Europe Dairy Alternatives Market Size (2024-2030)

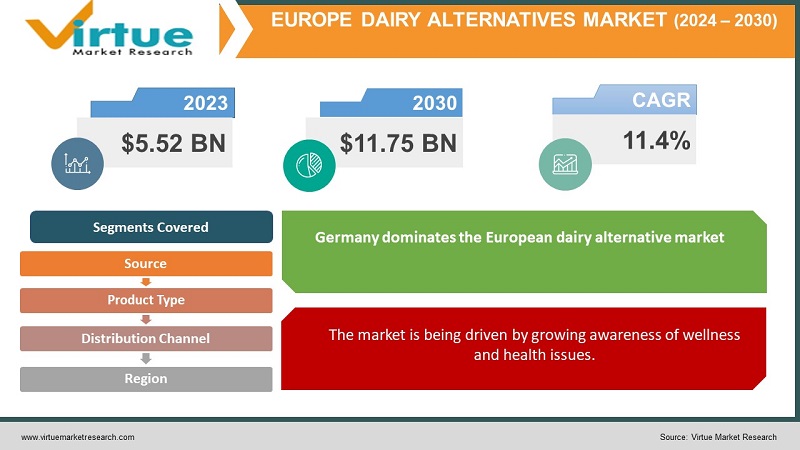

The European dairy alternative market exhibited a value of USD 5.52 billion in 2023 and is anticipated to reach USD 11.75 billion by the conclusion of 2030. Forecasted from 2024 to 2030, the market is expected to witness a robust compound annual growth rate (CAGR) of 11.4%.

The primary reason for the anticipated growth is the growing desire among the local population to consume healthier foods and beverages. Drinks made from dairy alternatives, such as soy, are becoming more popular than traditional dairy drinks. In order to meet consumer demands and expand their market share, businesses are constantly innovating. They make things like mixes for fresh and soy drinks, for instance. Sales of dairy substitutes, such as almond milk, generated significant revenue for Europe in 2023 and are predicted to continue growing in the future. By claiming to be organic, large corporations like Blue Diamond Growers and Earth's Own Food Company are increasing the popularity of these goods. Companies are creating a variety of flavors, like chocolate, vanilla, and honey, for beverages like soymilk and almond milk in an effort to pique consumers' interest. There will be more opportunities for businesses to market these goods as consumers grow more conscious of maintaining their health and express a preference for lower-fat and lower-cholesterol foods. Many people around the world require alternatives because lactose, a sugar present in milk, is intolerable to them. This indicates that the market for dairy substitutes in Europe and elsewhere has a bright future.

Key Market Insights:

The European dairy alternatives market is estimated to be around $5.5 billion in value, driven by the increasing consumer preference for plant-based and lactose-free products, as well as concerns over sustainability and animal welfare.

The plant-based milk segment holds a market share of over 60% in the Europe dairy alternatives market, with almond milk, soy milk, and oat milk being the most popular varieties.

Germany accounts for nearly 20% of the Europe dairy alternatives market share, attributed to the high consumer awareness and demand for sustainable and ethical food products.

The vegan segment is expected to grow at a rate of around 8% annually, driven by the rising popularity of veganism and the increasing availability of dairy-free alternatives in supermarkets and food service establishments.

The food service and hospitality industry contributes to around 25% of the overall Europe dairy alternatives market, driven by the growing demand for plant-based menu options to cater to diverse dietary preferences and lifestyles.

Global Europe Dairy Alternatives Market Drivers:

The market is being driven by growing awareness of wellness and health issues.

People are becoming more conscious of their health and inclined to make decisions based on what they believe to be healthy. Dairy substitutes made from plants are regarded as healthy because they are high in vitamins, minerals, and healthy fats. It's why they appeal to those who are health-conscious.

The expansion is being aided by the increasing number of vegans and lactose intolerant people.

In Europe, the number of people adopting the vegan diet—which forgoes eating animal products—is growing. This has increased demand for plant-based substitutes for various food types. Furthermore, many Europeans require dairy-free products because they are intolerant to lactose, a sugar present in milk.

Concerns about environmental sustainability are driving the market for dairy substitutes.

These days, consumers are more concerned about the environment and are selecting goods that cause less damage to it. Regular dairy production can alter a lot of land, use a lot of water, and produce a lot of greenhouse gases. Because they don't have as much of an impact on the environment, plant-based options are thought to be better.

