Asia Pacific Cocktail Market Size (2024-2030)

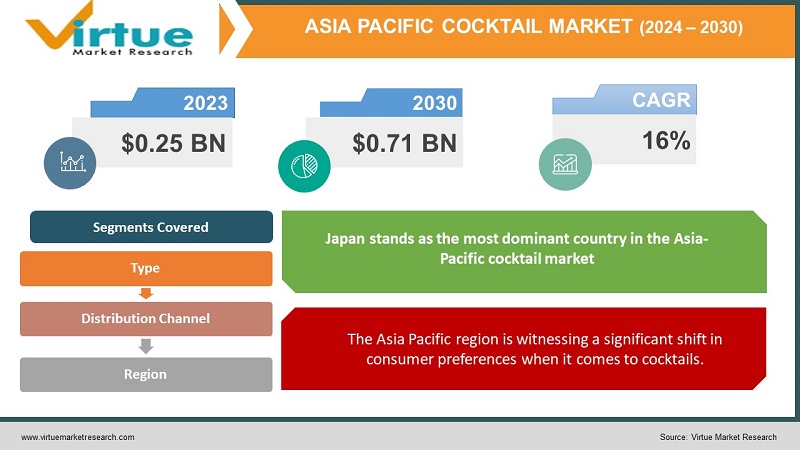

The Asia Pacific Cocktail Market was valued at USD 0.25 Billion in 2023 and is projected to reach a market size of USD 0.71 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 16%.

The Asia Pacific cocktail market is a vibrant scene, brimming with clinking glasses, innovative concoctions, and a growing thirst for high-quality libations. This market is experiencing a dynamic transformation, driven by a confluence of economic factors, evolving consumer preferences, and a burgeoning cocktail culture. The rapid growth of urban centers fosters a culture of socializing in bars and lounges, where cocktails are a popular beverage choice. Consumers are increasingly seeking premium experiences, including high-quality cocktails made with craft spirits and innovative ingredients. The growing influence of Western culture, particularly in major cities, is contributing to the popularity of cocktails. A growing interest in artisanal spirits and locally sourced ingredients is fueling the craft cocktail movement. This trend emphasizes skilled bartenders, unique flavor profiles, and a focus on the experience.

Key Market Insights:

By 2025, it is anticipated that the average disposable income in Asia Pacific will be USD 10,234, which will enable people to engage in recreational activities like sipping drinks at bars and restaurants.

The market for RTD cocktails is expanding rapidly; it was estimated to be worth USD 5.498 billion in 2023 and is projected to increase to USD 20.616 billion.

On-premises consumption (bars, restaurants, nightclubs) is expected to hold a dominant share of the market at around 65% in 2024, with the remaining 35% comprising off-premise consumption (retail stores, e-commerce platforms).

Disposable income across Asia Pacific is expected to reach an average of USD 10,234 per capita by 2025.

Consumers in the region are projected to spend an average of USD 32 per year on cocktails by 2025.

Convenience is a key factor driving the RTD cocktail market, with an estimated 65% of consumers valuing convenience when purchasing alcoholic beverages.

Online sales of alcoholic beverages in Asia Pacific are expected to reach USD 87.2 billion by 2025.

72% of consumers in Asia Pacific use social media to research and discover new alcoholic beverage brands.

2024 Nielsen survey indicates that 68% of consumers in Asia Pacific are willing to pay more for sustainable products.

Whiskey-based cocktails are expected to remain the most popular type, accounting for roughly 40% of the market share in 2024.

Asia Pacific Cocktail Market Drivers:

The Asia Pacific region is witnessing a significant shift in consumer preferences when it comes to cocktails.

As economies across the region strengthen, consumers have more disposable income to spend on leisure activities, including exploring premium cocktails. With the rise of travel and social media, consumers are exposed to international cocktail trends and sophisticated bar cultures. This fuels a desire to replicate these experiences in their own backyards. Millennials and Gen Z consumers prioritize experiences over material possessions. Well-crafted cocktails can be more than just a beverage; they can be an integral part of a memorable social experience. Partnering with skilled bartenders, hosting cocktail masterclasses, and showcasing unique cocktail-making techniques can elevate the brand image and attract enthusiasts. Consumers appreciate knowing the story behind the spirits and ingredients. Highlighting the provenance and quality of ingredients through creative storytelling can enhance the experience.

