Electric Cars Market Size Share, Growth Analysis (2024 – 2030)

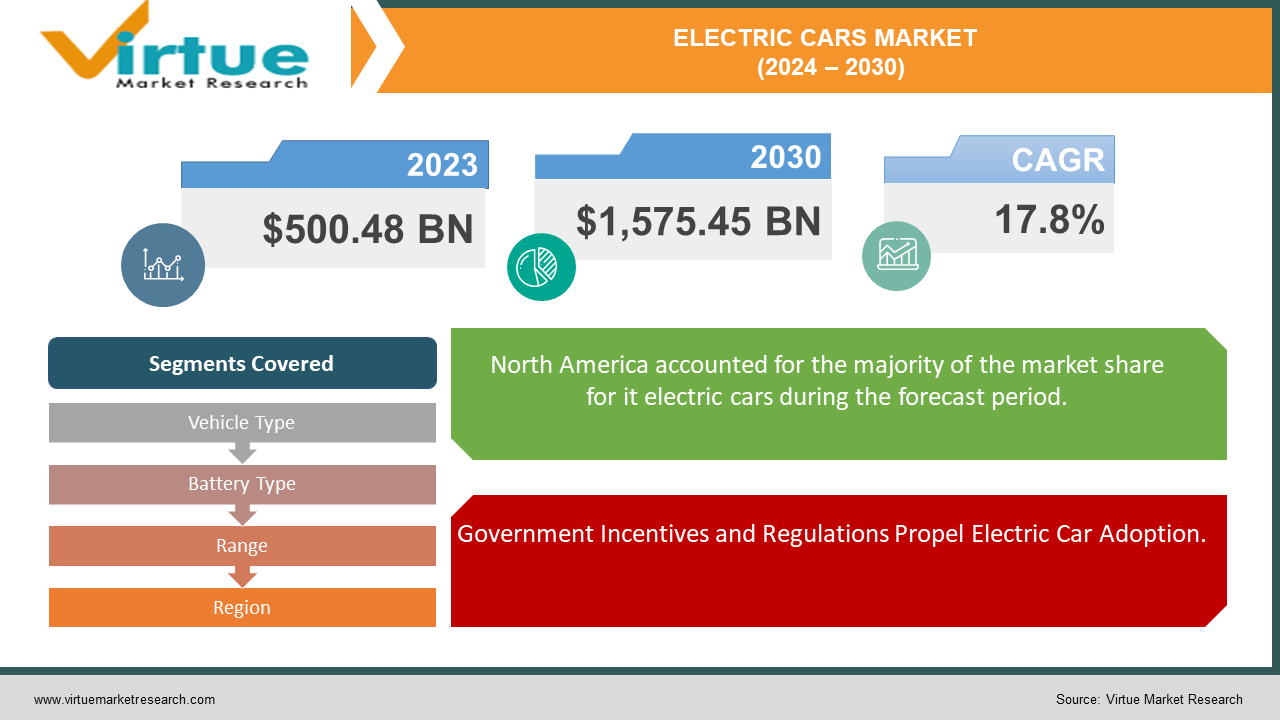

The market for electric cars was estimated to be worth USD 500.48 billion in 2023 and is expected to increase to USD 1,575.45 billion by 2030, with a projected compound annual growth rate (CAGR) of 17.8% from 2024 to 2030.

The global electric car market has undergone remarkable growth in recent years, fueled by a combination of environmental consciousness, government incentives, and technological innovation. With concerns about climate change mounting, consumers and policymakers alike are increasingly turning to electric vehicles (EVs) as a cleaner alternative to traditional internal combustion engine vehicles. This shift is evident in the expanding variety of electric car models available, ranging from compact city cars to luxury SUVs and high-performance vehicles. Key regions such as China, Europe, and North America have emerged as hotspots for electric car adoption, driven by supportive government policies, stringent emissions regulations, and robust charging infrastructure investments.

Key Insights:

- Global electric car sales reached a record high of over 3.2 million units in 2023, representing a year-on-year increase of 80%.

- China maintained its position as the largest electric car market, with sales surpassing 1.5 million units in 2023, accounting for nearly half of global electric car sales.

- Europe experienced a significant surge in electric car adoption, with sales exceeding 1 million units in 2023, fueled by strong consumer demand and supportive government incentives.

- Electric car battery prices continued to decline, with the average price per kilowatt-hour dropping by 15% in 2023, making electric vehicles more affordable for consumers.

Global Electric Cars Market Drivers:

Government Incentives and Regulations Propel Electric Car Adoption.

