Middle East And Africa Food Additives Market Size (2024-2030)

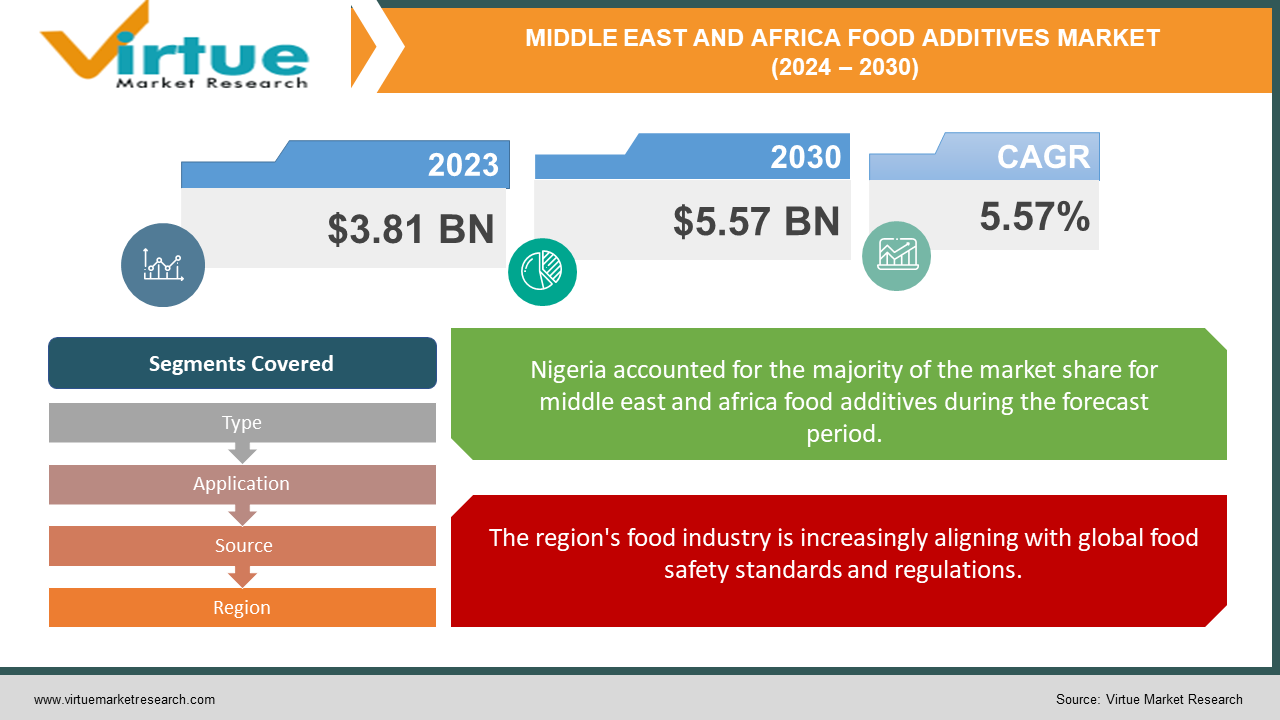

The Middle East And Africa Food Additives Market, valued at USD 3.81 billion in 2023, is projected to achieve a market size of USD 5.57 billion by 2030. This growth trajectory anticipates a compound annual growth rate (CAGR) of 5.57% from 2024 to 2030.

The Middle East and Africa (MEA) food additives market encompasses a diverse array of substances used to enhance the flavor, texture, appearance, and preservation of food products. This market is driven by the region's increasing urbanization, changing dietary habits, and the growing demand for convenience and processed foods. Key factors influencing the market include the rising awareness of health and wellness, leading to a preference for natural and clean-label additives, and the robust growth of the food and beverage industry.

Middle East And Africa Food Additives Market Drivers:

Primary drivers of the Middle East and Africa (MEA) food additives market are the burgeoning urbanization and changing dietary patterns.

As urban centers expand, the lifestyle of the population undergoes significant shifts, leading to increased demand for processed and convenience foods. This transition is influenced by the growing middle-class population with higher disposable incomes and a preference for ready-to-eat meals. Consequently, there is a heightened need for food additives to enhance flavor, texture, and shelf life, which are crucial for processed foods.

The Middle East and Africa (MEA) food additives market is the burgeoning demand for processed and convenience foods.