The rapid urbanization across the Asia Pacific is creating a vibrant social scene where socializing in bars and lounges is a popular pastime.

The increasing demand for social spaces is leading to a surge in the number of bars and lounges offering diverse cocktail menus. Bars and lounges create unique experiences through themed interiors, specialized menus, and curated music playlists, making cocktails an integral part of the overall ambiance. Cocktails are becoming a staple beverage for social gatherings, birthday celebrations, and special occasions, highlighting their role in fostering connections. Developing unique and interactive cocktail experiences with theatrical elements, tableside preparations, or personalized options can enhance customer engagement and brand loyalty. Creating a visually appealing and inviting atmosphere, coupled with well-trained bartenders who can guide customers through the cocktail menu, is crucial for attracting and retaining customers. Utilizing social media platforms and targeted online marketing campaigns can reach a wider audience, showcase exciting cocktails, and promote events, attracting customers seeking a vibrant social experience.

Asia Pacific Cocktail Market Restraints and Challenges:

Consumers who pay greater taxes may be deterred from frequenting bars and may choose to order cocktails instead. Tight laws may restrict outreach and marketing initiatives, which would impede the growth of brands and consumer base. There is intense competition in the cocktail sector in Asia Pacific. An increasing number of artisan spirit distilleries, individual bars, established pub chains and international spirits firms are competing for market share. It may be difficult for new companies to get noticed in this crowded market and for established firms to set themselves apart with their products. Concerns over the possible harm that excessive alcohol intake may have to one's health are becoming more prevalent as health consciousness increases. Furthermore, customers are thinking about the sustainability policies of bars and restaurants as they become more aware of environmental issues. While the demand for premium cocktails is growing, the availability and cost of high-quality spirits and ingredients can be a challenge in some parts of the Asia Pacific region. This can limit the ability of bars and restaurants to offer a diverse selection of premium cocktails.

Asia Pacific Cocktail Market Opportunities:

The Ready-to-Drink (RTD) cocktail segment is poised for explosive growth. Offering premium, innovative RTD options with convenient packaging and delivery services can cater to busy consumers and expand market reach beyond traditional bars and restaurants. Curated cocktail subscription boxes containing premium spirits, mixers, garnishes, and recipes can provide a unique and engaging experience for consumers. This allows them to explore new flavor profiles and experiment with cocktail creation in the comfort of their homes. Online platforms can be leveraged to offer interactive cocktail classes and tutorials led by skilled bartenders. This not only educates consumers but also fosters a sense of community and engagement with the cocktail culture. Bartenders can transform cocktail preparation into a captivating performance, incorporating flair techniques, tableside service, and storytelling elements to enhance the customer experience. Offering workshops or classes where customers can learn basic bartending skills and create their own personalized cocktails can foster engagement and a deeper appreciation for the craft. Utilizing locally sourced, seasonal fruits, herbs, and spices not only reduces the carbon footprint but also injects a touch of authenticity into the cocktail experience. This also supports local farmers and producers.

ASIA-PACIFIC COCKTAIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

|

Market Size Available |

2023 - 2030 |

|

|

Base Year |

2023 |

|

|

Forecast Period |

2024 - 2030 |

|

|

CAGR |

16% |

|

|

Segments Covered |

By Type, Distribution Channel and Region |

|

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

|

Regional Scope |

|

|

|

Key Companies Profiled |

Johnnie Walker, Smirnoff , Tanqueray, Bacardi, Pernod Ricard, Suntory Beverage & Food, ThaiBev , Archie Rose Distilling Co. , Nao Spirits , Rakuten , IMoët Hennessy , TCC Beverage, Ingevity Corporation |

Asia Pacific Cocktail Market Segmentation:

Asia Pacific Cocktail Market Segmentation: By Type

- Whiskey-Based Cocktails

- Gin-Based Cocktails

- Vodka-Based Cocktails

- Other Spirits

Whiskey-Based Cocktails: These have the highest market share (40%) and are the most popular because spirits such as blended Scotch, rye, and bourbon have long been popular. Depending on its provenance, grain composition, and aging procedure, whisky can have a wide range of flavors. Due to its adaptability, a wide variety of cocktail recipes are possible, ranging from robust and smokey to delicate and sweet. Whisky is a popular choice for celebratory meals and after-work cocktails because it goes well with a variety of cuisines. Well-known favorites are classic combos like steak and bourbon or oysters and rye whisky.

