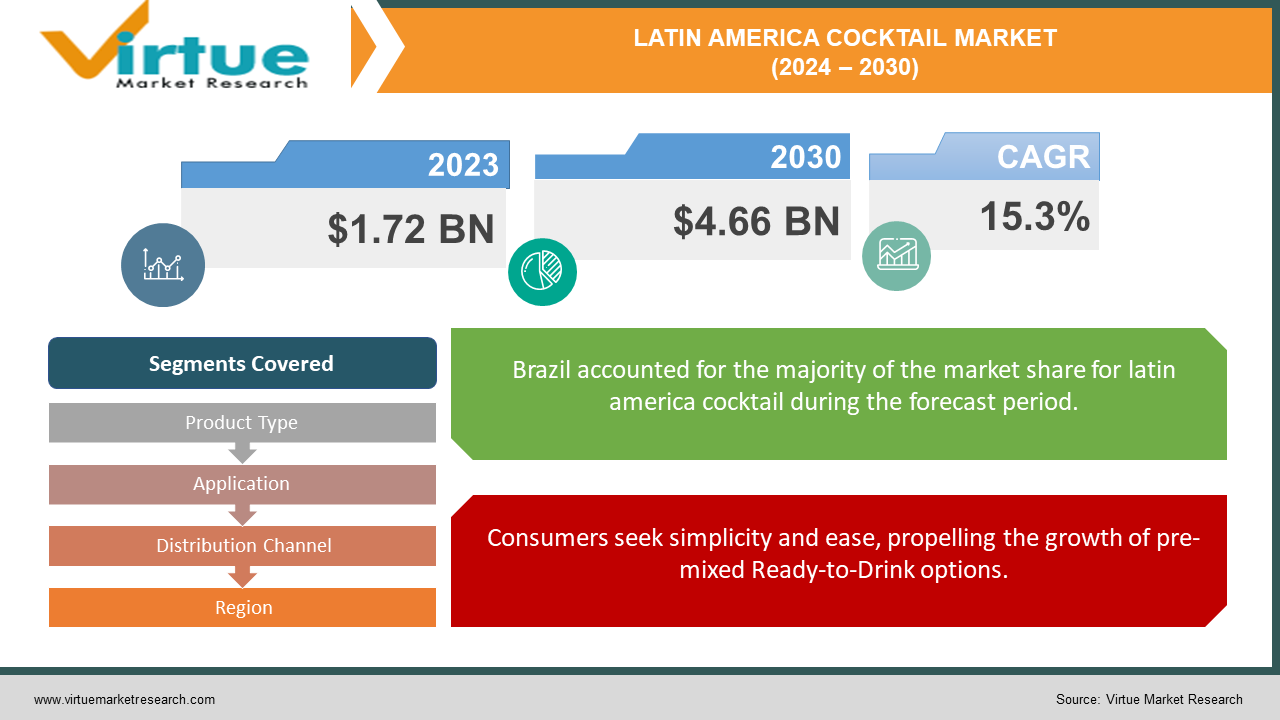

Latin America Cocktail Market Size (2024-2030)

The Latin America Cocktail Market was valued at USD 1.72 billion in 2023 and is projected to reach a market size of USD 4.66 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.3%.

The Latin American cocktail market is experiencing a boom, driven by a desire for convenience and exciting new flavors. Consumers are increasingly reaching for ready-to-drink (RTD) cocktails, which are pre-mixed and come in cans or bottles.

Key Market Insights:

The Latin American cocktail market is experiencing a delightful transformation. Convenience reigns supreme, with pre-mixed Ready-to-Drink (RTD) cocktails leading the charge at a staggering 6% CAGR. These bottled or canned concoctions cater to busy lifestyles, perfectly suited for those who want to skip the measuring and mixing. This segment's dominance reflects a broader trend in Latin America - a growing 40% of the population now lives in urban areas, and busier lives demand faster solutions.

The way Latin Americans acquire their cocktails is also evolving. While specialty stores currently hold the largest market share, online retail is anticipated to surge by 20% in the coming years. This shift reflects the growing comfort with online shopping and the wider selection it offers. The rise of entertaining at home is another key factor, potentially favoring RTD options for their convenience and ease of use in a home setting. With these trends in mind, the Latin American cocktail market promises to be a dynamic and exciting space for consumers and businesses alike.

Latin America Cocktail Market Drivers:

Consumers seek simplicity and ease, propelling the growth of pre-mixed Ready-to-Drink options.

Busy lifestyles across Latin America are fueling a surge in demand for Ready-to-Drink (RTD) cocktails. Consumers, strapped for time, increasingly seek out the ease and simplicity of pre-mixed cocktails in cans or bottles. This eliminates the need for measuring ingredients, finding specific spirits, or mastering complex mixing techniques – perfect for enjoying a delicious cocktail after a long workday or during a social gathering.

The popularity of hosting gatherings at home fuels the demand for convenient RTD cocktails for effortless entertaining.

