Nanomaterials as Food Additives Market Size (2024-2030)

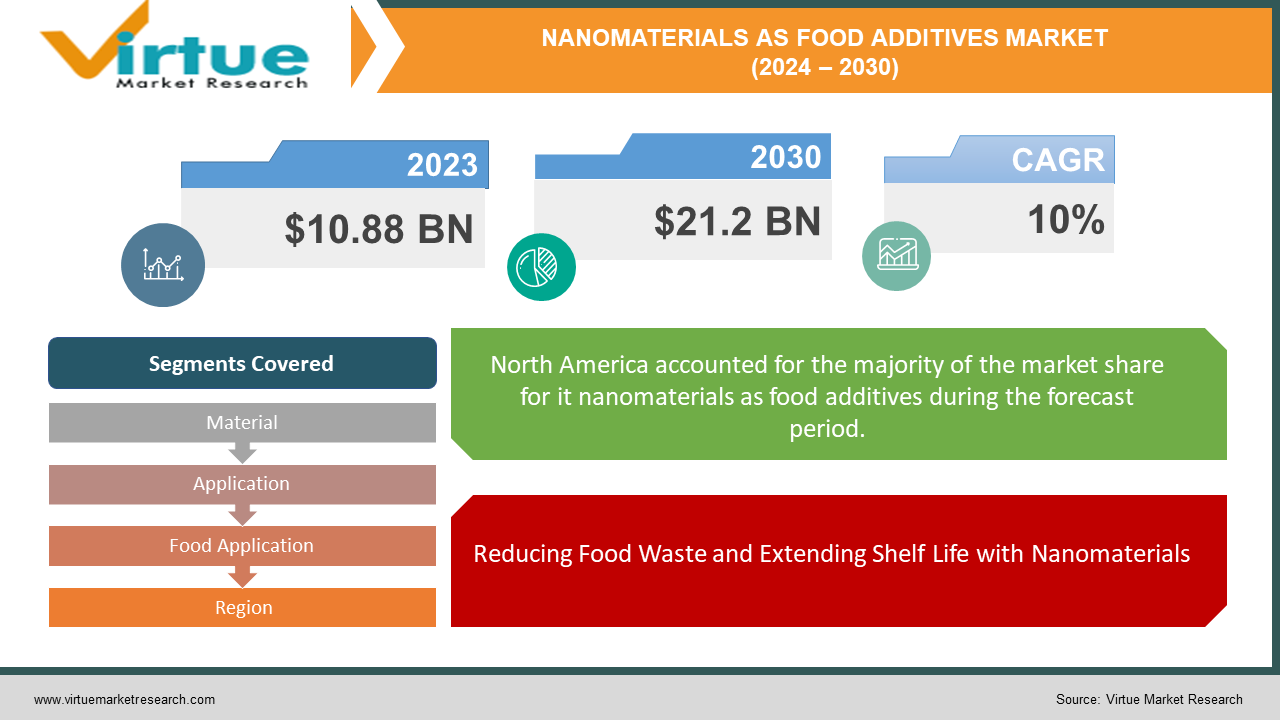

The Nanomaterials as Food Additives Market was valued at USD 10.88 billion in 2023 and is projected to reach a market size of USD 21.2 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10%.

The food industry is on the cusp of a revolution, thanks to the potential of nanomaterials. These microscopic materials, engineered to be incredibly small, offer a range of benefits for food additives. Imagine tastier, fresher food with enhanced textures and vibrant colors – that's the promise of nanotechnology. It could extend shelf life, improve nutrient delivery, and even pave the way for targeted functional ingredients.

Key Market Insights:

The food industry is abuzz with the potential of nanomaterials. These microscopic, engineered materials offer a glimpse into a future filled with tastier and more visually appealing food. Imagine food with enhanced textures and vibrant colors, alongside a potential 20% boost in flavor delivery – that's the promise of nanotechnology in food additives. But the benefits go beyond taste. Nanotechnology can potentially extend a food's shelf life by 30%, significantly reducing food waste, a major global concern. It can even pave the way for fortifying food with essential nutrients or delivering targeted functional ingredients, opening doors for personalized nutrition.

