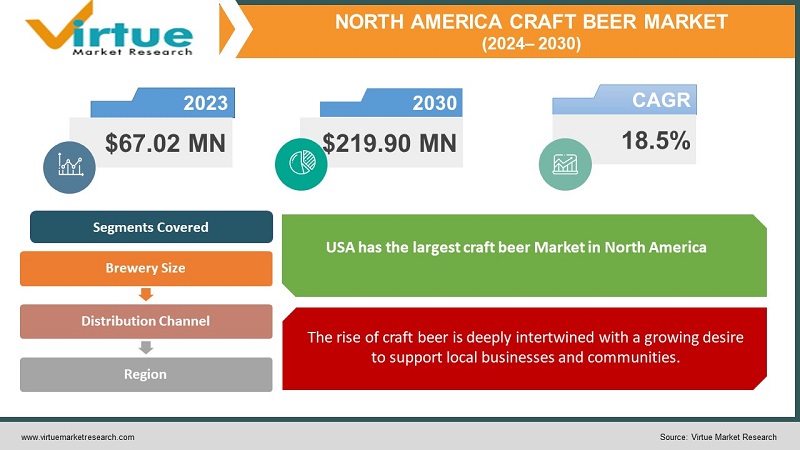

The North America Craft Beer Market was valued at USD 67.02 Million in 2023 and is projected to reach a market size of USD 219.90 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 18.5%.

The rise of craft beer over the past few decades has reshaped the North American beer landscape, challenged the dominance of large-scale breweries, and catered to an increasingly adventurous consumer palate. The United States holds the lion's share of the North American craft beer market, with Canada experiencing its own significant craft beer boom. The economic impact extends far beyond breweries, encompassing a vast network of ingredient suppliers, distributors, retailers, and the bustling 'brewpub' culture. While craft breweries are individually smaller than their multinational counterparts, collectively their economic impact is substantial and continues to grow. North American craft breweries are known for bold experimentation with diverse beer styles, ingredients, and brewing techniques. IPAs (India Pale Ales) with their hop-forward profiles remain immensely popular, alongside a resurgence in classic lagers, fruit-infused beers, sours, and barrel-aged specialties.

Key Market Insights:

The craft beer scene in North America, especially within the United States, has witnessed an extraordinary surge in recent decades. This shift is driven by a thirst for greater variety, local flavors, and a rejection of the mass-produced and homogenous beer offerings that once dominated the market. The very idea of 'craft beer' embodies experimentation, pushing boundaries, and a departure from standard lagers that defined the beer landscape for generations prior. The number of craft breweries in the United States has exploded. A few hundred existed in the 1980s, rising to over 9,000 operating craft breweries today. Craft beer now holds a significant and growing market share. While exact numbers fluctuate, craft beer consistently commands over 20% of the US beer market by volume, reaching as high as 27% in recent years. Craft beer enthusiasts crave unique flavor profiles, complex hops, barrel-aging, and seasonal ingredients not found in mass-market options. The craft beer market offers an astonishing array of styles: sour beers, stouts, fruit flavored, barrel-aged, lagers, Belgians, the list goes on. Craft brewery taprooms are more than just places to buy a pint. They have become social hubs, fostering a sense of community with events, food offerings, and a direct connection to the brewing process. Increased availability of craft beer in grocery stores, specialty retailers, and direct-to-consumer sales channels expand access and convenience for consumers. While bottles hold a traditional place, the use of cans for craft beer is rapidly increasing due to portability, light protection, and their 'cool' factor within the craft scene. As the market grows, some worry about potential dilution of the 'craft' ethos with a focus on rapid expansion over quality and consistency.

North America Craft Beer Market Drivers:

For decades, the North American beer landscape was dominated by mass-produced lagers with a relatively narrow flavor profile. Craft beer offers a thrilling departure from this homogeneity.

