Europe cultured Meat Market Size (2024-2030)

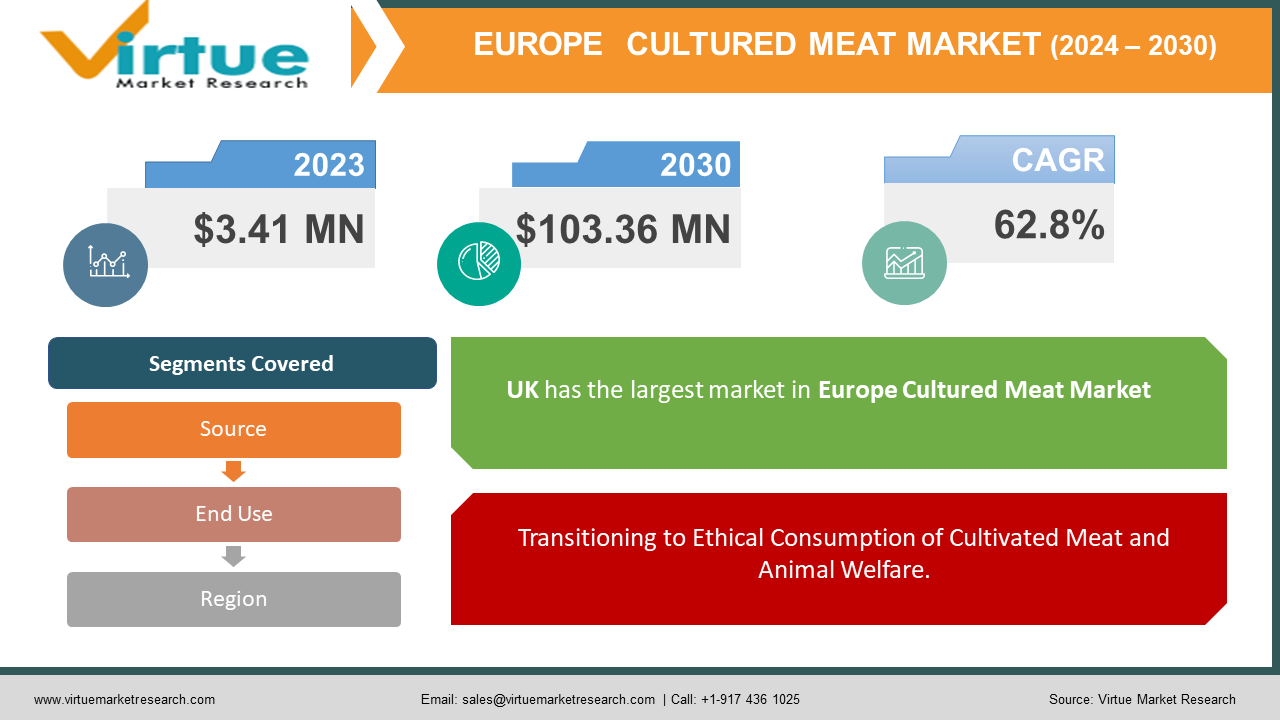

The Europe cultured Meat Market was valued at USD 3.41 million and is projected to reach a market size of USD 103.36 million by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 62.8% between 2024 and 2030.

Cultured meat, sometimes referred to as lab-grown meat or synthetic meat, is meat that is made by culturing animal cells in vitro. It is a type of cell cultivation that doesn't require animal sacrifice. Produced by tissue engineering, it is comparatively safe to eat, with less contamination from Salmonella and E. Coli germs. Cultured meat is meat that has been developed in a lab utilizing different tissue engineering techniques and created in a culture medium. Clean meat, extracorporeal meat, and synthetic meat are other names for cultured meat. The process of producing embryos involves gathering animal cells and cultivating them in a nutrient-rich growth medium. As a result, the finished meat is raised in a sterile, tightly regulated environment, guaranteeing that it is devoid of any potentially dangerous pathogens. A variety of animal cells are grown in a nutrient-rich medium to produce cultured meat. These cells can proliferate to the point that all the cells needed to create a year's worth of meat for the entire world's population can be used. Cultured meats are revolutionizing the food and beverage business as producers get closer to creating meat alternatives.