However, this exciting frontier comes with a question mark. The tiny size of nanomaterials raises concerns about how they interact with the human body. Potential toxicity and digestive issues are being explored, leading to increased scrutiny from regulatory bodies. Rigorous safety assessments are crucial before widespread adoption.

The Nanomaterials as Food Additives Market Drivers:

Consumers' Desire for Multi-Sensory Food Experiences Drives Demand for Nanomaterials in Additives

Consumers are increasingly seeking multi-sensory experiences when it comes to food. They crave food that is not only delicious but also visually appealing and boasts a delightful texture. Nanomaterials hold the promise of delivering on all these fronts. By potentially improving flavor delivery by up to 20% (estimated), creating smoother textures, and enhancing the vibrancy of food colors, nanomaterials can significantly elevate the overall sensory experience of food.

Reducing Food Waste and Extending Shelf Life with Nanomaterials

Food waste is a major global concern, with significant economic and environmental consequences. Traditional food additives often have limited effectiveness in preventing spoilage, leading to a substantial amount of food being wasted each year. Nanomaterials offer a potential solution to this problem. By acting as barriers against spoilage, they can potentially extend the shelf life of food products by an estimated 30%. This translates to a significant reduction in food waste, improved food security, and potentially lower food costs for consumers.

Nanomaterials Paving the Way for Personalized Nutrition with Fortified and Functional Foods

The demand for healthy and functional foods with added benefits is exploding. Consumers are actively seeking out food products that not only satisfy their hunger but also contribute to their overall well-being. Nanomaterials can play a crucial role in this growing trend. This technology can be used to fortify food with essential nutrients that might be lacking in our diets, such as vitamins and minerals. Additionally, nanotech can pave the way for the targeted delivery of functional ingredients or even drugs within food, promoting personalized nutrition.

Busy Lifestyles and Convenience Food Trends Fueling the Use of Nanomaterials in Food Additives

The fast-paced nature of modern life has led to a surge in the popularity of convenience foods. Consumers are increasingly opting for quick and easy meal options that can be prepared with minimal effort. However, convenience often comes at the expense of taste and nutritional value. Nanomaterials have the potential to bridge this gap. By potentially improving the quality and functionality of convenience foods, such as enhancing flavor and texture while also extending shelf life, nanomaterials can make these products a more attractive choice for busy consumers.

The Nanomaterials as Food Additives Market Restraints and Challenges:

The path to widespread adoption of nanomaterials in food additives is paved with both potential and challenges. While the benefits are enticing – tastier, fresher food with extended shelf life and potential for fortification – safety concerns remain a major hurdle. The tiny size of these engineered materials raises questions about their interaction with the human body. Potential toxicity and long-term health effects are being investigated, and regulatory bodies are still creating safety guidelines. This uncertainty makes businesses hesitant to fully embrace the technology. Consumer perception is another hurdle. Public anxiety surrounding nanotechnology in food is high, fuelled by a lack of awareness about its potential benefits and concerns about unknown risks. Unless consumers understand the advantages of nanomaterials in food additives, widespread adoption is unlikely.

Finally, ethical considerations and environmental impact must be addressed. The large-scale production and disposal of nanomaterials used in food additives need careful evaluation. Responsible development and implementation are crucial to ensure this technology doesn't have unintended consequences. In conclusion, while the potential of nanomaterials in food additives is undeniable, overcoming safety concerns, negative consumer perception, high production costs, and ethical considerations is essential for its successful integration into the food industry. Continued research, consumer education, and cost-effective production methods are key to unlocking the full potential of this transformative technology.

The Nanomaterials as Food Additives Market Opportunities:

The future of food is brimming with exciting possibilities thanks to nanomaterials. These tiny, engineered materials offer a range of opportunities that can transform the way we experience food. Imagine tastier, fresher food with extended shelf life – that's just the beginning. Nanomaterials have the potential to revolutionize food experiences by enhancing flavor and texture, reducing food waste by up to 30% (estimated), and paving the way for personalized nutrition. With a growing focus on healthy eating and convenience, nanomaterials can be used to fortify food with essential nutrients or even deliver targeted functional ingredients within food items. This aligns perfectly with the trend of preventative healthcare and customized food choices. Busy lifestyles also get a boost, as nanomaterials can improve the quality and functionality of convenience foods, making them more attractive options. The potential for innovation in this market is vast, especially for early adopters. As research progresses, the applications of nanomaterials in food additives will continue to evolve, opening doors for exciting new food products and a competitive edge. With rising disposable incomes in developing countries and a general shift towards innovative food technology, the nanomaterials in food additives market is poised for significant growth. However, it's important to remember that safety concerns, consumer perception, and ethical considerations need to be addressed to ensure the successful and sustainable integration of this promising technology into the food industry.

