Asia Pacific Food Additives Market Size (2024-2030)

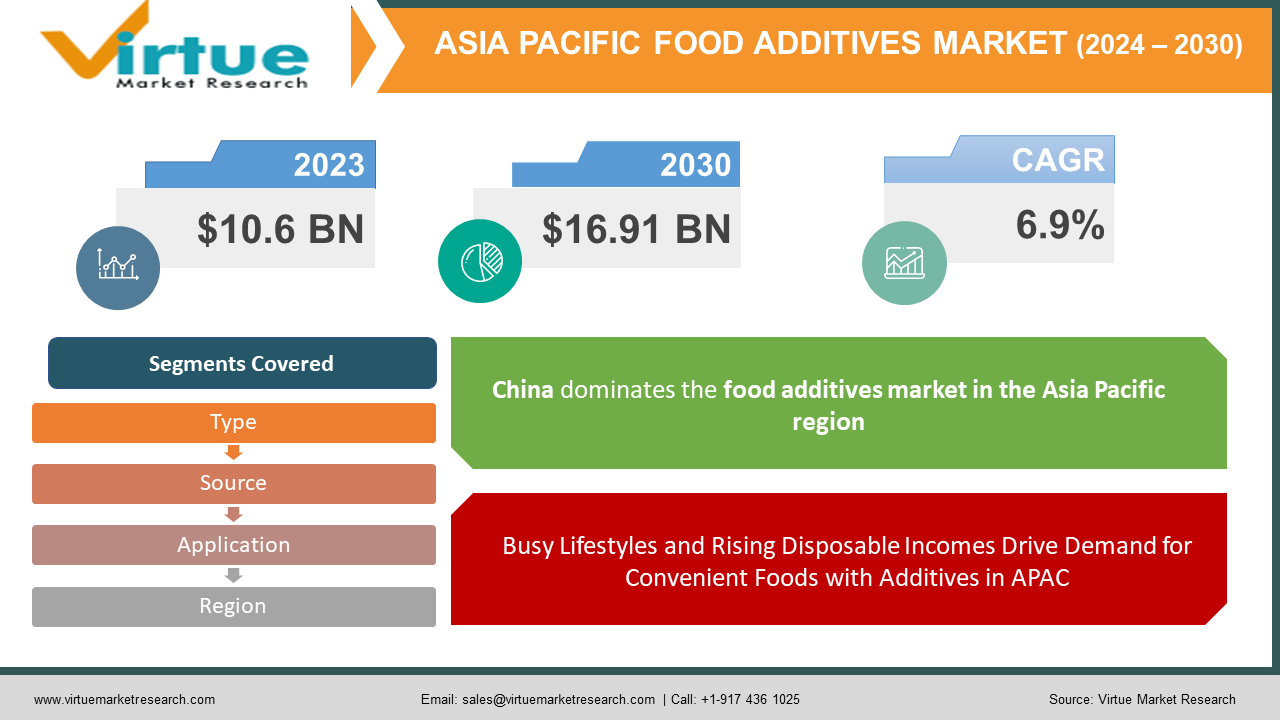

The Asia Pacific Food Additives Market was valued at USD 10.6 billion in 2023 and is projected to reach a market size of USD 16.91 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.9%.

The Asia Pacific Food Additives Market is flourishing, fueled by a rise in disposable incomes and busy lifestyles. Growing awareness of food safety is another driver, as additives can extend shelf life and prevent spoilage.

Key Market Insights:

There's a growing focus on food safety. Consumers are more aware of potential foodborne illnesses, and food additives play a vital role in ensuring food safety. Additives can extend shelf life by up to 30% in some cases, significantly reducing spoilage and the risk of contamination. This heightened awareness of food safety is propelling the use of food additives in the region.

The Asia Pacific Food Additives Market Drivers:

Busy Lifestyles and Rising Disposable Incomes Drive Demand for Convenient Foods with Additives in APAC

A confluence of rising disposable incomes, particularly in emerging economies like China and India, and increasingly busy lifestyles, is fueling a projected Compound Annual Growth Rate (CAGR) in the Asia-Pacific Food Additives Market by 2030. This translates to a significant surge in consumer demand for convenient food options. Food additives play a critical role in this trend by enhancing the taste, texture, and shelf life of these convenient foods, making them more appealing to time-pressed consumers.

Shifting Consumer Preferences for Natural Ingredients Lead to Innovation in Natural Food Additives

Consumer preferences in the Asia Pacific region are undergoing a significant shift, with a growing demand for natural ingredients. This trend is particularly evident in younger generations who are willing to pay a premium for natural and organic products. This shift in preferences is putting pressure on the food additives market to innovate. We are witnessing a rise in research and development of natural and functional food additives that offer functionalities similar to their synthetic counterparts but cater to the growing consumer desire for natural ingredients in their food.