Key Market Insights:

Despite being in its infancy, the European market for cultured meat is expected to grow significantly in the next years due to a shift in customer preferences towards animal welfare and environmental sustainability. The market for cultured meat products is becoming more open as a result of this trend, which motivates businesses to spend money on developing new goods for markets including beef, chicken, pig, and seafood. Nevertheless, obtaining regulatory approval is crucial, and managing the changing regulatory environment continues to be a significant barrier to market access. However, the European market is home to a vibrant ecosystem that includes up-and-coming businesses, well-known food brands, and academic institutions working to advance the science of cultured meat, suggesting that this new sector of the economy has a bright future.

Europe Cultured Meat Market Drivers:

Satisfying Consumer Demand for Cultured Meat's Sustainable Promise

Growing consumer worries about the environmental impact of traditional meat production are driving the need for sustainable protein sources, which is changing the face of the food sector. Concerns about greenhouse gas emissions, land use, and water use related to traditional meat production have driven customers to look for more environmentally friendly options. Within this framework, cultured beef shows great promise as a viable substitute that appeals to consumers who care about the environment. Cultured meat resolves important sustainability issues while offering the same amount of protein as conventional meat production methods by requiring a great deal less land, water, and feed resources. The growing preference for environmentally friendly food options among consumers has resulted in a rise in interest and demand for cultured meat products due to their alignment with their values. Cultured beef is expected to play a big part in satisfying the changing needs of consumers who are dedicated to making sustainable food choices as awareness of its environmental benefits grows.

Transitioning to Ethical Consumption of Cultivated Meat and Animal Welfare.

Growing consumer preferences for plant-based and alternative protein sources are being driven by growing concerns about animal cruelty. The goal of this movement is to lessen the suffering of animals kept in traditional methods for the production of meat. Cultured beef presents itself as a compelling alternative that satisfies the needs of consumers who place a high priority on animal compassion by removing the need for animal killing. The allure of cultured meat is its capacity to provide a guilt-free protein substitute, which appeals greatly to people who want to consume less traditional meat products but still get the familiar flavour and texture. Interest in cultured meat as a more sustainable and compassionate option is growing along with awareness of the moral ramifications of animal agriculture. Cultured meat is positioned to play a crucial role in satisfying the changing needs of customers who are becoming more conscious of animal welfare. It has the potential to completely transform the food business by offering a source of protein without involving cruelty to animals.

Europe Cultured Meat Market Restraints and Challenges:

The cultured meat sector has considerable problems due to stringent regulations and high production costs. The current cost of creating cultured meat is significantly higher than that of traditional meat production techniques, mainly because of the high cost of growing media, complex bioreactors, and continuous research and development. The increased expenses result in increased pricing points for customers, which hinders the extensive implementation of cultured meat products. Furthermore, since receiving permission for safety and labelling is essential for entering the market, the absence of clear regulatory norms in Europe presents further challenges. The strictness of these laws may make it difficult for businesses to launch novel goods made from cultured meat, which would further impede their ability to reach a wider market. Notwithstanding these difficulties, it is anticipated that further scientific progress and legislative changes will progressively remove these obstacles, opening the door for a more sustainable and profitable future for the cultured meat sector.

Europe Cultured Meat Market Opportunities:

Cultured meat has the potential to completely transform the food sector. It will probably gain popularity in premium or niche markets where consumers value ethical and sustainable production methods, even if they are more expensive. This covers places like upscale dining venues and specialty food shops in addition to items made to accommodate particular dietary requirements. Further expansion into a broader range of cultured meat products, including specialty meats, marine variants, and even the ability to replicate the well-known phenomenon of fat marbling in traditional meats, is possible as manufacturing methods become more economical. In order to address production issues and accelerate technological developments, cooperation between research institutes, startups, and existing food companies will be crucial in promoting faster market access. The secret to cutting production costs and raising competitiveness with traditional meat prices is ingredient innovation, especially in the development of more affordable and scalable growth media, which will increase consumer adoption. To overcome initial skepticism and propel long-term success in the cultured meat sector, however, extensive public education campaigns highlighting the sustainability and ethical advantages of cultured meat are necessary.

