Global Injection Molding Machines Market Size (2024-2030)

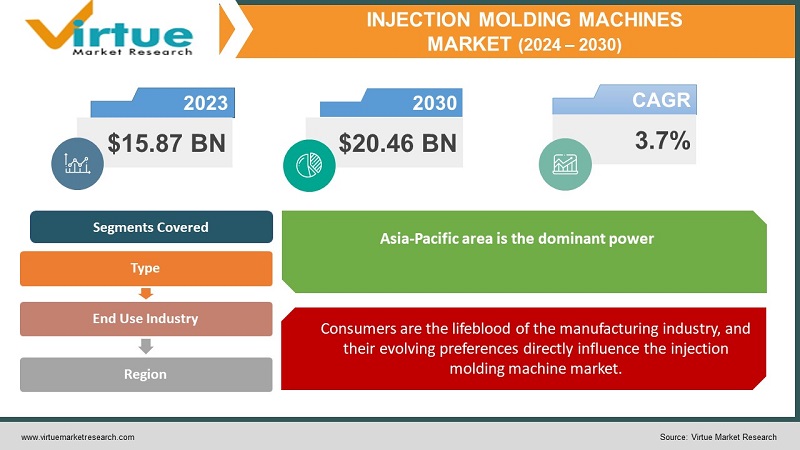

The Global Injection Molding Machines Market is valued at USD 15.87 Billion in 2023 and is projected to reach a market size of USD 20.46 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.7%.

A key component of contemporary production, the market for injection molding machines shapes a wide range of goods that affect almost every part of our lives. These devices control the process of transforming molten plastic into precise and useful forms, which are used in anything from complex medical gadgets to durable automotive components and the familiar plastic toys of childhood.

Utilising Electric Injection Moulding machines are becoming more and more popular because of their exact control and energy efficiency. Compared to hydraulic systems, they offer shorter cycle times and cheaper operating costs because they use electric motors for both clamping and injection. The increasing demand for consumer goods, electronics, automotive parts, and medical devices is driving the need for efficient and high-volume plastic molding solutions.

Key Market Insights:

- Hydraulic injection molding machines hold the largest market share, accounting for roughly 60-65% of the market in 2024. Their affordability and versatility make them popular for various applications.

- Electric injection molding machines are experiencing significant growth, with a projected market share of around 20-25% by 2030. Their energy efficiency and precise control are driving their adoption.

- Hybrid injection molding machines, combining hydraulic and electric elements, are expected to capture a market share of around 10-15% by 2030, offering a balance between power and efficiency.

- Because of their many uses and reusable nature, thermoplastics such as polypropylene (PP) and high-density polyethylene (HDPE) control the market and supply more than 80% of the material used in injection molding.

- The automobile sector, which is expected to hold 20–25% of the market in 2024, is a big consumer. This need is driven by the need for sturdy yet lightweight components for fuel economy.

- By 2030, the medical device sector is expected to have grown steadily and hold a 10-12% market share. One important consideration is the requirement for biocompatible and sterile components for a range of medical uses.

- By 2030, the electronics sector is expected to have grown to account for 8–10% of the market. One major aspect is the need for precise and long-lasting plastic parts for electrical equipment.

- By 2027, the smart injection molding machine market is projected to grow to a value of over USD 4.2 billion globally. These devices provide enhanced production efficiency, process optimization, and real-time data collection.

- By 2027, it is anticipated that the injection molding industry will have integrated artificial intelligence (AI) and machine learning (ML) at a compound annual growth rate (CAGR) of about 12%. These technologies provide enhanced quality control, optimized production processes, and predictive maintenance.

- The injection molding robot industry is expected to reach a valuation of over USD 1.8 billion on a global scale by 2025. Robots improve safety, efficiency, and consistency in production processes.

What's Next for Your Market? Get a Snapshot with Your Sample Report

Injection Molding Machines Market Drivers:

Consumers are the lifeblood of the manufacturing industry, and their evolving preferences directly influence the injection molding machine market.

Customers look for single-serve drinks, readily available goods, and prepared meals in a variety of industries. This results in a rise in the need for packaging options that are strong, portable, and aesthetically pleasing. The economical and efficient production of these packaging options is made possible by injection molding equipment.

