Electric Motor Market Size (2024 – 2030)

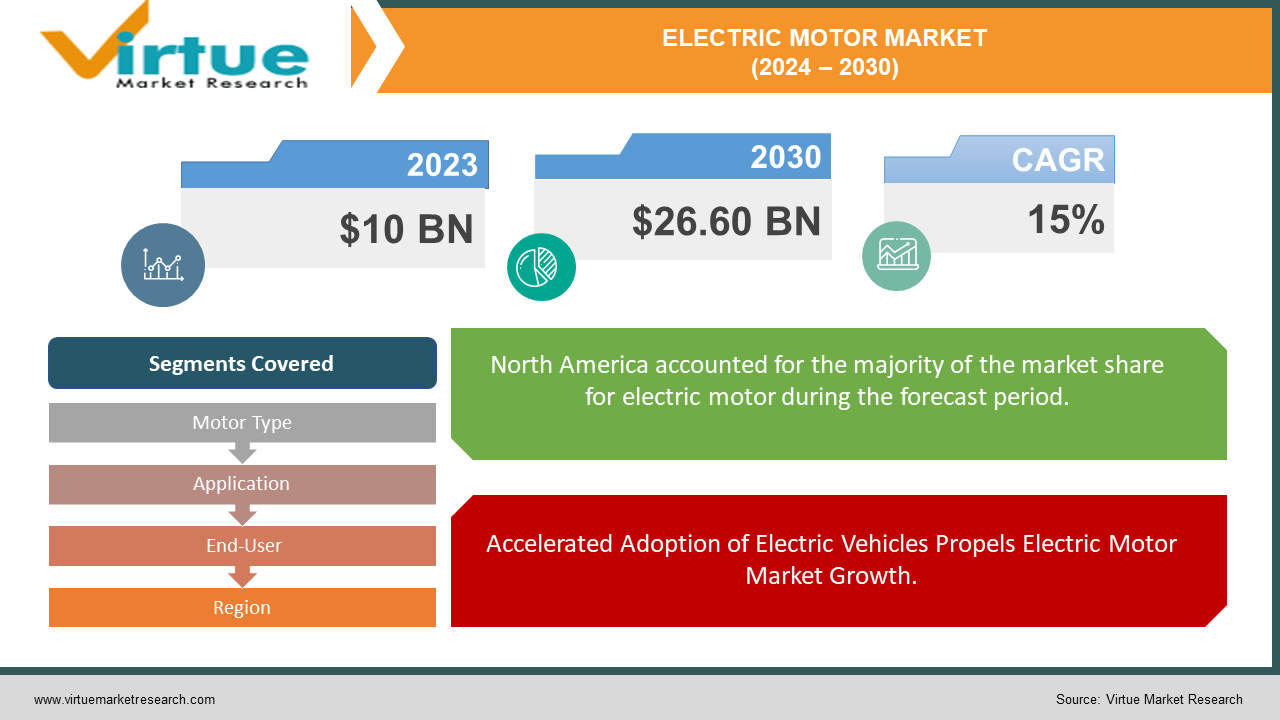

The market for electric motor was estimated to be worth USD 10 billion in 2023 and is expected to increase to USD 26.60 billion by 2030, with a projected compound annual growth rate (CAGR) of 15% from 2024 to 2030.

The electric motor market is a pivotal segment within the broader landscape of industrial and technological advancement, encompassing a diverse array of motors utilized across various sectors and applications. With a global market size projected to soar in the coming years, driven by factors such as the rapid expansion of electric vehicle adoption, burgeoning industrial automation trends, and heightened emphasis on energy efficiency, the market stands poised for significant growth. From powering electric vehicles to driving industrial machinery and facilitating household appliances, electric motors play a ubiquitous role in modern society. Technological innovations continue to refine motor design, enhancing efficiency, reliability, and performance while addressing environmental concerns and regulatory standards. As industries worldwide embrace electrification and sustainable practices, the electric motor market is positioned at the forefront of innovation, poised to shape the future of transportation, manufacturing, and energy consumption.

Key Insights:

Electric motors used in electric vehicle propulsion systems are expected to witness a robust CAGR of 20% during the forecast period, driven by increasing adoption of electric vehicles worldwide.

Industrial automation applications account for approximately 40% of the total electric motor market revenue, with demand fueled by the growing trend of Industry 4.0 implementation in manufacturing.

The Asia Pacific region dominates the electric motor market, accounting for over 50% of the global market share, propelled by rapid industrialization and infrastructure development in countries like China and India.

Despite overall growth, the electric motor market faces challenges related to supply chain disruptions, with 20% of manufacturers reporting delays in production due to shortages of rare earth magnets. One potential solution is to invest in research and development of alternative magnet materials or recycling technologies to mitigate dependency on scarce resources.

