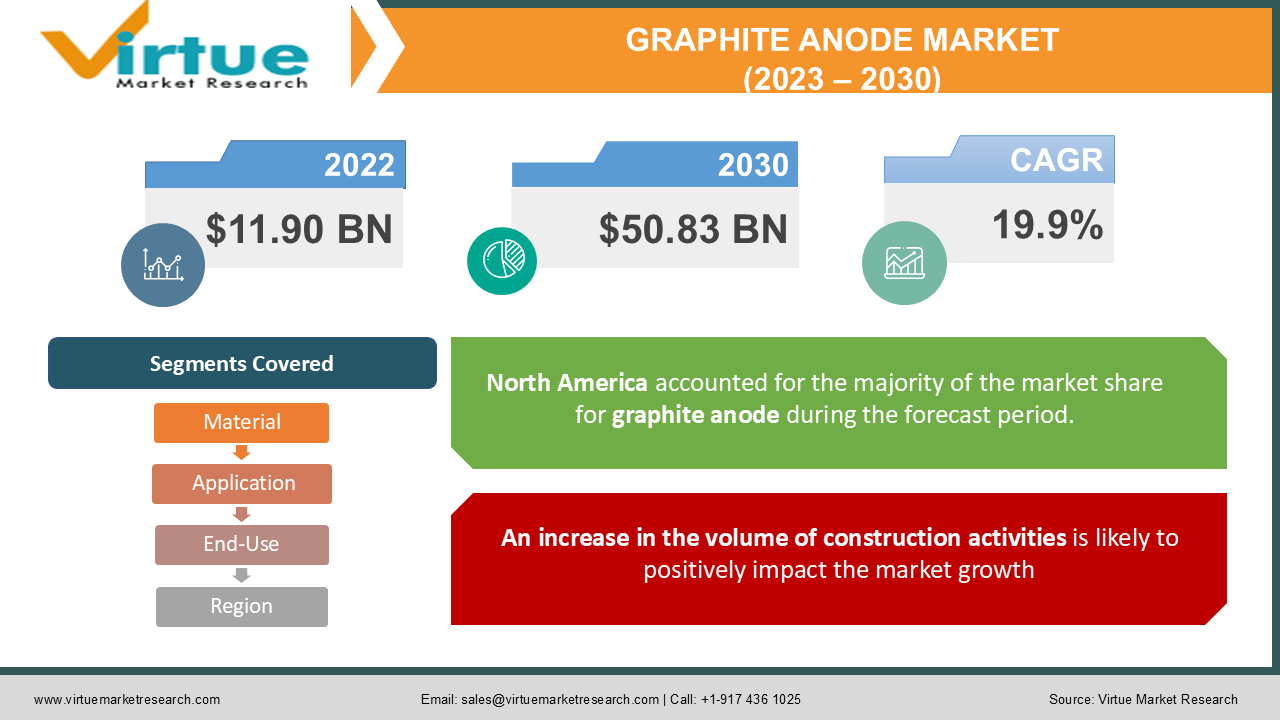

Graphite Anode Market Size (2023 – 2030)

The Global Graphite Anode Market was valued at $11.90 billion in 2022, and is projected to reach a market size of $50.83 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 19.9%. A few significant reasons propelling the expansion of the global graphite anode market include rising industrialization with contemporary infrastructures, rising need for engineering and building materials, and the spike in the production of steel and iron.

INDUSTRY OVERVIEW

The massive, cylindrical graphite electrodes are formed of coal tar pitch and petroleum needle coke. They transfer electrical energy from the power source and transform it into heat, which is then utilised to liquefy scrap metal. These electrodes are capable of producing heat up to 1600 degrees Celsius because of graphite's excellent thermal conductivity and low electrical resistance. For manufacturing steel and melting ferrous alloys, they are usually utilised in blast oxygen furnaces (BOF) and electric arc furnaces (EAF). These electrodes aid in the production of high-quality goods that can tolerate significant thermal dissipation, demonstrate outstanding mechanical strength and have great electrical conductivity. High electrical conductivity is a property of the carbon allotrope known as graphite. Under normal circumstances, it is a very stable allotrope of carbon. The only non-metallic material that conducts electricity is graphite. Lithium-ion batteries also heavily rely on graphite as a component. It has a high energy density, is chemically stable, has strong electrical conductivity, and is reasonably cheap. Graphite is moreover widely accessible. As a result, graphite anodes are used on underground pipelines and storage tanks as a practical way to reduce corrosion expenses.