The popularity of entertaining at home is another key driver of the Latin American cocktail market. As people increasingly host gatherings in their own spaces, at-home cocktail consumption is experiencing a significant boost. This trend potentially favors RTD options due to their convenience and ease of use. Gone are the days of scrambling to find the right ingredients or mastering complicated cocktail recipes. RTDs offer a simple solution for creating delicious and impressive cocktails within the comfort of one's own home, further propelling the growth of this segment within the market.

Latin America Cocktail Market Restraints and Challenges:

While the Latin American cocktail market enjoys a refreshing surge, it's not all sunshine and margaritas. Government regulations can put a damper on the party. Strict limitations and high taxes on alcoholic beverages, including cocktails, can significantly increase prices for consumers and stifle market growth.

Health concerns are another potential hangover. As awareness of the negative effects of excessive alcohol consumption rises, consumer enthusiasm for cocktails might wane. Public health initiatives and changing attitudes towards alcohol could pose a significant challenge. Economic woes can also steal the buzz. Latin America's economic climate can be unpredictable, with fluctuations in currency and disposable income impacting consumer spending. If people have less money for leisure activities and beverages like cocktails, market growth could slow down.

The competition is also stiff. Established alcoholic beverage categories like beer, wine, and spirits offer stiff competition to the cocktail market. Consumers might choose these familiar options, potentially impacting cocktail sales. Finally, keeping things chilled can be a challenge. The widespread availability of cold RTD cocktails can be limited by underdeveloped cold chain infrastructure in some Latin American countries. This crucial infrastructure for transporting and storing chilled products can hinder the distribution and reach of these popular options. Despite these hurdles, the Latin American cocktail market is brimming with potential. By addressing these challenges and capitalizing on its strengths, this market is poised to continue shaking things up for years to come.

Latin America Cocktail Market Opportunities:

Consumers with a taste for the finer things are driving a trend towards premiumization. This means high-quality RTD cocktails with unique ingredients like craft spirits, botanicals, and artisanal touches are a sure bet. Localization is another key to success. Latin Americans love a taste of home, so RTDs that incorporate regional flavors or offer twists on classic recipes will resonate with this market and foster brand loyalty. But health is a rising concern too. Developing RTDs with natural ingredients, lower sugar content, or even a functional twist like added vitamins or botanicals could be a healthy profit booster. Sustainability is another way to win hearts. Investing in eco-friendly packaging solutions like recyclable or biodegradable materials for RTDs shows customers you care about the environment, just like they do. The digital world also presents a golden opportunity. By leveraging social media, targeted online advertising, and user-friendly e-commerce platforms, brands can connect with new audiences and make buying RTDs a breeze. Finally, with at-home entertainment on the rise, there's a thirst for knowledge. Offering online tutorials, recipe guides, or partnering with influencers to teach consumers how to create their cocktails using RTDs as a base can be a profitable way to quench that thirst. By capitalizing on these exciting opportunities, companies can position themselves to be major shakers and movers in the ever-evolving Latin American cocktail market.

LATIN AMERICA COCKTAIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15.3% |

|

Segments Covered |

By Product Type, application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile and Rest of Latin America |

|

Key Companies Profiled |

Cachaça 51, Grupo Modelo, Havana Club International S.A., Johnnie Walker House, Fábrica Nacional de Licores de Guatemala, Fábrica Central, Yulo |

Latin America Cocktail Market Segmentation:

Latin America Cocktail Market Segmentation: By Product Type:

- Short Drinks

- Long Drinks

Currently, the Latin American cocktail market is dominated by Short Drinks like Margaritas and Mojitos, known for their concentrated Flavors. However, the market is witnessing a significant shift towards Long Drinks like Cuba Libres and Piña Coladas, which are larger and more refreshing, catering to the desire for convenience and session-able cocktails. This trend is likely driven by the hot climate and social gatherings in the region.

Latin America Cocktail Market Segmentation: By Application:

- Backyard BBQs

- Wedding Ceremonies

- Cocktail Parties

- Other Applications

The Latin American cocktail market caters to diverse drinking occasions. Backyard BBQs are the current king of cocktail consumption, driven by the demand for easy-to-fix, refreshing drinks. This segment leverages the convenience of RTD cocktails perfectly. However, online retail is the fastest-growing distribution channel, with consumers increasingly opting for the wider selection and ease of shopping from home. This trend is likely to reshape how people access their favorite cocktails.

Latin America Cocktail Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Other Channels

The Latin American cocktail market caters to diverse preferences through segmentation. Supermarkets and hypermarkets currently reign supreme, offering a one-stop shop for both RTDs and cocktail ingredients for home bartenders. However, online retail is the fastest-growing channel, fuelled by convenience and wider product selection. This online surge caters to busy lifestyles and allows consumers to explore a broader range of cocktails beyond what local stores might offer.