Governments worldwide are implementing a variety of incentives and regulations to promote the adoption of electric cars. These measures include subsidies, tax incentives, rebates, and mandates for automakers to produce zero-emission vehicles. Such policies not only make electric cars more affordable for consumers but also encourage manufacturers to invest in electric vehicle technology, driving innovation and market growth.

Technological Advancements Enhance Electric Vehicle Appeal.

Continuous advancements in battery technology, electric drivetrains, and vehicle connectivity are significantly enhancing the appeal of electric cars. Improved battery efficiency and energy density are extending driving ranges, while faster charging capabilities are addressing range anxiety. Additionally, features like autonomous driving and enhanced connectivity are making electric vehicles more convenient and attractive to consumers, driving increased adoption.

Environmental Concerns Drive Demand for Cleaner Transportation Options.

Growing awareness of environmental issues, such as air pollution and climate change, is driving demand for cleaner transportation options like electric cars. Electric vehicles produce zero tailpipe emissions, significantly reducing greenhouse gas emissions and improving air quality in urban areas. As concerns about environmental sustainability continue to rise, more consumers are choosing electric cars as a greener alternative to traditional gasoline and diesel vehicles, leading to increased market demand.

Unlock Market Insights: Get A FREE Sample Report Today!

Global Electric Cars Market Restraints and Challenges:

Range Anxiety Persists as a Barrier to Electric Car Adoption.

Despite advancements in battery technology, range anxiety remains a significant concern for many consumers considering electric cars. The limited driving range of some electric vehicles, coupled with the availability and accessibility of charging infrastructure, can deter potential buyers. Addressing range anxiety through improvements in battery technology, expanding charging infrastructure, and increasing public awareness about the capabilities of electric cars is essential to overcome this barrier to adoption.

High Initial Cost Hinders Widespread Electric Vehicle Adoption.

One of the primary challenges facing the electric car market is the higher upfront cost compared to traditional gasoline-powered vehicles. While electric vehicles offer long-term savings on fuel and maintenance, the initial purchase price can be a deterrent for budget-conscious consumers. Lowering the cost of electric vehicles through government incentives, economies of scale in manufacturing, and advancements in battery technology is crucial to making electric cars more accessible to a broader range of consumers.

Limited Charging Infrastructure Slows Market Growth.

The expansion of charging infrastructure remains a critical challenge for the widespread adoption of electric vehicles. In many regions, the availability of charging stations, particularly fast chargers, is limited, leading to concerns about range anxiety and inconvenience for electric car owners. Increasing investment in charging infrastructure development, including public charging stations, workplace charging, and home charging solutions, is essential to support the growing number of electric vehicles on the road and facilitate their integration into mainstream transportation.

Global Electric Cars Market Opportunities:

Growth Potential in Emerging Markets Presents Lucrative Opportunities for Electric Car Manufacturers.

Emerging markets, particularly in Asia, Latin America, and Africa, present significant growth opportunities for electric car manufacturers. Rising urbanization, increasing disposable incomes, and growing environmental awareness in these regions are driving demand for cleaner and more sustainable transportation options. By investing in market expansion, localization of production, and strategic partnerships with local stakeholders, electric car manufacturers can capitalize on the untapped potential of emerging markets and establish a strong presence in these dynamic regions.

Integration of Renewable Energy Sources Offers Synergies for Electric Vehicle Charging Infrastructure.

The integration of renewable energy sources, such as solar and wind power, presents a promising opportunity to enhance the sustainability and resilience of electric vehicle charging infrastructure. By leveraging renewable energy technologies, charging stations can reduce their carbon footprint and operating costs while providing cleaner energy to electric vehicles. Collaborations between electric car manufacturers, energy companies, and infrastructure developers can accelerate the adoption of renewable-powered charging solutions, creating a more sustainable ecosystem for electric mobility.

Advancements in Battery Technology Unlock New Possibilities for Electric Vehicle Applications.

Continued advancements in battery technology, including improvements in energy density, charging speed, and longevity, are opening up new opportunities for electric vehicle applications. From electric buses and trucks to drones and electric aircraft, the versatility and scalability of advanced batteries are expanding the horizons of electric mobility beyond traditional passenger cars. By investing in research and development, partnerships with battery suppliers, and pilot projects in niche markets, electric car manufacturers can leverage these technological innovations to diversify their product offerings and capture emerging opportunities in the electrification of transportation.