The explosive popularity of India Pale Ales (IPAs) highlights this shift. Their assertively hoppy bitterness, often with bold citrus or tropical fruit notes stood in stark contrast to traditional light lagers. While IPAs now hold a less dominant position, their legacy remains in paving the way for a market hungry for bolder tastes. Craft beer drinkers embrace variety. While everyone has their favorites, they are rarely content with drinking the same style day after day. The joy for many lies in the discovery of unique profiles – a rich coffee stout, a tart, fruity sour, a smoky, barrel-aged creation, or the latest in hop-forward innovation. Craft brewing not only pushes boundaries with new creations but also breathes life into traditional beer styles from around the world – Belgian Saisons with their peppery spice, German Hefeweizens with banana and clove notes, and rich, malty English porters. This revives a sense of beer's history while offering exciting flavors for modern palates. Our modern lives are inundated with mass-produced, often bland food and drinks. Craft beer offers a rebellion, reawakening our taste buds to a world of complexity and nuance. The dominance of one particular flavor profile (light lagers) for generations left many drinkers feeling uninspired. Craft beer fills this void, offering constant novelty to combat palate fatigue. The promise of a customer base that craves variety encourages the launch of new breweries. Each brewery needs to stand out with a unique lineup of beers to capture attention.

The rise of craft beer is deeply intertwined with a growing desire to support local businesses and communities.

The success of craft beer cannot be fully understood without recognizing its deep connection to a broader trend: the resurgence of 'localism.' This encompasses a desire to support independent businesses within one's community, a growing awareness of where products come from, and seeking authentic experiences over mass-produced homogeneity. Craft beer thrives in this environment because it offers tangibility and connection – the faces behind the brewery, a physical place to visit, and often ingredients sourced from nearby farms. Some consumers view supporting independent craft breweries as a small act of rebellion against the dominance of large, multinational beverage corporations. Craft brewery taprooms are rarely just places to grab a beer. They've become social hubs –hosting local food vendors, live music nights, community events, and fundraisers. Craft beer taprooms cultivate a sense of belonging, where regulars know the bartenders by name and forge friendships with fellow beer lovers. Breweries often incorporate their city, region, or state directly into their names and branding, emphasizing their roots and origin. Breweries highlight collaborations with local farmers or feature regional ingredients – hops, fruits, or even honey – in their beers, deepening their connection to the land. Craft breweries excel at sharing their stories with consumers through social media, websites, and taproom displays – showcasing the brewing team, ingredient sourcing, and their involvement in the community.

North America Craft Beer Market Restraints and Challenges:

The sheer number of breweries operating in North America has skyrocketed. Standing out becomes increasingly difficult for small- and mid-sized breweries with limited marketing budgets.

The sheer number of breweries operating in North America has skyrocketed. Standing out becomes increasingly difficult for small- and mid-sized breweries with limited marketing budgets. Retailers have finite shelf space. New beers constantly fight for consumer attention, making it tough for even established breweries to maintain distribution. In areas with a high density of breweries, competition intensifies for draft lines and patrons, even within a hyper-local market. Craft beer drinkers are often adventurous, seeking novelty. While IPAs were once the darling of the market, their dominance is wavering. Breweries must keep innovating to stay ahead of the curve. Hard seltzers, ready-to-drink cocktails, and even non-alcoholic options are pulling away some consumer interest from craft beer. The tight labour market impacts breweries, both in the production facility and taprooms. Attracting and retaining talent comes at an increased cost. Fuel price increases and transportation bottlenecks create further strains, making it more expensive to get beer into retailers or shipped to consumers. Alcohol laws vary wildly between states and provinces, often with remnants of outdated, post-prohibition legislation. This creates complexity for any brewery aiming for broader distribution. Some consumers are intimidated by complex craft beer styles. Breweries and retailers need to educate and welcome newcomers without being elitist. Craft beer often has a premium price point compared to mass-market options. Attracting price-conscious drinkers remains a challenge. Finding reliable, high-quality ingredients at scale can be difficult, particularly with sought-after hops or specialty grains.

