Plant-based Meat Size (2024-2030)

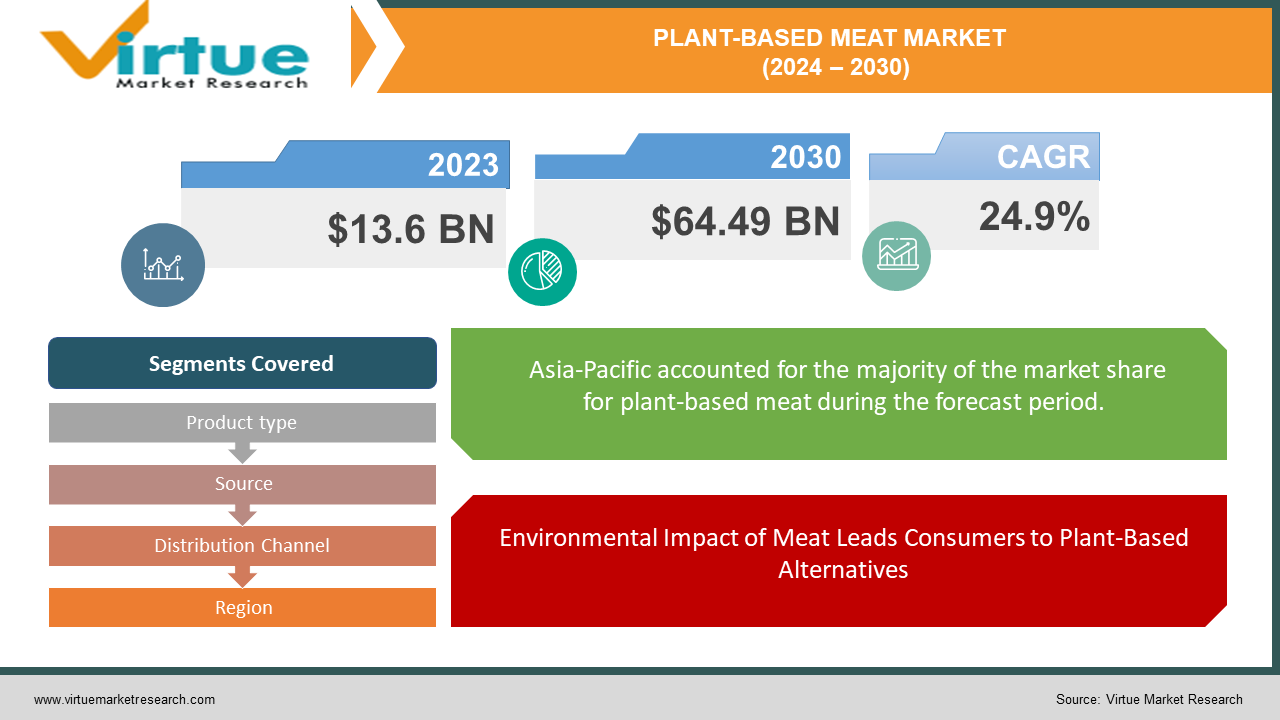

Plant-based Meat was valued at USD 13.6 billion in 2023 and is projected to reach a market size of USD 64.49 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 24.9%.

The plant-based meat market is a growing sector driven by a surge in consumer interest in sustainable and ethical food options. People are increasingly concerned about animal welfare and the environmental impact of meat production, leading them to explore plant-based alternatives.

Key Market Insights:

Innovation is a key driver of growth in this market. Manufacturers are constantly developing new products that better replicate the taste, texture, and appearance of real meat. This is attracting a wider range of consumers who may have previously been hesitant to try plant-based options. However, a major hurdle remains affordability. Plant-based meat can be more expensive than traditional meat, hindering its growth in price-sensitive regions. The recent dip in sales in 2023 further highlights this challenge. To achieve sustained market expansion, overcoming the price barrier through production efficiencies and cost-reduction strategies will be crucial.

Plant-based Meat Drivers:

Environmental Impact of Meat Leads Consumers to Plant-Based Alternatives

Livestock farming has a significant negative impact on the environment. It contributes heavily to greenhouse gas emissions, deforestation for grazing land, and water pollution from manure runoff. Plant-based meat offers a more sustainable option for meat consumption. Production typically requires less land and water and generates fewer greenhouse gases compared to traditional meat production.

Health-Conscious Consumers Seek Plant-Based Meat for its Nutritional Benefits

Consumers are increasingly interested in health and wellness, and plant-based meat can be a good fit for these goals. While the nutritional content varies by product, plant-based meat can often be lower in saturated fat and cholesterol than traditional meat. Additionally, some plant-based options are fortified with essential vitamins and minerals, and many are a good source of protein and fiber. This makes them appealing to health-conscious consumers seeking alternative protein sources that may be more heart-healthy and align with their dietary needs.