GLOBAL ELECTRIC CARS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.8% |

|

Segments Covered |

By Vehicle Type, Battery Type, Range, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tesla, Inc., BYD Company Limited, Volkswagen Group, Nissan Motor Corporation, BMW Group, General Motors Company, Ford Motor Company, Hyundai Motor Company, Kia Corporation, Daimler AG, Rivian Automotive, Inc., Lucid Motors Inc. |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

GLOBAL ELECTRIC CARS MARKET SEGMENTATION ANALYSIS

Electric Cars Market Segmentation: By Vehicle Type

-

Passenger Cars

-

Commercial Cars

Passenger cars emerge as the most effective category to focus on. Passenger cars constitute the largest segment within the electric car market, catering to individual consumers and households seeking sustainable and efficient transportation solutions. This segment encompasses a wide range of electric vehicles, including sedans, hatchbacks, SUVs, and luxury cars, offering diverse options to meet varying preferences and lifestyles.

Moreover, passenger cars often benefit from greater consumer awareness and acceptance compared to commercial vehicles, as they are more closely associated with daily commuting and personal mobility needs. By prioritizing the development, marketing, and distribution of electric passenger cars, automakers can capitalize on the growing demand for eco-friendly transportation options among individual consumers, driving significant market growth and adoption of electric cars globally.

Electric Cars Market Segmentation: By Battery Type

-

Lithium-Ion Battery Electric Vehicles (BEVs)

-

Plug-in Hybrid Electric Vehicles (PHEVs)

When analyzing market segmentation by battery type in the electric car industry, Lithium-Ion Battery Electric Vehicles (BEVs) emerge as the most effective category to focus on. BEVs rely solely on lithium-ion batteries for power, offering zero-emission driving and typically longer all-electric ranges compared to Plug-in Hybrid Electric Vehicles (PHEVs). This segment aligns closely with the increasing consumer demand for cleaner transportation options and addresses concerns about reducing carbon footprints and minimizing reliance on fossil fuels.

Additionally, the rapid advancements in battery technology have led to improvements in BEV performance, range, and affordability, making them increasingly attractive to a broader range of consumers. By emphasizing the development and promotion of BEVs, automakers can leverage the growing environmental consciousness and technological innovations to drive market growth and accelerate the transition to sustainable mobility solutions.

Electric Cars Market Segmentation: By Range

-

Short

-

Medium

-

Large

In the market segmentation by range in the electric car industry, vehicles with medium range emerge as the most effective category to focus on. While short-range electric cars cater to urban commuters and city driving needs, and large-range electric vehicles address long-distance travel requirements, medium-range electric cars strike a balance that appeals to a broader consumer base. These vehicles offer a practical compromise between range and cost, providing sufficient mileage for daily commuting and regional travel without the premium price tag associated with larger batteries.

With advancements in battery technology continually improving the range of medium-range electric cars, they offer a compelling value proposition for consumers seeking an eco-friendly and cost-effective alternative to traditional internal combustion engine vehicles. By prioritizing the development and marketing of medium-range electric cars, automakers can effectively target mainstream consumers and drive widespread adoption of electric vehicles, contributing to the overall growth and sustainability of the electric car market.

What's Next for Your Market? Get a Snapshot with FREE Sample Report

Electric Cars Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Market share by region in the global electric car industry reveals North America as the dominant player, capturing approximately 39% of the market. This prominence can be attributed to factors such as robust infrastructure, government incentives, and a growing awareness of environmental sustainability among consumers.

Following closely behind, Europe accounts for 28% of the market share, driven by stringent emissions regulations, ambitious climate targets, and a supportive policy environment that encourages the adoption of electric vehicles. The Asia-Pacific region holds a significant share of 21%, buoyed by strong demand from countries like China, which boasts the largest electric car market globally.

South America and the Middle East and Africa regions contribute 7% and 5% respectively, indicating a growing but comparatively smaller presence in the electric car market. Despite regional variations, the global electric car market continues to witness steady growth across all regions, fueled by technological advancements, shifting consumer preferences, and increasing government support for sustainable transportation solutions.

COVID-19 Impact Analysis on the Global Electric Cars Market:

The COVID-19 pandemic significantly impacted the global electric cars market, causing disruptions in manufacturing, supply chains, and consumer demand. During the height of the pandemic, widespread lockdowns and economic uncertainty led to a decline in car sales overall, including electric vehicles. Many automakers faced production halts and supply chain challenges, resulting in delays in the launch of new electric car models and constraints in battery supply.

Additionally, reduced consumer spending and uncertainty about future economic conditions dampened demand for electric cars, particularly among budget-conscious buyers. However, as countries began to reopen and recover from the initial impact of the pandemic, the electric car market showed resilience, with governments incentivizing green recovery initiatives and consumers increasingly prioritizing sustainability.