Gin-based cocktails are experiencing a remarkable surge in popularity across the Asia Pacific region. The rise of craft gins featuring unique botanical blends is fueling consumer interest. These gins offer exciting flavor profiles, ranging from floral and citrusy to spicy and herbal, allowing bartenders to create innovative and distinctive cocktails. Gin is often perceived as a lighter spirit compared to whiskey. This, coupled with the rise of low-calorie tonics and sugar-free mixers, makes gin-based cocktails appealing to health-conscious consumers. The refreshing and lighter nature of gin makes it ideal for summer months. Classic cocktails like Gin & Tonic and contemporary creations featuring seasonal fruits and herbs further enhance its appeal during warmer weather.

Asia Pacific Cocktail Market Segmentation: By Distribution Channel:

- On-Premises Consumption

- Off-Premises Consumption

- E-Commerce Platforms

- Other Channels

On-premises consumption (65%) is the undisputed king of the Asia Pacific cocktail scene, accounting for roughly two-thirds of the market share in 2023. On-premises establishments offer a personalized experience. Skilled bartenders can recommend cocktails, create customized options, and provide a touch of theatre with flair and tableside service. Bars, lounges, and nightclubs cater to the desire for social interaction. The atmosphere, music, and interaction with bartenders and other patrons create a unique social experience that's often intertwined with cocktail consumption. On-premises establishments serve as a platform for discovering new cocktails and trends. Bartenders can experiment with unique flavor combinations and techniques, pushing the boundaries of the cocktail scene.

Although on-premises is still the majority, off-premises sales are expected to increase more quickly due to convenience and changing customer tastes. Supermarkets and hypermarkets provide a practical way to buy mixers, spirits, and cocktail bottles for at-home use. Specialty stores provide a broader range of high-quality spirits, handmade mixers, and barware, catering to the discriminating cocktail connoisseur. Online retailers, who provide easy access to RTD (Ready-to-Drink) cocktails, cocktail kit subscription boxes, and direct-to-consumer spirits delivery, are a fast-expanding industry.

Asia Pacific Cocktail Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

Japan stands as the most dominant country in the Asia-Pacific cocktail market, driven by its long-standing cocktail culture, sophisticated palates, and a thriving nightlife scene. Japan has a deep-rooted cocktail culture that dates back to the late 19th century when the first Western-style bars and cocktail lounges were introduced. Over time, the Japanese have developed a unique and refined approach to cocktail-making, combining traditional Japanese ingredients and techniques with Western influences. Japan's major cities, such as Tokyo, Osaka, and Kyoto, boast a vibrant nightlife scene with a diverse array of cocktail bars, izakayas (Japanese-style pubs), and upscale lounges. This thriving nightlife culture has fueled the demand for innovative and unique cocktail creations.

China is emerging as the fastest-growing country in the Asia-Pacific cocktail market, driven by a combination of economic factors, evolving consumer preferences, and the influence of global trends. With the growth of the Chinese middle class and increasing disposable incomes, consumers are more willing to indulge in premium and luxury experiences, including high-end cocktails and nightlife. As China becomes more globally connected and exposed to Western culture, there has been a growing interest in cocktail culture and the associated lifestyle and social experiences. Chinese bartenders and mixologists are increasingly experimenting with unique ingredients, blending traditional Chinese flavors and techniques with contemporary cocktail trends, resulting in innovative and appealing creations.

