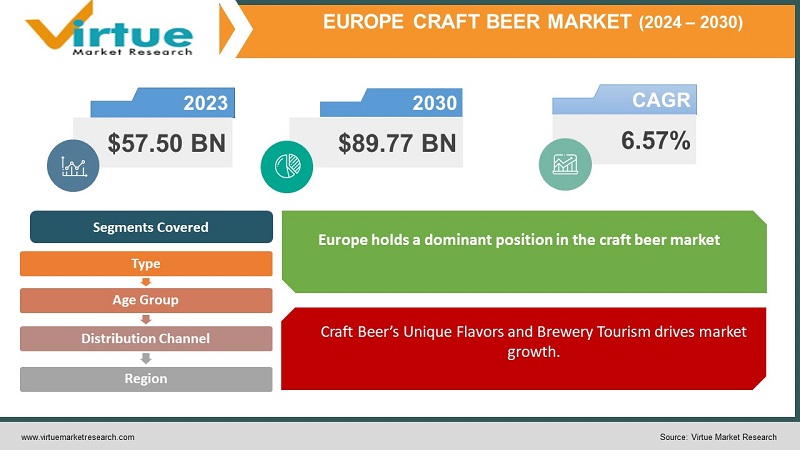

Europe Craft Beer Market Size (2024-2030)

The Europe Craft Beer Market was valued at USD 57.50 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 89.77 billion by 2030, growing at a CAGR of 6.57%.

The craft beer movement represents a vibrant and growing segment of the beer industry, highlighting the artistry, innovation, and passion of independent brewers. It stands in stark contrast to mass-produced, mainstream beers, with a mission to redefine and enhance the beer-drinking experience. This movement is distinguished by its focus on quality, diverse flavors, and brewing techniques that emphasize creativity and individuality. Craft beers are produced by small-scale brewers, typically individuals or small teams who invest considerable effort and passion into each batch. These brewers pride themselves on their willingness to experiment with various ingredients, including unique hops, malt blends, and adjuncts, resulting in a broad range of beer styles and flavors.

Key Market Insights:

According to a report by The Brewers of Europe in the 2023 edition, the data indicates a decline in beer sales within the European Union, dropping from 322 million hectoliters in 2019 to 297 million hl in 2020. Although a significant portion of these losses had recovered by 2022, beer consumption remained lower, reaching only 313 million hl by that year.

Despite the fluctuations in beer consumption, the count of operational breweries in the EU continued to rise. It increased from 9,500 breweries in 2021 to 9,680 by 2022.

Europe Craft Beer Market Drivers:

Craft Beer’s Unique Flavors and Brewery Tourism drives market growth.

One of the primary drivers behind the craft beer movement is the exceptional range of unique flavor profiles offered by craft brewers. In a market long dominated by uniform, mass-produced beers, consumers are increasingly attracted to diverse and distinctive taste experiences. Craft breweries lead this revolution, consistently pushing the boundaries of brewing by experimenting with innovative ingredients, techniques, and regional influences. This commitment to creating unique and flavorful beers has cultivated a dedicated and discerning consumer base passionate about exploring the wide array of tastes that craft beer offers.

Moreover, the integration of craft breweries into the tourism sector has emerged as another significant driver. Craft breweries have evolved beyond production sites to become vibrant tourist attractions. Visitors are drawn to these breweries for immersive experiences, including tours, tastings, and engaging events. These brewery-related tourism activities provide memorable experiences and make substantial contributions to local economies.

Experimentation with Flavors is increasing the market growth.

Craft beer has experienced a notable rise in microbreweries in recent years, spurred by a discerning consumer base seeking unique, locally brewed flavors. These small-scale breweries are renowned for their commitment to quality, innovation, and personalized offerings, effectively challenging established brands. They cater to diverse palates and emphasize artisanal craftsmanship by providing limited-edition seasonal brews and adventurous flavor profiles.

Health-conscious trends have also influenced the craft beer industry, with consumers prioritizing well-being and gravitating towards craft beers with lower alcohol content and distinctive ingredients such as fruits and spices. Brewers are increasingly focused on creating healthier options within their craft beer portfolios, offering refreshing alternatives to traditional beers. This approach aligns with evolving consumer tastes and preferences, blending flavor and wellness harmoniously.