Constant Innovation in Plant-Based Meat Creates More Appealing Products

The plant-based meat market is constantly evolving with exciting new offerings. Manufacturers are investing heavily in research and development to create products that better mimic the taste, texture, and appearance of real meat. This is attracting a wider range of consumers who may not have been interested in earlier plant-based options that lacked the sensory experience of traditional meat. Innovations like plant-based bleeding burgers and realistic plant-based seafood are blurring the lines between plant and animal products.

Plant-based Meat Restraints and Challenges:

Plant-based meat has carved a niche for itself but faces hurdles to becoming a mainstream choice. A major obstacle is consumer perception. Some remain unconvinced that plant-based meat can replicate the taste and texture of real meat, leading to hesitancy. Additionally, misconceptions about the nutritional value of these products can deter potential consumers. Addressing these concerns through targeted marketing and education campaigns that emphasize the sensory experience and health benefits of plant-based meat is crucial.

Another challenge lies in the competition from the traditional meat industry. This well-established sector benefits from economies of scale, making it difficult for plant-based alternatives to compete solely on price. Overcoming this requires a multi-pronged approach. Plant-based meat companies need to continue innovating to create more appealing products that rival traditional meat in taste and texture. Furthermore, focusing on product differentiation, highlighting the environmental and ethical benefits of plant-based options, and building brand loyalty through effective marketing strategies are all essential for attracting and retaining customers.

Plant-based Meat Opportunities:

The plant-based meat market is brimming with potential that extends far beyond simply mimicking existing meat products. One exciting opportunity lies in targeting specific dietary needs. By developing plant-based meat options that are gluten-free, soy-free, or cater to keto and other dietary preferences, these companies can attract entirely new consumer segments who may have previously been excluded. This tailored approach has the potential to significantly expand the customer base for plant-based meat.

Furthermore, there's immense potential for global expansion. Emerging markets with large populations present a significant opportunity for growth. However, simply replicating existing products won't guarantee success. To truly tap into these new markets, plant-based meat companies will need to adapt their offerings to local tastes and affordability. This might involve using familiar spices and flavor profiles, along with ensuring price points are competitive within the local market.

Finally, fostering partnerships between plant-based meat companies, food service providers, and even traditional retailers can significantly accelerate market penetration. Collaboration allows each party to leverage its unique strengths. Plant-based meat companies can provide innovative products, while food service providers can showcase these options on their menus, familiarizing a wider audience with the taste and texture of plant-based alternatives. Traditional retailers, on the other hand, can offer these products in their stores, making them readily accessible to consumers. By working together, these players can disrupt the traditional meat industry and bring plant-based options to a much wider audience.

PLANT-BASED MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24.9% |

|

Segments Covered |

By Product type, Source, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Beyond Meat, Impossible Foods, Maple Leaf Foods, Unilever, Quorn Foods, Tofurky, Lightlife Foods, Kellogg Company, Gardein, Boca, MorningStar Farms |

Plant-based Market Segmentation: By Source

-

Soy-based

-

Pea-based

-

Wheat-based

-

Other Sources

The most dominant segment in plant-based meat by source is Soy-based, accounting for over 46% of the global market revenue. Soybeans are a versatile and affordable source of protein, making them ideal for mass production of plant-based meat products. However, the fastest-growing segment is Pea-based meat. Pea protein is allergen-friendly and has a neutral taste, allowing for greater flavor innovation. This, along with growing consumer interest in alternative protein sources, is driving the rapid rise of pea-based meat options.

Plant-based Market Segmentation: By Product Type

-

Burgers

-

Nuggets and Tenders

-

Sausages

-

Meatballs

-

Others

Plant-based burgers currently reign supreme in the product type sector, offering a wide variety of options that mimic different meats. However, ground "meat" alternatives are experiencing the fastest growth, likely due to their versatility in familiar dishes like Bolognese or tacos. This trend suggests a growing consumer interest in incorporating plant-based options seamlessly into their existing culinary repertoire.

Plant-based Market Segmentation: By Distribution Channel

-

Retail

-

Foodservice

-

Direct-to-consumer

Within the distribution channels, retail holds the dominant position, offering plant-based meat directly to home cooks through grocery stores. However, the food service sector is experiencing the fastest growth. Restaurants and cafes are increasingly catering to a growing demand for sustainable dining options, making plant-based meat a strategic menu addition. This trend indicates a potential shift in consumer behavior, where plant-based meat goes beyond home cooking and becomes more widely available for convenient, on-the-go meals.

Plant-based Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America reigns supreme in the plant-based meat market, boasting a significant share and experiencing tremendous growth. This dominance can be attributed to several factors, including high consumer interest in health, sustainability, and animal welfare. Major players like Beyond Meat and Impossible Foods are headquartered here, further solidifying the region's leadership in innovation and product development.

