Lithium-ion Battery Market Size (2024-2030)

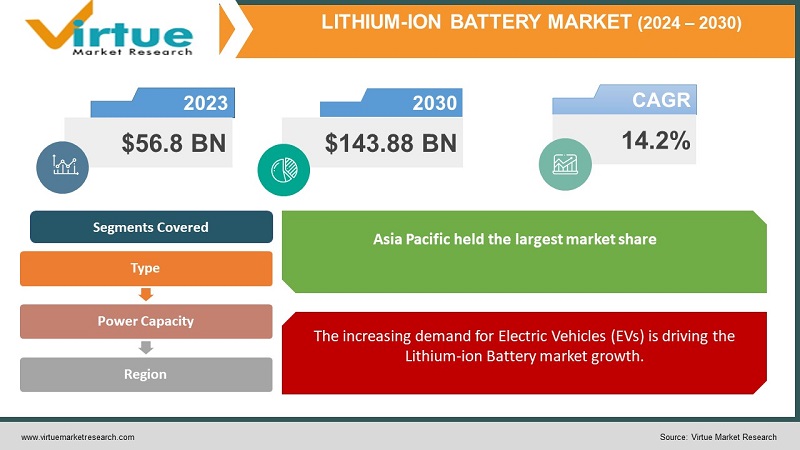

The Global Lithium-ion Battery Market reached USD 56.8 Billion in 2023 and is projected to witness lucrative growth by reaching up to USD 143.88 Billion by 2030. The market is growing at a CAGR of 14.2% during the forecast period (2024-2030).

Lithium-ion batteries, characterized by their rechargeable nature, represent an advanced battery technology utilizing lithium ions as a crucial component in their electrochemistry. Distinguished by a remarkable capacity for high voltage, charge storage per unit mass, and unit volume, lithium-ion batteries outperform their counterparts. Notable features include low self-discharge, elevated energy density, and an extended lifespan coupled with improved charging speed. These batteries find applications in various sectors, including electronic consumer devices such as laptops, PDAs, iPods, cell phones, as well as in automotive, military, aerospace industries, and more. Among electronic devices, smartphones & tablets/PCs hold dominance in the market.

The escalating demand for lithium-ion batteries is propelled by the increasing preference for hybrid and plug-in hybrid electric vehicles, stringent environmental protection mandates, heightened consumer electronics demand, and ongoing research and development initiatives aimed at enhancing battery performance. The reduction in lithium-ion battery prices further contributes to their widespread adoption across diverse industries.

Article: BESS Buying Guide: What “$ / kWh” Hides and How to Compare Storage Offers Properly

Key Market Insights:

Anticipated growth in the lithium-ion battery market is underpinned by a surge in awareness among individuals and businesses regarding the benefits of energy storage and the efficient utilization of lithium-ion technology. With attributes like high energy density, prolonged lifespan, and rapid charging capabilities, lithium-ion batteries are becoming the preferred choice over alternative technologies. Governments worldwide are advocating the transition to clean energy and supporting the deployment of energy storage technologies through incentives and regulations. This has led to a surge in demand for lithium-ion batteries in residential, commercial, and utility-scale applications. The increasing need for energy storage solutions, especially during peak usage periods, acts as a substantial driver for the global lithium-ion battery market. Major market players are actively responding to this demand through substantial investments in research and development to enhance battery performance, safety features, and cost-effectiveness. Additionally, the rising demand for electric vehicles is expected to further bolster the demand for lithium-ion batteries in the automotive sector.

Global Lithium-ion Battery Market Drivers:

The increasing demand for Electric Vehicles (EVs) is driving the Lithium-ion Battery market growth.

The increasing embrace of electric vehicles (EVs) is propelling a noteworthy upturn in the global lithium-ion battery industry. With governments and industries across the globe prioritizing the shift towards sustainable and eco-friendly transportation, there has been a substantial increase in the demand for EVs. Lithium-ion batteries, recognized for their high energy density and efficiency, have become pivotal in driving this transformation in the automotive sector. These batteries serve as the backbone for electric vehicles, providing the essential range and performance required to compete with traditional internal combustion engine vehicles. The substantial global upsurge in EV demand directly corresponds to an increased demand for Lithium-ion batteries.

Customers' expectation of longer battery life and faster charging is also driving the demand for Lithium-ion Batteries.

The continuous evolution of digital devices, coupled with the escalating expectations of customers for extended battery life and quicker charging, has similarly fueled the demand for lithium-ion batteries. Moreover, the expansion of renewable electricity sources, such as photovoltaic and wind power, has created a necessity for efficient electricity storage solutions. Lithium-ion batteries play a crucial role in storing electricity generated from these sources, ensuring grid stability, and facilitating the seamless integration of renewable power into existing electricity systems. The heightened focus on sustainability and the shift towards clean energy sources present significant opportunities for the lithium-ion battery market, particularly in the realm of renewable energy storage.

