Camel Meat Market Size (2024-2030)

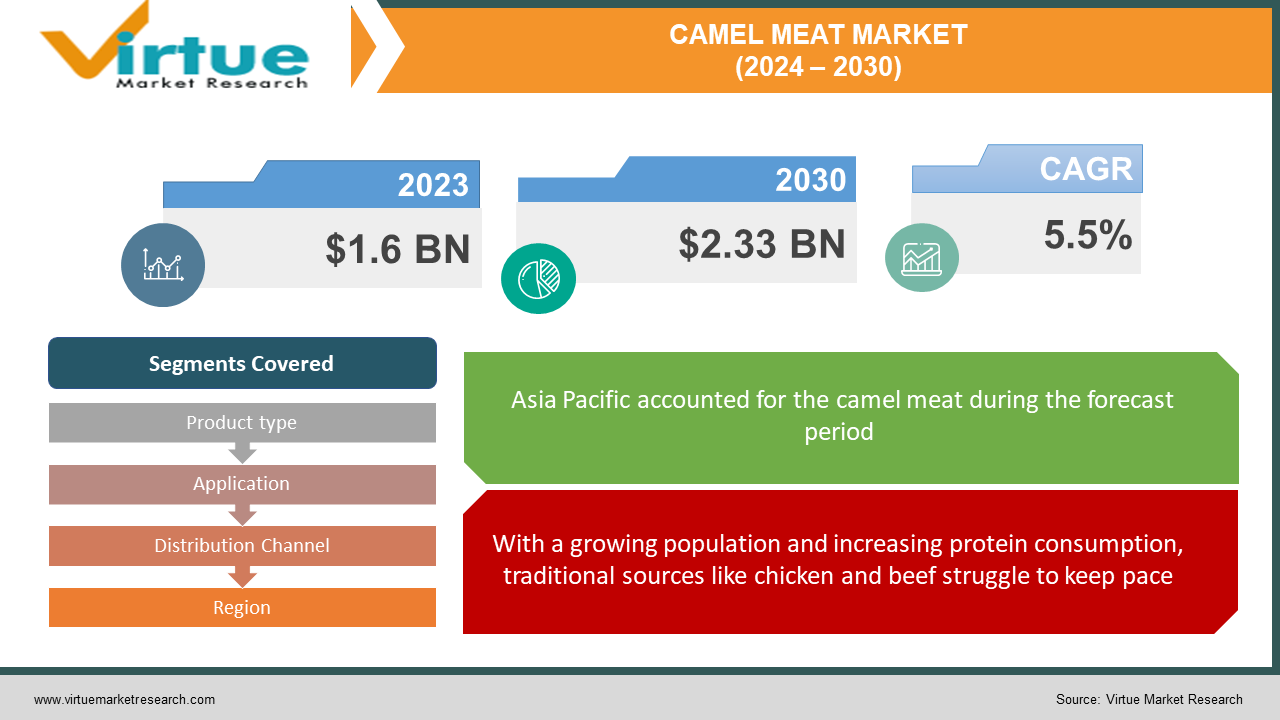

The Camel Meat Market was valued at USD 1.6 billion in 2023 and is projected to reach a market size of USD 2.33 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5.5%.

Fueling this growth are rising incomes in key regions like the Middle East and Africa, where camel meat is recognized for its health benefits and cultural significance. Additionally, its climate resilience and growing urban demand for convenient protein sources paint a promising future. However, the market faces hurdles. Production and supply chains lack development in many areas, and negative stereotypes regarding camel meat linger in some regions. Inconsistent regulations across borders further complicate international trade. Despite these challenges, the future looks bright. Emerging larger players like Samex Australian Meat Company are consolidating the market, while technological advancements and innovative processing methods are expected to enhance competitiveness.

Key Market Insights:

Despite its humble beginnings, the camel meat market is trotting confidently towards the future, predicted to outpace other meat categories with a brisk canter. Fueling this journey is rising prosperity in key regions like the Middle East and Africa, where camel meat isn't just a familiar sight, but also valued for its health benefits and cultural significance. Its ability to thrive in harsh environments adds a sustainability stamp to its already impressive resume.