COVID-19 Impact Analysis on the Asia Pacific Cocktail Market:

The market's vital organs, bars, lounges, and nightclubs were forced to close or function at reduced capacity. Cocktail sales saw a precipitous drop as a result, which had an effect on revenue streams and led to employment losses in the sector. Some alcohol and ingredients were in short supply due to disruptions in global supply lines, which made it more difficult for bars and restaurants to serve their regular cocktail menus. Ready-to-drink cocktails emerged as a saving grace. The convenience and safety of enjoying high-quality cocktails at home resonated with consumers, leading to a surge in RTD sales. Online platforms became a lifeline for both businesses and consumers. Bars and restaurants pivoted to offering delivery services for cocktails and cocktail kits, while e-commerce retailers witnessed a surge in demand for spirits, mixers, and barware. Bars and restaurants will prioritize safety measures like sanitation protocols, contactless ordering, and outdoor seating arrangements to rebuild customer confidence.

Latest Trends/ Developments:

Anticipate an increase in cocktails made with fruits and spices that are indigenous to particular areas. These ingredients, which range from native Australian wattle seed and Davidson plum to mangoes and lychees from Southeast Asia, give classic cocktails a distinctive touch while showcasing the richness of the Asia Pacific region. To develop distinctive base spirits for cocktails, craft distilleries are experimenting with locally grown grains such as japonica rice in Japan and red rice in China. This movement encourages local farming methods and satisfies the demand for authenticity in the area. Sourcing ingredients directly from local farms ensures freshness, reduces the carbon footprint, and supports sustainable farming practices. This allows bars to create seasonal cocktail menus that highlight the freshest local offerings. Techniques like using leftover fruit peels for infusions, opting for reusable straws and barware, and composting food scraps are becoming increasingy common. This minimizes waste generation and demonstrates a commitment to environmental responsibility.

Key Players:

- Johnnie Walker

- Smirnoff

- Tanqueray

- Bacardi

- Pernod Ricard

- Suntory Beverage & Food

- ThaiBev

- Archie Rose Distilling Co.

- Nao Spirits

- Rakuten

- IMoët Hennessy

- TCC Beverage

- Ingevity Corporation

Chapter 1. Asia Pacific Cocktail Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Cocktail Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Cocktail Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Cocktail Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Cocktail Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Cocktail Market– By Type

6.1. Introduction/Key Findings

6.2. Whiskey-Based Cocktails

6.3. Gin-Based Cocktails

6.4. Vodka-Based Cocktails

6.5. Other Spirits

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Asia Pacific Cocktail Market– By Distribution channel

7.1. Introduction/Key Findings

7.2. On-Premises Consumption

7.3. Off-Premises Consumption

7.4. E-Commerce Platforms

7.5. Other Channels

7.6. Y-O-Y Growth trend Analysis By Distribution channel

7.7. Absolute $ Opportunity Analysis By Distribution channel, 2024-2030

Chapter 8. Asia Pacific Cocktail Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Cocktail Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Johnnie Walker

9.2. Smirnoff

9.3. Tanqueray

9.4. Bacardi

9.5. Pernod Ricard

9.6. Suntory Beverage & Food

9.7. ThaiBev

9.8. Archie Rose Distilling Co.

9.9. Nao Spirits

9.10. Rakuten

9.11. IMoët Hennessy

9.12. TCC Beverage

9.13. Ingevity Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

A growing middle class across the Asia Pacific region translates to increased disposable income. This empowers consumers to spend more on leisure activities, including enjoying premium cocktails at bars and restaurants or indulging in high-quality ingredients for home cocktail creation

Excessive alcohol consumption is a serious public health concern across the Asia Pacific region. Governments may implement stricter regulations on alcohol advertising, sales, or taxation, potentially impacting the growth of the cocktail market.

Johnnie Walker, Smirnoff, Tanqueray, Bacardi, Pernod Ricard, Suntory Beverage & Food, ThaiBev, Archie Rose Distilling Co., Nao Spirits, Rakuten, IMoët Hennessy, TCC Beverage.

Japan has firmly established itself as the most dominant player in the Asia-Pacific market, commanding an impressive 35% market share

China emerges as the fastest-growing country in this sector. India's burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.