Asia Pacific Craft Beer Market Size (2024-2030)

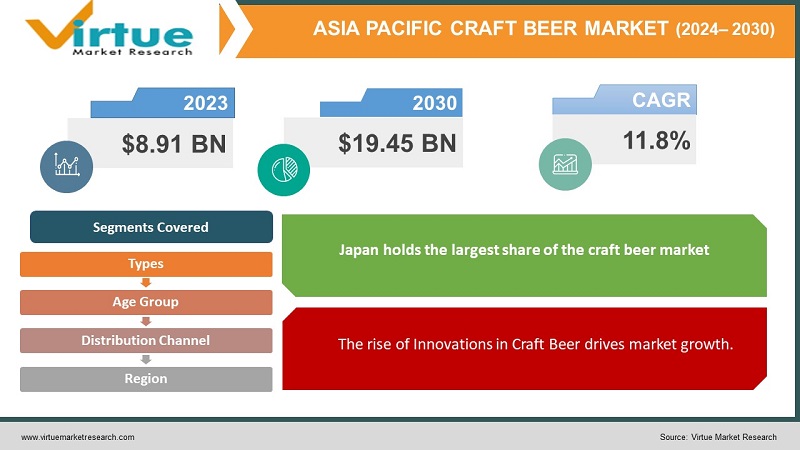

The Asia Pacific Craft Beer Market was valued at USD 8.91 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 19.45 billion by 2030, growing at a CAGR of 11.8%.

The craft beer market within the Asia-Pacific region exhibits significant diversity in both consumption habits and product offerings, largely due to varying preferences and distinct social and cultural practices among different countries. The market is expanding steadily, driven by a rising demand for premium craft beers.

Key Market Insights:

Over an extended period, numerous companies throughout Asia have emerged as trailblazers and frontrunners in the craft beer sector, symbolizing the regions where their products are brewed. Additionally, a notable rise in beer consumption has been recorded, largely attributed to the expanding youth demographic with a growing inclination toward beer. Changing lifestyles and evolving consumer preferences have greatly accelerated the adoption of beer in the Asia-Pacific region.

Asia Pacific Craft Beer Market Drivers:

The rise of Innovations in Craft Beer drives market growth.

Growing health awareness has prompted consumers to seek healthier options in craft beer, such as those with reduced or no calories and lower or no alcohol content. The rise in lifestyle-related illnesses, such as liver diseases, has significantly contributed to the preference for low-alcohol craft beers. Millennials, in particular, are showing a greater interest in alcohol-free craft beers, driven by the perception that beers with low or no alcohol content are healthier. In response to this growing demand, craft beer producers in the region are focusing on developing new product lines that feature lower calorie and alcohol content. For example, in September 2020, Big Drop Brewing Co. introduced its alcohol-free craft beer range in Australia, including Pine Trail Pale Ale and Uptown Craft Lager, both offered in 4-packs without alcohol but retaining the same flavor profile.

Additionally, the increasing prevalence of lactose intolerance and celiac disease, particularly in countries like Australia, has shifted consumer preferences toward gluten-free craft beers. According to Coeliac Australia, approximately 1 in 70 Australians is affected by celiac disease. Consequently, craft beer manufacturers have begun offering gluten-free options. In September 2021, TWØBAYS Brewing Co. launched the gluten-free Stargaze Hazy Pale craft beer. This beer, brewed on a Vienna millet base, features a fruity pale with aromas of pineapple, lychee, and mango, and delivers tropical, stone fruit, and citrus flavors.

The rising Number of Microbreweries increases market growth.

Craft beer has increasingly established a strong presence in the market, with a growing number of independent microbreweries emerging to offer a wide range of products. The surge in craft beer's popularity, particularly among the younger demographic, is a key driver of this growth. Contributing factors to the shift towards craft beer consumption include the demand for diverse options, increased disposable income, a preference for distinctive flavors, and a focus on beer quality. There is also a notable trend toward low-alcohol by-volume beverages, with rising sales of no-alcohol and low-alcohol beers driven by health-conscious consumers and an improved selection of high-quality options. The expansion of the craft beer market is closely linked to the increasing consumer appetite for variety.

Additionally, the shift in consumer preferences toward diverse and flavorful options has led to the integration of microbreweries into the craft beer sector. The active involvement of larger brewers has further supported the craft beer market, with these new entrants boosting exports and contributing to both stabilization and incremental growth. As more microbreweries enter the market, competition intensifies in areas such as product innovation, flavor differentiation, packaging, pricing, and production techniques. Consequently, the proliferation of microbreweries and small independent breweries has been a significant driver of growth in the craft beer market.