The primary driver propelling the market is the increasing demand for graphite electrodes in steel-oriented industries including construction, automotive, infrastructure, aerospace, and military. The oil and gas industry's growing need for anti-corrosive solutions for oil and petroleum wells and pipelines has increased the usage of EAF and, in turn, stoked demand for these electrodes. Another major trend anticipated to fuel the market is the rise in demand for Ultra-High Power (UHP) graphite electrodes. Due to UHP's increased thermal and electrical conductivity, scrap may be quickly melted to produce steel. As a result, steel producers strongly like it, and in the next years, its demand is anticipated to increase significantly.

COVID-19 IMPACT ON THE GRAPHITE ANODE MARKET

The negative impact of COVID-19 affected the operation of industries like mining, construction, metallurgy, chemical, automobiles, etc., as the initiatives adopted by the government of countries, such as lockdown, quarantining, and social distancing resulted in the closure of mining facilities, construction sites, service stations, and automotive factories. Graphite is utilised in a variety of industries, including the construction industry, lithium-ion batteries in electric cars, mining machinery lubricants, and cement. As an example, according to the Society of Electric Vehicle Manufacturers, the number of all-electric vehicle registrations fell by 20% in 2021 to 236,802 units from the 295,683 units sold in 2020. The output of the chemical industry between January and June decreased to 5.2 per cent, with the lowest point occurring in April, according to the 2021 European Union report on the impact of COVID-19 on European Union industries. Major nations like France and Italy showed reductions in the chemical output of 11.7% and 6.7%, respectively. Thus, if the output in these industries declines, there is less demand for graphite in them, which hurts the development of the graphite industry.

The COVID-19 pandemic had a substantial negative impact on the market for graphite electrodes because it caused a large decrease in the production of steel, particularly in the first half of 2020. In several areas, steel output fell significantly in the first half of 2020. As per the Organisation for Economic Co-operation and Development's (OECD) Steel Market Developments Q4 2020 report, the worst-affected areas in terms of steel output were Europe (-17.9%), North America (-17.6%), South America (-19.9%), and Africa (-20.9%) On the other hand, steel output was more robust in places like the Middle East (-0.5%) and Asia (-2.3%). Similarly, COVID-19 caused a dramatic reduction in global steel consumption of 2.4% in the first three months of 2020 compared to the drop in the same period last year.

MARKET DRIVERS:

An increase in Demand for Electric vehicles as Graphite anodes are widely used in lithium-ion batteries is likely to propel the market growth

As technology continues to improve, customers are beginning to choose electric hybrid automobiles over conventional vehicles. Several automotive facilities for electric vehicles are being built in different nations. For instance, according to the European Automobile Manufacturing Association, production of electric vehicles increased in the EU by 11% in 2020 from just 3% in 2019, and the International Energy Agency reports that worldwide registration of electric vehicles increased by 41% in 2020, with China and Europe accounting for the largest share of the market. Lithium-ion batteries, which are utilised as a fuel in next-generation cars like electric and driverless vehicles, are made using graphite anodes. As a result, the need for graphite anodes to be used in lithium-ion batteries will rise along with the production of electric cars, which will positively affect the development of the graphite anode sector.

An increase in the volume of construction activities is likely to positively impact the market growth

The volume of construction activity has expanded as a result of developing economies, rising urbanisation, and different infrastructure projects undertaken by nations. According to the State Council for the People's Republic of China, in July 2021, China authorised projects regarding the development of affordable rental homes for better access to housing in China's big cities. For example, the National Bureau of Statistics reports that China's construction industry grew by 22.8% in Q1 of 2021, followed by 6.6% in Q4 and 8.1% in Q3 and 7.8% in 2020. Additionally, according to the US Census Bureau, the total amount spent on building in November 2021 was $1,625 billion, which was 9.3% more than the $1,463.3 billion spent in November 2020 and 0.4% more than October of the same year. As a result, as construction activities grow in scope, the demand for building materials made of graphite will rise as well, creating the additional potential for the graphite anode industry to expand.

MARKET RESTRAINTS:

Stringent government regulations may hamper the growth

Environmental issues can result from the mining and manufacturing of graphite. While the dust released during graphite mining contains dangerous air pollutants, the hazardous chemicals employed during its processing might contaminate the environment when released into the nearby land and water. In order to stop this waste, government agencies have established a few rules. For instance, the wastewater discharge from processing 21 kinds of minerals, including graphite, is subject to the US EPA's Mineral Mining and Processing Effluent Guidelines 40CFR Part 436. Therefore, it has become necessary for miners to comply with such legislation about mining wastes.

