GLOBAL MEDICAL DEVICE MARKET SIZE (2024 - 2030)

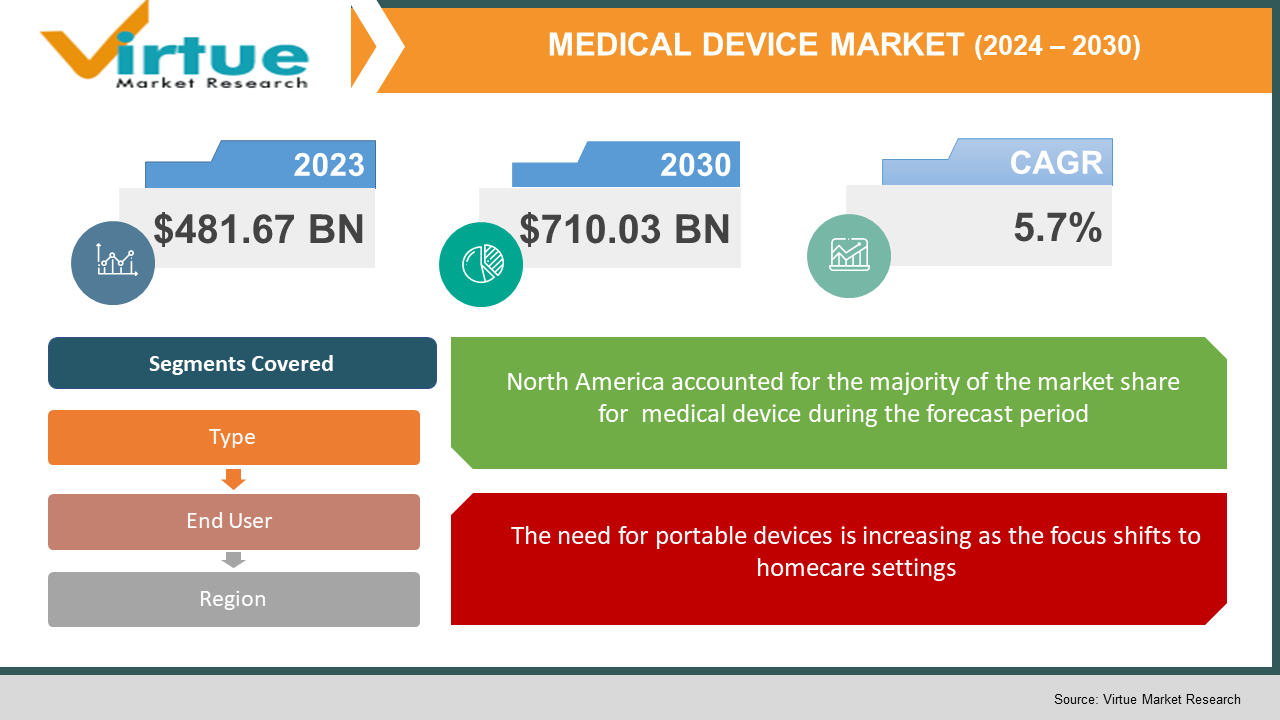

The Global Medical Device Market was valued at USD 481.67 billion in 2023 and is projected to reach a market size of USD 710.03 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.7 %.

INDUSTRY OVERVIEW

Medical devices are electronic devices that transmit signals from the body of a patient that corresponds to physical, chemical, or biological impulses. Medical sensors can be utilized for a wide range of applications, including diagnosis, monitoring, and therapy. Improvements in medical technology aid in the proper detection of numerous medical indications, resulting in accurate treatment. Chronic ailments including arthritis, liver inflammation, cancer, renal diseases, diabetes, chronic pain, sciatica, and other nerve disorders are on the rise and are driving up demand for medical gadgets. According to the Indian Council of Medical Research (ICMR), the Institute for Health Metrics and Evaluation, and the Public Health Foundation of India, 72 million Indians have Type-2 diabetes in 2019, with that number estimated to nearly double to 134 million by 2025, if current unhealthy eating habits continue. Furthermore, according to the International Diabetes Federation, there were 463 million diabetics around the globe in 2019. As a result of these high figures, the medical device industry is anticipated to rise. The high cost of medical devices, on the other hand, is anticipated to hamper market expansion to some extent. Furthermore, reimbursement problems in the medical device business, as well as strict restrictions, limit the market growth of medical devices.

COVID-19 IMPACT ON

The impact of the COVID-19 epidemic on the market was both positive and negative. Currently, countries are still facing a major pandemic danger. The majority of pharmaceutical and biotech businesses are concentrating their R&D efforts on finding new drugs or leads to treating the coronavirus condition. COVID-19 disrupted the supply chain, resulting in global shortages of key medical devices. As a result, several countries have taken concrete steps to alleviate shortages, such as importing equipment or domestically manufacturing medical gadgets. Furthermore, domestic production of critical medical gadgets is intended to eliminate trade obstacles while also ensuring product quality and market stability. Counterfeiting and overpricing of imported medical equipment, on the other hand, are projected to stifle the market's expansion. During the epidemic, however, several medical gadgets saw a sharp increase in demand. For COVID–19 patients, for example, ventilators were in great demand since they are a vital tool for patients in severe conditions.