Asia-Pacific holds immense potential for future growth. While currently in its nascent stage, the Asia-Pacific market is expected to see a surge due to factors like rising disposable incomes, increasing urbanization, and growing awareness of health and environmental issues. However, cultural preferences and affordability remain challenges that need to be addressed for wider adoption.

COVID-19 Impact Analysis on the Plant-based Meat:

The COVID-19 pandemic's impact on plant-based meat was a mixed bag. On the positive side, disruptions in the traditional meat supply chain presented an opportunity for plant-based alternatives, which were generally less affected. Additionally, heightened health consciousness during the pandemic may have led some consumers to explore plant-based options perceived as healthier. The longer shelf life of some frozen plant-based meat options compared to fresh meat might have also contributed to its appeal during the initial stockpiling phase.

However, the pandemic also brought challenges. The economic downturn led to increased price sensitivity, hindering sales in regions where plant-based meat remains more expensive. Additionally, with restaurants closed or offering limited service, food service sales, a key growth area for plant-based meat, declined. As consumers focused on staple foods during uncertain times, plant-based meat alternatives might have been seen as less essential.

Overall, the long-term effects of the pandemic on plant-based meat are yet to be fully understood. While there was an initial boost, the underlying drivers for plant-based meat consumption remain strong. Moving forward, overcoming price barriers and continuous product development will be key factors influencing the sustained growth of this promising market.

Latest Trends/ Developments:

The plant-based meat scene is buzzing with innovation, pushing the boundaries of what's possible. Cultivated meat, grown directly from animal cells in a lab, is a revolutionary technology with the potential to create hyper-realistic plant-based options that mimic the taste, texture, and even the sizzle of real meat. Additionally, new plant-based fats are mimicking animal fat in taste and mouthfeel, creating a more satisfying sensory experience. Beyond land-based meats, the focus is expanding to hyper-realistic plant-based seafood alternatives like shrimp, scallops, and even tuna. Fermentation techniques are being utilized to create novel plant-based proteins and flavors, potentially improving the nutritional profile and taste of these products. Furthermore, plant-based meat companies are moving beyond imitation, developing options with additional functionalities. This includes fortification with essential vitamins and minerals, or formulations high in protein and low in sodium. Finally, distribution channels are expanding beyond grocery stores. Partnerships with fast-food chains and convenience stores are making plant-based options more accessible for on-the-go consumers, while companies are setting their sights on global expansion, tailoring products to local tastes and affordability in new markets. These trends showcase the exciting potential of the plant-based meat industry, constantly evolving to deliver more sustainable, ethical, and delicious protein options.

Key Players:

-

Beyond Meat

-

Impossible Foods

-

Maple Leaf Foods

-

Unilever

-

Quorn Foods

-

Tofurky

-

Lightlife Foods

-

Kellogg Company

-

Gardein

-

Boca

-

MorningStar Farms

Chapter 1. Plant-based Meat Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plant-based Meat Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plant-based Meat Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plant-based Meat Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plant-based Meat Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plant-based Meat Market – By Source

6.1 Introduction/Key Findings

6.2 Soy-based

6.3 Pea-based

6.4 Wheat-based

6.5 Other Sources

6.6 Y-O-Y Growth trend Analysis By Source

6.7 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Plant-based Meat Market – By Product Type

7.1 Introduction/Key Findings

7.2 Burgers

7.3 Nuggets and Tenders

7.4 Sausages

7.5 Meatballs

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Product Type

7.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Plant-based Meat Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Retail

8.3 Foodservice

8.4 Direct-to-consumer

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Plant-based Meat Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Product Type

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Product Type

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Product Type

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Product Type

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Product Type

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Plant-based Meat Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Beyond Meat

10.2 Impossible Foods

10.3 Maple Leaf Foods

10.4 Unilever

10.5 Quorn Foods

10.6 Tofurky

10.7 Lightlife Foods

10.8 Kellogg Company

10.9 Gardein

10.10 Boca

10.11 MorningStar Farms

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Plant-based Meat was valued at USD 13.6 billion in 2023 and is projected to reach a market size of USD 64.49 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 24.9%.

Ethical Concerns, Environmental Impact, Health and Wellness, Product Innovation.

Plant-based burgers, Ground "meat" alternatives, Plant-based sausages, Plant-based chicken nuggets, and tenders are emerging categories.

North America reigns supreme in the plant-based meat market, boasting the largest share and experiencing significant growth.

Beyond Meat, Impossible Foods, Maple Leaf Foods, Unilever, Quorn Foods, Tofurky, Lightlife Foods, Kellogg Company, Gardein, Boca, MorningStar Farms.