But the path isn't without obstacles. Underdeveloped production and supply chains keep camel meat out of reach in many areas, and outdated stereotypes linger in some markets. Inconsistent regulations across borders create another hurdle.

Thankfully, the horizon shines bright. Larger players like Samex Australian Meat Company are consolidating the market, while innovative processing methods and exciting technological advancements promise to boost its competitiveness. Research and education are also galloping forward, aiming to address consumer concerns and broaden acceptance. This unique protein source is poised for steady growth, potentially becoming a more common sight on our global dinner plates in the years to come.

The Camel Meat Market Drivers:

With a growing population and increasing protein consumption, traditional sources like chicken and beef struggle to keep pace:

As disposable incomes flourish in regions like the Middle East and Africa, traditionally familiar with camel meat, the demand for this protein source is surging. Its cultural significance and perception of health benefits, including lower fat and higher iron content compared to red meat, further boost its appeal.

Camels, requiring less water and thriving in harsh environments, minimize their environmental footprint compared to other livestock:

Camels are champions of adaptability, thriving in harsh environments with minimal water requirements. This makes them a highly sustainable meat source in arid and semi-arid regions, attracting increasing interest in a world facing climate challenges.

Strategic campaigns focusing on specific demographics and regions can raise awareness and promote camel meat as a viable protein option:

The rapid rise of urban populations creates a demand for convenient and protein-rich food options. Camel meat, with its long shelf life and versatility in various dishes, presents itself as a potential answer to this need.

Camel meat generally has lower fat content than other red meats, making it attractive to health-conscious consumers:

Beyond cultural appreciation, camel meat is gaining traction for its perceived health benefits. Its lower fat content and higher iron and vitamin levels compared to other red meats make it an attractive option for health-conscious consumers.

Technological advancements in processing and preservation enhance product quality, shelf life, and accessibility, expanding market reach:

Innovations in processing and preservation methods are enhancing the camel meat industry's competitiveness. This includes techniques like vacuum packaging and cold chain management, which improve product quality and shelf life.

The Camel Meat Market Restraints and Challenges:

Despite its promising trajectory, the camel meat market faces several hurdles that need to be addressed for sustained growth. Limited availability due to underdeveloped production infrastructure, particularly in emerging markets, hinders wider accessibility. Cultural perceptions and unfamiliarity with camel meat in some regions can act as deterrents, requiring educational campaigns and targeted marketing to change mindsets. Regulatory frameworks and certification processes vary across countries, creating complexities for both producers and exporters. Additionally, concerns regarding disease control and food safety require robust practices and transparency to build trust among consumers.

Other challenges include logistical constraints in distribution and supply chains, particularly in transporting fresh camel meat over long distances. The lack of standardization in processing and quality control across producers can also limit market confidence. Furthermore, the relatively high cost of camel meat compared to some traditional options might deter price-sensitive consumers. Finally, ethical concerns regarding animal welfare and slaughter practices in some regions need to be addressed through responsible and transparent production practices.

Overcoming these restraints requires a collaborative effort from various stakeholders. Producers need to invest in infrastructure development, breeding programs, and improved processing techniques. Governments can play a role in streamlining regulations and promoting camel meat production through subsidies and incentives. Research institutions can contribute by conducting studies on disease control, nutrition, and consumer preferences. Finally, marketing, and educational campaigns can help address cultural perceptions and build consumer confidence in the safety and quality of camel meat.

The Camel Meat Market Opportunities:

Despite facing limitations like limited availability and negative perceptions, the camel meat market boasts exciting prospects. Value-added products like sausages and ready-to-eat meals can entice new consumers, while tapping into untapped markets like Europe and North America expands reach. Technological advancements hold the key to enhanced quality, shelf life, and variety, attracting busy consumers with pre-marinated cuts and convenient options. Moreover, embracing sustainability and ethical sourcing practices resonates with a growing segment of environmentally and ethically conscious consumers, creating a niche market with immense potential.