In response to changing consumer tastes, manufacturers are investing more and more in machinery that can handle a wider variety of materials, including bioplastics for environmentally concerned consumers. While convenience is sought after, there's also a growing desire for personalization. Consumers want products that cater to their individual needs and preferences. This trend manifests in various ways, from customized phone cases to single-dose medication packaging.

Injection molding machines with advanced capabilities come into play here, allowing for the production of intricate designs and variations within shorter lead times. This caters to the growing demand for customization without compromising on production efficiency.

The injection molding machine market is undergoing a significant transformation fueled by the relentless march of technology.

On the production line, repetitive operations are getting more and more automated. This is due to the advancement of intelligent robots that can do tasks like material loading, unloading, and part removal more reliably and efficiently. Combining robots with injection molding equipment lowers the possibility of workplace accidents and human mistakes while also increasing production speed. This frees up manufacturers to concentrate on more complex jobs like quality assurance and production scheduling.

Machine learning (ML) and artificial intelligence (AI) have the potential to revolutionize the injection molding machine industry. Large volumes of production data can be analyzed by these technologies in order to spot trends, foresee future issues, and optimize process parameters for increased effectiveness and quality assurance.

In order to guarantee consistent outcomes, AI-powered systems can also learn from previous production cycles and modify parameters in real time. For manufacturers of injection molding, this degree of automation and intelligence will result in a major improvement in production efficiency and product quality.

Injection Molding Machines Market Restraints and Challenges:

High-end injection molding machines can be expensive, especially those with automated features, smart features, and electric or hybrid technology. For smaller producers and those with tighter finances, this can be a major obstacle. These machines can be very expensive initially, which could prevent them from being widely adopted and possibly stifle market innovation.

Limited access to advanced technology can lead to a gap in production efficiency and product quality between larger and smaller players. This can stifle competition and prevent smaller manufacturers from capitalizing on emerging market trends.

The integration of automation, AI, and other advanced technologies in injection molding machines necessitates a skilled workforce capable of operating, maintaining, and troubleshooting these complex systems. However, a potential skills gap exists in the industry, with a shortage of workers possessing the necessary technical expertise and knowledge to handle these sophisticated machines.

Injection Molding Machines Market Opportunities:

The medical device manufacturing sector is projected to experience steady growth, with increasing demand for injection-molded components for procedures like minimally invasive surgery and the production of biocompatible implants. This presents a significant opportunity for injection molding machine manufacturers to cater to this specialized market with machines capable of handling high-precision medical-grade plastics and ensuring stringent sterility requirements.

Advancements in medical device design and the use of biocompatible materials necessitate the development of specialized injection molding machines. These machines will require features like multi-material injection capabilities for complex components, micron-level precision for delicate parts, and cleanroom compatibility for sterile production environments.

Developing injection molding machines capable of producing innovative and sustainable packaging solutions specifically designed for e-commerce applications is crucial. This could involve advancements in lightweight techniques, tamper-evident closures, and the use of bio-based or recyclable materials for packaging components.

Developing expertise in processing lightweight materials like carbon fiber composites and high-performance plastics alongside traditional polymers opens doors to new market segments. Injection molding machines need to be adaptable to handle these materials with varying thermal properties and molding requirements.

GLOBAL INJECTION MOLDING MACHINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.7% |

|

Segments Covered |

By Type, End User industry ,and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Haitian International Holdings Limited , Chen Hsong Holdings Limited , Engel Austria GmbH , Sumitomo Heavy Industries, Ltd, Arburg GmbH + Co KG , Milacron Holdings Corp, Nissei Plastic Industrial Co., Ltd. , Husky Injection Molding Systems Ltd., KraussMaffei Group GmbH , UBE Machinery |

Customize This Full Report As Per Your Needs

Segmentation Analysis

Injection Molding Machines Market - By Type:

- Hydraulic Injection Molding Machines

- Electric Injection Molding Machines

- Hybrid Injection Molding Machines

Hydraulic injection molding machines, the well-established industry veterans command a dominant market share of approximately 60–65%. Because they are typically less expensive than their electric equivalents, hydraulic machines are a desirable choice for producers on a tight budget, especially those who are just starting out in the industry.

Standard thermoplastics and more difficult materials like thermosets are among the many materials that these machines can handle. Because of their adaptability, they can serve a wide range of applications in different sectors. Hydraulic machines excel at generating high clamping forces. This makes them suitable for producing large or complex parts that require significant pressure to hold the mold shut during injection.

