Latin America Food Additives Market Size (2024-2030)

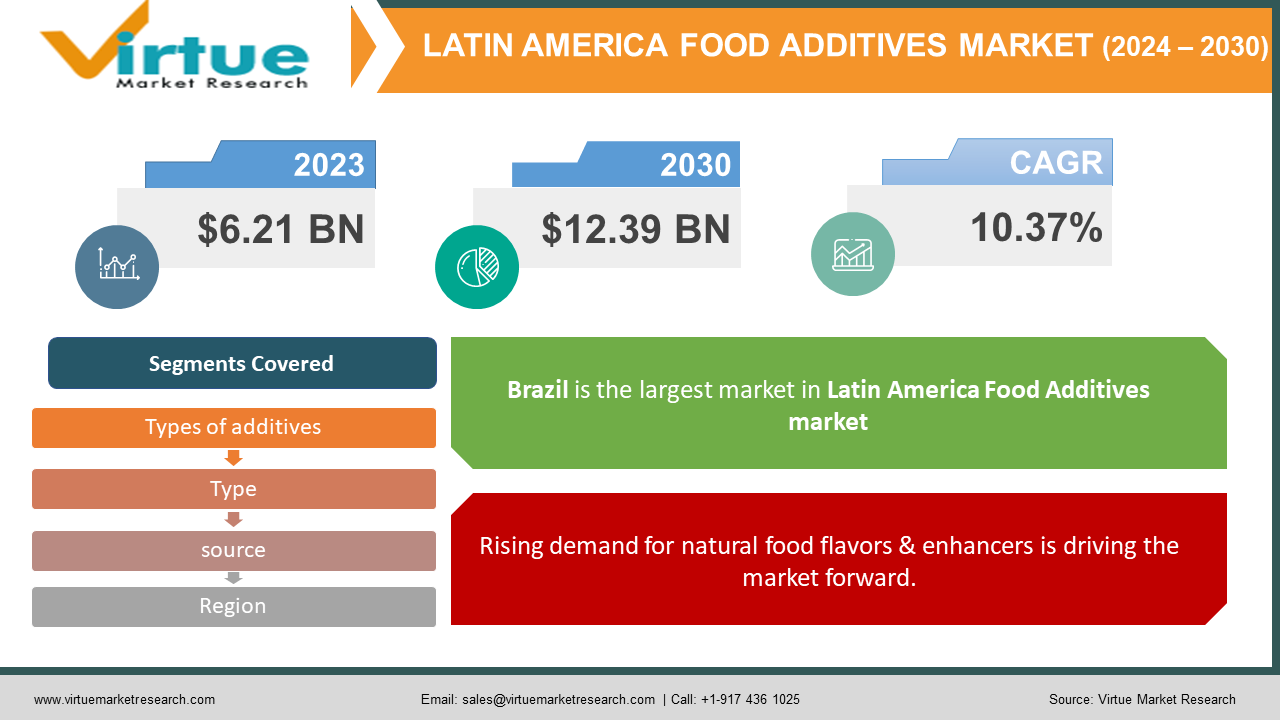

Latin America's food additives market was valued at USD 6.21 billion in 2023 and is projected to reach a market size of USD 12.39 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10.37%.

Food additives are substances added to food during production to add flavor, improve taste or appearance, or extend shelf life. They can be natural or synthetic and serve many purposes, such as stabilizing, thickening, or coloring food. Common additives include preservatives such as sodium nitrite, antioxidants such as vitamin C, flavor enhancers such as monosodium glutamate (MSG), and sweeteners such as aspartame.

Key Market Insights:

Latin America accounted for 10.5% of the global market share for food additives in 2022.

The Latin American market for food stabilizers is expected to grow to 1.24 billion US dollars by 2025.

Food emulsifiers were projected to be worth 410 million US dollars in Latin America in 2023.

The food enzyme market in Latin America is projected to grow to $410 million by 2025, according to Statista.

A Pew Research Center study found that 65% of respondents who said they eat mostly or some organic food believe food additives to be hazardous to their health. This is stated by 41% of those who claim to consume fewer organic foods. Improving food label transparency by giving customers clear and simple information about the presence of additives and their intended use can enable customers to make well-informed decisions about the goods they buy.

