Meat Market Size (2025 - 2030)

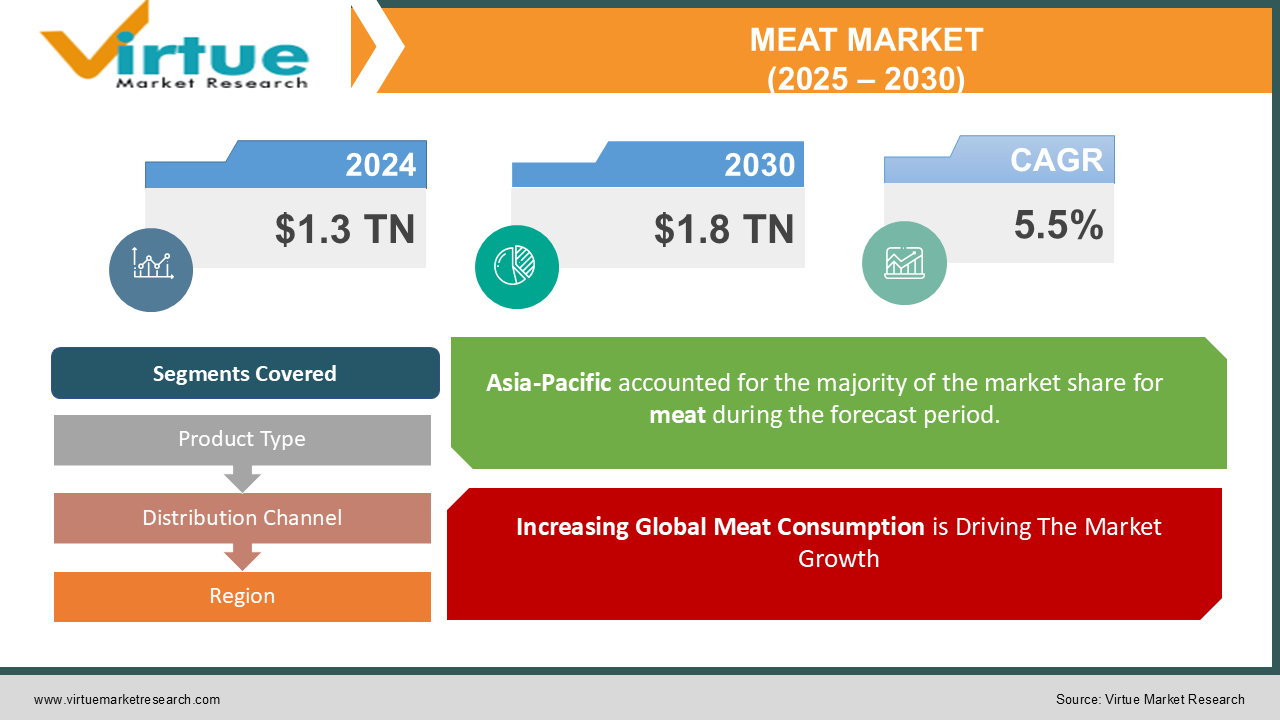

The Global Meat Market was valued at USD 1.3 trillion in 2024 and is projected to reach USD 1.8 trillion by 2030, growing at a CAGR of 5.5% during the forecast period.

The market is driven by a rising global population, increasing consumer demand for protein-rich diets, and innovations in meat processing and packaging technologies.

Rapid urbanization, rising disposable incomes, and the growing popularity of ready-to-eat meat products are further fueling market growth. While traditional fresh meat continues to dominate, the demand for processed and frozen meats is witnessing exponential growth, particularly in developed and emerging economies.

Key Market Insights

-

Poultry meat accounts for the largest Meat Market share, making up over 40% of the global revenue in 2024, due to its affordability and nutritional profile.

-

The offline distribution channel continues to dominate, representing approximately 75% of the market, with supermarkets and butcher shops being key sales points.

-

Asia-Pacific is the largest regional Meat Market, contributing over 35% of global consumption, driven by dietary preferences and population size.

-

The increasing adoption of plant-based and lab-grown meat products is creating challenges and opportunities in the meat market.

-

Government initiatives supporting animal husbandry and technological advancements in meat production are boosting market growth.

-

Rising health concerns, including links between red meat consumption and certain diseases, are encouraging diversification within the industry.

Global Meat Market Drivers

Increasing Global Meat Consumption is Driving The Market Growth

The global population is expected to reach 9.7 billion by 2050, significantly increasing the demand for meat. Protein is a key dietary component for many populations, and meat remains a primary source due to its high-quality protein content.

Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing a growing middle class with higher disposable incomes. These consumers are shifting towards diets that include more meat, spurring market growth. Additionally, the expansion of quick-service restaurants (QSRs) and rising consumption of meat-based snacks are further propelling the market.

Innovations in Meat Processing and Packaging are Driving The Market Growth

Advancements in meat processing techniques, such as vacuum sealing, modified atmosphere packaging, and freezing technologies, are enhancing the shelf life and quality of meat products. These innovations cater to the growing demand for convenience foods and processed meats in urban markets. Furthermore, the development of ready-to-cook and marinated meat products has gained significant popularity among time-pressed consumers. Companies are also investing in automation and robotics in meat processing to ensure product consistency and safety, driving efficiency and productivity.

Rising Demand for Poultry Meat is Driving The Market Growth

Poultry meat remains the preferred choice for many consumers due to its lower cost compared to beef and pork, ease of preparation, and versatility in cuisines. Additionally, it is perceived as a healthier alternative, being lower in fat and cholesterol than other types of meat. The global production and consumption of poultry are also supported by shorter production cycles and lower feed costs, making it a cost-effective protein source for producers and consumers alike.

Global Meat Market Challenges and Restraints

Ethical and Environmental Concerns are Restricting the Global Meat Market Growth

Meat production is often associated with environmental challenges, including high greenhouse gas emissions, deforestation, and water consumption. For example, beef production accounts for 14.5% of global greenhouse gas emissions, leading to growing scrutiny of the industry’s environmental footprint. In addition, ethical concerns regarding animal welfare and industrial farming practices are becoming more prominent, leading to increased adoption of plant-based and lab-grown meat alternatives. Companies in the meat market must address these concerns to maintain consumer trust and market share.

Health-Related Concerns is Restricting the Global Meat Market Growth

Growing awareness about the health risks associated with excessive meat consumption, particularly red and processed meats, is acting as a restraint. Studies linking red meat to heart diseases, obesity, and certain cancers have prompted many consumers to reduce meat intake or switch to alternative protein sources. The rise of flexitarian diets, where consumers reduce their meat intake but do not completely eliminate it, poses a challenge to traditional meat producers. Companies are diversifying their offerings to include healthier options and alternatives to cater to this shifting demand.

Market Opportunities

The meat industry is facing a period of significant transformation. The rise of lab-grown and plant-based meats presents both challenges and opportunities for traditional meat companies. By embracing sustainability, these companies can diversify their portfolios and cater to the growing demand for environmentally conscious protein sources. Integrating alternative protein options allows companies to tap into new consumer segments and maintain market relevance. Simultaneously, investing in sustainable practices, such as regenerative farming techniques that improve soil health and reduce greenhouse gas emissions, and implementing feed efficiency technologies to minimize resource consumption, can enhance the environmental credentials of traditional meat production. Emerging economies in Asia, Africa, and Latin America offer significant growth potential, driven by expanding populations and rising disposable incomes. Companies that invest in local production and tailor their offerings to regional tastes and preferences will gain a competitive edge. Furthermore, the increasing demand for premium and organic meats, particularly in developed markets, creates a lucrative niche for producers targeting health-conscious and affluent consumers. These products often command higher price points and profit margins, offering a premium segment for growth. Finally, the rapid expansion of e-commerce platforms provides a convenient and accessible channel for selling meat products, especially processed and frozen varieties. Companies can leverage online platforms to reach a broader consumer base, offer subscription-based meat delivery services, and build direct-to-consumer relationships.

MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tyson Foods, Inc., JBS S.A., Cargill, Inc., BRF S.A., Danish Crown Group, Hormel Foods Corporation, Smithfield Foods, Inc., Pilgrim’s Pride Corporation, Marfrig Global Foods S.A., Vion Food Group |

Meat Market Segmentation - By Product Type

-

Poultry

-

Beef

-

Pork

-

Lamb

-

Others

The poultry segment currently dominates the meat market, accounting for a substantial 40% of total revenue in 2024. This dominance is attributed to several key factors. Poultry is widely favored for its affordability, making it an accessible protein source for a broad range of consumers. Its versatility in culinary applications, from simple roasts to complex dishes, further enhances its appeal. Additionally, poultry is perceived as a relatively healthy option, offering a good source of protein with lower fat content compared to some other meats. Beef and pork follow as the second and third-largest segments, respectively. Beef consumption is often driven by cultural preferences and traditions in many regions, while pork's versatility and adaptability to various cuisines contribute to its significant Global Meat Market share..