Asia Pacific Craft Beer Market Restraints and Challenges:

Tough Competition with Large Brewers restrains market growth.

The craft beer market encounters intense competition from established large-scale brewing conglomerates. These industry giants benefit from considerable marketing budgets, extensive distribution networks, and economies of scale, which pose significant challenges for craft breweries in capturing a significant market share. This competitive environment can restrict the growth opportunities for craft breweries and requires them to employ innovative strategies to distinguish their products.

Difficult Brand Recognition hinders market growth.

Establishing and sustaining brand recognition presents a formidable challenge in a competitive market. The craft beer industry is characterized by a multitude of innovative and dedicated brewers, necessitating that breweries develop effective marketing and branding strategies. Building a strong brand identity and earning consumer trust is essential for distinguishing oneself and forging meaningful connections with discerning craft beer enthusiasts.

Asia Pacific Craft Beer Market Opportunities:

As consumers increasingly seek unique and high-quality brews, craft breweries can broaden their customer base and build brand loyalty by innovating with diverse flavors and styles.

Additionally, craft breweries have the potential to expand into emerging markets, which present significant opportunities as more consumers develop an interest in craft beer. By forming strategic partnerships, pursuing export opportunities, and implementing localized marketing strategies, craft beer brands can establish a robust presence in these new regions.

Furthermore, adopting sustainability practices and emphasizing health-conscious brewing can appeal to environmentally and health-conscious consumers. Investing in eco-friendly production methods, minimizing waste, and offering low-alcohol or non-alcoholic craft beer options can help breweries attract this growing market segment.

ASIA PACIFIC CRAFT BEER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.8% |

|

Segments Covered |

By Type, Age group, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

Beijing Yanjing Brewery Co., Ltd., Carlsberg Group, Dogfish Head Craft Brewery, Inc., Diageo PLC, Squatters Pub and Beers, |

Asia Pacific Craft Beer Market Segmentation:

Asia Pacific Craft Beer Market Segmentation- By Type:

- Ale

- Pale Ale

- Brown Ale

- Strong Ale

- Scottish Style Ale

- Porters

- Stouts

- Lagers

- Pale Lagers

- Dark Lagers

- Pilsners

Ale has represented a substantial portion of the craft beer market. This segment is categorized into pale ale, brown ale, Scottish-style ale, porters, and stouts. In recent years, a growing number of beer consumers have shown a strong preference for traditional varieties such as pale ale, porters, and stouts. This shift in consumer tastes has prompted leading players in the beer market to reintroduce a range of traditional beers to cater to this evolving demand.

Asia Pacific Craft Beer Market Segmentation- By Age Group:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

Individuals aged 21–35 years, commonly known as millennials, have notably impacted the development of various industries through their preferences for products and services. In the craft beer market, millennials represent a key consumer group. Craft beer brewers are consistently adapting their strategies and product offerings to align with the diverse tastes and preferences of this demographic. As the millennial population continues to grow, it is anticipated that this segment will create significant opportunities for the craft beer market in the years ahead.

Asia Pacific Craft Beer Market Segmentation- By Distribution Channel:

- On-trade

- Off-trade

The on-trade segment holds a significant share of the craft beer market, encompassing distribution outlets such as bars, restaurants, coffee shops, clubs, and hotels. Unlike the off-trade market, the on-trade segment involves distinct distribution and sales practices. In this segment, bar and restaurant owners or managers, as well as staff members such as bartenders and waiters, play a pivotal role in the sales process. Consumers often seek a more refined and enjoyable experience in on-trade venues, including brewpubs, tasting rooms, and tiki bars. This desire for a stylish and comfortable setting has contributed to the rise of pub and bar culture among millennials, further fueling the growth of the craft beer market.

Asia Pacific Craft Beer Market Segmentation- by Region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

Japan holds the largest share of the craft beer market within the Asia-Pacific region. Beer is deeply ingrained in Japan's drinking and dining culture, and craft beer has emerged as a premium choice, attracting affluent consumers. The market offers a diverse range of craft beers, each with unique tastes and flavors, driven by increasing affluence and a growing demand for innovative flavors. This trend has led to a rise in the quality and variety of craft beers, propelling the growth of the Asia-Pacific craft beer market. Major craft beer brands in Japan include Asahi, Kirin, Sapporo, and Suntory, among others.

