North America Cocktail Market Size (2024-2030)

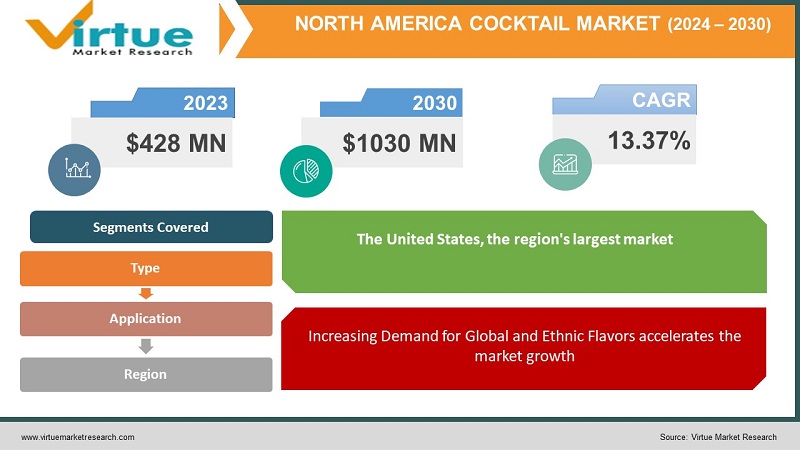

North America's Cocktail Market was valued at USD 428 million in 2023 and is projected to reach a market size of USD 1030 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.37%.

A Cocktail is a mixture of two or more drinks, at least one of which contains alcohol. A mixed drink is a highball when it's just a mixture of ingredients and distilled alcohol, like juice or soda. The cocktail is dual when it contains only liquor and distilled alcohol; When the mixer is added it is called a triple. Other ingredients that can be used are sugar, milk, cream, honey, and various types of vanilla. Beverages used in cocktail making are generally gin, vodka, whiskey, brandy, tequila, cachaça and rum. The ingredients of the cocktail vary from region to region. Two drinks may have the same name but taste very different because the way the drinks are prepared is different.

Key Market Insights:

The North American cocktail market represents a dynamic, evolving landscape shaped by culture, consumer preferences, and business innovations. A key insight into this market is the increasing demand for premium and craft cocktails. Consumers are increasingly looking for a unique and valuable drinking experience; This increases the popularity of stories, small products, and local ingredients. This trend demonstrates a shift toward complexity and originality, as consumers prioritize quality over value and seek new flavor profiles and creative presentations.

Additionally, sustainability and health are also becoming important factors influencing consumer behavior in the North American cocktail market. As awareness of environmental problems increases, consumers are looking for environmentally friendly alternatives and supporting brands that prioritize sustainability in their production processes. This includes sourcing organic ingredients, using environmentally friendly packaging, and reducing the carbon footprint. Likewise, demand for low-alcohol and non-alcoholic options is growing as healthy consumers want to enjoy a beverage without the side effects of booze.

North America Cocktail Market Drivers:

Shift towards Premiumization and Craft Cocktails drives the market forward.

Consumers are looking for unique and well-crafted cocktails, favoring artisanal, small-batch products and local ingredients. This trend reflects a shift towards quality in the cocktail industry, with consumers willing to pay higher prices for brands perceived to offer superior quality stuff, facts, and innovations. Craft cocktails not only have a variety of flavors and ingredients but also have a sense of fragility and beautiful craftsmanship that appeal to drinkers looking to make memories and experiences.

Increasing Demand for Global and Ethnic Flavors accelerates the market growth.

Increasing demand for global and ethnic flavors is another important market driver for the Cocktail industry. Today's consumers are more adventurous in their drinking choices and are seeking unique flavor experiences. This diversity has led to an interest in international and national flavors in a wide variety of cocktails. Cocktail makers have responded with a variety of flavor options inspired by different traditions. A variety of flavor profiles, increase the Cocktail's appeal to consumers.

Growing Interest in Ready-to-Drink (RTD) Cocktails drives the market forward.

Another important driver is the increasing demand for ready-to-drink (RTD) cocktails. Convenience is an important factor driving consumer behavior, especially in today's fast-paced lifestyle. Ready-to-drink cocktails offer an easy, hassle-free option to enjoy cocktails without requiring much preparation or bartender skills. With advances in packaging and distribution, ready-made cocktails are becoming increasingly diverse, with many classic and modern flavors available. This model appeals to a wide range of customers, from busy workers to drinkers looking for easy entertainment at home or on the go.

Cocktail Market Restraints and Challenges:

Supply Chain Disruptions and Raw Material Costs hinder the market growth.