Growth in the dairy alternative market is being driven by improvements in taste and product innovation.

New plant-based dairy substitutes with improved taste, texture, and functionality are constantly being developed by businesses. Even those who previously disliked these products are becoming more interested in them as a result of this.

The market is more accessible because of how convenient online retail is.

Online grocery shopping is growing in popularity these days. This implies that a wide variety of dairy substitutes, including those not found in traditional stores, are readily available to consumers.

Europe Dairy Alternatives Market Challenges and Restraints:

Dairy substitutes made from plants can be more expensive than conventional dairy, which may be prohibitive for some people, particularly those on a limited budget. Despite the abundance of options available online, physical stores may not always carry them, so it may be challenging to find them there. There are still some who maintain that plant-based substitutes for dairy products don't feel or taste as good. It can also be confusing because different European nations have different laws regarding the labeling of these goods. The plant-based food industry is growing, and the conventional dairy industry may use advertising and lobbying to try to slow it down.

Europe Dairy Alternatives Market Opportunities:

The market for dairy substitutes in Europe has a lot of room to grow. Companies can concentrate on demonstrating the health benefits of dairy substitutes like soy, almond, oat, and coconut milk because people are very concerned about their health. They are also capable of creating novel and intriguing goods with mouthwatering flavors that appeal to a wide range of consumers. Expanding the availability of these products to new locations, such as convenience stores and online, can increase their customer base. Businesses can draw in even more customers by educating and promoting the advantages of dairy substitutes. collaborating with eateries and influencers can also aid in spreading the word. Additionally, there is a great chance to enter new markets as more people become aware of these options globally. Ensuring that products adhere to regulations and have readable labels is another way to foster consumer trust. In general, there is a great deal of room for growth and success for businesses in the European dairy substitutes market.

EUROPE DAIRY ALTERNATIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.4% |

|

Segments Covered |

By Product Type, Source, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Blue Diamond Growers, Danone S.A., Melt Organic, Ecomil, Ecotone, First Grade International Limited, Oatly Group AB, The Hain Celestial Group, Inc., Upfield Holdings BV., Unilever PLC |

Europe Dairy Alternatives Market Segmentation:

European Dairy Alternatives Market Segmentation: By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

In Europe, soy milk is the most widely used dairy substitute due to its long history, high level of consumer confidence, and affordability for a wide range of consumers. It's a healthy choice because it's also a great source of protein, calcium, vitamin D, and occasionally vitamin B12. Due to its low-calorie content, nutty flavor, and lack of lactose, almond milk is becoming increasingly popular. Almond milk is preferred by some people who are allergic to soy or have health issues. In Europe, oat and coconut milk are becoming more and more popular than cow's milk. They are popular because they are lactose-free, low in calories, and suitable for vegan diets. Because they are readily available and available in a variety of flavors, people like them.

European Dairy Alternatives Market Segmentation: By Product Type

- Non-dairy Milk

- Better

- Cheese

- Yogurts

- Ice Cream

- Others

Non-dairy milk is the most widely used and rapidly expanding segment of the dairy substitute market in Europe. Options like rice milk, coconut milk, oat milk, almond milk, and soy milk are highly favored by consumers. These types of milk are used in smoothies, baked goods, coffee, and cereal at breakfast.

European Dairy Alternatives Market Segmentation: By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

Supermarkets and large retailers are the primary locations in Europe where consumers purchase dairy substitutes. These stores offer a wide variety of products from various brands, allowing customers to compare costs and select their favorite. Furthermore, it's usually simple to locate plant-based products because they have their own section. However, online shopping is rapidly gaining popularity. People enjoy it because it offers a wide range of options and allows them to select from both domestic and foreign brands. You can order anything you want and have it delivered straight to your door, which makes it incredibly convenient. Online shopping gained even more traction during the COVID-19 pandemic. It is made even more alluring by the frequent discounts and special offers available to online buyers.

European Dairy Alternatives Market Segmentation: Regional Analysis

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

For a number of reasons, Germany dominates the European dairy alternative market. First off, plant-based milk alternatives like soy, almond, and oat milk are highly favored by Germans who place a high value on maintaining their health. Second, the demand for dairy substitutes is increased by the large number of vegans in Germany who abstain from eating any animal products. Finally, the German government encourages sustainable food production, which obliquely promotes the expansion of plant-based goods. Germany is the market leader in Europe for dairy substitutes because of all these factors. The UK market is expanding at a very rapid pace. As people become more aware of environmental and health concerns, they are choosing plant-based alternatives such as oat milk, soy milk, and almond milk. Animal welfare and environmental concerns are also driving an increasing number of people to adopt dairy-free diets, which increases demand for these products.