Graphite Anode Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

19.9% |

|

Segments Covered |

By Material, Application, End-Use and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GRAFTECH INTERNATIONAL LTD., SYRAH RESOURCES LTD., GRAPHITE INDIA LTD., TOKAI CARBON CO. LTD., SHANSHAN CORPORATION, QINGDAO GUANGXING ELECTRONIC MATERIALS CO. LTD., FANGDA CARBON NEW MATERIAL TECHNOLOGY CO. LTD. |

CLICK HERE TO CUSTOMIZE THIS REPORT

Segmentation Analysis

GRAPHITE ANODE MARKET – BY MATERIAL

- Natural Graphite

- Synthetic Graphite

- Flakes

- Others

Based on the material type, the graphite anode market is segmented into Natural Graphite, Synthetic Graphite, Flakes and Others. With a market share of more than 40% in 2021, natural graphite had the biggest market share for graphite anodes. This is due to characteristics like great cost-competitiveness, low friction, and top performance. As a result of its rich qualities, natural graphite finds extensive industrial use in refractories, batteries, the production of steel, brake linings, and lubricants, among other things. For example, according to the 2021 report of the National Automobile Dealers Association, the US sold 17 million cars in the second quarter, with light trucks accounting for 76.9% of those sales. Additionally, the manufacture of electrical equipment, including computers, laptops, mobile phones, and other electrical equipment, climbed by 13.5 per cent in 2021, according to the National Bureau of Statistics of China. Consequently, as natural graphite is utilised as a battery in electrical instruments and as brake lining in large vehicles, an increase in output of these sectors would lead to a rise in demand for natural graphite to be used in them, favouring the graphite anode market.

GRAPHITE ANODE MARKET – BY APPLICATION

- Steel Manufacturing

- Silicon Metal Manufacturing

- Steel Refining

- Smelting Processes

- Ferroalloy Production

- Non-Ferrous Metals Production

- Lithium-Ion Batteries Production

- Others

Based on the application, the graphite anode market is segmented into Steel Manufacturing, Silicon Metal Manufacturing, Steel Refining, Smelting Processes, Ferroalloy Production, Non-Ferrous Metals Production, Lithium-Ion Batteries Production, and Others. With a CAGR of 7% over the projection period, the steel manufacturing segment is estimated to rise at the fastest rate throughout the forecast period. It had the highest share in 2021. Due to the extensive use of graphite anode for the manufacture of steel in electric arc furnaces, the market is anticipated to rise at a rapid rate during the forecast period. The graphite anode may be used in electric arc furnaces in extremely hot environments because of its excellent thermal resistance capabilities. Given that the manufacture of steel was one of the worst-hit businesses during the pandemic, there is currently a rising need for its production on a worldwide scale. According to the World Steel Organization, worldwide crude steel output reached 167.9 million tonnes (MT) in June 2021, a rise of 11.6% from the same time the previous year. Additionally, increased demand for steel from the construction, automotive, equipment, and other sectors will result in increased use of graphite electrodes on a huge scale.

GRAPHITE ANODE MARKET - BY END-USE

- Automotive

- Appliances

- Construction

- Machinery

- Transportation

- Aerospace and Defence

- Oil and Refinery

- Others.

Based on the end-use, the graphite anode market is segmented into Automotive, Appliances, Construction, Machinery, Transportation, Aerospace and defence, Oil and Refinery and Others. In 2021, the market for graphite electrodes was controlled by the construction industry. Due to the rising need for swift construction and infrastructure rehabilitation projects now, the construction industry is predicted to propel the growth of the graphite anodes market worldwide over the forecast period. The need for steel and non-ferrous metals will be supported by the expanding activity in the building construction sector, eventually driving up the demand for a significant number of graphite anodes. For example, the European housebuilding sector is anticipated to have positive investment growth of 5.5 per cent in 2021, according to the European Construction Industry Federation's 2021 statistics report. Investment growth rates of 5.7 per cent and 4.8 per cent, respectively, are anticipated for the construction of new homes and refurbishment projects. Furthermore, according to research by the India Brand Equity Foundation (IBEF), India received USD 26.08 billion in foreign direct investment (FDI) in the built-up infrastructure, housing, and building development sectors between April 2000 and March 2021. As a result, the growing construction industry will fuel demand for steel and other non-ferrous metals, propelling the expansion of the graphite anodes market during the projected period.