Disruption of the supply chain and changes in raw materials costs pose a major problem for Cocktails manufacturers. Disruptions in the supply chain, such as natural disasters or geographic issues, can cause shortages or delays in the procurement of raw materials, affect production plans, and increase operating costs. Additionally, changes in commodity prices can impact profits and pricing strategies, requiring companies to adjust their practices and cost controls to reduce costs.

Maintaining quality and Standardization provides a challenge to market growth.

Maintaining consistency in quality and standardization of Cocktails can be difficult due to differences between material and processing. Ensure batch-to-batch consistency and compatibility requirements, especially for companies sourcing from multiple suppliers or regions.

Sustainability and Environmental Impact restrains market growth.

The increasing demand for Cocktails has led to concerns about their sustainability and environmental impact. Maintaining sustainable practices and supporting local communities are key challenges facing the Cocktail industry.

Cocktail Market Opportunities:

The North American cocktail market offers a fascinating view of business interests. With its rich history and passion for innovation, North America is a melting pot of cocktail trends and flavors. The diverse region has a variety of attractions and areas of interest; Driving requires a variety of cocktail knowledge. Especially Generation Y and Generation Z embrace the cocktail culture and seek originality, creativity and sustainability in their drinks. This demographic shift is increasing the demand for craft cocktails made with quality local and international ingredients. Additionally, the growing popularity of cocktail bars, speakeasies, and mixology events in major cities across North America in terms of business potential. The rise of consumer health has led to increased demand for low-calorie foods and natural ingredients, paving the way for new product development. Additionally, the growth of home entertainment due to the coronavirus disease (COVID-19) pandemic has created an opportunity for ready-to-drink (RTD) cocktails and cocktail mixers. As cocktail culture continues to evolve, North America has become a profitable place where companies can capitalize on consumer preferences and lifestyles, leading to business growth and innovation.

NORTH AMERICA COCKTAIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.37% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CANADA, MEXICO |

|

Key Companies Profiled |

Diageo plc , Pernod Ricard SA, Bacardi, Brown-Forman Corporation, Constellation Brands, Inc. , Five Drinks Co , New Holland Brewing Co LLC , Post Meridiem Spirit Co , The Crown Royal Co, Beam Suntory Inc |

North America Cocktail Market Segmentation:

North America Cocktail Market Segmentation by Type:

- Long Drink

- Short Drink

In 2023, based on Type, Fresh Cocktail are the dominant in the market and have more than 65% of the market share. A long drink or tall drink is a mixed drink of large size (>12 cl, usually 16-40 cl or 5-9 fl oz). The growth of tall drinks has been further fueled by the increasing preference for tall drinks because they are lighter and have less bloated feeling.

Moreover, the Long Drink segment is expected to grow at a CAGR of 11.8% during the forecast period 2024-2030 as it is a mixed alcoholic beverage with alcoholic and non-alcoholic ingredients and has less potency than short drinks where alcohols are flavored with other alcohols and thus long drink may be the preference for more mindful consumers.

North America Cocktail Market Segmentation by Application:

- Wedding Ceremony

- Backyard Barbeque

- Cocktail Party

- Others

In 2023, based on Application, Weeding Ceremony accounts for a 45% share of the North American market. The reason for this growth is the widespread use of cocktails at weddings in Western countries. Often, special cocktails are prepared for the bride and groom specifically for their celebration. The growing brand of wedding cocktails, which consists of alcoholic beverages mixed with fruit juice or other favorite ingredients, has strengthened the growth of this segment.

Additionally, the Backyard Barbecue segment is expected to grow during the forecast period 2024-2030 due to the increasing use of low-alcohol beverages such as Americano cocktails (which are a blend of alcoholic beverages such as Campari and sweet vermouth). The fastest CAGR occurred in soft drinks with 11.6%.

|

North America Cocktail Market Segmentation: Country Analysis:

- USA

- Canada

- Mexico

In 2023, based on Country, the United States, the region's largest market, has a diverse culture, from classic cocktails to innovative crafts. Big cities like New York, Los Angeles, and Chicago are the center of bartending competition with an emphasis on quality ingredients and drinking establishments.

Canada has a mix of traditional and modern cocktail scenes, cities like Toronto, Vancouver and Montreal showcase a combination of classic cocktails and local creations.

Mexico also contributes to the North American mushroom industry, although to a lesser extent than the United States and Canada. Famous for its tequila and mezcal, Mexico brings a strong and delicious taste to the cocktail market dominated by margaritas and palomas with creative cocktails prepared using local ingredients.

COVID-19 Impact Analysis on the North America Cocktail Market:

The COVID-19 pandemic has had a significant impact on the North American cocktail industry. It has changed consumer behavior, business practices, and business trends. The market has been severely impacted as restaurants, bars, and nightclubs face closures or reduced capacity due to widespread closures, quarantine measures, and restrictions on accommodation facilities. This has led to a decline in domestic consumption, which is an important source of income for many cocktail businesses, including bars, clubs, and hotels. As a result, there was a notable shift towards off-premise consumption, with consumers opting to enjoy cocktails at home.

