Latin America Dairy Alternatives Market Size (2024-2030)

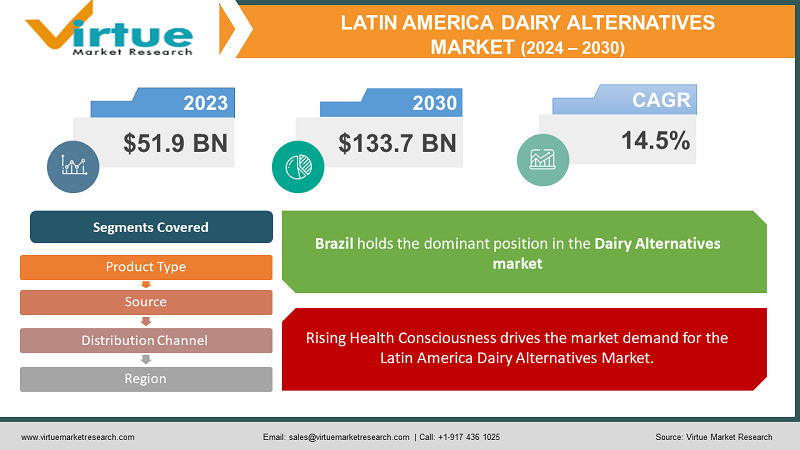

The Latin America Dairy Alternatives Market is valued at USD 51.9 Billion and is projected to reach a market size of USD 133.7 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.5%.

A significant long-term driver for the Latin America Dairy Alternatives Market is the increasing health consciousness among consumers. As awareness about the health benefits of plant-based diets grows, more consumers are opting for dairy alternatives over traditional dairy products. Concerns about lactose intolerance, milk allergies, and the perceived health risks associated with dairy consumption are driving this shift in consumer preferences. Additionally, rising concerns about animal welfare and environmental sustainability are prompting consumers to seek plant-based alternatives to dairy products. This long-term trend towards healthier and more sustainable dietary choices is expected to fuel the demand for dairy alternatives in Latin America in the years to come. An emerging opportunity in the Latin America Dairy Alternatives Market is the expansion of distribution channels to reach a wider consumer base. Traditionally, dairy alternatives were primarily available in health food stores and specialty outlets. However, there is a growing trend towards mainstream adoption of plant-based diets, driven by increasing awareness and accessibility of dairy alternative products.

A notable trend observed in the Latin America Dairy Alternatives Market is the innovation in product formulations to enhance taste, texture, and nutritional profiles. Manufacturers are investing in research and development to create dairy alternative products that closely mimic the taste and functionality of traditional dairy products.

Key Market Insights:

- The Latin America Dairy Alternatives Market is projected to expand at a compound annual growth rate of over 14.5% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

- Hain Celestial Group (United States), Blue Diamond Growers (United States), and Danone S.A. (France) are 3 major key players in the Latin America Dairy Alternatives Market.

- Brazil & Mexico account for approximately 75-85 % of the Latin America Dairy Alternatives Market, driven by Rising Health Consciousness, Growing Vegan Population, Regulatory Support, and Incentives & Expansion of Distribution Channels.

Latin America Dairy Alternatives Market Drivers:

Rising Health Consciousness drives the market demand for the Latin America Dairy Alternatives Market.

A primary driver for the Latin America Dairy Alternatives Market is the increasing health consciousness among consumers. As awareness about the health benefits of plant-based diets grows, more consumers are opting for dairy alternatives over traditional dairy products. Concerns about lactose intolerance, milk allergies, and the perceived health risks associated with dairy consumption are driving this shift in consumer preferences. Additionally, rising concerns about animal welfare and environmental sustainability are prompting consumers to seek plant-based alternatives to dairy products. This long-term trend towards healthier and more sustainable dietary choices is expected to fuel the demand for dairy alternatives in Latin America.

Growing Vegan Population drives the market demand for Latin American dairy Alternatives Market.