Global Lithium-ion Battery Market Restraints and Challenges:

Environmental impact associated with extraction and disposal of Lithium-ion Battery is market barriers.

A critical challenge is the environmental impact linked to the extraction and disposal of lithium, creating market barriers. Manufacturers are actively striving to implement more sustainable and environmentally friendly battery manufacturing techniques to address these concerns. The accumulation of used Lithium-ion batteries from electric vehicles, smartphones, laptops, watches, etc., is a result of the lack of cost-effective solutions for recycling these batteries. Since spent/used batteries retain a residual charge, there is a risk of unplanned discharge, posing potential harm to properties and individuals. Large lithium-based batteries used in automotive applications can be misidentified if incorrectly labeled by local battery manufacturers, potentially leading to safety hazards. Proper sorting is essential to avoid risks, and these batteries must be separated from spent lead-acid batteries before storage.

The demand for Lithium-ion battery alternatives poses an obstacle to market expansion.

The increasing demand for substitutes, such as sodium nickel chloride batteries, lithium-air flow batteries, lead-acid batteries, and solid-state batteries in electric vehicles, energy storage, and consumer electronics, is expected to impede the growth of the lithium-ion battery industry. Lithium-air technology utilizes oxygen as an oxidizer, resulting in batteries that are five times cheaper and lighter than lithium-ion, with a longer lifespan. Additionally, the growing demand for flow batteries is anticipated to restrain the growth of the lithium-ion battery industry. The increasing popularity of sodium-nickel-chloride batteries is attributed to the ready availability and lower manufacturing costs of their components compared to lithium-ion batteries, further hindering market growth.

Global Lithium-ion Battery Market Opportunities:

In recent years, there has been a significant shift in energy generation from fossil fuels to renewable sources like solar, wind, and water. Several economies are taking initiatives to transition to cleaner energy sources. For instance, the European Union is rapidly advancing solar Photovoltaics (PV) and wind initiatives to address a potential energy crisis in the future. In 2022, the region witnessed a remarkable addition of over 50 GW of renewable energy capacity, marking a 45% increase from the previous year. The ambitious policies outlined in the REPowerEU Plan and The Green Deal Industrial Plan are poised to attract substantial investments in renewable energy projects throughout the European Union in the coming years, presenting significant opportunities in the global Lithium-ion battery market.

LITHIUM-ION BATTERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.2% |

|

Segments Covered |

By Type, Power capacity, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BYD Co., Ltd., A123 Systems LLC, Hitachi, Ltd., Johnson Controls, LG Chem, Panasonic Corp., Saft, Samsung SDI Co., Ltd., Toshiba Corp., GS Yuasa International Ltd. |

Global Lithium-ion Battery Market Segmentation:

Lithium-ion Battery Market Segmentation: By Type

- Lithium Cobalt Oxide (LCO)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt (LI-NMC)

- Lithium Titanate Oxide (LTO)

- Others

In terms of revenue, the LCO segment held the largest market share, exceeding 30.0% in 2023. The high demand for LCO batteries in mobile phones, tablets, laptops, and cameras, driven by their elevated energy density and safety levels, is anticipated to drive segment growth in the forecast period. LFP batteries, known for excellent safety and long lifespan, contribute to the overall market expansion.

The increasing demand for lithium iron phosphate batteries, particularly in portable and stationary applications requiring high load currents and endurance, is set to boost industry growth. The rising popularity of NCA, attributed to its high specific energy, specific power, and extended lifespan, is expected to foster segment growth. NCA finds applications in electric vehicles (EVs), medical devices, and industrial sectors. The growing utilization of lithium titanate in various applications, including electric powertrains, streetlights, uninterruptible power supply (UPS), and solar-powered street lighting, is projected to drive segment growth. LTO, with its advantageous properties such as safety, low-temperature performance, and high lifespan, is poised to gain market share over the forecast period.

Lithium-ion Battery Market Segmentation: By Power Capacity

- 0 to 3,000 mAH

- 3,000 to 10,000 mAH

- 10,000 to 60,000 mAH

- More than 60,000 mAH

The above 60,000 mAh segment is expected to witness significant market share growth during the forecast period. These high-capacity batteries serve as power backups and power heavy electric vehicles, industrial applications, hybrid electric vehicles, electric boats, energy storage systems, and emergency power systems. Their applications include uninterrupted power supply, inverters, telecommunications, power manufacturing, among others. Lithium-ion batteries are preferred in these high-power applications due to advantages such as overcharge protection, high and low-temperature protection, and short circuit protection. Complex applications necessitate modules, arrays of modules, power racks, and power containers rather than single cells.

Lithium-ion Battery Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The global market is analyzed regionally, covering North America, Asia-Pacific, Europe, South America, and the Middle East and Africa. Asia Pacific held the largest market share, exceeding 47.0% in 2023. Steady growth is expected in the European market over the forecast period, driven by the increasing use of Li-ion batteries in various sectors, including medical, aerospace and defense, automotive, energy storage, and data communication & telecom. Germany, in particular, is expected to experience consistent growth due to the expanding utilization of Li-ion batteries in energy storage systems, electric vehicles (EVs), and consumer electronics.