The pandemic has also accelerated existing trends, such as e-commerce and the demand for ready-to-drink (RTD) cocktails. Online sales are crucial for businesses to reach consumers directly, leading to increased investments in digital marketing and e-commerce infrastructure. Additionally, the demand for DIY cocktail equipment and the ultimate home bartending experience is on the rise as consumers seek to recreate the experience in their own homes.

Additionally, health and safety concerns are driving interest in low-alcohol or alcohol-free foods and beverages made from natural ingredients and disease prevention. The shift towards healthier drinking options and health needs continues to influence consumer preferences even after the pandemic.

Latest Trends/ Developments:

The North American cocktail industry is experiencing some new trends and innovations that are reshaping the mixology and beverage culture landscape. One notable trend is the continuation of craft cocktails, with consumers increasingly looking for unique creations created with premium ingredients and innovative techniques. This trend is encouraging the growth of craft cocktail products in the region by offering consumers a variety of craft cocktails to suit their tastes.

Additionally, the industry is increasingly focusing on sustainability and environmental awareness. Bars and restaurants are adopting eco-friendly practices such as using biodegradable straws, sourcing local ingredients and reducing waste through creative cocktail services. In addition, considering the consumer's changing health preferences and desire to drink, the demand for low-alcohol and non-alcoholic cocktails is increasing.

Furthermore, technology plays an important role in improving the cocktail experience. Mobile apps and online platforms allow customers to search for new recipes, order cocktail ingredients for home delivery, and even take virtual mixology classes. In addition, the spread is faster with the use of digital solutions for contactless ordering and payment in stores and restaurants.

Collectively, these trends and developments demonstrate the strength of the North American cocktail industry, driven by consumer demand for quality, innovation, sustainability and convenience. As the economy continues to evolve, businesses are adapting and innovating to meet consumers' changing needs and preferences, ensuring a successful and exciting future for cocktail culture in the region.

Key Players:

- Diageo plc

- Pernod Ricard SA

- Bacardi

- Brown-Forman Corporation

- Constellation Brands, Inc.

- Five Drinks Co

- New Holland Brewing Co LLC

- Post Meridiem Spirit Co

- The Crown Royal Co

- Beam Suntory Inc

- In October 2023, The Coca-Cola Company and Pernod Ricard announced plans to Debut Absolut Vodka & Sprite Ready-To-Drink Cocktail.

- In November 2022, Captain Morgan unveiled a new addition to their spirits lineup - the Sliced Apple Spirit Drink. Infused with autumnal flavors, this spirit was introduced just in time for Bonfire Night and became available at Asda stores nationwide. Responding to the growing demand for flavored spirits, Captain Morgan has answered the call of fans, with the new spirit poised to be another crowd-pleaser.

Chapter 1. North America Cocktail Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Cocktail Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Cocktail Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Cocktail Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Cocktail Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Cocktail Market– By Application

6.1. Introduction/Key Findings

6.2. Wedding Ceremony

6.3. Backyard Barbeque

6.4. Cocktail Party

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Application

6.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. North America Cocktail Market– By Type

7.1. Introduction/Key Findings

7.2. Long Drink

7.3. Short Drink

7.4. Y-O-Y Growth trend Analysis By Type

7.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 8. North America Cocktail Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Cocktail Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Diageo plc

9.2. Pernod Ricard SA

9.3. Bacardi

9.4. Brown-Forman Corporation

9.5. Constellation Brands, Inc.

9.6. Five Drinks Co

9.7. New Holland Brewing Co LLC

9.8. Post Meridiem Spirit Co

9.9. The Crown Royal Co

9.10. Beam Suntory Inc

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

North America's Cocktail Market was valued at USD 428 million in 2023 and is projected to reach a market size of USD 1030 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.37%.

The segments under the North America Cocktail Market based on Type are Long Drink and Short Drink

The USA is dominant in the North America Cocktail Market.

Diageo plc, Pernod Ricard SA, Bacardi, Brown-Forman Corporation, Constellation Brands, Inc., etc.

The COVID-19 pandemic has had a significant impact on the North American cocktail industry. It has changed consumer behavior, business practices, and business trends. The market has been severely impacted as restaurants, bars, and nightclubs face closures or reduced capacity due to widespread closures, quarantine measures, and restrictions on accommodation facilities. This has led to a decline in domestic consumption, which is an important source of income for many cocktail businesses, including bars, clubs, and hotels. As a result, there was a notable shift towards off-premise consumption, with consumers opting to enjoy cocktails at home.