North America Craft Beer Market Opportunities:

A growing segment of consumers are seeking healthier lifestyle choices, including within their beverage options. 'Session beers' with lower alcohol content, well-crafted for both flavor and moderation, provide an entry point for the health-conscious drinker who still enjoys craft beer. The market for non-alcoholic (NA) craft beer is exploding. Advancements in brewing techniques finally allow for NA beers that actually taste delicious, capturing a massive untapped market. Expect to see craft beers incorporating functional or 'wellness' ingredients like botanicals, superfoods, or even adaptogens, catering to this trend. The craft beer scene has sometimes been perceived as male dominated. There's a major opportunity to make the craft beer world more welcoming and inclusive. Women represent a significant growth opportunity. Breweries that create inviting spaces, offer a diverse range of styles (beyond just super hoppy or high ABV), and use inclusive marketing have the potential to gain loyal customers. E-commerce can level the playing field, allowing smaller breweries to reach customers beyond their immediate region without traditional distribution deals. Beer subscription boxes and brewery-specific memberships offer a recurring revenue stream and foster brand loyalty. Consumers seek memorable experiences. Breweries offering unique events, tasting flights, brewery tours, and pairings with local cuisine stand out. Craft beer destinations with multiple breweries and 'beer trails' are flourishing. This drives tourism spending across accommodations, dining, and other attractions.

NORTH AMERICA CRAFT BEER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

18.5% |

|

Segments Covered |

By Bewery size, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, Canada, Rest of North America |

|

Key Companies Profiled |

D.G. Yuengling & Son, Boston Beer Company, Sierra Nevada Brewing Co, New Belgium Brewing, Bell's Brewery , Tree House Brewing Company, Trillium Brewing Company |

North America Craft Beer Market Segmentation:

North America Craft Beer Market Segmentation: By Distribution Channel -

- Taprooms

- On-Premises

- Off-Premises

- Direct-to-Consumer (DTC)

The off premises channel traditionally holds the largest market share, often estimated between 50-65%. The accessibility and wide selection found in retail locations attract a large consumer base. Taproom sales are a significant and fast-growing segment, potentially accounting for 20-30% of the market. High-profit margins and direct consumer connection drive this trend. Bars and restaurants remain an important channel, though their market share can fluctuate. Consumer dining habits and trends in 'drinking out' influence the numbers, usually ranging from 15-25%. While still a smaller share compared to others (perhaps 5-10% at the moment), direct-to-consumer sales have the potential to disrupt the picture, particularly as regulations evolve. Historically, selling craft beer through grocery stores, liquor stores, and similar retail outlets has been the most dominant channel for breweries in North America. Brewery taprooms are experiencing significant and sustained growth within the North American craft beer market.

North America Craft Beer Market Segmentation: By Brewery Size -

- Microbreweries

- Local Craft Breweries

- Big craft breweries

Microbreweries- Produce less than 15,000 barrels of beer per year. It is the heart and soul of the craft beer movement. Highly focused on local markets and taproom-driven sales. Often emphasize innovation and experimentation. Microbreweries are the most numerous categories, likely representing well over 80% of total breweries in the US. However, their combined production volume share is lower due to their small scale. Local Craft Breweries- Make one million to six million barrels of beer a year. These achieve a balance between preserving a "craft" identity and expanding distribution. Some are well-known in their local community or among devoted drinkers of craft beer in a wider area. While making up a small share of all breweries, they sell a sizable amount of all craft beer. Big craft brewers frequently run on a national level, and some even export abroad. Several well-known "craft" brands grew or were acquired to attain this status from lesser beginnings. These are the fewest, yet because of their production capacity, they can hold a substantial market share in terms of sales volume.

North America Craft Beer Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

USA: Dominates the North American craft beer market, accounting for the vast majority of overall share. Estimates often place the US market share upwards of 80%. Canada: Holds a smaller but significant share of the market. Canadian craft beer markets are likely in the 10-15% share range of the total North American market. Mexico: Currently represents the smallest share, likely below 5%, but has the potential for significant growth as the craft beer trend gains further momentum. The USA is the clear leader within the North America craft beer scene. The modern craft beer revolution arguably began in the US, giving it a substantial head start in terms of brewery numbers and market development. The sheer size of the US population, combined with growing interest in craft beer, translates into a massive consumer base for breweries. States like California, Oregon, Colorado, Michigan, and regions like the Pacific Northwest and Northeast are hotspots with high concentrations of breweries. While a smaller market currently, Mexico is likely experiencing the most rapid growth within the North American craft beer scene. Mexico's craft beer scene is relatively young compared to the US and Canada. This leaves significant room for expansion and the emergence of new breweries.