MARKET DRIVERS:

The growing trend of high spending on healthcare and the rapid and everchanging healthcare landscape is driving the market growth

Healthcare spending is linked to an aging population, increased per capita disposable income, and a better quality of life. Medical costs per person in the 60+ age group are significantly greater than those in the 15–30 age group. The world's elderly population is growing at a rapid pace, resulting in higher life expectancy but also a slew of comorbidities. Even though healthcare infrastructure throughout the world is increasing and improving, pricing and accessibility hurdles keep medical gadgets from reaching the overwhelming majority of the people. To tackle the problem of low accessibility and affordability, healthcare spending must be expanded. Increases in total healthcare expenditures are anticipated to improve access to medical devices and motivate medical electronics device vendors to invest in research and development and innovation. Thus, the aforementioned reasons are likely to positively influence the market growth.

The need for portable devices is increasing as the focus shifts to homecare settings

The increased frequency of chronic diseases, as well as the treatment of individuals struggling with these diseases, is putting enormous strain on healthcare systems across the world. The total cost of treating a patient in a hospital inpatient environment is much greater, and longer hospital stays are linked to a higher financial burden. Market participants are proactively investing in research and development of innovative and easy-to-use medical equipment for the treatment of chronic illnesses, citing initiatives by healthcare authorities to move patients to home care settings. Their efforts have resulted in the development of portable and wearable technologies that patients may use at home without requiring expert support.

MARKET RESTRAINTS:

High Cost of Medical Devices is hampering the Medical Device Market Growth

In the last decade, the medical device business has seen significant changes in terms of new technology and design updates, among other things. However, the high cost of these devices, which involves a higher purchase cost and upkeep expenditures, results in an overall rise in device cost and ownership. Some complex gadgets are linked to a variety of different components, such as chips, batteries, sensors, and other accessories, which must be replaced regularly. As a result, it pushes up the financial burden on the patient as the total cost of ownership is greater. Medical device reimbursement has also been a stumbling block in the adoption of these technologies in developing nations. As a result of the aforementioned difficulties, as well as insufficient reimbursement policies, the adoption of these types of devices in emerging nations has been rather restricted.

Creating a networked ecosystem and designing appropriate medical gadgets is a complex process

In this modern medical era, there is an increasing need for compact, lightweight, and more portable medical equipment that is of higher quality and cost-effectiveness. Medical gadgets must also be electromagnetically compatible. This encompasses not only emission and immunity measures against transmitted electromagnetic waves but also design-related electromagnetic compatibility practices. Medical electronics should be built such that they don't interfere with the operation of medical devices. In the sphere of advanced medical science, the Internet of Medical Things (IoMT) is becoming increasingly popular. Connected medical devices must be integrated into the traditional healthcare system, which requires major cooperation from numerous stakeholders throughout the IoMT ecosystem. The Internet of Medical Things (IoMT) is a network of medical equipment, software applications, and health systems and services that are all linked together. To serve senior people, the medical electronics ecosystem necessitates the collaboration of numerous service providers who must operate in unison. However, when it comes to catering to end-users, these service providers and numerous stakeholders frequently run into problems. It's one of the stifling variables that can wreak havoc on the system's general operation, resulting in a complete breakdown.

MEDICAL DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Type, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DePuy Synthes, Medtronics Plc, Fesenius Medical Care, GE Healthcare, Philips Healthcare, Ethicon LLC, Siemens Healthineers, Stryker, Cardinal Health, Baxter International Inc., BD |

This research report on the medical device market has been segmented and sub-segmented based on By Type, By End User and By Region.

MEDICAL DEVICE MARKET – BY TYPE

-

Orthopedic Devices

-

Cardiovascular Devices

-

Diagnostic Imaging

-

IVD

-

MIS

-

Wound Management

-

Diabetes Care

-

Ophthalmic

-

Dental

-

Nephrology

-

General Surgery

-

Others

Based on types, the medical device market is segmented into Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, IVD, MIS, Wound Management, Diabetes Care, Ophthalmic, Dental, Nephrology, and General Surgery among others. Among these, the in-vitro diagnostics (IVD) segment is projected to expand at a higher CAGR over the forecast period because of the growing use of real-time diagnostic testing for accurate detection of chronic and infectious illnesses such as diabetes, cancer, HIV/AIDS, and others. In the medical device market, the cardiology devices segment is also poised to capture a significant market share over the forecast period. Cardiovascular devices are used to detect and treat heart disorders and other health issues, which are among the major causes of mortality globally. Electrocardiograms (ECGs), defibrillators, pacemakers, cardiac rhythm management devices, catheters, grafts, heart valves, and stents are some of the most often utilized cardiovascular devices. The increased incidence of coronary heart illnesses, such as heart attacks and cardiomyopathy, which generate a global burden of cardiac fatalities, is one of the primary drivers driving the expansion of the cardiology devices market. Furthermore, technical improvements in surgical robots, as well as their rising use by healthcare professionals, are likely to propel the minimally invasive surgery (MIS) market forward throughout the forecast period. Additionally, the rising prevalence of diabetes and retinal illnesses in the general population is estimated to enhance the use of diabetes care and ophthalmic equipment, driving medical device market development throughout the forecast period.