Furthermore, collaboration between producers, processors, retailers, and research institutions can unlock further opportunities. Imagine joint marketing campaigns, research projects, and streamlined supply chains boosting market confidence and accessibility. Additionally, addressing consumer concerns through education and awareness campaigns can dispel myths and build trust, leading to wider acceptance. Highlighting the unique health benefits like lower fat and higher iron content can woo health-conscious individuals seeking nutritious protein options. Exploring e-commerce and specialty stores can bridge the gap between camel meat and consumers, while diversification in breeds, cuts, and branding strategies caters to diverse tastes and creates a premium image.

CAMEL MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DCF Trading, Exotic Meat Markets, Steppen Meat, Meat & Livestock Australia, The Camel Milk Company, Samex Australian Meat Company, Windy Hills Australian Game Meats, Fettayleh Smallgoods, Al-Nass Camel Meat Company |

Camel Meat Market Segmentation: By Product Type

-

Fresh Camel Meat

-

Processed Camel Meat

-

Live Camels

The most dominant segment in the camel meat market by product type is Fresh Camel Meat, accounting for a significant portion of consumption, particularly in traditional markets like the Middle East and Africa. However, the fastest-growing segment is Processed Camel Meat.

Camel Meat Market Segmentation: By Application

-

Household Consumption

-

Food Service

-

Institutional Use

Household Consumption is the most dominant segment in the camel meat market by application, driven by established consumption patterns in traditional regions like the Middle East and Africa. However, the Food Service segment is experiencing the fastest growth.

Camel Meat Market Segmentation: By Distribution Channel

-

Traditional Butchers

-

Supermarkets and Hypermarkets

-

Online Retailers

-

Specialty Stores

The most dominant segment by distribution channel in the camel meat market is traditional butchers, particularly in regions with established camel meat consumption like the Middle East and Africa. However, the fastest-growing segment is expected to be online retailers.

Camel Meat Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America: Imagine camel steaks sizzling on grills as a novelty protein source. This nascent market, fuelled by rising incomes and interest in exotic fare, holds vast potential. However, hurdles like limited availability and consumer unfamiliarity need to be tackled. Targeted marketing and education will pave the way for wider acceptance. Think premium camel burgers alongside familiar options at your local supermarket!

Asia-Pacific: The aroma of camel curry wafts through the air in China and India, where the camel meat market is on the rise. Rising protein demand and cultural influences from the Middle East are key drivers. But limited supply chains and regulations hold it back. Imagine research unlocking the region's potential, making camel meat a familiar sight on Asian dinner tables.

Europe: European consumers are becoming increasingly health-conscious and open to alternative protein sources, creating a promising market for camel meat. Think camel sausages alongside traditional options at your local butcher shop. However, varying consumer perceptions and regulations across countries call for tailored strategies. Imagine European and Middle Eastern producers collaborating to smooth supply chains and market entry.

South America: Camel meat is still a rare sight in this region, with limited production and consumption. However, niche markets focused on sustainability and exotic proteins show potential for future growth. Imagine camel jerky becoming a popular snack choice amongst adventurous South American consumers. Research and development efforts are crucial to understand preferences and adapt production practices for this unique region.

Middle East and Africa: The vibrant aroma of spices fills the air as camel meat dishes are prepared in homes and restaurants across these regions. With a long history and cultural significance, the market is well-established. Imagine innovative value-added products like camel meat pies alongside traditional dishes. While mature, opportunities exist for improved processing and increased exports to other regions.

COVID-19 Impact Analysis on the Camel Meat Market:

The camel meat market, initially galloping towards growth, hit a hurdle with the COVID-19 pandemic. Lockdowns disrupted supply chains, tourism slumps reduced restaurant demand, and misinformation fueled temporary consumer fears. While traditional camel meat hubs like the Middle East faced major hits, other regions saw potential benefits. Increased focus on local food sources potentially helped producers in self-sufficient areas, and the e-commerce boom offered new sales avenues. Additionally, heightened hygiene protocols might have instilled long-term consumer confidence.