Electric injection molding machines are the rising stars of the market, projected to capture a significant share of 20-25% by 2030. Electric machines are significantly more energy-efficient than their hydraulic counterparts. This translates to lower operating costs and a smaller environmental footprint, aligning with the growing focus on sustainability.

Electric machines offer precise control over the injection process, leading to consistent product quality and minimal waste. This is particularly beneficial for applications requiring high accuracy, such as medical device manufacturing. Electric machines operate with minimal noise and generate less heat, making them ideal for cleanroom environments and reducing noise pollution on the production floor.

Injection Molding Machines Market - By End Use Industry:

- Packaging Industry

- Automotive Industry

- Medical Device Industry

- Electronics Industry

The Packaging Industry (30-35%) is the reigning champion, the packaging industry remains the largest consumer of injection molded products. The relentless demand for convenient, lightweight, and aesthetically pleasing packaging solutions fuels this segment.

From single-serve beverage bottles to intricate blister packs for medicine, injection molding offers a versatile and cost-effective solution for countless packaging needs. Especially for large-scale manufacturing runs, injection molding is more affordable than other techniques like blow molding or thermoforming. Packaging solutions that are both visually beautiful and functional can be created because of injection molding's ability to create complicated forms and elaborate designs.

The medical device industry is projected to be the fastest-growing segment in the injection molding machine market. The continuous development of new medical technologies necessitates the creation of specialized injection-molded components with high precision and biocompatibility. The growing preference for minimally invasive surgeries creates a demand for smaller, more intricate medical devices that can be manufactured using injection molding.

As biocompatible materials like PEEK (polyether ether ketone) and bioresorbable polymers gain traction, injection molding machines capable of handling these materials efficiently become increasingly crucial. The medical device industry presents a lucrative market for injection molding machine manufacturers due to the high value-added nature of medical products and the stringent quality requirements.

Unlock Market Insights: Get Your FREE Sample Report Today!

Injection Molding Machines Market - By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

The Asia-Pacific region stands as the undisputed leader in the global injection molding machine market. This dominance is driven by a powerful combination of factors:

- Thriving Manufacturing Hub: The region boasts a well-established and robust manufacturing base, offering a competitive edge.

- Cost-Effective Labor: Competitive labor costs make the region an attractive destination for injection molding operations.

- Major Consumer & Automotive Players: The presence of leading manufacturers in consumer goods and automotive industries further fuels demand for injection molding machines.

China: A Powerhouse in Injection Molding

China, the world's manufacturing powerhouse, acts as the primary driver of injection molding machine demand within the Asia-Pacific region. Its booming industries in consumer goods, electronics, and automobiles rely heavily on injection molding to create a vast array of plastic components and products. This immense demand has attracted leading injection molding machine manufacturers like Haitian International, Sumitomo Heavy Industries, and Nissei Plastic Industrial Co., Ltd. to establish production facilities within China. These companies capitalize on the country's extensive manufacturing capabilities and government policies that actively support the industry's growth.

The Rise of the Middle East and Africa

While Asia-Pacific currently reigns supreme, the Middle East and Africa (MEA) region is experiencing the fastest growth in the injection molding machine market. This rapid ascent is fueled by several key factors:

- Economic Diversification: The MEA region is actively pursuing economic diversification, moving beyond its reliance on the oil and gas industry. This diversification includes significant investments in various manufacturing sectors like consumer goods, construction, and automobiles.

- Industrialization & Infrastructure Development: Expanding industrialization and large-scale infrastructure development projects across the region are creating a surge in demand for injection molding equipment for producing plastic parts and goods.

- Domestic Manufacturing Focus: The MEA region's focus on promoting domestic manufacturing and reducing reliance on imports is leading to the establishment of new, technologically advanced manufacturing facilities. This further drives the demand for advanced injection molding machines.

Latest Trends/ Developments:

Electric machines utilize electric motors instead of hydraulic pumps, leading to significantly lower energy consumption. This translates to cost savings for manufacturers and a reduced environmental footprint. Electric motors offer more precise control over the injection process compared to hydraulic systems. This allows for tighter tolerances and improved product quality, particularly for intricate parts. Electric machines operate significantly quieter than their hydraulic counterparts. This creates a cleaner production environment and improves worker comfort.