The growing vegan population in Latin America is another significant driver for the dairy alternatives market. As more consumers embrace veganism for ethical, environmental, and health reasons, the demand for dairy alternatives is on the rise. Veganism has gained popularity among younger demographics, particularly millennial and Gen Z consumers, who prioritize sustainability and animal welfare in their purchasing decisions. This growing segment of vegan consumers represents a lucrative market opportunity for dairy alternative manufacturers, driving innovation and product development to cater to their unique dietary preferences.

Regulatory Support and Incentives drive the market demand for the Latin America Dairy Alternatives Market.

Regulatory support and incentives from governments and health organizations are also driving the growth of the Latin America Dairy Alternatives Market. Governments in the region are implementing policies to promote healthy eating habits and reduce the consumption of animal-based products. This includes initiatives such as dietary guidelines recommending plant-based diets, nutrition labeling requirements for dairy alternatives, and subsidies for dairy alternative producers. Additionally, health organizations are raising awareness about the health benefits of plant-based diets through educational campaigns and public health initiatives, further driving consumer demand for dairy alternatives.

Expansion of Distribution Channels drives the market demand for Latin America Dairy Alternatives Market.

An emerging driver for the Latin America Dairy Alternatives Market is the expansion of distribution channels to reach a wider consumer base. Traditionally, dairy alternatives were primarily available in health food stores and specialty outlets. However, there is a growing trend towards mainstream adoption of plant-based diets, driven by increasing awareness and accessibility of dairy alternative products. Manufacturers are capitalizing on this opportunity by expanding distribution channels to supermarkets, hypermarkets, convenience stores, and online platforms. By making dairy alternatives more readily available and accessible to consumers across various retail channels, manufacturers can capitalize on the growing demand for plant-based products in Latin America.

Latin America Dairy Alternatives Market Restraints and Challenges:

A key challenge for the Latin America Dairy Alternatives Market is the limited awareness and consumer education regarding the benefits of dairy alternatives. While awareness about plant-based diets and dairy alternatives is growing, many consumers in the region still lack knowledge about the availability, variety, and nutritional value of dairy alternative products. Additionally, misconceptions and myths surrounding plant-based diets may hinder consumer acceptance and adoption. Addressing these challenges requires concerted efforts from industry players, governments, and health organizations to educate consumers about the health, environmental, and ethical advantages of dairy alternatives through targeted marketing campaigns, educational initiatives, and nutritional labeling.

Latin America Dairy Alternatives Market Opportunities:

Latin America is witnessing a shift towards healthier lifestyles, with an increasing number of consumers adopting plant-based diets and seeking dairy alternatives for health and wellness reasons. This trend presents a significant opportunity for dairy alternative manufacturers to capitalize on the growing demand for nutritious and functional plant-based products. By offering dairy alternatives fortified with vitamins, minerals, and other health-enhancing ingredients, manufacturers can cater to the preferences of health-conscious consumers and differentiate their products in the market.

LATIN AMERICA DAIRY ALTERNATIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.5% |

|

Segments Covered |

By Product Type, source, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile and Rest of Latin America |

|

Key Companies Profiled |

Hain Celestial Group (United States), Blue Diamond Growers (United States), Danone S.A. (France), The WhiteWave Foods Company (United States), SunOpta, Inc. (Canada), Califia Farms (United States), Oatly AB (Sweden), Daiya Foods Inc. (Canada), Good Karma Foods (United States), Ripple Foods (United States) |

Latin America Dairy Alternatives Market Segmentation:

Latin America Dairy Alternatives Market Segmentation: By Source:

- Soy Milk

- Almond Milk

- Rice Milk

- Oat Milk

- Coconut Milk

- Others

Soy milk stands out as the largest segment in the Latin America Dairy Alternatives Market. Soy milk has been a traditional dairy alternative in many Latin American countries, valued for its high protein content and nutritional benefits. It is widely consumed by individuals with lactose intolerance or milk allergies and is commonly used as a substitute for cow's milk in various culinary applications. The widespread availability and affordability of soy milk products contribute to its dominance in the Latin American market, making it the preferred choice for many consumers seeking dairy alternatives.