Latin America Food Additives Market Drivers:

Rising demand for natural food flavors & enhancers is driving the market forward.

Latin American countries such as Argentina and Brazil are taking steps to prevent obesity, with some policies aimed at limiting the consumption of man-made flavors, which add unnecessary calories to the diet. Pineapple soaked in Martinique rum, Guatemala pure Arabica coffee, Argentine dairy milk, Brazilian orange smoothie, spices, and other flavors popular with consumers in South American countries, especially Brazil, are also exported to Europe, such as the UK. These companies have replaced man-made ingredients in food and beverages with the best natural ingredients, such as fruits and natural sweeteners, in the food and beverage industry.

The rapid growth of the food and beverage industry is accelerating the market.

The food and beverage industry in Latin America is experiencing significant growth, driven by factors such as population growth, increasing disposable income, and urbanization. This growth has led to the need for food additives, including antibiotics, antioxidants, emulsifiers, and flavoring agents. The expansion of the food and beverage industry presents a valuable opportunity for food additive manufacturers to capitalize on the growing demand for food and packaged foods. Additionally, the rise of food businesses such as restaurants, cafes, and fast food has also increased the demand for food additives as they seek to increase the quality and demand of their products.

The growing preference for convenience foods is enabling its development.

Urbanization and changing lifestyles in Latin America have led to a significant rise in the demand for convenience foods and beverages. Busy consumers are seeking ready-to-eat and easy-to-prepare options, driving the need for food additives that enhance the shelf life, texture, and flavor of processed foods. Additives play a crucial role in maintaining the quality and freshness of packaged foods, making them an essential component of the convenience food industry. As the demand for convenience foods continues to grow, so does the demand for food additives, which improve product stability and sensory attributes.

Latin America Food Additives Market Restraints and Challenges:

Health and safety concerns prove to be a challenge.

Despite strict controls, health and safety concerns surrounding certain food additives persist among consumers in Latin America. Misconceptions or misperceptions about the safety and health of food additives, especially synthetic ones, can influence consumer decisions and lead to increased distrust of additives. Reports of side effects, allergic reactions, or long-term health risks associated with a particular product may lead to consumer complaints and investigations. That's why companies need to invest in transparent communication, customer education, and new products to solve these problems and maintain customers' trust in them.

Consumers’ preference for natural and clean-label products hinders market growth.

Although demand for natural and clean-label products continues to grow in Latin America, meeting this trend poses additional challenges for food additive companies. Consumers are increasingly looking for products with more natural ingredients and fewer synthetic chemicals, leading to a reduced use of artificial additives. This shift in consumer preferences requires companies to update their products and invest in research and development to identify natural alternatives to conventional additives. However, natural additives can be more expensive and less effective than synthetic ones, which leads to excessive cost, performance, and availability issues.

A strict regulatory environment restrains market growth.

One of the main restraints facing the Latin American food additive market is the strict regulations on the use of food additives. Regulatory bodies such as Brazil's ANVISA and Peru's DIGESA impose strict rules on the approval, labeling, and permissible levels of food additives. Complying with these regulations can be difficult and costly for manufacturers because they often require extensive testing, documentation, and compliance with certain standards. Additionally, the constant changes and inconsistencies in legislation in various countries make it difficult for companies to find effective environmental management practices.

Latin America Food Additives Market Opportunities:

Influenced by many factors, the Latin American food additive market offers many business opportunities. First, the region's food and beverage industry is expanding due to population growth, increasing disposable income, and urbanization, leading to greater use of food additives. This demand extends across various segments, including processed foods, beverages, bakery products, and dairy products, providing ample opportunities for manufacturers to cater to diverse consumer preferences. In addition, the trend toward portable foods and ready-made meals offers many opportunities for companies operating in the food additive industry. As busy lifestyles become the norm, consumers are looking for easy meal solutions without compromising on taste and quality. Additives are important in preserving the freshness, texture, and taste of processed and packaged foods, making them indispensable in the ready-made food industry. Manufacturers can capitalize by creating new natural products from herbs, fruits, and herbs to meet clean product needs while ensuring safety and regulatory compliance.