Global Electric Motor Market Drivers:

Accelerated Adoption of Electric Vehicles Propels Electric Motor Market Growth.

The rapid adoption of electric vehicles (EVs) worldwide stands as a primary driver fueling the growth of the global electric motor market. With governments implementing stringent emissions regulations and consumers increasingly prioritizing sustainability, the automotive industry is witnessing a significant shift towards electrification. Electric motors serve as the heart of EV propulsion systems, driving wheels with remarkable efficiency and powering various auxiliary systems. As automakers invest heavily in EV development and infrastructure, the demand for electric motors is set to soar, presenting lucrative opportunities for manufacturers and suppliers alike.

Industrial Automation Drives Demand for High-Performance Electric Motors.

The ongoing trend towards industrial automation and Industry 4.0 initiatives is a major catalyst for the electric motor market. Across manufacturing sectors, companies are embracing automation to enhance productivity, efficiency, and operational flexibility. Electric motors play a pivotal role in powering machinery, conveyors, robots, and other automated systems, enabling seamless production processes. As industries seek increasingly sophisticated automation solutions, the demand for high-performance electric motors capable of delivering precision, reliability, and energy efficiency continues to rise, driving market growth.

Focus on Energy Efficiency Spurs Innovation in Electric Motor Technology.

The growing emphasis on energy efficiency and sustainability is driving significant innovation in electric motor technology. As industries strive to reduce energy consumption and minimize carbon emissions, there's a heightened demand for electric motors that offer superior efficiency and performance. Manufacturers are investing in research and development to design motors with advanced materials, optimized designs, and intelligent control systems, resulting in significant energy savings across applications. With stringent regulatory mandates and consumer preferences favoring eco-friendly solutions, the market for energy-efficient electric motors is poised for substantial expansion in the coming years.

Global Electric Motor Market Restraints and Challenges:

Supply Chain Disruptions Pose Challenges for Electric Motor Manufacturers.

Supply chain disruptions present significant challenges for electric motor manufacturers, impacting production timelines, and increasing costs. Factors such as raw material shortages, geopolitical tensions, and logistics constraints can disrupt the flow of critical components needed for motor assembly. As manufacturers strive to maintain continuity in production, they face the dilemma of balancing operational efficiency with mitigating supply chain risks, highlighting the need for robust contingency plans and diversified sourcing strategies.

Technological Complexity Adds Complexity and Cost to Electric Motor Development.

The rapidly evolving landscape of electric motor technology introduces complexities and cost challenges for manufacturers. Advancements in motor design, materials, and control systems require substantial investments in research and development, testing, and validation. Additionally, integrating new technologies into existing production processes can necessitate upgrades to facilities and equipment, further adding to development costs. Balancing the pursuit of innovation with cost-effective solutions poses a delicate challenge for industry players, requiring strategic decision-making and resource allocation to stay competitive in the market.

Environmental Regulations Increase Compliance Burden on Electric Motor Industry.

Stringent environmental regulations and sustainability initiatives impose compliance burdens on the electric motor industry, necessitating adherence to strict efficiency standards and emissions targets. Manufacturers must invest in developing environmentally friendly products and processes, ensuring compliance with regulations governing energy efficiency, emissions, and hazardous materials. Meeting regulatory requirements adds complexity to product development cycles and may entail additional testing and certification procedures, impacting time-to-market and overall costs. Effectively navigating the regulatory landscape requires proactive engagement with regulatory bodies and continuous monitoring of evolving standards to maintain market relevance and competitiveness.

Global Electric Motor Market Opportunities:

Electrification of Transportation Presents Vast Opportunities for Electric Motor Market.

The accelerating shift towards electrification in transportation, including electric vehicles (EVs), hybrid electric vehicles (HEVs), and electric buses, presents significant opportunities for the global electric motor market. As governments worldwide enact stricter emissions regulations and consumers embrace electric mobility for environmental and economic reasons, the demand for electric motors used in vehicle propulsion systems continues to surge. Manufacturers and suppliers have a unique opportunity to capitalize on this trend by developing innovative motor technologies that offer enhanced efficiency, power density, and reliability, thus playing a pivotal role in driving the transition towards sustainable transportation solutions.

Industrial Automation and Industry 4.0 Drive Demand for Advanced Electric Motors.

The ongoing evolution of industrial automation and the adoption of Industry 4.0 technologies present lucrative opportunities for the electric motor market. Across manufacturing sectors, companies are increasingly deploying automated machinery, robots, and smart factory systems to enhance productivity, flexibility, and competitiveness. Electric motors serve as critical components in powering these automated systems, driving demand for advanced motors capable of delivering precision, speed, and energy efficiency. Manufacturers can seize opportunities in this space by developing specialized motor solutions tailored to the unique requirements of industrial automation, thereby catering to the growing demand for high-performance, intelligent motor technologies.