Almond milk emerges as the fastest-growing segment in the Latin America Dairy Alternatives Market. Almond milk has gained popularity in recent years due to its creamy texture, nutty flavor, and perceived health benefits. It is favored by health-conscious consumers looking for dairy alternatives that are low in calories and cholesterol-free. The rising demand for almond milk is driven by increasing awareness of its nutritional value and versatility in culinary applications. Additionally, the growing availability of almond milk products in supermarkets, health food stores, and online retail platforms is contributing to its rapid growth in the Latin American market.

Latin America Dairy Alternatives Market Segmentation: By Product Type:

- Milk Substitutes

- Yogurts

- Cheese Substitutes

- Ice Creams

- Butter Substitutes

- Others

Milk substitutes represent the largest segment in the Latin America Dairy Alternatives Market. Milk substitutes encompass a wide range of products, including soy milk, almond milk, rice milk, oat milk, and coconut milk. These products serve as alternatives to traditional cow's milk and are used for various purposes, such as drinking, cooking, and baking. The popularity of milk substitutes is driven by factors such as lactose intolerance, milk allergies, health consciousness, and environmental sustainability concerns. With a diverse range of options available to consumers, milk substitutes dominate the Latin American market for dairy alternatives.

Yogurts have emerged as the fastest-growing segment in the Latin America Dairy Alternatives Market. Dairy-free yogurts made from plant-based ingredients such as soy, almond, coconut, and oat are gaining traction among health-conscious consumers seeking alternatives to traditional dairy yogurts. These dairy-free yogurts offer similar taste, texture, and nutritional benefits as their dairy counterparts, making them a popular choice for individuals with dietary restrictions or preferences. The growing demand for dairy-free yogurts is driven by factors such as increased awareness of lactose intolerance, veganism, and the desire for healthier snack options, contributing to its rapid growth in the Latin American market.

Latin America Dairy Alternatives Market Segmentation: By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Health Food Stores

- Others

Supermarkets and hypermarkets serve as the largest distribution channel for dairy alternatives in Latin America. These retail outlets offer a wide selection of dairy alternative products, including milk substitutes, yogurts, cheeses, and ice creams, catering to the diverse preferences of consumers. Supermarkets and hypermarkets provide convenient access to dairy alternative products, allowing consumers to browse and compare different brands and variants in one location. The extensive reach and established presence of supermarkets and hypermarkets make them the preferred destination for purchasing dairy alternatives in Latin America.

Online retail emerges as the fastest-growing distribution channel for dairy alternatives in Latin America. The growing popularity of e-commerce platforms and the increasing prevalence of online shopping have contributed to the rapid growth of online retail channels for dairy alternative products. Consumers appreciate the convenience and accessibility of online shopping, allowing them to browse, purchase, and receive dairy alternative products from the comfort of their homes. Additionally, online retail offers a wider selection of products, competitive pricing, and the convenience of doorstep delivery, driving its rapid growth in the Latin American market for dairy alternatives.

Latin America Dairy Alternatives Market Segmentation: Regional Analysis:

- Brazil

- Mexico

- Columbia

- Chile

- Argentina

- Others

In the Latin America Dairy Alternatives Market, Brazil stands out as the largest region in terms of both consumption and production. Brazil's dominance in the market can be attributed to its large population, growing health consciousness, and diverse consumer preferences. The country boasts a robust agricultural sector capable of producing a wide variety of dairy alternative ingredients, such as soybeans, almonds, and coconuts. Additionally, Brazil's well-developed food and beverage industry and extensive distribution networks make it a prime market for dairy alternative products. With increasing awareness about the health and environmental benefits of plant-based diets, Brazilian consumers are increasingly turning to dairy alternatives as substitutes for traditional dairy products, driving the growth of the market in the region.

On the other hand, Mexico emerges as the fastest-growing region in the Latin America Dairy Alternatives Market. Mexico's rapid economic growth, urbanization, and changing consumer lifestyles are driving the demand for convenient and healthy food options, including dairy alternatives. The country's large population, coupled with a growing middle class and rising disposable incomes, provides a fertile ground for the expansion of the dairy alternatives market. Moreover, Mexico's rich culinary heritage and diverse gastronomic culture create opportunities for innovation and product differentiation in the dairy alternatives segment. As manufacturers introduce new and innovative dairy alternative products tailored to Mexican tastes and preferences, the market is expected to experience significant growth in the coming years. Overall, both Brazil and Mexico play pivotal roles in shaping the growth and development of the Latin America Dairy Alternatives Market, with Brazil leading as the largest market and Mexico driving as the fastest-growing region.

