Cultured Meat Market size (2025-2030)

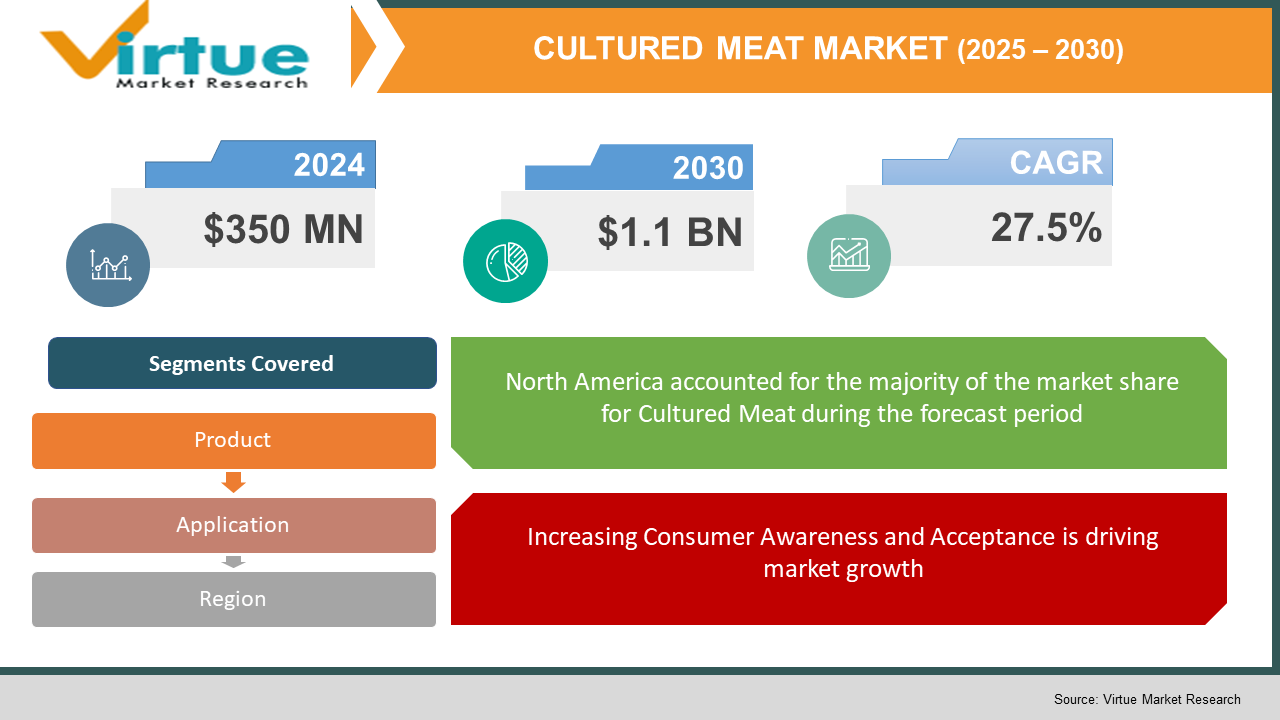

The Global Cultured Meat Market reached a valuation of USD 350 million in 2024 and is expected to grow at a CAGR of 27.5% from 2025 to 2030, with an anticipated market value of USD 1.1 billion by 2030.

Cultured meat, or lab-grown meat, is derived from the growing animal cells in a controlled environment, eliminating the need for traditional farming of animals. The market is driven by the increasing demand for food production methods that yield sustainable food production, animal welfare, and environmental sustainability. Global population growth and increased protein demand will also contribute to the cultured meat market growth as a potential solution for consumers, while reducing the environmental burdens of conventional meat production. Additionally, advancements in technology, alongside growing investments from major food companies, will drive the growth of cultured meat products and commercialization of these products. The cultured meat market is gaining momentum as more governments, regulatory, and food producers dive into the lab-grown meat market to change the future of food.

Key market insights:

- Growing investments in both the private and public sectors are advancing cultured meat production, with many major companies entering the industry. Additionally, cultured meat is appealing to consumers because of its low environmental footprint, such as lower greenhouse gas emissions, lower land use, and lower water use.

- Although acceptance is growing, consumers remain hesitant to embrace cultured meat until more information about its benefits is available, especially regarding animal welfare.

- The regulatory environment is changing as many countries move towards approving cultured meat, such as Singapore, which has approved lab-grown meat for sale. Cost of production is a major barrier to the widespread implementation of cultured meat, although technological advancements may reduce costs over the next few years.