Renewable Energy Expansion Spurs Growth in Electric Motor Applications.

The rapid expansion of renewable energy infrastructure, including wind turbines, solar photovoltaic systems, and hydropower plants, presents diverse opportunities for the electric motor market. Electric motors play a crucial role in renewable energy generation, powering wind turbine generators, solar tracking systems, and hydroelectric generators. With governments and businesses worldwide investing heavily in renewable energy projects to mitigate climate change and achieve energy independence, the demand for electric motors in renewable energy applications is poised for significant growth. Manufacturers can capitalize on this trend by developing specialized motor solutions optimized for renewable energy systems, thus contributing to the global transition towards a sustainable energy future.

ELECTRIC MOTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Motor Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd., Siemens AG, Nidec Corporation, General Electric (GE), Toshiba Corporation, Rockwell Automation, WEG S.A., Johnson Electric Holdings Limited, AMETEK, Inc., Allied Motion Technologies Inc., Schneider Electric SE, Danfoss Group |

Electric Motor Market Segmentation: By Motor Type

-

AC Motor

-

DC Motor

-

Hermetic Motor

-

Others

AC motors stand out as the most effective and widely utilized type in the electric motor market, driving substantial demand across numerous industries. Renowned for their robustness, efficiency, and versatility, AC motors are employed in a broad range of applications, from industrial machinery and HVAC systems to household appliances and electric vehicles. Their ability to operate on standard power supplies and their relatively simple design, which reduces maintenance requirements, makes them a preferred choice for both manufacturers and end-users. With advancements in variable frequency drive (VFD) technology, AC motors now offer enhanced control over speed and torque, improving energy efficiency and performance in diverse applications. This adaptability and continuous innovation solidify AC motors' position as a cornerstone in the electric motor market, catering to the evolving needs of modern industries and contributing to sustainable growth.

Electric Motor Market Segmentation: By Application

-

Industrial Machinery

-

HVAC Systems

-

Household Appliances

-

Others

The industrial machinery segment emerges as the most effective application of electric motors, significantly contributing to market growth. Industrial machinery relies heavily on electric motors for operations such as conveyors, pumps, compressors, machine tools, and robotics. These motors are essential for ensuring efficiency, precision, and reliability in manufacturing processes, making them indispensable across various industries including automotive, aerospace, food and beverage, and textiles. The ongoing trend towards automation and the implementation of Industry 4.0 technologies further amplify the demand for electric motors, as factories and production lines increasingly adopt automated systems to enhance productivity and reduce operational costs. The need for robust, high-performance motors that can withstand demanding industrial environments drives continuous innovation in motor design and technology, reinforcing the critical role of electric motors in powering the machinery that forms the backbone of global industrial operations.

Electric Motor Market Segmentation: By End-User

-

Automotive

-

Manufacturing

-

Energy & Power

-

HVAC

-

Healthcare

-

Others

The automotive sector stands as the most effective and influential end-user segment in the electric motor market, driving significant growth and innovation. The surge in demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) has propelled the need for advanced electric motors capable of delivering high efficiency, reliability, and performance. Governments worldwide are implementing stringent emissions regulations and providing incentives for the adoption of electric mobility, further accelerating market expansion. Electric motors are essential components in EVs and HEVs, powering propulsion systems, auxiliary systems, and various vehicle functionalities. As automakers invest heavily in research and development to enhance electric motor technology, including advancements in power density, thermal management, and cost-effectiveness, the automotive sector continues to push the boundaries of what electric motors can achieve. This ongoing innovation and the global shift towards sustainable transportation solidify the automotive sector's pivotal role in shaping the future of the electric motor market.

Electric Motor Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The global electric motor market exhibits a diverse regional distribution, with North America leading the way, commanding a substantial 37% market share. This dominance is fueled by the region's strong automotive industry, significant investments in industrial automation, and a robust focus on energy efficiency and renewable energy projects. Europe follows with a 26% market share, driven by stringent environmental regulations, a well-established automotive sector, and advancements in industrial technology. The Asia-Pacific region holds a 23% market share, reflecting its rapid industrialization, burgeoning electric vehicle market, and extensive manufacturing capabilities, particularly in countries like China, Japan, and South Korea. South America, with a 9% market share, is gradually expanding its electric motor market presence, supported by industrial growth and increasing energy efficiency initiatives. The Middle East and Africa, accounting for 5% of the market, are also witnessing growth, albeit at a slower pace, driven by infrastructure development and a gradual shift towards automation and renewable energy projects. Each region's unique dynamics and growth drivers contribute to the overall expansion and innovation within the global electric motor market.