Additionally, there is a growing interest in low-sugar craft beers among health-conscious consumers. Breweries are innovating by developing new flavors and reducing sugar content. For example, Kirin increased the production volume of Kirin Ichiban Zero Sugar Beer by 60% in 2022, highlighting the rising demand for low-calorie beers.

Conversely, India is expected to experience rapid growth during the forecast period due to lower manufacturing costs and rising disposable incomes. The increasing beer consumption in India, driven by its expanding youth population and changing lifestyles, has significantly boosted beer adoption in the Asia-Pacific region. As a result, companies in the region are scaling up to meet both domestic and international demand.

COVID-19 Pandemic: Impact Analysis

At the beginning of the pandemic, craft beer sales experienced a decline due to COVID-19 restrictions affecting physical retail outlets. However, major industry players have since adapted by enhancing their market presence through e-commerce platforms and online marketing initiatives. This strategic shift is designed to reach consumers beyond traditional geographical limits. The pandemic accelerated the transition to off-trade channels, as lockdowns and social distancing measures restricted opportunities in the on-trade sector.

Latest Trends/ Developments:

In August 2023, Lone Wolf, the distinguished craft beer producer, introduced two new beer variants—Mavrick and Alpha—at a launch event in New Delhi. This release underscores the brand's dedication to innovation and creativity in the craft beer industry. Mavrick, a 100% malt lager, and Alpha, a Belgian Witbier, both feature distinctive flavors and refreshing profiles, with an alcohol by volume (ABV) of under 5 percent. Lone Wolf has quickly gained momentum, achieving notable revenue in its inaugural year and setting ambitious goals to more than double that figure in the next year.

Key Players:

These are the top 10 players in the Asia Pacific Craft Beer Market: -

- Beijing Yanjing Brewery Co., Ltd.

- Carlsberg Group

- Dogfish Head Craft Brewery, Inc.

- Diageo PLC

- Squatters Pub and Beers

- The Boston Beer Company, Inc.

- Heineken Holding NV.

- Anheuser-Busch InBev

- United Breweries Limited

- Sierra Nevada Brewing Co.

Chapter 1. Asia Pacific Craft Beer Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Craft Beer Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Craft Beer Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Craft Beer Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Craft Beer Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Craft Beer Market– By Type

6.1. Introduction/Key Findings

6.2. Ale

6.2.1. Pale Ale

6.2.2. Brown Ale

6.2.3. Strong Ale

6.2.4. Scottish Style Ale

6.2.5. Porters

6.2.6. Stouts

6.3. Lagers

6.3.1. Pale Lagers

6.3.2. Dark Lagers

6.3.3. Pilsners

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Asia Pacific Craft Beer Market– By Age Group

7.1. Introduction/Key Findings

7.2. 21–35 Years Old

7.3. 40–54 Years Old

7.4. 55 Years and Above

7.5. Y-O-Y Growth trend Analysis By Age Group

7.6. Absolute $ Opportunity Analysis By Age Group , 2023-2030

Chapter 8. Asia Pacific Craft Beer Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. On-trade

8.3. Off-trade

8.4. Y-O-Y Growth trend Analysis Distribution Channel

8.5. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Craft Beer Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Distribution Channel

9.1.3. By Type

9.1.4. By Age Group

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Craft Beer Market– Company Profiles – (Overview, Age Group Portfolio, Financials, Strategies & Developments)

10.1 Beijing Yanjing Brewery Co., Ltd.

10.2. Carlsberg Group

10.3. Dogfish Head Craft Brewery, Inc.

10.4. Diageo PLC

10.5. Squatters Pub and Beers

10.6. The Boston Beer Company, Inc.

10.7. Heineken Holding NV.

10.8. Anheuser-Busch InBev

10.9. United Breweries Limited

10.10. Sierra Nevada Brewing Co.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Growing health awareness has prompted consumers to seek healthier options in craft beer, such as those with reduced or no calories and lower or no alcohol content

The top players operating in the Asia-Pacific Craft Beer Market are - Beijing Yanjing Brewery Co., Ltd., Carlsberg Group, Dogfish Head Craft Brewery, Inc., Diageo PLC, Squatters Pub and Beers, and many more.

At the beginning of the pandemic, craft beer sales experienced a decline due to COVID-19 restrictions affecting physical retail outlets

In August 2023, Lone Wolf, the distinguished craft beer producer, introduced two new beer variants—Mavrick and Alpha—at a launch event in New Delhi. This release underscores the brand's dedication to innovation and creativity in the craft beer industry.

India is expected to experience rapid growth during the forecast period due to lower manufacturing costs and rising disposable incomes