Global Cultured Meat Market Drivers:

Increasing Demand for Sustainable Food Production is a key a factor for market growth

The increasing desire for more sustainable food production systems is one of the central reasons for the cultured meat market's growth. Traditional beef and livestock meat production is resource heavy as it needs significant land, water, and feed, and is extraordinarily greenhouse gas intensive in their life cycle. Given that global population is projected to reach 9.7 billion people by 2050, the traditional means of producing livestock meat is simply not sustainable for a long time period. Cultured meat can be an attractive solution as it significantly reduces the environmental footprint for beef and meat production. Meat can be cultivated directly from animal cells and vastly require less land, water, and feed, and greenhouse gas. As concerns about climate change and resource depletion grow among consumers and food producers, they have shifted to alternative sources of protein and food sources, such as cultured meat, to get around the environmental burdens of farming for food. Cultured meat also has some efficiencies in their production process and can be scaled to produce more protein without drawing down natural resources. Cultured meat is positively positioned to be a promising and attractive solution for sustainable food production systems.

Advancements in Technology and Biotechnology is driving market growth:

Advances in technology related to cell culture, bioreactors, and tissue engineering have been crucial to the expansion of the cultured meat industry. Novel methods developed for culturing animal cells with the flavor, texture, and nutritional profile of traditional meat have made cultured meat products much more attractive to consumers. In recent years, improved bioreactor design and construction methods that are larger and more efficient than previous designs and could thereby facilitate animal cell culture at commercially relevant scales have increased production capacity in the cultured meat sector. Additionally, advancements in cell lines, culture media, and bioprocessing approaches have resulted in cultured meat technologies that are more efficient and cost-effective. Continued research in this field will ultimately expand affordable and cost-effective options which will aid widespread adoption of cultured meat products. Continuous improvements in biotechnologies, along with significant investment from private and public institutions, will hasten the commercialization of cultured meat products to meet the growing acceptance from other global markets.

Increasing Consumer Awareness and Acceptance is driving market growth:

An increase in consumer awareness around environmental, ethical, and health issues arising from conventional meat production helps to foster acceptance of cultured meat products. Recent consumer trends reveal that consumers are generally more aware and conscientious about the environmental effects of meat production, specifically, greenhouse gas emissions and deforestation associated with raising livestock compared to plant-based production. Consumers are also concerned about animal welfare and the ethical issues around factory-farm raised animals. These trends will create an opportunity for consumers to seek alternatives to conventional meat. As consumers become aware of the advantages of cultured meat, its popularity will increase among environmentally conscious, health-conscious, and ethically-conscious consumers. Additionally, hybrid meat products that combine cultured meat with plant-based ingredients may increase consumer acceptance by appealing to both plant-based and meat-eating consumers. As cultured meat becomes available to consumers at scale and at lower price points, consumer interest in cultured meat will continue to grow, contributing to the growth of the industry overall.

Global Cultured Meat Market Challenges and Restraints:

High Production Costs and Scalability Issues is restricting market growth:

One of the key challenges for the cultured meat industry is the expensive costs for production. While advances have been made in technology that has made cultured meat easier to produce in the last few years, it is still much more costly to produce than conventional meat. Production of cultured meat requires expensive growth media, bioreactors and specialized equipment. Because of high production costs, cultured meat products are produced at a relatively high price and are difficult to access for a wider consumer base. Scalability for cultured meat production is still in early phases, with companies looking to develop large-scale production systems that can meet the increased demand for these products. Some progress has been made, but scaling production of cultured meat is an ongoing challenge which requires further technological innovation and capital investment. Until the costs of production come down significantly and scalability challenges are met, cultured meat products will continue to be a niche product and will not be widely adopted.

Regulatory Approval and Public Perception is restricting market growth:

Another major obstacle facing the cultured meat industry is the approval process from regulators. Although some nations such as Singapore have already authorized the commercial sale of cultured meat, other countries do not have guidelines for lab-grown meat products. The regulatory approval process is necessary to address product safety and quality, and can be lengthy and complicated. Regulatory bodies will have to deal with issues such as labeling and marketing and consumer protection issues, all of which could impact the market's growth. As public opinion is closely related to acceptable of cultured meat products, public awareness and understanding of cultured meat is extending, however, some consumers will still be hesitant to eat lab-grown meat products due to safety, taste, and the "unnatural"-ness of these products. Meeting this challenge will take the efforts of companies, regulators, and educators to build consumer confidence in their product and ensure cultured meat products are safe and carry a high-quality guarantee.

Market opportunities:

There are many avenues for growth and innovation in the cultured meat market. One potential opportunity for growth may be large-scale production, which could lower the cost of cultured meat and help to deliver it to the mass market. As technology continues to improve, we would expect that production efficiencies will drive down the price of cultured meat, so that it will be a feasible competitor to conventional meat based on price alone. Another opportunity is the collaboration of cultured meat producers and traditional food companies, which could provide scaled growth pathways to commercialize and distribute lab-grown meat products faster. Further, hybrid meat products that combine cultured meat with plant-based ingredients present a substantial opportunity to attract more customers, including existing plant-based eaters and existing beef, poultry and pork using customers alike. Cultured meat also presents an opportunity for expansion into new markets, such as expanding across borders to regions with rapidly growing protein demands, primarily in Asia-Pacific and Africa regions. New awareness of the environmental and ethical advantages of lab-grown meat will increase acceptance and result in further attempts to introduce sophisticated new food sources to displacing current animal-based protein. In summary, the cultured meat market is well-positioned for considerable growth as technology increases, and costs decrease and as consumer acceptance grows.