The pandemic also underscored the importance of cleaner transportation solutions, leading to renewed interest and investment in electric vehicles as part of efforts to build back greener and more resilient economies. Overall, while the COVID-19 pandemic posed temporary challenges to the global electric cars market, it also highlighted the potential for electric vehicles to play a pivotal role in shaping a more sustainable and resilient future for the automotive industry.

Latest Trends/ Developments:

In the rapidly evolving landscape of the global electric cars market, several latest trends and developments are shaping the industry's trajectory. One notable trend is the acceleration of electric vehicle (EV) adoption driven by ambitious government policies and commitments to reduce carbon emissions. Countries worldwide are implementing stricter regulations and offering incentives to promote EV sales, spurring innovation and investment in electric vehicle technology.

Additionally, there is a growing focus on enhancing the charging infrastructure to address range anxiety and facilitate long-distance travel, with an emphasis on fast-charging networks and ultra-fast charging technologies. Moreover, advancements in battery technology continue to drive improvements in EV performance, range, and affordability, making electric cars increasingly competitive with traditional internal combustion engine vehicles. Alongside these technological advancements, there is a rising demand for electric SUVs and crossover models, reflecting changing consumer preferences and the desire for versatility and utility in electric vehicles.

Furthermore, the integration of renewable energy sources into EV charging infrastructure is gaining momentum, aligning with the broader push towards sustainability and decarbonization. Overall, these latest trends and developments underscore the continued momentum and potential for growth in the global electric cars market, positioning electric vehicles as a key driver of the automotive industry's future.

Key Players:

-

Tesla, Inc.

-

BYD Company Limited

-

Volkswagen Group

-

Nissan Motor Corporation

-

BMW Group

-

General Motors Company

-

Ford Motor Company

-

Hyundai Motor Company

-

Kia Corporation

-

Daimler AG

-

Rivian Automotive, Inc.

-

Lucid Motors Inc.

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Electric Cars Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electric Cars Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electric Cars Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electric Cars Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electric Cars Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electric Cars Market – By Vehicle Type

6.1 Introduction/Key Findings

6.2 Passenger Cars

6.3 Commercial Cars

6.4 Y-O-Y Growth trend Analysis By Vehicle Type

6.5 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 7. Electric Cars Market – By Battery Type

7.1 Introduction/Key Findings

7.2 Lithium-Ion Battery Electric Vehicles (BEVs)

7.3 Plug-in Hybrid Electric Vehicles (PHEVs)

7.4 Y-O-Y Growth trend Analysis By Battery Type

7.5 Absolute $ Opportunity Analysis By Battery Type, 2024-2030

Chapter 8. Electric Cars Market – By Range

8.1 Introduction/Key Findings

8.2 Short

8.3 Medium

8.4 Large

8.5 Y-O-Y Growth trend Analysis By Range

8.6 Absolute $ Opportunity Analysis By Range, 2024-2030

Chapter 9. Electric Cars Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Vehicle Type

9.1.3 By Battery Type

9.1.4 By By Range

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Vehicle Type

9.2.3 By Battery Type

9.2.4 By Range

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Vehicle Type

9.3.3 By Battery Type

9.3.4 By Range

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Vehicle Type

9.4.3 By Battery Type

9.4.4 By Range

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Vehicle Type

9.5.3 By Battery Type

9.5.4 By Range

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Electric Cars Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Tesla, Inc.

10.2 BYD Company Limited

10.3 Volkswagen Group

10.4 Nissan Motor Corporation

10.5 BMW Group

10.6 General Motors Company

10.7 Ford Motor Company

10.8 Hyundai Motor Company

10.9 Kia Corporation

10.10 Daimler AG

10.11 Rivian Automotive, Inc.

10.12 Lucid Motors Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for electric cars was estimated to be worth USD 500.48 billion in 2023 and is expected to increase to USD 1,575.45 billion by 2030, with a projected compound annual growth rate (CAGR) of 17.8% from 2024 to 2030.

The primary drivers of the global electric cars market are environmental concerns, government incentives, technological advancements, and changing consumer preferences.

The key challenges facing the global electric cars market include high initial costs, range anxiety, limited charging infrastructure, and supply chain constraints.

In 2023, North America held the largest share of the global electric cars market.

Tesla, Inc., BYD Company Limited, Volkswagen Group, Nissan Motor Corporation, BMW Group, General Motors Company, Ford Motor Company, Hyundai Motor Company, Kia Corporation, Daimler AG, Rivian Automotive, Inc., Lucid Motors Inc. are the main players.