Rapid Urbanization Fuels Demand for Processed Foods Reliant on Additives for Preservation

Rapid urbanization is a defining characteristic of the Asia Pacific region. As cities grow, living spaces become smaller, and people have less time for home cooking. This trend fuels the demand for readily available processed foods that offer convenience and ease of preparation. Food additives play a crucial role in processed foods by ensuring preservation, enhancing taste, and maintaining texture, making them a vital component of the urban food landscape in the Asia Pacific region.

The Asia Pacific Food Additives Market Restraints and Challenges:

While the Asia Pacific Food Additives Market is flourishing, there are hurdles to address. One key challenge is consumer wariness regarding the health risks of certain synthetic additives. This growing concern can lead to a shift towards natural and organic options, potentially hindering the demand for synthetic additives.

Navigating the regulatory environment can also be a challenge. The Asia Pacific region has a complex web of food safety regulations, and the approval process for new additives can be lengthy and stringent. This can discourage new players from entering the market and slow down innovation in the development of improved or novel food additives.

Another obstacle is the volatility of raw material prices. The cost of natural colors, flavors, and other ingredients used in food additive production can fluctuate significantly. This volatility can squeeze profit margins for manufacturers and create uncertainties in the market.

Finally, some consumers still hold misconceptions about the safety of food additives, despite regulations in place. Educating consumers and promoting clear labeling of food products with accurate information about additives is crucial for building trust and ensuring the long-term growth of this market.

The Asia Pacific Food Additives Market Opportunities:

The Asia Pacific Food Additives Market is brimming with opportunities. A major trend is the consumer demand for natural and organic products, which creates a significant opening for the development and marketing of natural and functional food additives. These additives cater to the evolving preference for clean-label ingredients and healthier options.

Technological advancements are another exciting prospect. Research in food science is leading to novel food additives with functions like encapsulation, controlled release, and biopreservation. These advancements can lead to more effective additives that enhance food quality, safety, and shelf life.

The clean-label movement, emphasizing recognizable and natural ingredients, is another area ripe for opportunity. Manufacturers can develop clean-label alternatives to synthetic additives and leverage consumer-friendly terms on product labels to capitalize on this trend.

While major cities are the current market drivers, there's immense potential for expansion in rural areas. Developing cost-effective and shelf-stable food additives suitable for these regions can unlock new customer segments and propel market growth. Finally, the e-commerce boom presents a unique opportunity for manufacturers to establish a strong online presence and offer direct-to-consumer sales, expanding their reach and catering to a wider customer base.

ASIA PACIFIC FOOD ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.9% |

|

Segments Covered |

By Type, source, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

Cargill, Incorporated, Kerry Inc., Corbion NV, Tate & Lyle, Archer Daniels Midland Company, Ingredion Incorporated, DuPont de Nemours, Inc., BASF SE, Dow Inc. |

The Asia Pacific Food Additives Market Segmentation:

Asia Pacific Food Additives Market Segmentation: By Type:

- Acidulants

- Anti-Caking Agents

- Colors

- Emulsifiers

- Enzymes

- Flavors

- Hydrocolloids

- Preservatives

- Sweeteners

Flavors and sweeteners are currently the most dominant segment in the Asia Pacific Food Additives Market by Type, driven by the increasing demand for tastier and more convenient food options. However, Natural Food Additives are experiencing the fastest growth due to the rising consumer preference for clean-label products and healthier ingredients. This trend is expected to continue as health consciousness gains traction across the region.

Asia Pacific Food Additives Market Segmentation: By Source:

- Natural

- Synthetic

Synthetic additives currently dominate the Asia Pacific Food Additives Market due to their established functionalities and lower production costs. However, natural additives are experiencing the fastest growth, driven by the rising consumer preference for clean-label products and ingredients perceived as healthier. This trend is expected to continue as demand for natural and organic food options surges across the region.

Asia Pacific Food Additives Market Segmentation: By Application:

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices & Condiments

- Sauces & Dressings

The dominant segment by application in the Asia Pacific Food Additives Market is "Bakery & Confectionery" due to its high demand for additives that enhance texture, sweetness, shelf life, and visual appeal. However, the "Convenience Foods" segment is projected to be the fastest-growing application sector, driven by the increasing popularity of ready-to-eat meals and processed foods that rely on additives for preservation and taste enhancement.

Asia Pacific Food Additives Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

The undisputed giant, China boasts the largest and fastest-growing food additives market in the Asia Pacific region. This is fueled by its massive population, rising disposable incomes, and a growing demand for convenient and processed foods.

