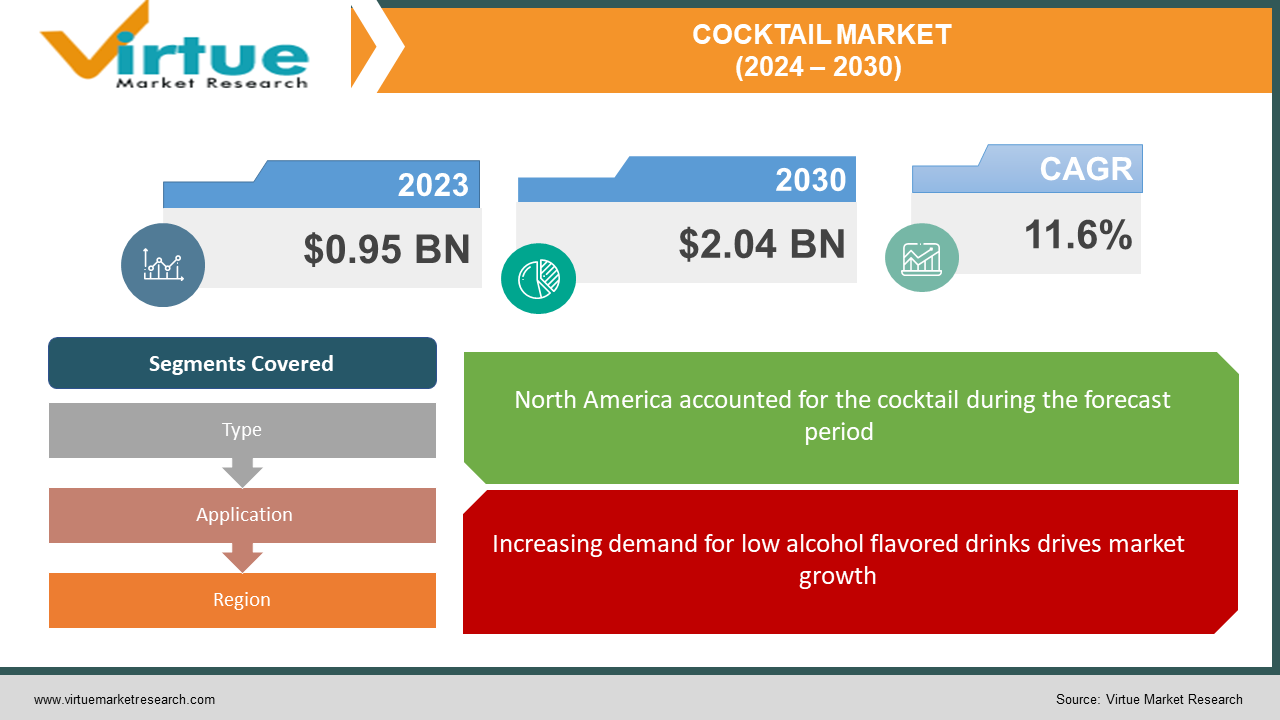

Cocktail Market Size (2024 – 2030)

The Cocktail Market was valued at USD 0.95 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 2.04 billion by 2030, growing at a CAGR of 11.6%.

A cocktail is defined as a beverage containing alcohol, such as gin, brandy, vodka, whiskey, tequila, or rum, mixed with various other ingredients like fruit juice, cream, honey, milk, sugar, herbs, or additional flavorings. Within the realm of alcohol appreciation, discerning trends are emerging among new enthusiasts seeking high-quality drinking experiences, driving a renewed focus on premiumization across spirit categories, including the popularization of premium-quality canned cocktails. The current trend of digital imbibing emphasizes the use of technology for enjoying alcoholic beverages conveniently from one's home, with spirits delivered directly to the consumer's doorstep.

Key Market Insights:

The market for cocktails is experiencing growth driven by an increase in disposable income and shifts in lifestyle choices, fostering a greater demand for such beverages. Furthermore, the availability of vegetable and botanical-based cocktails serves as a significant catalyst for the expansion of the global cocktail market. Additionally, countries like the U.S. exhibit a higher consumption rate and a well-established cocktail culture, offering promising growth prospects for market participants. However, it's imperative to note that excessive consumption of cocktails can lead to adverse health effects such as liver and heart damage, cancer, and mental health issues like depression, posing a constraint on the overall growth trajectory of the global market.

Cocktail Market Drivers:

Increasing demand for low alcohol flavored drinks drives market growth.

In developed nations, consumers are increasingly prioritizing health-conscious choices, leading to a shift towards low-alcohol flavored beverages. Typically containing alcohol levels ranging from 4% to 7%, these drinks are infused with flavors like cranberry, orange, lemon, and passion fruit, appealing to health-conscious individuals. Consequently, the rising popularity of low-alcohol by volume beverages has garnered significant attention in recent years. As a result, the market is expected to experience accelerated growth due to the surging demand for such flavorful, low-alcohol options.

