Carbon Graphite Market Size (2023 - 2030)

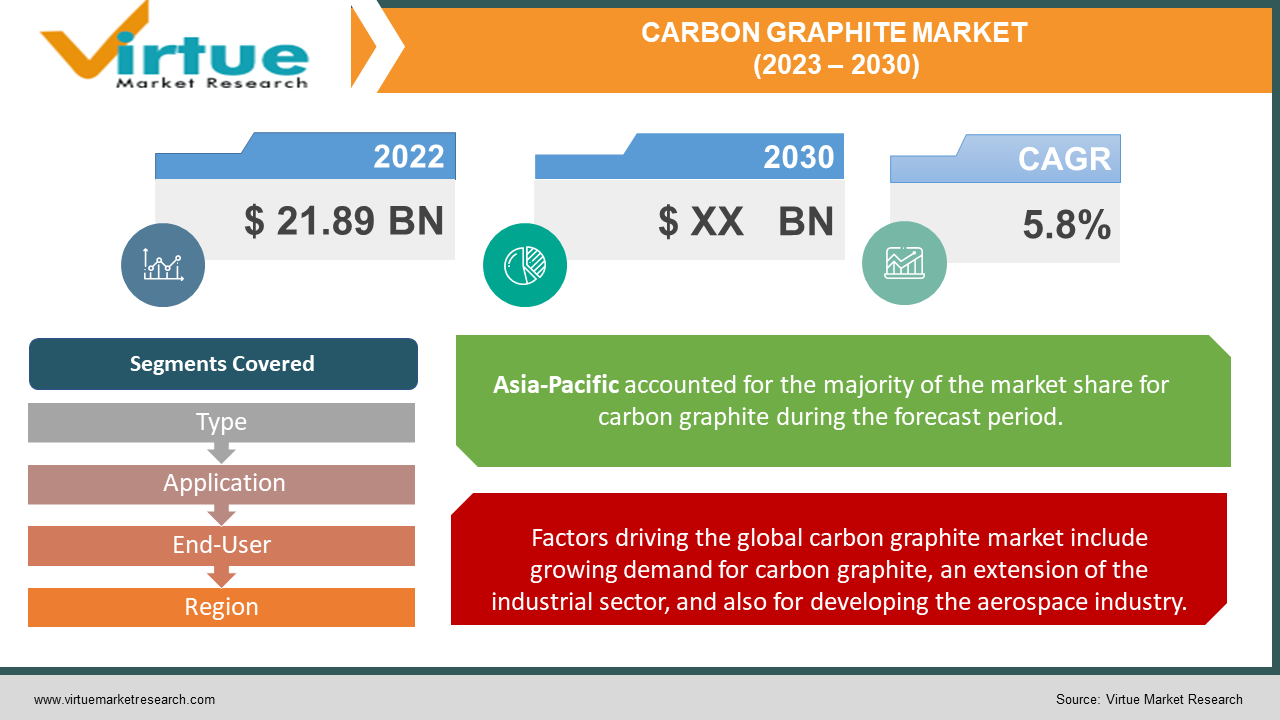

The global carbon graphite market size is estimated to reach USD 21.89 billion by 2022 with a growing CAGR of 5.8% during the forecast period 2022-2030.

Industry Overview:

Graphite is a carbon mineral utilized for different applications like foundry, electrical vehicles, construction applications, etc. Graphite is non-metal but exhibits properties of metal-like strength, a good conductor of heat and electricity, and stiffness. Natural and Synthetic are two different types of graphite.

COVID-19 Impact on the global Carbon Graphite Market: The worldwide spread of the novel coronavirus (COVID-19) has significantly affected the metal industry.

Market Drivers:

Factors driving the global carbon graphite market include growing demand for carbon graphite, an extension of the industrial sector, and also for developing the aerospace industry. The need for a lithium-ion battery and prominent steel production is increasing which boosts the carbon graphite market growth globally. The use of graphite in green technologies and growing demand is surging from developing countries create more opportunities during the forecast period.

Market Restraints: Factors like adverse effects of carbon graphite on humans and animals and strict rules towards the metallurgy industry obstruct the global carbon graphite market growth.

CARBON GRAPHITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cabot Corporation, Cytec, Solvay Group, Hexcel Corporation, Mersen S.A., HEG Ltd., Mitsubishi Rayon Co. Ltd., Nippon Carbon Co. Ltd., Toray Industries Inc, Tokai Carbon Co. Ltd. |

Segment Analysis:

The global Carbon Graphite Market has been segmented and sub-segmented based on the type, product type, end-user, and application.

Carbon Graphite Market - By Type

Natural:

-

Flake

-

Vein/Lump

-

Amorphous

Based on the natural type of carbon graphite, flake graphite continues to capture the largest share from amorphous as high-tech applications have become more important and the availability of flake graphite increases quickly.

Synthetic:

-

Carbon Graphite Electrode

-

Carbon Graphite Powder

-

Carbon Graphite Fiber

-

Others

Based on the synthetic type, the carbon graphite electrode segment is witnessing the largest share in the carbon graphite market during the forecast period. The electrodes are majorly used in steel manufacturing and electric arc furnace. The graphite electrode is likely to remain the largest segment in the synthetic type over the upcoming years. The growing use of electric arc furnaces in producing steel across the world is driving graphite electrodes sales.

Carbon Graphite Market - By Application

-

Batteries and Fuel Cells

-

Carbon Brushes

-

Refractory

-

Electrodes

-

Foundry

-

Lubricants

-

Automotive Parts

-

Others

By application carbon graphite, the refractory segment is projected to have the highest share during the timeline period.