MEDICAL DEVICE MARKET – BY END-USER

-

Hospitals & ASCs

-

Clinics

-

Others

Based on end-user, the medical device market is segmented into Hospitals & ASCs, and Clinics among others. Due to the growing number of multispecialty and community hospitals, particularly in emerging nations, the hospitals & ASC category had a dominant position in 2021. Thus, the aforementioned reasons, as well as the rising emphasis of healthcare organizations and the government on regular patient diagnosis and early treatment, have resulted in increased awareness among the general public, which is driving the market's expansion over the projection period. Due to increased financing by public and private players in small and medium-sized clinics and long-term care centers worldwide to strengthen healthcare infrastructure, the clinics and other categories are likely to rise at a substantial CAGR over the projection period.

MEDICAL DEVICE MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

Based on region, the medical device market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East, and Africa. The North American region dominated the medical device market. In 2021, the medical devices market in North America was valued at USD 168.76 billion. Its leadership is partly due to the availability of appropriate and attractive reimbursement regulations, a well-developed healthcare infrastructure, quick adoption of modern medical technology, and significant companies in the region. This is intensified by the expanding number of patients in the region receiving diagnosis and treatment as a result of the rising incidence and prevalence of chronic diseases.

Attributing to the rising healthcare spending, well-established infrastructure, and increased use of innovative diagnostic and treatment equipment, the European market is projected to expand at a high rate. During the projected period, the market is projected to develop due to a strong focus on a transition of medical treatment to home care settings and the launch of portable medical equipment by key market players in the region. Due to the rising incidence of diseases such as cardiovascular disorders, infectious diseases, dental disorders, diabetes, and others, Asia Pacific is anticipated to grow at a faster rate than the rest of the world, as well as market players' increased focus on expanding their direct presence in developing markets such as China and India to meet patient demand.

MEDICAL DEVICE MARKET - BY COMPANIES

The market for medical devices is fragmented and competitive due to the presence of many market players. Some of the prominent players operating in the medical device market are:

-

DePuy Synthes

-

Medtronics Plc

-

Fesenius Medical Care

-

GE Healthcare

-

Philips Healthcare

-

Ethicon LLC

-

Siemens Healthineers

-

Stryker

-

Cardinal Health

-

Baxter International Inc.

-

BD

NOTABLE HAPPENING IN THE MEDICAL DEVICE MARKET

-

PRODUCT LAUNCH- Hugo System, a robotic-assisted surgical system that assists in the detection or treatment of illness or ailment, was introduced by Medtronic in December 2021.

-

PRODUCT LAUNCH - VELYS Digital Surgery was released by Johnson & Johnson in August 2021. In the United States, a robotic-assisted total knee arthroplasty procedure is commercially accessible.

-

PRODUCT LAUNCH- The abdominal aortic aneurysm (AAA) model was introduced by Koninklijke Philips N.V. in January 2021, offering doctors a more patient-friendly option than the existing standard of treatment for AAA patients.

-

PARTNERSHIP- Smith & Nephew teamed with Movemedical, a firm located in the United States, in January 2021 to extend its inventory automation solutions and enhance customer experience.

-

PARTNERSHIP- Medtronic PLC and The Foundry, a medical device firm, established a collaboration in October 2020.

Chapter 1. MEDICAL DEVICE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MEDICAL DEVICE MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. MEDICAL DEVICE MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. MEDICAL DEVICE MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. MEDICAL DEVICE MARKET Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MEDICAL DEVICE MARKET – By Type

6.1. Orthopedic Devices

6.2. Cardiovascular Devices

6.3. Diagnostic Imaging

6.4. IVD

6.5. MIS

6.6. Wound Management

6.7. Diabetes Care

6.8. Ophthalmic

6.9. Dental

6.10. Nephrology

6.11. General Surgery

6.12. Others

Chapter 7. MEDICAL DEVICE MARKET – By End User

7.1. Hospitals & ASCs

7.2. Clinics

7.3. Others

Chapter 8. MEDICAL DEVICE MARKET - By Region

8.1. North America

8.2. Europe

8.3. Asia-P2acific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. MEDICAL DEVICE MARKET – By Companies

9.1. DePuy Synthes

9.2. Medtronics Plc

9.3. Fesenius Medical Care

9.4. GE Healthcare

9.5. Philips Healthcare

9.6. Ethicon LLC

9.7. Siemens Healthineers

9.8. Stryker

9.9. Cardinal Health

9.10. Baxter International Inc.

9.11. BD

Download Sample

Choose License Type

2500

4250

5250

6900