The popularity of spirit-based cocktails increases market growth.

Spirit-based cocktails are projected to maintain their dominance in the bottled cocktail market throughout the forecast period. These cocktails typically contain alcohol levels of up to 5%, blended with various other ingredients such as juices, and are conveniently packaged in single-serve containers offering a wide array of flavors. Commonly utilized spirits include whiskey, vodka, gin, tequila, and rum. The diverse range of options, including cocktails infused with lavender, ginger, and rose, coupled with the spirits themselves, has contributed to their increasing preference among consumers seeking low-alcohol beverages. Consequently, the growing popularity of spirit-based cocktails is expected to propel the market growth rate in the forecast period.

Cocktail Market Opportunities:

The bottled cocktail market is marked by the presence of both well-established market leaders and numerous medium and small players. These companies have been actively introducing new products in response to the growing global demand for cocktails. As an example, in January 2022, The Coca-Cola Company entered into a brand authorization agreement with Constellation Brands Inc. to introduce FRESCA Mixed, a line of spirit-based ready-to-drink (RTD) cocktails in the U.S. This brand aims to cater to consumers seeking premium-quality RTD cocktails and richer flavor profiles, serving as a bridge between traditional bar cocktails and refreshing hard seltzers.

Cocktail Market Restraints and Challenges:

The growth of the bottled cocktail market is expected to face obstacles due to heavy taxation and duties, along with various health concerns associated with alcohol consumption. Additionally, religious and cultural beliefs prevalent in certain economies may present significant challenges to market expansion during the forecast period.

As alcoholic beverages, cocktails inherently share the same drawbacks as alcohol itself. Potential limitations of consuming cocktails include loss of self-control and the risk of liver damage. Prolonged consumption can lead to progressive degeneration of the nervous system and contribute to conditions such as obesity due to excessive calorie intake. Moreover, addiction, sedation, and even fatalities may occur as severe consequences. Conditions such as acute alcohol poisoning and chronic alcohol intoxication are also potential risks associated with cocktail consumption. These inherent disadvantages of cocktails contribute to hindrances in the growth of the Cocktail Market.

COCKTAIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.6% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Brown-Forman Corporation (U.S.), Bacardi Limited (Bermuda), Asahi Group Holdings, Ltd. (Japan), Suntory Holdings Limited (Japan), Halewood International Limited (U.K.), Mike's Hard Lemonade Co. (U.S.), JMR Cocktails Limited (New Zealand), The Miller Brewing Company (U.S.), Castel Group (France), PernodRicard SA (France) |

Cocktail Market Segmentation: By Type

-

Long Drink

-

Short Drink

The Cocktail Market, categorized by type, includes Long Drink and Short Drink segments. The Long Drink segment currently holds the largest market share, primarily driven by the increasing consumption of Long Drinks, particularly notable in countries like Finland. A Long Drink, also known as a tall drink, is an alcoholic beverage blended to a relatively large volume (> 12 cl, often between 16–40 cl or 5–9 fluid ounces). The growing preference for Long Drinks is attributed to their lighter nature, which avoids a bloated sensation, further bolstering the growth of this segment.

Moreover, the Long Drink segment is expected to exhibit the fastest Compound Annual Growth Rate (CAGR) of 12.1% during the forecast period. This growth can be attributed to Long Drinks being concoctions of alcohol blended with non-alcoholic components, offering lower potency compared to short drinks where alcohol is flavored with other alcohols. Consequently, Long Drinks are increasingly preferred by more health-conscious consumers.

Cocktail Market Segmentation: By Application

-

Wedding Ceremony

-

Backyard Barbeque

-

Cocktail Party

-

Others

The Cocktail Market, segmented by application, includes categories such as Wedding Ceremonies, Backyard Barbeque, Cocktail Parties, and Others. Among these, the Wedding Ceremony segment currently holds the largest market share, primarily driven by the widespread use of customized cocktails during wedding ceremonies in Western countries. Typically, bespoke cocktails tailored to the preferences of the bride and groom are prepared to commemorate the occasion. The increasing symbolism of wedding ceremonies through specially crafted cocktails, comprising alcoholic beverages mixed with fruit juices or other preferred ingredients, further contributes to the growth of this segment.

Additionally, the Backyard Barbeque segment is anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR) of 12.3% during the forecast period. This growth is attributed to the widespread adoption of classic low-proof cocktails such as the Americano Cocktail, which blends alcoholic ingredients like Campari and sweet vermouth with club soda, making them particularly suitable for casual outdoor gatherings like backyard barbecues.