COVID-19 Impact Analysis on the Global Electric Motor Market:

The COVID-19 pandemic had a profound impact on the global electric motor market, disrupting supply chains, halting manufacturing operations, and causing significant economic uncertainty. During the initial phases of the pandemic, lockdowns and restrictions led to a slowdown in production and a reduction in industrial activity, directly affecting the demand for electric motors across various sectors, including automotive, industrial machinery, and consumer electronics. Supply chain disruptions, particularly in key regions like Asia-Pacific, caused delays in the procurement of essential components, exacerbating production challenges. However, the pandemic also accelerated certain trends, such as the shift towards automation and the adoption of electric vehicles, as industries sought to enhance operational efficiency and reduce dependence on human labor. Post-pandemic recovery efforts and government stimulus packages aimed at revitalizing economies and promoting green technologies have further supported the resurgence of the electric motor market. As industries adapt to the new normal, the market is poised for robust growth, driven by an increased focus on sustainability, energy efficiency, and technological advancements.

Latest Trends/ Developments:

The electric motor market is experiencing several notable trends and developments that are shaping its future landscape. One significant trend is the advancement of electric motor technologies aimed at enhancing energy efficiency and performance, driven by stricter environmental regulations and the push for sustainability. Innovations in materials, such as the use of high-performance magnets and lightweight composites, are improving motor efficiency and reducing energy consumption. Additionally, the integration of smart technologies, including IoT and AI, is enabling predictive maintenance and real-time performance monitoring, thereby increasing operational reliability and reducing downtime. The rise of electric vehicles (EVs) is also a major development, with automakers investing heavily in the development of high-efficiency motors to extend driving range and improve vehicle performance. Furthermore, the growing adoption of automation in industrial sectors is driving demand for advanced electric motors that can deliver precision and efficiency in automated systems. As these trends continue to evolve, they are set to drive substantial growth and innovation in the electric motor market, catering to the dynamic needs of various industries.

Key Players:

-

ABB Ltd.

-

Siemens AG

-

Nidec Corporation

-

General Electric (GE)

-

Toshiba Corporation

-

Rockwell Automation

-

WEG S.A.

-

Johnson Electric Holdings Limited

-

AMETEK, Inc.

-

Allied Motion Technologies Inc.

-

Schneider Electric SE

-

Danfoss Group

Chapter 1. Electric Motor Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electric Motor Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electric Motor Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electric Motor Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electric Motor Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electric Motor Market – By Motor Type

6.1 Introduction/Key Findings

6.2 AC Motor

6.3 DC Motor

6.4 Hermetic Motor

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Motor Type

6.7 Absolute $ Opportunity Analysis By Motor Type, 2024-2030

Chapter 7. Electric Motor Market – By End-User

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Manufacturing

7.4 Energy & Power

7.5 HVAC

7.6 Healthcare

7.7 Others

7.8 Y-O-Y Growth trend Analysis By End-User

7.9 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Electric Motor Market – By Application

8.1 Introduction/Key Findings

8.2 Industrial Machinery

8.3 HVAC Systems

8.4 Household Appliances

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Electric Motor Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Motor Type

9.1.3 By End-User

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Motor Type

9.2.3 By End-User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Motor Type

9.3.3 By End-User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Motor Type

9.4.3 By End-User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Motor Type

9.5.3 By End-User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Electric Motor Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ABB Ltd.

10.2 Siemens AG

10.3 Nidec Corporation

10.4 General Electric (GE)

10.5 Toshiba Corporation

10.6 Rockwell Automation

10.7 WEG S.A.

10.8 Johnson Electric Holdings Limited

10.9 AMETEK, Inc.

10.10 Allied Motion Technologies Inc.

10.11 Schneider Electric SE

10.12 Danfoss Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for electric motor was estimated to be worth USD 10 billion in 2023 and is expected to increase to USD 26.60 billion by 2030, with a projected compound annual growth rate (CAGR) of 15% from 2024 to 2030.

The primary drivers of the global electric motor market are the increasing adoption of electric vehicles, industrial automation, and the growing emphasis on energy efficiency and sustainability.

Key challenges facing the global electric motor market include supply chain disruptions, high development costs, and stringent environmental regulations.

In 2023, North America held the largest share of the global electric motor market.

ABB Ltd., Siemens AG, Nidec Corporation, General Electric (GE), Toshiba Corporation, Rockwell Automation, WEG S.A., Johnson Electric Holdings Limited, AMETEK, Inc., Allied Motion Technologies Inc., Schneider Electric SE, Danfoss Group are the main players.