As India's economy flourishes, its food additives market is experiencing significant growth. Rising disposable incomes and a growing middle class are driving the demand for processed and packaged foods, which rely heavily on additives. However, affordability and price sensitivity remain key factors in this market.

COVID-19 Impact Analysis on the Asia Pacific Food Additives Market:

The COVID-19 pandemic's impact on the Asia Pacific Food Additives Market has been a double-edged sword. On the positive side, lockdowns and movement restrictions fueled a surge in demand for packaged and processed foods with extended shelf life. This in turn boosted the use of food additives for preservation, taste, and texture in these convenient options. Additionally, heightened hygiene concerns during the pandemic highlighted the importance of food safety, potentially increasing the use of preservatives and antimicrobials.

However, the pandemic also brought challenges. Disrupted global supply chains due to lockdowns and travel restrictions impacted the availability and cost of raw materials used in food additive production, leading to potential price fluctuations and production slowdowns. There were also shifts in consumer preferences, with some prioritizing health and wellness, which might have temporarily reduced demand for synthetic additives and increased interest in natural and organic alternatives.

Latest Trends/ Developments:

The Asia Pacific Food Additives Market is witnessing a wave of exciting new trends. One key area of development is the rise of plant-based alternatives. The growing popularity of these products is driving innovation in natural flavorings, coloring agents, and texturizers that can mimic the sensory experience of animal-derived ingredients. Another trend is the focus on gut health. Consumers are increasingly interested in the role of food additives like prebiotics and probiotics in promoting a healthy gut microbiome. This is leading to the development of functional food additives that offer digestive health benefits. The future of the market is also likely to see a rise in microbial applications, with research in fermentation leading to novel food additives derived from microorganisms. These can include natural preservatives, flavorings, and coloring agents, offering more clean-label and natural options. Finally, sustainability is becoming a growing concern throughout the food additives supply chain. Manufacturers are focusing on ethically sourced raw materials, minimizing production waste, and developing biodegradable or recyclable packaging solutions. These trends highlight the continuous innovation and adaptation within the Asia Pacific Food Additives Market.

Key Players:

- Cargill, Incorporated

- Kerry Inc.

- Corbion NV

- Tate & Lyle

- Archer Daniels Midland Company

- Ingredion Incorporated

- DuPont de Nemours, Inc.

- BASF SE

- Dow Inc.

Chapter 1. Asia Pacific Food Additives Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Food Additives Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Food Additives Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Food Additives Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Food Additives Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Food Additives Market– By Application

6.1. Introduction/Key Findings

6.2. Bakery & Confectionery

6.3. Beverages

6.4. Convenience Foods

6.5. Dairy & Frozen Desserts

6.6. Spices & Condiments

6.7. Sauces & Dressings

6.8. Y-O-Y Growth trend Analysis By Application

6.9. Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 7. Asia Pacific Food Additives Market– By Types

7.1. Introduction/Key Findings

7.2. Acidulants

7.3. Anti-Caking Agents

7.4. Colors

7.5. Emulsifiers

7.6. Enzymes

7.7. Flavors

7.8. Hydrocolloids

7.9. Preservatives

7.10. Sweeteners

7.11. Y-O-Y Growth trend Analysis By Types

7.12. Absolute $ Opportunity Analysis By Types , 2023-2030

Chapter 8. Asia Pacific Food Additives Market– By Source

8.1. Introduction/Key Findings

8.2. Natural

8.3. Synthetic

8.4. Y-O-Y Growth trend Analysis Source

8.5. Absolute $ Opportunity Analysis Source , 2023-2030

Chapter 9. Asia Pacific Food Additives Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Application

9.1.3. By Types

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Food Additives Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill, Incorporated

10.2. Kerry Inc.

10.3. Corbion NV

10.4. Tate & Lyle

10.5. Archer Daniels Midland Company

10.6. Ingredion Incorporated

10.7. DuPont de Nemours, Inc.

10.8. BASF SE

10.9. Dow Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific Food Additives Market was valued at USD 10.6 billion in 2023 and is projected to reach a market size of USD 16.91 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.9%.

Soaring Convenience, Enhanced Food Safety, Shifting Consumer Preferences, and Expanding Urbanization are some of the factors driving market growth.

Bakery & Confectionery, Beverages, Convenience Foods, Dairy & Frozen Desserts, Spices & Condiments, Sauces & Dressings are the segments under the Asia Pacific Food Additives Market by Application.

China is the undisputed giant in the Asia Pacific Food Additives Market, boasting the largest and fastest-growing market share due to its massive population and surging demand for convenient processed foods

Cargill, Incorporated, Kerry Inc., Corbion NV, Tate & Lyle, Archer Daniels Midland Company, Ingredion Incorporated, DuPont de Nemours, Inc., BASF SE, and Dow Inc.