GRAPHITE ANODE MARKET - BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the Graphite Anode Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. With a market share of more than 40% in 2021, Asia-Pacific had the highest share of the graphite market. This is because the area, which includes nations like China, India, Japan, and South Korea, has significant end-users of graphite in the automotive, construction, metallurgical, and other industries. According to the National Investment Promotion & Facilitation Agency, the Indian construction industry will become the third-largest in the world by 2025, with an average annual growth rate of 7.1 per cent for construction output and $24.72 in infrastructure spending between April 2000 and March 2021. Additionally, according to the World Steel Association, there were 1878 million tonnes of crude steel produced, with China accounting for up to 56.6 per cent of that total, an increase of 3.4 per cent from 2019. Thus, the fast growth of the construction and metallurgical industries in these nations has boosted the demand for graphite in those nations, which in turn has boosted the development of the graphite anode industry in the Asia-Pacific area.

The construction industry is estimated to grow significantly in the European area. The European construction sector (residential, commercial, renovation, and civil engineering) is anticipated to experience an attractive investment growth rate of 4.2 per cent, according to the European Construction Industry Federation's 2021 statistical report. This, in turn, will accelerate the expansion of the graphite anode market in the upcoming years.

GRAPHITE ANODE MARKET - BY COMPANIES

Some of the major players operating in the Graphite Anode Market include:

- GRAFTECH INTERNATIONAL LTD.,

- SYRAH RESOURCES LTD.,

- GRAPHITE INDIA LTD.,

- TOKAI CARBON CO. LTD.,

- SHANSHAN CORPORATION,

- QINGDAO GUANGXING ELECTRONIC MATERIALS CO. LTD.,

- FANGDA CARBON NEW MATERIAL TECHNOLOGY CO. LTD.

NOTABLE HAPPENING IN THE GRAPHITE ANODE MARKET

- ACQUISITION- - To increase its capacity for producing ultra-high power graphite electrodes to 60,000–100,000 tonnes annually, Nantong Yangzi Carbon Co. bought Xufeng Carbon Technology Co. Ltd in April 2021.

- MERGER- In order to form the Tokai Carbon Group, Tokai Carbon Co. Ltd. amalgamated its two businesses, Tokai COBEX and Tokai Carbon Savoie, in January 2021. This group is involved in producing electrodes of graphites.

- PRODUCT LAUNCH- Epsilon introduced a novel graphite anode material for lithium-ion batteries on August 24, 2020, which aided the business in broadening its portfolio and producing high-performance and high-quality carbon products for anode elements of lithium-ion batteries (LiB).

- ACQUISITION- Hitachi Chemical Company, which manufactures graphite-based anode materials for lithium-ion batteries, was bought by Showa Denko KK in June 2020 and is now known as Showa Denko Materials Co., Ltd. The market for graphite electrodes will develop as a result of this takeover, which will assist the expansion of the manufacturing of graphite anodes.

Chapter 1. GRAPHITE ANODE MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GRAPHITE ANODE MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GRAPHITE ANODE MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GRAPHITE ANODE MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.GRAPHITE ANODE MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GRAPHITE ANODE MARKET– By Application

6.1. Steel Manufacturing,

6.2. Silicon Metal Manufacturing,

6.3. Steel Refining,

6.4. Smelting Processes

6.5. Ferroalloy Production,

6.6. Non-Ferrous Metals Production,

6.7. Lithium-Ion Batteries Production,

6.8. Others

Chapter 7. GRAPHITE ANODE MARKET– By End Use

7.1. Automotive

7.2. Appliances

7.3. Construction

7.4. Machinery

7.5. Transportation

7.6. Aerospace and Defence

7.7. Oil and Refinery

7.8. Others.

Chapter 8. GRAPHITE ANODE MARKET– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. GRAPHITE ANODE MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. GRAFTECH INTERNATIONAL LTD.,

9.2. SYRAH RESOURCES LTD.,

9.3. GRAPHITE INDIA LTD.,

9.4. TOKAI CARBON CO. LTD.,

9.5. SHANSHAN CORPORATION,

9.6. QINGDAO GUANGXING ELECTRONIC MATERIALS CO. LTD.,

9.7. FANGDA CARBON NEW MATERIAL TECHNOLOGY CO. LTD.

Download Sample

Choose License Type

2500

4250

5250

6900