LATIN AMERICA FOOD ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.37% |

|

Segments Covered |

By Types of additives, application, source, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

Cargill, Incorporated , ADM, DuPont, BASF SE, DSM, Chr. Hansen A/S, Alltech, Kemin Industries Inc. , Palital Feed Additives B.V , Bentoli |

Latin America Food Additives Market Segmentation:

Latin America Food Additives Market Segmentation: By Type of Additive

- Preservatives

- Sweeteners

- Flavor Enhancers

- Emulsifiers

- Colorants

- Others

In the Latin American food additive market, sweeteners are the largest growing type. They are essential because they provide sugar substitutes that can accommodate a range of dietary requirements and health issues. Sweeteners provide a variety of ingredients to manufacturers so they may create products that meet the needs of health-conscious consumers in response to the growing demand for low-calorie and diabetic product options.

Flavor enhancers are the fastest-growing category. They are added to create more complex and nuanced meals and drinks. Flavor enhancers like spices, herbs, and seasoning mixes give depth, complexity, and authenticity to culinary experiences, whether they are used in classic recipes or new inventions.

Latin America Food Additives Market Segmentation: By Source

- Natural

- Synthetic

The natural segment is the largest and fastest-growing source. Natural additives produced from plants, animals, or minerals are becoming more and more in demand as customers place a higher value on sustainability and clean-label products. Manufacturers are adding ingredients such as fruit juices, plant extracts, and sea salts to improve flavor, texture, and shelf life in response to customer demand for healthy meals and regulatory requirements for natural ingredients. This trend is driven by consumers' increased inclination towards natural ingredients.

Latin America Food Additives Market Segmentation: By Application:

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices, Condiments, Sauces & Dressings

- Others

Bakery & confectionery are the largest growing applications. To improve texture, lengthen shelf life, and enhance flavor in goods like bread, cakes, cookies, and chocolates, chemicals like stabilizers, emulsifiers, and preservatives are frequently used in the bakery and confectionery industry, which is a large application area for additives. Manufacturers in the region depend on food additives to fulfill market expectations and preserve product quality as customer demand for convenience foods and decadent desserts grows. The beverages area, which includes a wide range of goods such as fruit juices, soft drinks, alcoholic beverages, and functional drinks, is the fastest-growing category. Sweeteners, flavor enhancers, and colorants are examples of additives that are essential to creating novel and enticing beverage solutions that satisfy shifting customer demands about convenience, taste, and health. Additives will continue to be necessary for producing goods that match customer expectations and regulatory requirements due to the elevating demand.

Latin America Food Additives Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of Latin America

Brazil is Latin America's largest growing food additive market due to its large population, diverse food industry, and strong economy. The country's food additives market benefits from strong demand for processed and packaged foods, driven by urbanization, changing lifestyles, and increasing disposable incomes. The main areas of the Brazilian market include preservatives, flavor enhancers, and natural additives. Regulatory oversight by ANVISA (National Security Agency) affects product and label production in Brazil. Argentina is the fastest-growing market. This region has strong agriculture, a diverse cuisine, and a growing demand for prepared foods. This market includes additives such as preservatives, antioxidants, and sweeteners used in a variety of foods, including meat, dairy, and baked goods. Management led by ANMAT (the National Agency for Medicines, Food and Medical Technologies) ensures the safety and quality of food products in Argentina.

COVID-19 Impact Analysis on the Latin American Food Additives Market:

The COVID-19 pandemic has had a significant impact on the Latin American food additive market, creating challenges and opportunities for industry participants. Supply chains, production, and export pipelines in the region have been disrupted by lockdown measures, travel restrictions, and economic uncertainty. Decreasing consumer spending, changes in purchasing patterns, and shifting demand for essential and non-essential products have impacted food additive production in Latin America. However, the pandemic has also led to some economic changes in the food additive industry, such as increased demand for packaging and shelf-stable products with simple and functional ingredients. Interest in natural, clean-label products and functional additives has increased after the pandemic, with people seeking significant help for their health and well-being. Manufacturers continue to innovate to meet changing consumer preferences while ensuring product safety, compliance, and supply chain flexibility. Despite the challenges brought by COVID-19, the Latin American food additive market is expected to recover as the region gradually recovers and adjusts to normal.