COVID-19 Impact Analysis on Latin America Dairy Alternatives Market:

One of the immediate impacts of the COVID-19 pandemic on the Latin America Dairy Alternatives Market was the disruption in supply chains and manufacturing operations. Lockdown measures, travel restrictions, and border closures implemented to contain the spread of the virus led to disruptions in the transportation of raw materials and finished products, affecting the availability and distribution of dairy alternative products in the region. Additionally, operational challenges such as workforce shortages, production slowdowns, and sanitation requirements further strained manufacturing operations, impacting the supply of dairy alternatives to the market.

Latest Trends/ Developments:

There is a growing demand for plant-based milk alternatives in Latin America, driven by increasing awareness of lactose intolerance, milk allergies, and health concerns associated with dairy consumption. Consumers are turning to plant-based milk options such as almond milk, soy milk, and oat milk as healthier and more sustainable alternatives to traditional dairy milk.

Dairy alternative manufacturers in Latin America are expanding their product portfolios to offer a wider variety of options to consumers. Beyond traditional plant-based milk alternatives, companies are introducing innovative products such as plant-based yogurts, cheeses, ice creams, and desserts to cater to diverse dietary preferences and lifestyle choices.

Key Players:

- Hain Celestial Group (United States)

- Blue Diamond Growers (United States)

- Danone S.A. (France)

- The WhiteWave Foods Company (United States)

- SunOpta, Inc. (Canada)

- Califia Farms (United States)

- Oatly AB (Sweden)

- Daiya Foods Inc. (Canada)

- Good Karma Foods (United States)

- Ripple Foods (United States)

Chapter 1. Latin America Dairy Alternatives Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Dairy Alternatives Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Dairy Alternatives Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Dairy Alternatives Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Dairy Alternatives Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Dairy Alternatives Market– By Product Type

6.1. Introduction/Key Findings

6.2. Milk Substitutes

6.3. Yogurts

6.4. Cheese Substitutes

6.5. Ice Creams

6.6. Butter Substitutes

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Product Type

6.9. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Latin America Dairy Alternatives Market– By Source

7.1. Introduction/Key Findings

7.2 Soy Milk

7.3. Almond Milk

7.4. Rice Milk

7.5. Oat Milk

7.6. Coconut Milk

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Source

7.9. Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 8. Latin America Dairy Alternatives Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3. Convenience Stores

8.4. Online Retail

8.5. Health Food Stores

8.6. Other Channels

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.8. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Latin America Dairy Alternatives Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Latin America

9.1.1. By Country

9.1.1.1. Mexico

9.1.1.2. Brazil

9.1.1.3. Argentina

9.1.1.4. Chile

9.1.1.5. Rest of Latin America

9.1.2. By Product Type

9.1.3. By Distribution Channel

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Latin America Dairy Alternatives Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Hain Celestial Group (United States)

10.2. Blue Diamond Growers (United States)

10.3. Danone S.A. (France)

10.4. The WhiteWave Foods Company (United States)

10.5. SunOpta, Inc. (Canada)

10.6. Califia Farms (United States)

10.7. Oatly AB (Sweden)

10.8. Daiya Foods Inc. (Canada)

10.9. Good Karma Foods (United States)

10.10. Ripple Foods (United States)

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Latin America Dairy Alternatives Market is valued at USD 51.9 Billion and is projected to reach a market size of USD 133.7 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.5%.

Rising Health Consciousness, Growing Vegan Population, Regulatory Support, and Incentives & Expansion of Distribution are the major market drivers of the Latin America Dairy Alternatives Market

Milk Substitutes, Yogurts, Cheese Substitutes, Ice Creams, Butter Substitutes & Others are the segments under the Latin American dairy Alternatives Market by product type.

Brazil is the most dominant region for the Latin America Dairy Alternatives Market.

Mexico is the fastest-growing region in the Latin America Dairy Alternatives Market.