Latin America Cocktail Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil boasts a booming market fueled by its large population and growing disposable income. RTDs reign supreme here, with consumers drawn to their convenience. Caipirinhas, a refreshing rum-based cocktail, remains a national favorite, but Brazilians are also open to exploring new and innovative flavors.

Argentina's cocktail culture leans towards the sophisticated. Here, specialty stores offering premium spirits and classic cocktails like the Negroni or Old Fashioned thrive. However, RTDs are gaining traction, particularly for casual gatherings like Asados (barbecues).

Colombia boasts a vibrant cocktail scene with a strong emphasis on local ingredients. Expect to find RTDs infused with tropical fruits like passionfruit or mango alongside classic cocktails with a Colombian twist. Aguardiente, a local sugarcane spirit, is a popular base for many Colombian cocktails.

COVID-19 Impact Analysis on the Latin America Cocktail Market:

The COVID-19 pandemic undeniably shook things up in the Latin American cocktail market. Lockdowns and social distancing measures forced bars and restaurants to close, causing a major dip in sales of cocktails traditionally enjoyed out on the town. However, this hardship presented a golden opportunity for the RTD (Ready-to-Drink) segment. Unable to visit their favorite bars, consumers turned to convenient pre-mixed cocktails for at-home enjoyment, fueling a surge in RTD demand and propelling the segment's growth. Limited physical shopping options also led to an e-commerce boom, with consumers flocking to online platforms to purchase RTDs and cocktail ingredients for home delivery. This trend towards online retail is expected to stay strong even as the world recovers from the pandemic. Interestingly, COVID-19 also impacted consumer preferences. While some opted for budget-friendly cocktail solutions, others sought premium RTDs with high-quality ingredients to create a luxurious at-home cocktail experience. In conclusion, the COVID-19 pandemic acted as a catalyst for the RTD segment and online retail within the Latin American cocktail market. While the market may see some adjustments as life normalizes, these trends are likely to continue shaping the future of the industry.

Latest Trends/ Developments:

The Latin American cocktail market continues to innovate and cater to the ever-changing desires of its consumers. One exciting trend is the rise of botanical and vegetable infusions in RTD cocktails. Think cucumber-infused Margaritas or rosemary-infused Gin & Tonics for a more complex and adventurous flavor profile. Another development is the growing demand for low and non-alcoholic options. As health-consciousness rises, brands are creating innovative RTDs that mimic the taste and experience of classic cocktails, but without the alcohol content. Subscription boxes are also popping up, offering curated selections of RTD cocktails delivered directly to consumers' doorsteps, making exploration of new flavors effortless. Finally, the market is embracing sustainability efforts. Eco-conscious consumers are driving a focus on using biodegradable or recyclable materials for cans and bottles, demonstrating the industry's commitment to environmental responsibility. These trends showcase the dynamic nature of the Latin American cocktail market, and by staying ahead of the curve, brands can position themselves for continued success in this exciting and ever-growing space.

Key Players:

- Cachaça 51

- Grupo Modelo

- Havana Club International S.A.

- Johnnie Walker House

- Fábrica Nacional de Licores de Guatemala

- Fábrica Central

- Yulo

Chapter 1. Latin America Cocktail Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Cocktail Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Cocktail Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Cocktail Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Cocktail Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Cocktail Market– By Product Type

6.1. Introduction/Key Findings

6.2. Short Drinks

6.3. Long Drinks

6.8. Y-O-Y Growth trend Analysis By Product Type

6.9. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Latin America Cocktail Market– By Application

7.1. Introduction/Key Findings

7.2 Backyard BBQs

7.3. Wedding Ceremonies

7.4. Cocktail Parties

7.5. Other Applications

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Latin America Cocktail Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3. Specialty Stores

8.4. Online Retail

8.5. Other Channels

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Latin America Cocktail Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Latin America

9.1.1. By Country

9.1.1.1. Mexico

9.1.1.2. Brazil

9.1.1.3. Argentina

9.1.1.4. Chile

9.1.1.5. Rest of Latin America

9.1.2. By Product Type

9.1.3. By Distribution Channel

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Latin America Cocktail Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cachaça 51

10.2. Grupo Modelo

10.3. Havana Club International S.A.

10.4. Johnnie Walker House

10.5. Fábrica Nacional de Licores de Guatemala

10.6. Fábrica Central

10.7. Yulo

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Latin America Cocktail Market was valued at USD 1.72 billion in 2023 and is projected to reach a market size of USD 4.66 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.3%.

Convenience Craving, Innovation Inspires Experimentation, Urbanization influences Social Scenes, Home Entertainment Boom, and the Rise of RTDs.

Short Drinks, Long Drinks.

Brazil reigns supreme in the Latin American Cocktail Market, boasting the largest population, growing disposable income, and a booming RTD segment.

Cachaça 51, Grupo Modelo, Havana Club International S.A., Johnnie Walker House, Fábrica Nacional de Licores de Guatemala, Fábrica Central, Yulo.