With rapid urbanization and a growing middle-class population, consumer lifestyles in the region are becoming increasingly fast-paced. This shift is fostering a higher inclination towards ready-to-eat meals, snacks, and other convenience food products that require a range of food additives to enhance flavor, preserve freshness, and maintain quality. Additionally, the rising awareness of food safety and quality standards among consumers is pushing manufacturers to adopt advanced additives to meet these expectations. The MEA region is also witnessing an expansion of modern retail formats, such as supermarkets and hypermarkets, which further amplifies the accessibility and availability of processed foods. This dynamic, coupled with increasing disposable incomes, is driving the demand for food additives as essential components in the production and preservation of a wide array of food products, thereby propelling the market's growth trajectory.

The region's food industry is increasingly aligning with global food safety standards and regulations.

Propelling the use of food additives that comply with these stringent guidelines. Health-conscious consumers are also driving demand for natural and clean-label additives, encouraging manufacturers to innovate and diversify their product offerings. These dynamics collectively create a robust framework for the food additives market in the MEA region, fostering growth and innovation while meeting the evolving preferences and regulatory requirements of the modern consumer.

Challenges in the Middle East And Africa Food Additives Market:

Regulatory Hurdles and Compliance Issues:

One of the significant challenges in the Middle East and Africa food additives market is the diverse and stringent regulatory landscape. Each country within the region often has its own set of regulations and standards for food additives, making it difficult for manufacturers to achieve compliance. This patchwork of regulations can lead to increased costs and delays as companies navigate through various bureaucratic requirements and ensure their products meet the local safety and quality standards. Additionally, the lack of harmonization in regulatory frameworks can hinder market expansion and pose barriers to entry for new players.

Economic Instability and Supply Chain Disruptions:

The region's economic volatility, driven by factors such as fluctuating oil prices, political instability, and currency devaluations, poses a significant restraint on the food additives market. Economic instability can lead to reduced consumer spending power, impacting the overall demand for food products, including those containing additives. Moreover, supply chain disruptions, exacerbated by geopolitical tensions and inadequate infrastructure, can impede the steady supply of raw materials and finished products. These disruptions can result in increased costs and logistical challenges for manufacturers, affecting their ability to maintain consistent product quality and availability in the market.

Opportunities in the Middle East And Africa Food Additives Market:

One of the most significant opportunities lies in the rising demand for natural and clean-label additives.

As health consciousness among consumers in the MEA region grows, there is a noticeable shift towards products that are perceived as healthier and free from artificial ingredients. This trend is spurring manufacturers to innovate and incorporate natural additives such as plant extracts, natural colorants, and organic preservatives. Companies that can effectively capitalize on this demand by offering high-quality, naturally derived additives stand to gain a competitive edge.

Furthermore, the region's diverse culinary traditions and flavors offer a unique platform for the introduction of novel additives that enhance taste and nutrition. With urbanization and rising disposable incomes, there is an increasing appetite for processed and convenience foods, further bolstering the need for food additives that extend shelf life, improve texture, and maintain product integrity.

MIDDLE EAST AND AFRICA FOOD ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.57% |

|

Segments Covered |

By Type, application, source, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

ADM (Archer Daniels Midland Company), BASF SE, Cargill, Incorporated, DuPont de Nemours, Inc., Kerry Group plc, Ingredion Incorporated, Chr. Hansen Holding A/S, Tate & Lyle PLC, Ajinomoto Co., Inc., DSM Nutritional Products AG, Givaudan SA, Symrise AG, Firmenich SA, Ashland Global Holdings Inc., Corbion NV. |

Middle East And Africa Food Additives Market Segmentation:

Middle East And Africa Food Additives Market Segmentation: By Type

- Preservatives

- Sweeteners

- Emulsifiers

- Anti-caking agents

- Enzymes

- Hydrocolloids

- Colorants

- Flavors

- Acidulants

- Others

In the Middle East and Africa food additives market, preservatives hold the highest market share, underscoring their crucial role in extending the shelf life of food products, particularly in the region's hot climate. Simultaneously, the sweeteners segment is experiencing the fastest growth, propelled by increasing consumer demand for low-calorie and sugar-free products amid rising health concerns. Other significant segments include emulsifiers, which are essential for maintaining food texture and consistency; anti-caking agents, which prevent lumps in powdered products; and enzymes, which enhance food processing efficiency. The market's diversity is further enriched by hydrocolloids, valued for their thickening properties, and colorants, which enhance food's visual appeal. Flavors, crucial for taste enhancement, are also rapidly growing, especially as consumers seek exotic and ethnic options. Acidulants, vital for tartness and preservation, and a variety of other additives such as nutritional supplements and stabilizers, round out the market, contributing to its estimated valuation of USD 1.8 billion in 2023, with an expected CAGR of 5.5% from 2024 to 2029.