The injection molding industry is witnessing a wave of automation and intelligent machine integration. Artificial intelligence (AI) and machine learning (ML) are no longer futuristic concepts but are becoming practical tools for optimizing production processes.

Key Players:

- Haitian International Holdings Limited

- Chen Hsong Holdings Limited

- Engel Austria GmbH

- Sumitomo Heavy Industries, Ltd

- Arburg GmbH + Co KG

- Milacron Holdings Corp

- Nissei Plastic Industrial Co., Ltd.

- Husky Injection Molding Systems Ltd.

- KraussMaffei Group GmbH

- UBE Machinery

COVID-19 Impact Analysis on the Injection Molding Machines Market:

Lockdowns and travel restrictions disrupted global supply chains, hindering the flow of raw materials and critical components necessary for injection molding machine production. This led to shortages of parts, delays in deliveries, and production slowdowns.

The pandemic caused a rollercoaster ride for demand across various end-use industries. Sectors like automotive and aerospace faced plummeting demand due to travel restrictions and production shutdowns. This translated into a decrease in orders for injection molding machines used for manufacturing components in these industries. Social distancing measures and worker illness led to labor shortages at manufacturing facilities, impacting both injection molding machine production and the operation of machines in factories.

The economic uncertainty caused by the pandemic led to a general reluctance to invest in new capital equipment, including injection molding machines. Manufacturers adopted a wait-and-see approach, delaying or postponing planned upgrades or expansions.

Chapter 1. GLOBAL INJECTION MOLDING MACHINES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL INJECTION MOLDING MACHINES MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL INJECTION MOLDING MACHINES MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL INJECTION MOLDING MACHINES MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL INJECTION MOLDING MACHINES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL INJECTION MOLDING MACHINES MARKET – By Type

6.1. Introduction/Key Findings

6.2 Hydraulic Injection Molding Machines

6.3. Electric Injection Molding Machines

6.4. Hybrid Injection Molding Machines

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL INJECTION MOLDING MACHINES MARKET – By End Use Industry

7.1. Introduction/Key Findings

7.2 Packaging Industry

7.3. Automotive Industry

7.4. Medical Device Industry

7.5. Electronics Industry

7.6. Y-O-Y Growth trend Analysis By End Use Industry

7.5. Absolute $ Opportunity Analysis By End Use Industry , 2024-2030

Chapter 8. GLOBAL INJECTION MOLDING MACHINES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End Use Industry

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By End Use Industry

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By End Use Industry

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By End Use Industry

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By End Use Industry

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL INJECTION MOLDING MACHINES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Haitian International Holdings Limited

9.2. Chen Hsong Holdings Limited

9.3. Engel Austria GmbH

9.4. Sumitomo Heavy Industries, Ltd

9.5. Arburg GmbH + Co KG

9.6. Milacron Holdings Corp

9.7. Nissei Plastic Industrial Co., Ltd.

9.8. Husky Injection Molding Systems Ltd.

9.9. KraussMaffei Group GmbH

9.10 .UBE Machinery

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The ever-growing demand for convenient, lightweight, and visually appealing packaging solutions in sectors like food and beverages, pharmaceuticals, and consumer goods is a significant driver. Injection molding offers a cost-effective and versatile solution for producing a wide range of packaging components

Injection molding machines, particularly high-performance electric or hybrid models, can be expensive upfront compared to simpler technologies. Additionally, maintenance costs associated with complex machinery can be significant. This can be a hurdle for small and medium-sized enterprises considering entering the injection molding space

Haitian International Holdings Limited, Chen Hsong Holdings Limited

Engel Austria GmbH, Sumitomo Heavy Industries, Ltd, Arburg GmbH + Co KG

Milacron Holdings Corp, Nissei Plastic Industrial Co., Ltd., Husky Injection

Molding Systems Ltd., KraussMaffei Group GmbH, UBE Machinery

The Asia-Pacific region has firmly established itself as the most dominant player in the market, commanding an impressive 50% market share

The Middle East and Africa region is emerging as the fastest-growing market in this sector. This rapid growth can be attributed to several factors, including increasing industrialization, infrastructure development, and the region's efforts to diversify its economies beyond the oil and gas sector