Latest Trends/ Developments:

One of the newest trends in the Latin American food additive industry is the increasing demand for natural and clean products. Focused on health and wellness, consumers in Latin America are looking for foods with natural ingredients and fewer synthetic ingredients. These trends stem from concerns about the health risks of synthetic ingredients and a desire for clarity on food labels. Therefore, there was a demand for natural products obtained from the region, such as fruits, vegetables, herbs, and spices. Manufacturers have responded by adapting their products to include alternatives to everyday products and investing in research and innovation to create new solutions. Additionally, regulators in Latin America are tightening regulations on food additives alongside the shift to natural ingredients. The Latin American food additive market is expected to grow in favor of natural and clean products as consumer preferences continue to grow.

Key Players:

- Cargill, Incorporated

- ADM

- DuPont

- BASF SE

- DSM

- Chr. Hansen A/S

- Alltech

- Kemin Industries Inc.

- Palital Feed Additives B.V

- Bentoli

In September 2022, BASF expanded its feed enzyme production capacity at Ludwigshafen (Germany) plant. With this expansion, BASF has increased its annual production. The higher production capacity allows BASF to meet the increasing demand for a reliable, high-quality supply from customers. BASF feed enzymes are Natugrain TS (xylanase and glucanase), Natuphos E (phytase), and the recently launched Natupulse TS (mannanase).

In June 2022, Cargill acquired Delacon, which is a plant-based additive manufacturing company. This acquisition is anticipated to increase the portfolio of Cargill, which has significant experience in feed additives and helps the production of more nutritious food.

Chapter 1. Latin America Food Additives Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Food Additives Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Food Additives Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Food Additives Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Food Additives Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Food Additives Market– By Type of Additive

6.1. Introduction/Key Findings

6.2. Preservatives

6.3. Sweeteners

6.4. Flavor Enhancers

6.5. Emulsifiers

6.6. Colorants

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Type of Additive

6.9. Absolute $ Opportunity Analysis By Type of Additive , 2024-2030

Chapter 7. Latin America Food Additives Market– By Application

7.1. Introduction/Key Findings

7.2 Bakery & Confectionery

7.3. Beverages

7.4. Convenience Foods

7.5. Dairy & Frozen Desserts

7.6. Spices, Condiments, Sauces & Dressings

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Application

7.9. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Latin America Food Additives Market– By Source

8.1. Introduction/Key Findings

8.2 Natural

8.3. Synthetic

8.4. Y-O-Y Growth trend Analysis Source

8.5. Absolute $ Opportunity Analysis Source , 2024-2030

Chapter 9. Latin America Food Additives Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Latin America

9.1.1. By Country

9.1.1.1. Mexico

9.1.1.2. Brazil

9.1.1.3. Argentina

9.1.1.4. Chile

9.1.1.5. Rest of Latin America

9.1.2. By Type of Additive

9.1.3. By Application

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Latin America Food Additives Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill, Incorporated

10.2. ADM

10.3. DuPont

10.4. BASF SE

10.5. DSM

10.6. Chr. Hansen A/S

10.7. Alltech

10.8. Kemin Industries Inc.

10.9. Palital Feed Additives B.V

10.10. Bentoli

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Latin America's food additives market was valued at USD 6.21 billion in 2023 and is projected to reach a market size of USD 12.39 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10.37%.

The segments under the food additives market based on source are natural and synthetic

Brazil is dominant in the Latin American food additive market.

Cargill, Incorporated, ADM, DuPont, BASF SE, and DSM are the major players in the Latin American food additives market

The COVID-19 pandemic has had a significant impact on the Latin American food additive market, creating challenges and opportunities for industry participants. Supply chains, production, and export pipelines in the region have been disrupted by lockdown measures, travel restrictions, and economic uncertainty. Decreasing consumer spending, changes in purchasing patterns, and shifting demand for essential and non-essential products have impacted food additive production in Latin America.