Middle East And Africa Food Additives Market Segmentation: By Applications

- Bakery & Confectionery

- Beverages

- Dairy & Frozen Desserts

- Snacks & Convenience Foods

- Meat & Poultry Products

- Sauces, Dressings, and Condiments

- Others

The Middle East and Africa food additives market is dynamically evolving, with the snacks and convenience foods segment emerging as the fastest-growing, boasting an impressive compound annual growth rate (CAGR) of over 6%. This growth is driven by the increasing preference for quick and easy meal solutions among the region's busy consumers. Simultaneously, the bakery and confectionery segment holds the highest market share at 25%, fueled by the rising demand for baked goods and sweets. Other key segments, including beverages, dairy and frozen desserts, and meat and poultry products, also contribute significantly to the market, catering to the region's diverse and expanding culinary landscape. This vibrant market reflects a broader trend towards convenience, enhanced flavors, and extended shelf life in food products, underscoring the vital role of additives in meeting these consumer demands.

Middle East And Africa Food Additives Market Segmentation: By Source

- Natural

- Synthetic

The Middle East and Africa (MEA) food additives market is notably dominated by the natural food additives segment, which stands out as both the highest in market share and the fastest-growing category. In 2023, natural additives commanded approximately 58% of the market, a reflection of the region's increasing consumer preference for organic and clean-label products. This segment's rapid expansion, with a projected compound annual growth rate (CAGR) of 6.5% from 2024 to 2029, underscores the heightened health awareness and regulatory support favoring natural over synthetic alternatives. Although synthetic food additives, which held a 42% market share in 2023, continue to be essential due to their cost-effectiveness and functional benefits, they are expected to grow at a slower rate of 4.3% CAGR. This market dynamic indicates a significant shift towards natural additives, driven by evolving consumer demands and stringent health regulations, positioning them as the focal point of the MEA food additives market's future growth.

Middle East And Africa Food Additives Market Segmentation: By Region

- UAE

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The Middle East and Africa food additives market is witnessing robust growth, with Nigeria emerging as the fastest-growing segment, boasting a projected CAGR of 6.3%, while South Africa commands the highest market share at approximately 25%. This dynamic region is characterized by diverse growth patterns, where Saudi Arabia, with a significant 20% market share, is expanding at a notable CAGR of 6.0%, fueled by the rising demand for convenience foods. The UAE and Israel, contributing 15% and 10% of the market share respectively, are also experiencing steady growth driven by advanced food processing sectors and technological innovation. Meanwhile, Qatar, Kenya, and Egypt, holding market shares of 7%, 8%, and 10% respectively, continue to see increased demand for processed foods. The Rest of MEA, encompassing countries like Oman, Kuwait, and Bahrain, collectively holds 8% of the market, reflecting a steady CAGR of 4.5%. This diverse growth landscape underscores the region's evolving food industry, driven by urbanization, rising disposable incomes, and a burgeoning appetite for packaged and convenience foods.

Impact of COVID-19 on the Middle East And Africa Food Additives Market:

The COVID-19 pandemic has left a profound imprint on the Middle East and Africa Food Additives Market, intertwining challenges with transformative shifts. As the pandemic disrupted global supply chains, the food additives sector faced significant hurdles, including raw material shortages and logistical constraints. However, this period also spurred innovation and adaptation, as manufacturers pivoted towards local sourcing and digital solutions to mitigate supply chain disruptions. Consumer behavior shifted dramatically, with an increased demand for food products perceived as healthier and more natural, propelling the market for clean labels and natural additives. Additionally, heightened food safety concerns and the necessity for longer shelf lives during lockdowns underscored the importance of preservatives and antimicrobial additives. Despite initial setbacks, the market demonstrated resilience through strategic adjustments and accelerated adoption of technological advancements, such as AI and automation, to optimize production and quality control. In the post-pandemic era, the sector is poised for robust growth, driven by a renewed focus on health and wellness, sustainability, and local production. This dynamic period has not only highlighted the vulnerabilities within the food additives supply chain but has also catalyzed a paradigm shift towards more resilient, innovative, and consumer-centric approaches in the Middle East and Africa. The industry's ability to adapt and evolve amidst unprecedented challenges showcases a promising trajectory, underscored by an enduring commitment to meeting evolving consumer preferences and ensuring food security in the region.