CULTURED MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

27.5% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mosa Meat, Memphis Meats, Eat Just, Aleph Farms, and Future Meat Technologies. |

Cultured Meat Market segmentation:

Cultured Meat Market Segmentation By Product:

- Beef

- Poultry

- Pork

- Seafood

- Others

Beef is the leading product segment in the cultured meat sector, due to it being one of the most commonly consumed meats across the globe. Given consumer demand and reduced environmental impacts compared to producing beef, companies have devoted a significant amount of research to lab-grown beef. The expansion of beef production is a core area of focus, and as the technology improves, the costs of producing lab-grown beef are expected to decrease. This will lead to an increase in market share in the beef cultured meat sector.

Cultured Meat Market Segmentation By Application:

- Foodservice

- Retail

- Industrial

Foodservice is the leading application in the cultured meat market, as it continues to be a primary way for consumers to have their first experience with lab-grown meat products. High-end restaurants and to-go food providers are the primary ways consumers first introduced to cultured meat products. As lab-grown meat continues to be accepted by consumers, foodservice applications will eventually widen their offering of lab-grown meat products, growing the market presence of cultured meat into the foodservice application.

Cultured Meat Market Regional Segmentation:

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

The cultured meat market is led by North America as a dominant region, due to its established food industry, government regulatory support, and growing consumer demand for sustainable and novel food products. The U.S. and Canada are home to some of the leading cultured meat companies, and there has been significant investment into research and development of cultured meat technologies. Moreover, North American consumers are becoming more concerned about the ethical and environmental impact of their food and shifting demand towards alternatives like cultured meat. Overall, the increased interest from consumers and food producers is expected to solidify North America as an industry leader in cultured meat.

COVID-19 Impact Analysis on the Cultured Meat Market:

The cultured meat industry faced both opportunities and challenges with the COVID-19 pandemic. Disruption the pandemic caused at various levels across the globe influenced the supply chain creation, causing delays in research and product development initiatives. However, the pandemic also shed a light on the vulnerabilities associated with the traditional meat supply chain, in particular the threats of zoonotic disease and disruption to animal agriculture. Interest in the cultured meat market is reclining on an overall growing interest in alternative protein sources - including cultured meat - as a method of reducing opportunity cost associated with traditional animal agriculture. As the world operates in recovery from the pandemic it has recognized the need for a more resilient and sustainable food production system. As these trends grow, and many of the catalysts for this change remain the same (increased demand and technological advances), the post-pandemic market has built significantly on an existing momentum leading to anticipated eventual growth in the cultured meat market.

Latest trends/Developments:

Current developments in the cultured meat sector include improvements in bioreactor technology that aid scalability and lower costs. Companies are focusing on more efficient and larger bioreactors needed for mass production, which will serve as a foundational step toward making cultured meat commercially viable. Another related trend is the exploration of hybrid products that pair cultured meat with plants so that the products are more marketable and appealing based on price. These hybrid products will attract a broader range of consumers; especially those who may not be fully committed to trying lab-grown meat, yet. Additionally, regulatory avenues continue to develop, beginning primarily in Singapore, wherein cultured meat has now been approved for commercialization. As more regions seek regulatory approval, commercialization can be expected to ramp up to help further develop the market.

Key Players

- Mosa Meat

- Memphis Meats

- Eat Just

- Aleph Farms

- Future Meat Technologies

- SuperMeat

- Wild Type

- BioTech Foods

- UPSIDE Foods

- Shiok Meats

Chapter 1. CULTURED MEAT MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. CULTURED MEAT MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. CULTURED MEAT MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. CULTURED MEAT MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. CULTURED MEAT MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CULTURED MEAT MARKET – By Product

6.1 Introduction/Key Findings

6.2 Beef

6.3 Poultry

6.4 Pork

6.5 Seafood

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. CULTURED MEAT MARKET – By Application

7.1 Introduction/Key Findings

7.2 Foodservice

7.3 Retail

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. CULTURED MEAT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. CULTURED MEAT MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Mosa Meat

9.2 Memphis Meats

9.3 Eat Just

9.4 Aleph Farms

9.5 Future Meat Technologies

9.6 SuperMeat

9.7 Wild Type

9.8 BioTech Foods

9.9 UPSIDE Foods

9.10 Shiok Meats

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cultured Meat Market was valued at USD 350 million in 2024 and is projected to reach USD 1.1 billion by 2030.

Drivers include growing demand for sustainable food production, technological advancements, and increasing consumer awareness of environmental and ethical issues related to meat consumption.

The market is segmented by product (beef, poultry, pork, seafood, others) and application (foodservice, retail, industrial).

North America is the dominant region, driven by strong investments in technology, a robust food industry, and growing consumer demand for sustainable food alternatives.

Leading players include Mosa Meat, Memphis Meats, Eat Just, Aleph Farms, and Future Meat Technologies.