The overall impact remains complex. The short-term was undoubtedly disruptive, with reduced demand and supply chain challenges. However, the long-term picture seems more nuanced. While the market recovers, the full impact and future trajectory are still unfolding. Regional variations also paint a diverse picture. Established markets like the Middle East faced different challenges than emerging ones, and processed camel meat might have weathered the storm better than fresh cuts.

Despite the initial setbacks, the camel meat market shows resilience. By adapting to the post-pandemic landscape, it can capitalize on potential opportunities like increased awareness, e-commerce adoption, and a continued focus on sustainability. So, while the COVID-19 journey took an unexpected turn, the camel meat market's future still holds promise, with the potential to trot towards a brighter, more diversified future.

Latest Trends/ Developments:

The camel meat market, once known for its traditional cuts, has taken a sharp turn towards innovation and diversification. Plant-based alternatives catering to sustainability concerns and lab-grown options promising ethical production are just the beginning. Imagine "camel" burgers made from peas or cultured steaks in controlled settings!

Sustainability is becoming a major driver, with regenerative agriculture practices like improved land management and water conservation gaining traction. Additionally, AI and blockchain are streamlining the industry, optimizing breeding, predicting diseases, and ensuring transparency in supply chains. Picture AI-powered farms and blockchain-based traceability of your camel meat!

Beyond traditional cuts, value-added products like sausages, snacks, and ready-to-eat meals are expanding the market's reach. This, coupled with ventures into new markets like Europe and North America, paints a picture of a dynamic and adaptable industry. Think camel sausages alongside familiar options at your local butcher!

Health and wellness are also playing a key role. Highlighting lower fat content, higher iron levels, and halal/kosher certifications attracts health-conscious consumers seeking diverse protein sources. Additionally, collaborative partnerships between producers, processors, retailers, and researchers are fostering innovation, improving supply chains, and expanding market reach. Imagine research projects and joint marketing campaigns propelling the industry forward!

Key Players:

-

DCF Trading

-

Exotic Meat Markets

-

Steppen Meat

-

Meat & Livestock Australia

-

The Camel Milk Company

-

Samex Australian Meat Company

-

Windy Hills Australian Game Meats

-

Fettayleh Smallgoods

-

Al-Nass Camel Meat Company

Chapter 1. Camel Meat Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Camel Meat Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Camel Meat Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Camel Meat Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Camel Meat Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Camel Meat Market – By Product Type

6.1 Introduction/Key Findings

6.2 Fresh Camel Meat

6.3 Processed Camel Meat

6.4 Live Camels

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Camel Meat Market – By Application

7.1 Introduction/Key Findings

7.2 Household Consumption

7.3 Food Service

7.4 Institutional Use

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Camel Meat Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Traditional Butchers

8.3 Supermarkets and Hypermarkets

8.4 Online Retailers

8.5 Specialty Stores

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Camel Meat Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Camel Meat Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 DCF Trading

10.2 Exotic Meat Markets

10.3 Steppen Meat

10.4 Meat & Livestock Australia

10.5 The Camel Milk Company

10.6 Samex Australian Meat Company

10.7 Windy Hills Australian Game Meats

10.8 Fettayleh Smallgoods

10.9 Al-Nass Camel Meat Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Camel Meat Market was valued at USD 1.6 billion in 2023 and is projected to reach a market size of USD 2.33 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5.5%.

With a growing population and increasing protein consumption, traditional sources like chicken and beef struggle to keep pace, Camels, requiring less water and thriving in harsh environments, minimize their environmental footprint compared to other livestock, Camel meat generally has lower fat content than other red meats, making it attractive to health-conscious consumers, Technological advancements in processing and preservation enhance product quality, shelf life, and accessibility, expanding market reach.

Traditional Butchers, Supermarkets and Hypermarkets, Online Retailers, Specialty Stores

The Middle East and Africa is the most dominant region for the camel meat market, boasting established production infrastructure, cultural significance, and long history of consumption.

DCF Trading, Exotic Meat Markets, Steppen Meat, Meat & Livestock Australia, The Camel Milk Company, Samex Australian Meat Company, Windy Hills Australian Game Meats, Fettayleh Smallgoods, Al-Nass Camel Meat Company