Europe Craft Beer Market Restraints and Challenges:

Regulatory And Market Competitions Hinders the Craft Beer Growth.

Craft beer faces significant challenges due to the varying and often stringent regulations imposed by governments worldwide. These regulations include labeling requirements, alcohol content limits, distribution restrictions, and taxation policies. Compliance with these diverse regulations can be both costly and time-consuming for craft breweries, especially those looking to expand into multiple markets. Navigating this complex regulatory landscape poses a barrier to market entry and growth, thereby limiting the industry’s potential for expansion.

The craft beer market is also highly competitive, with small breweries competing for market share and larger beverage companies consolidating through acquisitions. This competitive environment presents difficulties for new and smaller breweries in maintaining profitability. Success in this sector requires effective differentiation, branding, and distribution strategies. Innovative approaches are essential for these breweries to stand out in a crowded marketplace.

Europe Craft Beer Market Opportunities:

As consumers increasingly seek unique and high-quality brews, craft breweries can attract a broader customer base and foster brand loyalty through innovation in diverse flavors and styles.

Craft breweries also have opportunities to extend their reach into emerging markets, which offer untapped potential as more consumers develop a taste for craft beer. Through strategic partnerships, exports, and localized marketing, craft beer brands can establish a strong presence in these regions.

Moreover, embracing sustainability practices and promoting health-conscious brewing can attract environmentally and health-conscious consumers. By investing in eco-friendly production methods, reducing waste, and offering low-alcohol or non-alcoholic craft beer options, breweries can tap into this growing market segment.

EUROPE CRAFT BEER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.57% |

|

Segments Covered |

By Type, Age group, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Beijing Yanjing Brewery Co., Ltd., Dogfish Head Craft Brewery, Inc., Squatters Pub and Beers, Carlsberg Group, Heineken Holding NV., Diageo PLC, United Breweries Limited , The Boston Beer Company, Inc. , Sierra Nevada Brewing Co., Anheuser-Busch InBev |

Europe Craft Beer Market Segmentation:

Europe Craft Beer Market Segmentation By Type:

- Ale

- Pale Ale

- Brown Ale

- Strong Ale

- Scottish Style Ale

- Porters

- Stouts

- Lagers

- Pale Lagers

- Dark Lagers

- Pilsners

Ale has accounted for a significant share of the craft beer market. The ale segment is further divided into pale ale, brown ale, Scottish-style ale, porters, and stouts. Over the years, many beer consumers have developed a particular preference for traditional beers such as pale ale, porters, and stouts. This shift in consumer preferences has led major players in the beer market to reintroduce a variety of traditional beers to meet the demand.

Europe Craft Beer Market Segmentation By Age Group:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

People aged 21–35 years, commonly referred to as millennials, have significantly influenced the evolution of various industries through their preferences for product offerings and services. In the craft beer market, millennials have been the primary customers. Craft beer brewers continuously strategize to evolve their product offerings to cater to the diverse perceptions and preferences of the millennial segment. Consequently, the increase in the number of millennials is expected to provide lucrative opportunities for the craft beer market in the coming years.

Europe Craft Beer Market Segmentation By Distribution Channel:

- On-trade

- Off-trade

The on-trade segment has captured a significant share of the craft beer market. This segment includes distribution outlets such as bars, restaurants, coffee shops, clubs, and hotels. The distribution and sales practices in the on-trade market are distinct from those in the off-trade market. In the on-trade segment, bar and restaurant owners or managers, along with professionals working at these establishments (such as bartenders and waiters), play a crucial role in the sales process. Consumers seek a more comfortable and stylish experience in on-trade venues, including brewpubs, tasting rooms, and tiki bars. This preference drives the increase in pub and bar culture among millennials, which, in turn, promotes the growth of the craft beer market.

Europe Craft Beer Market Segmentation- by Region

- Germany

- France

- United Kingdom

- Italy

- Spain

- Rest of Europe

Europe holds a dominant position in the craft beer market, with a notable increase in the consumption of various types of craft beers. This surge in demand has attracted both regional and international players, significantly contributing to the market's growth in terms of value. Germany leads the region with its renowned traditional beer culture, including lagers, wheat beers, and bocks. Meanwhile, France is the fastest-growing market within the region. Although traditionally known for its wine culture, beer consumption is also substantial in certain areas of France.