Meat Market Segmentation - By Distribution Channel

-

Online

-

Offline

The offline channel continues to dominate the Global Meat Market, accounting for a significant 75% of the market in 2024. Supermarkets, hypermarkets, and traditional butcher shops remain the primary distribution points for meat products. Consumers often prefer the tactile experience of selecting fresh meat, assessing its quality firsthand, and interacting with local butchers for personalized advice. However, the online channel is experiencing rapid growth, driven by the increasing popularity of e-commerce platforms and the convenience of home delivery. Online platforms offer a wider selection of products, often with competitive pricing and convenient delivery options. This trend is particularly appealing to busy consumers seeking time-saving solutions for their grocery shopping needs. As online platforms continue to improve their cold chain logistics and ensure the quality and freshness of their meat products, the online channel is poised for further growth in the coming years.

Meat Market Segmentation - By Region

-

Asia-Pacific

-

North America

-

Europe

-

Latin America

-

Middle East & Africa

Asia-Pacific is the largest regional Global Meat Market, accounting for over 35% of global consumption in 2024. The region’s dominance is attributed to its large population, cultural preferences for meat-centric diets, and increasing disposable incomes. China is the leading market in Asia-Pacific, driven by its vast consumer base and high consumption of pork and poultry. India and Southeast Asian nations are emerging as key markets due to urbanization and dietary shifts toward higher protein intake. North America follows as the second-largest Global Meat Market, with high consumption of beef and processed meats. The U.S. leads the market, supported by a well-established meat processing industry and growing demand for organic and premium meat products.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the global meat market. Disruptions in supply chains, labor shortages, and lockdown restrictions led to temporary declines in meat production and distribution. However, demand for frozen and processed meats surged as consumers stocked up on non-perishable goods during lockdowns. The pandemic also highlighted the vulnerability of traditional meat supply chains, prompting investments in automation and alternative protein sources. E-commerce channels witnessed a significant boost as consumers shifted to online grocery shopping, a trend that continues to reshape the market landscape.

Latest Trends/Developments

Several key trends are shaping the future of the meat industry. The commercialization of lab-grown meat is gaining traction, driven by advancements in cellular agriculture and growing consumer interest in sustainable protein sources. Simultaneously, the rise of plant-based meat alternatives is reshaping consumer preferences, particularly in developed markets. Companies are increasingly incorporating plant-based options into their portfolios to cater to evolving consumer demands. Innovations in smart packaging, such as temperature-sensitive labels and QR codes for traceability, are enhancing consumer trust and ensuring product quality. Furthermore, the demand for organic, grass-fed, and hormone-free meat products is growing, particularly among health-conscious consumers. This focus on premiumization is driving a shift towards higher-quality, value-added products. Finally, meat companies are embracing digital transformation, leveraging technologies like blockchain to enhance supply chain transparency, ensure compliance with food safety standards, and build stronger consumer relationships.

Key Players

-

Tyson Foods, Inc.

-

JBS S.A.

-

Cargill, Inc.

-

BRF S.A.

-

Danish Crown Group

-

Hormel Foods Corporation

-

Smithfield Foods, Inc.

-

Pilgrim’s Pride Corporation

-

Marfrig Global Foods S.A.

-

Vion Food Group

Chapter 1. Meat Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Meat Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Meat Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Meat Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Meat Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Meat Market – By Product Type

6.1 Introduction/Key Findings

6.2 Poultry

6.3 Beef

6.4 Pork

6.5 Lamb

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Meat Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online

7.3 Offline

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Meat Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Meat Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Tyson Foods, Inc.

9.2 JBS S.A.

9.3 Cargill, Inc.

9.4 BRF S.A.

9.5 Danish Crown Group

9.6 Hormel Foods Corporation

9.7 Smithfield Foods, Inc.

9.8 Pilgrim’s Pride Corporation

9.9 Marfrig Global Foods S.A.

9.10 Vion Food Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Meat Market was valued at USD 1.3 trillion in 2024 and is expected to reach USD 1.8 trillion by 2030, with a CAGR of 5.5%.

Key drivers of the Global Meat Market include rising global meat consumption, innovations in meat processing and packaging, and increasing demand for poultry meat.

Segments in the Global Meat Market include Product Type (Poultry, Beef, Pork, Lamb, Others) and Distribution Channel (Online, Offline).

Asia-Pacific dominates the meat market, accounting for over 35% of global consumption, driven by dietary preferences and population size.

Key players in the Meat Market include Tyson Foods, JBS S.A., Cargill, Hormel Foods Corporation, BRF S.A.Danish Crown Group, Smithfield Foods, Inc., Pilgrim’s Pride Corporation, Marfrig Global Foods S.A., Vion Food Group.