EUROPE CULTURED MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

62.8% |

|

Segments Covered |

By Source, end use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Mosa Meat Ltd., Aleph Farms Ltd., Meatable Ltd., Higher Steaks Ltd., Avant Meats Ltd., Peace of Meat Ltd., Orbillion Bio Ltd., Biotech Foods Ltd., Vow ASA Ltd., Hoxton Farms Ltd. |

Europe Cultured Meat Market Segmentation:

Europe Cultured Meat Market Segmentation By Source:

- Poultry

- Beef

- Seafood

- Pork

- Duck

The Europe-Cultured Meat Market Segmented by Source, Poultry held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Cultured poultry is an appealing alternative that meets consumer preferences while addressing ethical and environmental issues. The enormous demand for chicken among consumers and its widespread appeal make it a prime target for disruption in the meat market. Compared to other meats like red meat, the process of producing cultured poultry is simpler because it involves fewer sophisticated bioengineering procedures for the chicken cells. This makes it a more affordable choice for businesses that want to produce cultured meat. Additionally, the adaptability of chicken flesh to a variety of culinary applications—from stir-fries and curries to nuggets and tenders—improves the allure of cultured chicken by catering to a wide range of customer preferences and dietary trends. Customers' innate familiarity with chicken as a source of protein may help cultured chicken gain acceptability and adoption since people are more likely to test a familiar protein source made in a novel way. This familiarity may facilitate the shift to options for cultured meat, which would help cultured poultry become more widely accepted and integrated into regular food consumption patterns.

Europe Cultured Meat Market Segmentation By End-use:

- Nuggets

- Burgers

- Meatballs

- Sausages

- Hot Dogs

The Europe-Cultured Meat Market Segmented by End-use, Burgers held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The market for cultured burgers is anticipated to rise as consumers' preferences for ethical and sustainable meat substitutes increase. Burgers made with cultured meat may lessen the meat industry's negative environmental effects. Cultivated meat is being tested by several startups and major businesses, which is anticipated to help the market expand. The first-ever cultured meat hamburger manufacturer, Mosa Meat, said in January 2020 that it has partnered with Nutreco, an animal nutrition firm, to supply Mosa Meat with a nutrient-rich liquid to generate meat. Customers buy processed meat products like meatballs in big quantities from supermarkets. Additionally, the industry's customer base has grown as a result of increased knowledge of the purported health benefits of cultured meats. Throughout the forecast period, it is projected that the growing demand for meatballs and consumers' shifting preferences toward clean meats and alternatives will propel the rise of the cultured meatball sector.

Europe Cultured Meat Market Segmentation By Region:

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

The Europe Cultured Meat Market Segmented by Region, UK held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Due to its ability to lessen the environmental impact of animal production, the European market for cultured meat, which is dominated by the UK, Germany, Spain, and France, offers enormous prospects for the product. Growing R&D expenditures and a greater focus on innovation and development are anticipated to propel the UK cultured meat market. The expansion of the Spanish culture meat market is being driven by health concerns regarding the consumption of meat products. The demand for cultured meat products in Germany is increasing due to investors' growing interest in alternative proteins and their ability to provide customised proteins with the necessary nutrition. This shift in consumer preferences from traditional meat to cultured meat products is a significant factor in this trend. The way consumers see the consumption of meat products that drive the French cultured Meat market has been significantly impacted by the growing concern about animal cruelty in the meat industry.