COVID-19 Pandemic: Impact Analysis

At the outset of the pandemic, craft beer sales encountered a downturn due to COVID-19 restrictions impacting brick-and-mortar stores. However, major industry players have since strategically shifted their focus toward bolstering their market presence via e-commerce platforms and online marketing endeavors. This strategic move aims to engage consumers beyond conventional geographical boundaries. The COVID-19 pandemic expedited the transition towards off-trade channels as lockdowns and social distancing measures restricted opportunities within the on-trade sector.

Latest Trends/ Developments:

Craft breweries often concentrate on serving local or regional markets, thereby fostering community ties and supporting local economies. Enthusiasts of craft beer enjoy exploring and discovering new flavors, with tasting rooms and brewpubs offering opportunities for consumers to interact directly with brewers, learn about the brewing process, and build relationships within the craft beer community. Furthermore, beer festivals and events dedicated to craft beer have grown in popularity, providing the public with the chance to sample a diverse array of brews and celebrate the culture of craft beer.

In August 2023, Anheuser-Busch announced a $22.5 million investment in its Houston brewery, signaling its commitment to enhancing its brewing capabilities and infrastructure.

In July 2023, craft beer maker Lone Wolf broadened its portfolio by introducing two new beer variants, Alpha and Maverick. This expansion aims to offer customers a wider range of flavors and aromas through their growing product lineup.

Key Players:

These are the top 10 players in the Europe Craft Beer Market: -

- Beijing Yanjing Brewery Co., Ltd.

- Dogfish Head Craft Brewery, Inc.

- Squatters Pub and Beers

- Carlsberg Group

- Heineken Holding NV.

- Diageo PLC

- United Breweries Limited

- The Boston Beer Company, Inc.

- Sierra Nevada Brewing Co.

- Anheuser-Busch InBev

Chapter 1. Europe Craft Beer Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Craft Beer Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Craft Beer Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Craft Beer Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Craft Beer Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Craft Beer Market– By Type

6.1. Introduction/Key Findings

6.2. Ale

6.2.1. Pale Ale

6.2.2. Brown Ale

6.2.3. Strong Ale

6.2.4. Scottish Style Ale

6.2.5. Porters

6.2.6. Stouts

6.3. Lagers

6.3.1. Pale Lagers

6.3.2. Dark Lagers

6.3.3. Pilsners

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Craft Beer Market– By Age Group

7.1. Introduction/Key Findings

7.2 21–35 Years Old

7.3. 40–54 Years Old

7.4. 55 Years and Above

7.5. Y-O-Y Growth trend Analysis By Age Group

7.6. Absolute $ Opportunity Analysis By Age Group , 2024-2030

Chapter 8. Europe Craft Beer Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. On-trade

8.3. Off-trade

8.4. Y-O-Y Growth trend Analysis Distribution Channel

8.5. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Craft Beer Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Age Group

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Craft Beer Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Beijing Yanjing Brewery Co., Ltd.

10.2. Dogfish Head Craft Brewery, Inc.

10.3. Squatters Pub and Beers

10.4. Carlsberg Group

10.5. Heineken Holding NV.

10.6. Diageo PLC

10.7. United Breweries Limited

10.8. The Boston Beer Company, Inc.

10.9. Sierra Nevada Brewing Co.

10.10. Anheuser-Busch InBev

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

One of the primary drivers behind the craft beer movement is the exceptional range of unique flavor profiles offered by craft brewers. In a market long dominated by uniform, mass-produced beers, consumers are increasingly attracted to diverse and distinctive taste experiences.

The top players operating in the Europe Craft Beer Market are - Beijing Yanjing Brewery Co., Ltd., Dogfish Head Craft Brewery, Inc., Squatters Pub and Beers, Carlsberg Group, Heineken Holding NV., Diageo PLC, United Breweries Limited, The Boston Beer Company, Inc., Sierra Nevada Brewing Co., Anheuser-Busch InBev.

At the outset of the pandemic, craft beer sales encountered a downturn due to COVID-19 restrictions impacting brick-and-mortar stores.

Craft breweries have opportunities to extend their reach into emerging markets, which offer untapped potential as more consumers develop a taste for craft beer. Through strategic partnerships, exports, and localized marketing, craft beer brands can establish a strong presence in these regions.

France is the fastest-growing market within the region. Although traditionally known for its wine culture, beer consumption is also substantial in certain areas of France.