COVID-19 Impact Analysis on the North America Craft Beer Market:

The COVID-19 pandemic sent shockwaves through the North American craft beer industry. While the long-term picture remains unclear, the initial effects were undeniably disruptive. Lockdowns and social distancing measures shuttered bars, restaurants, and taprooms – crucial sales channels for many breweries, particularly smaller ones reliant on draft sales. Supply chains were disrupted, impacting the flow of raw materials and finished products. Breweries faced difficulties obtaining ingredients like hops and malt and getting their beers to retailers. Craft beer thrives on festivals, tastings, and community events. These were canceled, eliminating valuable marketing opportunities and revenue streams for breweries. Economic anxieties and shifting priorities led some consumers to tighten their spending, potentially impacting discretionary purchases like craft beer. With on-premises sales dwindling and distribution uncertain, breweries were forced to scale back production or risk having unsaleable stock. Faced with declining revenue, many breweries had to make difficult staffing decisions, impacting livelihoods within the industry.

Latest Trends/ Developments:

While IPAs remain a major force, their complete dominance is waning. Consumers crave variety and brewers are stepping up. Sour beers with their tart, complex, and often fruit-forward profiles are gaining significant popularity. Think Berliner Weisse, Goses, and fruited sours. We're seeing a shift away from extreme bitterness. Even IPAs are embracing juicier, fruitier hop profiles with less palate-wrecking astringency. Breweries are reviving classic European styles: crisp pilsners, malty lagers, rich Belgian ales, and exploring historical ingredients or techniques. Health-conscious consumers are driving innovation in craft beer, creating demand for options that align with their wellness goals. 'Session beers' with full flavor but lower alcohol content is booming, allowing for enjoyment without overindulgence. The NA beer segment is exploding. New brewing techniques finally yield NA beers with the complex flavor profiles craft beer lovers expect. Expect to see "functional" craft beers – brews incorporating superfoods, botanicals with adaptogenic properties, or even probiotics. The traditional craft beer scene has faced criticism for being male-centric and lacking diversity. There's a concerted push to change this. Breweries owned and operated by women are on the rise, alongside initiatives to create welcoming spaces for female craft beer enthusiasts. We're seeing breweries actively foster inclusivity across race, ethnicity, and the LGBTQ+ community. Partnerships, inclusive events, and beers celebrating diversity are part of this shift.

Key Players:

- D.G. Yuengling & Son

- Boston Beer Company

- Sierra Nevada Brewing Co

- New Belgium Brewing

- Bell's Brewery

- Tree House Brewing Company

- Trillium Brewing Company

Chapter 1. North America Craft Beer Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Craft Beer Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Craft Beer Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Craft Beer Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Craft Beer Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Craft Beer Market– By Distribution Channel

6.1. Introduction/Key Findings

6.2. Taprooms

6.3. On-Premises

6.4. Off-Premises

6.5. Direct-to-Consumer (DTC)

6.6. Y-O-Y Growth trend Analysis By Distribution Channel

6.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 7. North America Craft Beer Market– By Brewery Size

7.1. Introduction/Key Findings

7.2. Microbreweries

7.3. Local Craft Breweries

7.4. Big craft breweries

7.5. Y-O-Y Growth trend Analysis By Brewery Size

7.6. Absolute $ Opportunity Analysis By Brewery Size , 2024-2030

Chapter 8. North America Craft Beer Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Brewery Size

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Craft Beer Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. D.G. Yuengling & Son

9.2. Boston Beer Company

9.3. Sierra Nevada Brewing Co

9.4. New Belgium Brewing

9.5. Bell's Brewery

9.6. Tree House Brewing Company

9.7. Trillium Brewing Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

For decades, mass-produced lagers dominated the North American beer scene. Craft brewing offered a rebellion, with bold IPAs, complex stouts, and a world of rediscovered styles to explore.

Craft beer drinkers are inherently curious. Small-batch and limited-edition brews create excitement and anticipation, fueling a constant search for the next unique experience.

D.G. Yuengling & Son, Boston Beer Company, Sierra Nevada.

The USA currently holds the largest market share, estimated at around 80%.

Mexico exhibits the fastest growth, driven by its increasing population, expanding economy.