COVID-19 Impact Analysis on the Europe-Cultured Meat Market:

The COVID-19 pandemic has forced the closure of manufacturing plants and laboratories, leading to societal isolation and shutdown scenarios. Sales slowed down and the supply chain was disrupted as speciality shops and supermarkets had to close in order to enforce social separation. After COVID-19, sales and demand for conventional meat, including beef, are likely to drop by half, which is predicted to boost the European cultured meat sector. Because meat products are thought to be the virus's original source, changes in consumer purchasing patterns expected an increase in the use of farm and alternative meats as a result of the outbreak. Microbial methods are primarily used in the production of Europe Cultured Meat, which is one of the emerging industries for the food and beverage industry. Diseases that may have an impact on Europe's production of cultured meat have caused a halt to manufacturing and research and development activities. Furthermore, following the coronavirus outbreak, consumer demands for food and lifestyle may have a significant influence, which may contribute significantly to future demand for Europe Cultured Meat. Consequently, the COVID-19 pandemic will have a moderate to high impact on the Europe cultured meat market.

Latest Trends/ Developments:

Businesses in the cultured meat sector are continuously conducting research to optimise production procedures with an acute focus on cost reduction. The development of more effective bioreactors, the search for substitute and affordable growth media ingredients, and the improvement of cell cultivation methods are some of the initiatives underway. Additionally, there has been a noticeable trend in favour of increasing production scale, as shown by European businesses moving from pilot plants to larger facilities, indicating a drive towards commercialization and increased confidence in the technology. Meanwhile, European regulatory agencies are moving forward with creating frameworks for cultured meat; recent developments include pre-market consultations and pilot regulatory programmes, which point to the direction of market approvals. Furthermore, significant obstacles are being addressed by developments in bioprinting technologies and nutrient inclusion that replicate the fat and texture of conventional beef. collaborations with large food retailers are gaining traction as companies venture beyond burgers to explore a wider assortment of items like sausages, seafood alternatives, and high-value cuts like steaks. These collaborations offer the potential for wider consumer access and market penetration. These changes highlight the inventiveness and drive propelling the cultured meat sector towards commercial success and widespread acceptance.

Key players:

- Mosa Meat Ltd.

- Aleph Farms Ltd.

- Meatable Ltd.

- Higher Steaks Ltd.

- Avant Meats Ltd.

- Peace of Meat Ltd.

- Orbillion Bio Ltd.

- Biotech Foods Ltd.

- Vow ASA Ltd.

- Hoxton Farms Ltd.

Chapter 1. Europe Cultured Meat Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Source

1.5. Secondary Product Source

Chapter 2. Europe Cultured Meat Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Cultured Meat Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Cultured Meat Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Cultured Meat Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Cultured Meat Market– By Source

6.1. Introduction/Key Findings

6.2. Poultry

6.3. Beef

6.4. Seafood

6.5. Pork

6.6. Duck

6.7. Y-O-Y Growth trend Analysis By Source

6.8. Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 7. Europe Cultured Meat Market– By End-use

7.1. Introduction/Key Findings

7.2 Nuggets

7.3. Burgers

7.4. Meatballs

7.5. Sausages

7.6. Hot Dogs

7.7. Y-O-Y Growth trend Analysis By End-use

7.8. Absolute $ Opportunity Analysis By End-use , 2024-2030

Chapter 8. Europe Cultured Meat Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By End-use

8.1.3. By Source

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Cultured Meat Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Mosa Meat Ltd.

9.2. Aleph Farms Ltd.

9.3. Meatable Ltd.

9.4. Higher Steaks Ltd.

9.5. Avant Meats Ltd.

9.6. Peace of Meat Ltd.

9.7. Orbillion Bio Ltd.

9.8. Biotech Foods Ltd.

9.9. Vow ASA Ltd.

9.10. Hoxton Farms Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe cultured Meat Market was valued at USD 3.41 million and is projected to reach a market size of USD 103.36 million by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 62.8% between 2024 and 2030.

The Europe Cultured Meat market is expected to reach USD 103.36 million by 2030.

The poultry sector drives the Europe-cultured meat market.

By 2023, the Europe Cultured Meat market is expected to be valued at USD 3.41 million.

The UK dominates the Europe-Cultured Meat market.