Cocktail Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

In terms of revenue and market share, Europe stands out as the dominant force in the bottled cocktail market. This leadership position is primarily attributed to the rising interest in mixed refreshments and the growing preference for bottled cocktails among millennials across the region.

North America is anticipated to experience the most rapid growth during the forecast period, driven by shifting consumer lifestyles and high purchasing power in the region. The burgeoning consumption of alcoholic beverages in North America contributes significantly to this growth trajectory. Moreover, the increasing demand for on-the-go products offering diverse flavors, coupled with the presence of key players like Miami Cocktail Co., further accelerates the expansion of the Cocktail Market in North America.

Meanwhile, the Asia-Pacific region is expected to exhibit the fastest growing rate over the forecast period. This growth is attributed to factors such as improved lifestyles resulting from increased income levels in communities across the Asia-Pacific region. The surge in demand for premium, convenient, and high-quality cocktails, driven by the growing influence of Western culture, along with the increasing popularity of vodka and whiskey-based beverages, contributes to the rapid progress of the Cocktail Market in the Asia-Pacific region.

COVID-19 Pandemic: Impact Analysis

The Cocktail industry has traditionally been associated with social gatherings, parties, and various celebratory occasions. However, the onset of the COVID-19 pandemic and subsequent lockdown measures, which commenced in late March, had profound effects across all sectors, including our industry. Regrettably, the pandemic and enforced lockdowns, coupled with the implementation of social distancing protocols, led to a notable decline in business, with global consumption experiencing a significant drop of 15 percent and a corresponding 35-40 percent decrease in overall industry activity. Furthermore, bars and restaurants bore the brunt of the impact, enduring complete shutdowns that further exacerbated the industry's challenges.

Latest Trends/ Developments:

In November 2022, Captain Morgan unveiled a new addition to their spirits lineup - the Sliced Apple Spirit Drink. Infused with autumnal flavors, this spirit was introduced just in time for Bonfire Night and became available at Asda stores nationwide. Responding to the growing demand for flavored spirits, Captain Morgan has answered the call of fans, with the new spirit poised to be another crowd-pleaser.

Key Players:

These are top 10 players in the Cocktail Market: -

-

The Brown-Forman Corporation (U.S.)

-

Bacardi Limited (Bermuda)

-

Asahi Group Holdings, Ltd. (Japan)

-

Suntory Holdings Limited (Japan)

-

Halewood International Limited (U.K.)

-

Mike's Hard Lemonade Co. (U.S.)

-

JMR Cocktails Limited (New Zealand)

-

The Miller Brewing Company (U.S.)

-

Castel Group (France)

-

PernodRicard SA (France)

Chapter 1. Cocktail Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cocktail Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cocktail Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cocktail Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cocktail Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cocktail Market – By Type

6.1 Introduction/Key Findings

6.2 Long Drink

6.3 Short Drink

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Cocktail Market – By Application

7.1 Introduction/Key Findings

7.2 Wedding Ceremony

7.3 Backyard Barbeque

7.4 Cocktail Party

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Cocktail Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cocktail Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Brown-Forman Corporation (U.S.)

9.2 Bacardi Limited (Bermuda)

9.3 Asahi Group Holdings, Ltd. (Japan)

9.4 Suntory Holdings Limited (Japan)

9.5 Halewood International Limited (U.K.)

9.6 Mike's Hard Lemonade Co. (U.S.)

9.7 JMR Cocktails Limited (New Zealand)

9.8 The Miller Brewing Company (U.S.)

9.9 Castel Group (France)

9.10 PernodRicard SA (France)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for cocktails is experiencing growth driven by an increase in disposable income and shifts in lifestyle choices, fostering a greater demand for such beverages.

The top players operating in the Cocktail Market are - The Brown-Forman Corporation (U.S.), Bacardi Limited (Bermuda), Asahi Group Holdings, Ltd. (Japan), Suntory Holdings Limited (Japan), Halewood International Limited (U.K.), Mike's Hard Lemonade Co. (U.S.), JMR Cocktails Limited (New Zealand), The Miller Brewing Company (U.S.), Castel Group (France), PernodRicard SA (France).

The pandemic and enforced lockdowns, coupled with the implementation of social distancing protocols, led to a notable decline in business, with global consumption experiencing a significant drop of 15 percent and a corresponding 35-40 percent decrease in overall industry activity.

The bottled cocktail market is marked by the presence of both well-established market leaders and numerous medium and small players. These companies have been actively introducing new products in response to the growing global demand for cocktails.

The Asia-Pacific region is expected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period, 2024-2030. This tremendous growth is attributed to factors such as improved lifestyles resulting from increased income levels in communities across the Asia-Pacific region.