Europe stands out as the world's leading market for energy storage systems and renewable energy development. The Asia Pacific region, with a rapidly growing market for electric vehicles in countries like India and China, is influenced by increasing demand for Li-ion batteries. China's environmental concerns have led to a ban on conventional fossil fuel-powered scooters in major cities, driving the sales of e-scooters.

COVID-19 Impact Analysis on the Global Lithium-ion Battery Market:

The global lithium-ion battery market has experienced adverse effects due to the COVID-19 pandemic, primarily attributed to work restriction measures implemented in China. Over the past five years, China has been the dominant force in the lithium-ion battery supply chain, encompassing raw materials, electrode material production, and battery and pack manufacturing. The pandemic has highlighted vulnerabilities in China-centric sourcing strategies, potentially leading to a shift in production back to Japan and South Korea. Despite China's proactive support for electric vehicles (EVs) through government funding, the emphasis on maintaining domestic battery production to meet high domestic demand is evident. The global market faced a 10% reduction in lithium-ion battery supply due to the production slowdown in China. However, post the lifting of production facility restrictions, China, along with other Asian countries like Japan and South Korea, has resumed production at 60% to 70% of pre-pandemic levels. While the risks to battery supply have diminished, the economic downturn in 2020 is expected to exert additional downward pressure on demand, particularly in residential energy storage, impacting the lithium-ion battery market.

Latest Trends/ Developments:

- CATL and Daimler Truck AG strengthened their collaboration in May 2021, with a shared objective of CO2-neutral electric trucking. This collaboration will see CATL providing lithium-ion battery packs for the Mercedes-Benz eActros LongHaul battery-electric truck, slated for series production in 2024.

Key Players:

- BYD Co., Ltd.

- A123 Systems LLC

- Hitachi, Ltd.

- Johnson Controls

- LG Chem

- Panasonic Corp.

- Saft

- Samsung SDI Co., Ltd.

- Toshiba Corp.

- GS Yuasa International Ltd.

Chapter 1. GLOBAL LITHIUM-ION BATTERY MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL LITHIUM-ION BATTERY MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL LITHIUM-ION BATTERY MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL LITHIUM-ION BATTERY MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL LITHIUM-ION BATTERY MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL LITHIUM-ION BATTERY MARKET – By Type

6.1. Introduction/Key Findings

6.2. Lithium Cobalt Oxide (LCO)

6.3. Lithium Iron Phosphate (LFP)

6.4. Lithium Nickel Manganese Cobalt (LI-NMC)

6.5. Lithium Titanate Oxide (LTO)

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL LITHIUM-ION BATTERY MARKET – By Power Capacity

7.1. Introduction/Key Findings

7.2. 0 to 3,000 mAH

7.3. 3,000 to 10,000 mAH

7.4. 10,000 to 60,000 mAH

7.5. More than 60,000 mAH

7.6. Y-O-Y Growth trend Analysis By Power Capacity

7.7. Absolute $ Opportunity Analysis By Power Capacity , 2024-2030

Chapter 8. GLOBAL LITHIUM-ION BATTERY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Power Capacity

8.1.3. By Type

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Power Capacity

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Power Capacity

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Power Capacity

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Power Capacity

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL LITHIUM-ION BATTERY MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BYD Co., Ltd.

9.2. A123 Systems LLC

9.3. Hitachi, Ltd.

9.4. Johnson Controls

9.5. LG Chem

9.6. Panasonic Corp.

9.7. Saft

9.8. Samsung SDI Co., Ltd.

9.9. Toshiba Corp.

9.10. GS Yuasa International Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Lithium-ion Battery Market reached USD 56.8 Billion in 2023 and is projected to witness lucrative growth by reaching up to USD 143.88 Billion by 2030. The market is growing at a CAGR of 14.2% during the forecast period (2024-2030).

The worldwide Global Lithium-ion Battery Market growth is estimated to be 14.2% from 2024 to 2030

The Global Lithium-ion Battery Market is segmented by Type (Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt (LI-NMC), Lithium Titanate Oxide (LTO), Others); By Power Capacity (0 to 3,000 mAH, 3,000 to 10,000 mAH, 10,000 to 60,000 mAH, More than 60,000 mAH); By Application (Marine, Energy and Power, Consumer Electronics, Automotive, Aerospace and Defense, Others).

Global demand for lithium-ion batteries is expected to expand exponentially in the future due to the growing need for portable electronics, renewable energy storage solutions, and electric cars. Technological developments in this dynamic and quickly growing business present several potentials for innovation, cost-cutting, and sustainable development as battery performance and energy density continue to improve

The COVID-19 epidemic has had a severe effect on the global market for lithium-ion batteries, mostly because of work restrictions implemented by China. The slowdown in China's production activity resulted in a 10% drop in the supply of lithium-ion batteries to the worldwide market.