NANOMATERIALS AS FOOD ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Material, Application, Food Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, BASF, Archer Daniels Midland Company (ADM), International Flavors & Fragrances Inc. (IFF), Kerry Group, Ingredion, Tate & Lyle, Givaudan, Darling Ingredients, Aquanova, Nanopack |

Nanomaterials as Food Additives Market Segmentation: By Material

-

Metal-based nanoparticles

-

Carbon-based nanomaterials

-

Polymeric nanoparticles

-

Other Nanomaterials

While the market is still evolving, nanoparticles are expected to be the most dominant segment by material type due to their versatility in applications like flavor delivery and nutrient fortification. Nanotubes, on the other hand, are poised for the fastest growth. Their potential for targeted delivery of functional ingredients within food presents exciting possibilities for personalized nutrition, a growing trend in the food industry.

Nanomaterials as Food Additives Market Segmentation: By Application

-

Flavour and Texture Enhancement

-

Food Preservation and Shelf-Life Extension

-

Fortification and Functionalization

-

Other Applications

While reliable data on the dominant segment is scarce, beverages are likely a major application area due to the potential for taste enhancement, cloudiness control, and extended shelf life using nanomaterials. The fastest-growing segment is expected to be fruits and vegetables. With the rising focus on fresh produce and delivering essential nutrients, nanomaterials offer exciting possibilities for preserving freshness, enhancing color, and fortifying these products.

Nanomaterials as Food Additives Market Segmentation: By Food Application

-

Baked Goods

-

Beverages

-

Meat Products

-

Fruits and Vegetables

While the specific dominant segment is yet to be definitively established, baked goods and beverages are strong contenders due to their high consumption rates and potential for shelf-life extension and flavor enhancement using nanomaterials. The fastest-growing segment is expected to be fruits and vegetables. Rising health consciousness and the potential for nanomaterials to preserve freshness and deliver nutrients are likely to drive this segment's growth.

Nanomaterials as Food Additives Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is a pioneer in nanotechnology research and development, with a well-established food processing industry. Stringent regulations and a focus on safety might initially slow down widespread adoption. However, the presence of major players like DuPont and significant investment in research position North America for potential future dominance.

Asia-Pacific is expected to witness the fastest growth due to several factors. Rising disposable incomes, a large and young population, and a growing demand for convenient and healthy food options are driving the market here. Countries like China and India are actively investing in nanotechnology research, making them potential leaders in the Asia-Pacific market.

COVID-19 Impact Analysis on the Nanomaterials as Food Additives Market:

The COVID-19 pandemic cast a long shadow over the burgeoning nanomaterials in the food additives market. Initial disruptions in global supply chains due to lockdowns and travel restrictions significantly impacted the production and availability of nanomaterials. Consumer priorities also shifted dramatically, with a focus on stocking up on essential goods rather than exploring potentially nanomaterial-enhanced processed foods. Research and development efforts might have also been put on hold as resources were diverted toward battling the virus and finding solutions to the immediate crisis.

However, the long-term outlook for the nanomaterials in the food additives market remains cautiously optimistic. The pandemic has inadvertently highlighted areas where nanotechnology can play a crucial role. The potential of nanomaterials to enhance food safety and extend shelf life – factors that became paramount during COVID-19 – could lead to renewed interest and investment in the long run. The rise of e-commerce and the increasing demand for convenient, shelf-stable food options further strengthens the case for nanomaterials. Additionally, some research is exploring the use of nanomaterials for delivering essential nutrients or functional ingredients that could support immunity, a potentially valuable avenue in a post-pandemic world where health and well-being are top priorities.