COVID-19 Impact on the global Europe Dairy Alternatives Market:

There were some positive developments for plant-based dairy substitutes in Europe during the COVID-19 pandemic. During the outbreak, people's concerns about their health increased, and they demanded better options. This indicates that more people shifted to plant-based substitutes because they believed them to be beneficial to their general health and immune systems. In addition, demand increased as more people searched for dependable substitutes when regular dairy supply chains were disrupted. However, fewer people used dairy substitutes in cafes and restaurants as a result of their closure. In the long run, things seem promising despite these ups and downs. Even with some setbacks due to the pandemic, people's concerns about environmental sustainability and health should sustain the market growth for plant-based dairy products.

Latest Trend/Development:

Almond, oat, and soy milk are becoming more popular in Europe as dairy substitutes because consumers believe they are healthier and better for the environment. New tasty and healthful plant-based dairy products are constantly being developed by companies. Additionally, they are selling them online, which facilitates customer purchasing. Labels such as organic and non-GMO are also important to consumers. Labeling regulations are constantly evolving, which can occasionally be confusing. Nevertheless, those who wish to transition to dairy substitutes have a wide range of options available to them. Businesses are collaborating to produce and market these goods more effectively, and more consumers are looking for vegan options.

Key Players:

- Blue Diamond Growers

- Danone S.A.

- Melt Organic

- Ecomil

- Ecotone

- First Grade International Limited

- Oatly Group AB

- The Hain Celestial Group, Inc.

- Upfield Holdings BV.

- Unilever PLC

Market News:

- Almond milk, known as Almond Breeze, almond flour, and almonds themselves were all introduced by Blue Diamond in February 2023. This demonstrates their ongoing efforts to showcase the benefits of almonds. To promote almond snacks, they created appealing songs and packaging in various sizes. They also emphasized almond milk's deliciousness and adaptability.

- Oatly Group AB started selling vegan cream cheese in the United States in June 2023. There are two flavors available: chive & onion and plain.

Chapter 1. Europe Dairy Alternatives Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Dairy Alternatives Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Dairy Alternatives Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Dairy Alternatives Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Dairy Alternatives Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Dairy Alternatives Market– By Source

6.1. Introduction/Key Findings

6.2. Soy

6.3. Almond

6.4. Coconut

6.5. Rice

6.6. Oats

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Source

6.9. Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Europe Dairy Alternatives Market– By Product Type

7.1. Introduction/Key Findings

7.2 Non-dairy Milk

7.3. Better

7.4. Cheese

7.5. Yogurts

7.6. Ice Cream

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Product Type

7.9. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 8. Europe Dairy Alternatives Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience Stores

8.4. Online Retail

8.5. Others

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Dairy Alternatives Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.1. By Source

9.1.3. By Product Type

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Dairy Alternatives Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Blue Diamond Growers

10.2. Danone S.A.

10.3. Melt Organic

10.4. Ecomil

10.5. Ecotone

10.6. First Grade International Limited

10.7. Oatly Group AB

10.8. The Hain Celestial Group, Inc.

10.9. Upfield Holdings BV.

10.10. Unilever PLC

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The European dairy alternative market exhibited a value of USD 5.52 billion in 2023 and is anticipated to reach USD 11.75 billion by the conclusion of 2030. Forecasted from 2024 to 2030, the market is expected to witness a robust compound annual growth rate (CAGR) of 11.4%.

Rising health and wellness consciousness, a growing vegan and lactose-intolerant population, environmental sustainability concerns, product innovation, and the improved taste and convenience of online retail are propelling the European dairy alternative market.

Based on the source, the European dairy alternatives market is segmented into soy, almond, coconut, rice, oats, and others

Germany is the most dominant region in the European dairy alternative market

Blue Diamond Growers, Danone S.A., Melt Organic, Ecomil, Ecotone, First Grade International Limited, Oatly Group AB, The Hain Celestial Group Inc., Upfield Holdings BV., and Unilever PLC are some of the leading players in the European dairy alternatives market.