Carbon Graphite Market - By End-User

-

Electronics

-

Metallurgy

-

Automotive (Includes EV/HEV Vehicles)

-

Others

By end-user, the metallurgy segment is dominating the carbon graphite market owing to the increasing production of steel using the electric arc furnace procedure, resulting in the growing demand for graphite.

Regional Analysis

-

Geographically, Asia-Pacific experiencing the lion's share in the carbon graphite market and continues to continue its prominence throughout the foreseen period. The increasing use of graphite in the manufacturing of structural composite parts used in aircraft and adopting graphite in refractories is rising because of its high thermal property.

-

China is the leading producer of carbon graphite in the consumption and production capabilities of graphite electrodes. The country has nearly produced 520 thousand metric tons of graphite electrodes, where 62% of the production is used for domestic consumption. In China, the demand for lithium-ion batteries is increasing and is evolving swiftly due to the assumption of new energy vehicles (NEVs) and ESS for off-grid and on-grid applications.

-

In Asia-Pacific, India is the third-largest producer of steel and iron throughout the period. In India, the demand for iron and steel production is growing at a brisk rate. By 2031, steel production is expected to rise and by 2019, the production growth rate was about 1.5%. Such factors are likely to raise the demand for graphite electrodes. The Indian government has taken some initiatives like the National Steel Policy is supporting the growing demand for steel production in India.

-

North American carbon graphites market is expected to have a considerable growth rate over the period. The U.S and Canada contribute the majority of the share due to the growing demand for iron and steel production.

-

On July 26, 2021, Mason Graphite, a Canadian Company announced the launch of Black Swan Graphene Inc. and its execution. Through Black Swan Graphite, Mason Graphite decided to acquired strategic assets to a patented graphene processing technology from Thomas Swan & Co. Limited.

-

Europe is likely to experience substantial carbon graphite growth globally. In the country, around 30 companies are involved in the production of carbon and graphite from raw materials. Europe is pretty wealthy in natural graphite deposits and serves the European batteries.

-

On March 10, 2021, the German Federal Government and the Free State of Bavaria have invested Euros 42.9 million to 2028 for SGL Carbon GmbH. SGL Carbon is one of the synthetic graphite manufacturers for anode materials in Europe.

-

Regionally, Latin America is growing quickly in the carbon graphite market due to increased iron and steel demand. The Brazilian government has developed its reasons for developing the agricultural sector in terms of energy. Through the Centro Technico Association, the Brazilian government has initiated developmental activities in carbon fiber technology.

-

The Middle East & African region for carbon graphite is said to have notable growth in the forthcoming years. UAE is leading the carbon graphite market in MEA.

Carbon Graphite Market - By Company Share

Major key players operating in the global carbon graphite market are

-

Cabot Corporation

-

Cytec

-

Solvay Group

-

Hexcel Corporation

-

Mersen S.A., HEG Ltd.

-

Mitsubishi Rayon Co. Ltd.

-

Nippon Carbon Co. Ltd.

-

Toray Industries Inc

-

Tokai Carbon Co. Ltd.

Notable Happenings in the global Carbon Graphite Market

-

On March 13, 2017, Cabot Corporation is advancing graphenes towards commercial applications. IDTechEx has invited some of the players in graphene in contributing their opinions, Cabot is one key player. https://www.printedelectronicsworld.com/articles/10732/cabot-corporation-advancing-graphenes-towards-commercial-applications

-

On May 5, 2021, Hexcel Corporation announced certification of approval of HexPly M9 prepreg materials by DNV GL. https://www.compositesworld.com/news/hexcel-hexply-m9-prepregs-receive-dnv-gl-type-approval-certification

-

On October 06, 2019, Tokai Carbon Co.'s acquired the SGL SE graphite electrodes business. https://www.globallegalchronicle.com/tokai-carbon-co-s-acquisition-of-sgl-ge-graphite-electrodes-business/

-

On March 02, 2020, Tokai Carbon invested $25 million in extending operations and install new equipment at its plant in Hickman, Fulton County, and Kentucky. https://www.areadevelopment.com/newsItems/2-3-2020/tokai-carbon-ge-hickman-fulton-county-kentucky.shtml

Chapter 1. Carbon Graphite Market - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Carbon Graphite Market - Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Carbon Graphite Market - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Carbon Graphite Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Carbon Graphite Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Carbon Graphite Market - By Type

6.1 Natural

6.1.1 Flake

6.1.2 Vein/Lump

6.1.3 Amorphous

6.2 Synthetic

6.2.1 Carbon Graphite Electrode

6.2.2 Carbon Graphite Powder

6.2.3 Carbon Graphite Fiber

6.2.4 Others

Chapter 7. Carbon Graphite Market - By Application

7.1 Batteries and Fuel Cells

7.2 Carbon Brushes

7.3 Refractory

7.4 Electrodes

7.5 Foundry

7.6 Lubricants

7.7 Automotive Parts

7.8 Others

Chapter 8. Carbon Graphite Market - By End-User

8.1 Electronics

8.2 Metallurgy

8.3 Automotive (Includes EV/HEV Vehicles)

8.4 Others

Chapter 9. Carbon Graphite Market – By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. Carbon Graphite Market – Key players

10.1 Cabot Corporation

10.2 Cytec

10.3 Solvay Group

10.4 Hexcel Corporation

10.5 Mersen S.A., HEG Ltd.

10.6 Mitsubishi Rayon Co. Ltd.

10.7 Nippon Carbon Co. Ltd.

10.8 Toray Industries Inc

10.9 Tokai Carbon Co. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900