Latest Trends/ Developments:

The world of nanomaterials in food additives is brimming with innovation. Consumer demand for natural and organic options is driving research toward nanomaterials derived from sustainable sources like cellulose or chitosan. This could potentially address concerns about potential health risks associated with synthetic materials. Scientists are also developing targeted delivery systems using nanocarriers and nanocapsules. These microscopic vehicles can precisely deliver functional ingredients or nutrients within food, maximizing their impact and ensuring the body absorbs them effectively. Biodegradable nanomaterials are another exciting trend. These eco-friendly materials safely break down after use, minimizing their environmental footprint.

The production of nanomaterials is also transforming. Precision fermentation, an emerging technology, utilizes microorganisms to produce specific types of nanomaterials with desired properties. This offers a more sustainable and controlled method compared to traditional techniques. Additionally, artificial intelligence (AI) is playing a growing role in the design and development of these food additives. By analyzing vast datasets, AI can help optimize the properties of nanomaterials for specific applications in food, ensuring they function as intended.

Regulatory bodies are actively involved in shaping the future of this market. They are developing guidelines and frameworks for the safe use of nanomaterials in food additives. This provides clarity for businesses and fosters responsible innovation within the market. However, building consumer trust is equally important. Companies are increasingly focusing on transparency and education, informing consumers about the benefits and safety of nanomaterials used in their food. By addressing these concerns and staying abreast of the latest trends, the nanomaterials in the food additives market are poised to revolutionize the food industry, offering tastier, healthier, and more functional food options for consumers in the years to come.

Key Players:

-

Cargill

-

BASF

-

Archer Daniels Midland Company (ADM)

-

International Flavors & Fragrances Inc. (IFF)

-

Kerry Group

-

Ingredion

-

Tate & Lyle

-

Givaudan

-

Darling Ingredients

-

Aquanova

-

Nanopack

Chapter 1. Nanomaterials as Food Additives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nanomaterials as Food Additives Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nanomaterials as Food Additives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nanomaterials as Food Additives Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nanomaterials as Food Additives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nanomaterials as Food Additives Market – By Material

6.1 Introduction/Key Findings

6.2 Metal-based nanoparticles

6.3 Carbon-based nanomaterials

6.4 Polymeric nanoparticles

6.5 Other Nanomaterials

6.6 Y-O-Y Growth trend Analysis By Material

6.7 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 7. Nanomaterials as Food Additives Market – By Application

7.1 Introduction/Key Findings

7.2 Flavour and Texture Enhancement

7.3 Food Preservation and Shelf-Life Extension

7.4 Fortification and Functionalization

7.5 Other Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Nanomaterials as Food Additives Market – By Food Application

8.1 Introduction/Key Findings

8.2 Baked Goods

8.3 Beverages

8.4 Meat Products

8.5 Fruits and Vegetables

8.6 Y-O-Y Growth trend Analysis By Food Application

8.7 Absolute $ Opportunity Analysis By Food Application, 2024-2030

Chapter 9. Nanomaterials as Food Additives Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material

9.1.3 By Application

9.1.4 By By Food Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material

9.2.3 By Application

9.2.4 By Food Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material

9.3.3 By Application

9.3.4 By Food Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material

9.4.3 By Application

9.4.4 By Food Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material

9.5.3 By Application

9.5.4 By Food Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Nanomaterials as Food Additives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill

10.2 BASF

10.3 Archer Daniels Midland Company (ADM)

10.4 International Flavors & Fragrances Inc. (IFF)

10.5 Kerry Group

10.6 Ingredion

10.7 Tate & Lyle

10.8 Givaudan

10.9 Darling Ingredients

10.10 Aquanova

10.11 Nanopack

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Nanomaterials as Food Additives Market was valued at USD 10.88 billion in 2023 and is projected to reach a market size of USD 21.2 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10%.

Enhanced Sensory Appeal, Extended Shelf Life and Reduced Food Waste, Functional and Fortified Foods, Convenience Food Trends, and Catering to Busy Lifestyles.

Flavor and Texture Enhancement, Food Preservation and Shelf-Life Extension, Fortification and Functionalization, and Other Applications.

North America currently holds a strong position due to established players and research. However, Asia-Pacific is projected to see the fastest growth due to rising demand and investment.

Cargill, BASF, Archer Daniels Midland Company (ADM), International Flavors & Fragrances Inc. (IFF), Kerry Group, Ingredion, Tate & Lyle, Givaudan, Darling Ingredients, Aquanova, Nanopack.