Latest Trends and Developments:

The market is supported by technological advancements in food processing and preservation techniques, which have expanded the range and effectiveness of additives available. In the MEA region, regulatory frameworks and standards play a crucial role in shaping market dynamics and ensuring the safety and quality of food additives. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are notable contributors to market growth, driven by their strong economic development and increasing consumer spending on food products. Moreover, local manufacturers and international players are focusing on innovation and strategic partnerships to capture a larger market share. As consumer preferences continue to evolve, the MEA food additives market is poised for steady growth, driven by the dual forces of rising demand for enhanced food quality and the ongoing trend towards healthier and more sustainable food options.

Middle East And Africa Food Additives Market Key Players:

- ADM (Archer Daniels Midland Company)

- BASF SE

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- Kerry Group plc

- Ingredion Incorporated

- Chr. Hansen Holding A/S

- Tate & Lyle PLC

- Ajinomoto Co., Inc.

- DSM Nutritional Products AG

- Givaudan SA

- Symrise AG

- Firmenich SA

- Ashland Global Holdings Inc.

- Corbion NV

Chapter 1. Middle East and Africa food additives Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa food additives Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa food additives Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa food additives Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa food additives Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa food additives Market– By Type

6.1. Introduction/Key Findings

6.2. Preservatives

6.3. Sweeteners

6.4. Emulsifiers

6.5. Anti-caking agents

6.6. Enzymes

6.7. Hydrocolloids

6.8. Colorants

6.9. Flavors

6.10. Acidulants

6.11. Others

6.12. Y-O-Y Growth trend Analysis By Type

6.13. Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Middle East and Africa food additives Market– By Application

7.1. Introduction/Key Findings

7.2 Bakery & Confectionery

7.3. Beverages

7.4. Dairy & Frozen Desserts

7.5. Snacks & Convenience Foods

7.6. Meat & Poultry Products

7.7. Sauces, Dressings, and Condiments

7.8. Others

7.9. Y-O-Y Growth trend Analysis By Application

7.10. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East and Africa food additives Market– By Source

8.1. Introduction/Key Findings

8.2. Natural

8.3. Synthetic

8.4. Y-O-Y Growth trend Analysis By Source

8.5. Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 9 . Middle East and Africa food additives Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Type

9.1.3. By application

9.1.4. Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa food additives Market– Company Profiles – (Overview, Type Type Portfolio, Financials, Strategies & Developments)

10.1. ADM (Archer Daniels Midland Company)

10.2. BASF SE

10.3. Cargill, Incorporated

10.4. DuPont de Nemours, Inc.

10.5. Kerry Group plc

10.6. Ingredion Incorporated

10.7. Chr. Hansen Holding A/S

10.8. Tate & Lyle PLC

10.9. Ajinomoto Co., Inc.

10.10. DSM Nutritional Products AG

10.11. Givaudan SA

10.12. Symrise AG

10.13. Firmenich SA

10.14. Ashland Global Holdings Inc.

10.15. Corbion NV

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Middle East And Africa Food Additives Market, valued at USD 3.81 billion in 2023, is projected to achieve a market size of USD 5.57 billion by 2030. This growth trajectory anticipates a compound annual growth rate (CAGR) of 5.57% from 2024 to 2030.

The Segments under the Middle East And Africa Food Additives Market by type are Preservatives, Sweeteners, Emulsifiers, Anti-caking agents, Enzymes, Hydrocolloids, Colorants, Flavors, Acidulants, and Others.

Some of the top industry players in the Middle East And Africa Food Additives Market are ADM (Archer Daniels Midland Company), BASF SE, Cargill, Incorporated, DuPont de Nemours, Inc., Kerry Group plc, Ingredion Incorporated, Chr. Hansen Holding A/S, Tate & Lyle PLC, Ajinomoto Co., Inc., DSM Nutritional Products AG, Givaudan SA, Symrise AG, Firmenich SA, Ashland Global Holdings Inc., Corbion NV.

The Middle East And Africa Food Additives Market is segmented based on type, applications, sources, and region

The Natural sector is the most common source of the Middle East And Africa Food Additives Market.