Dairy Alternatives Market Size (2024 – 2030)

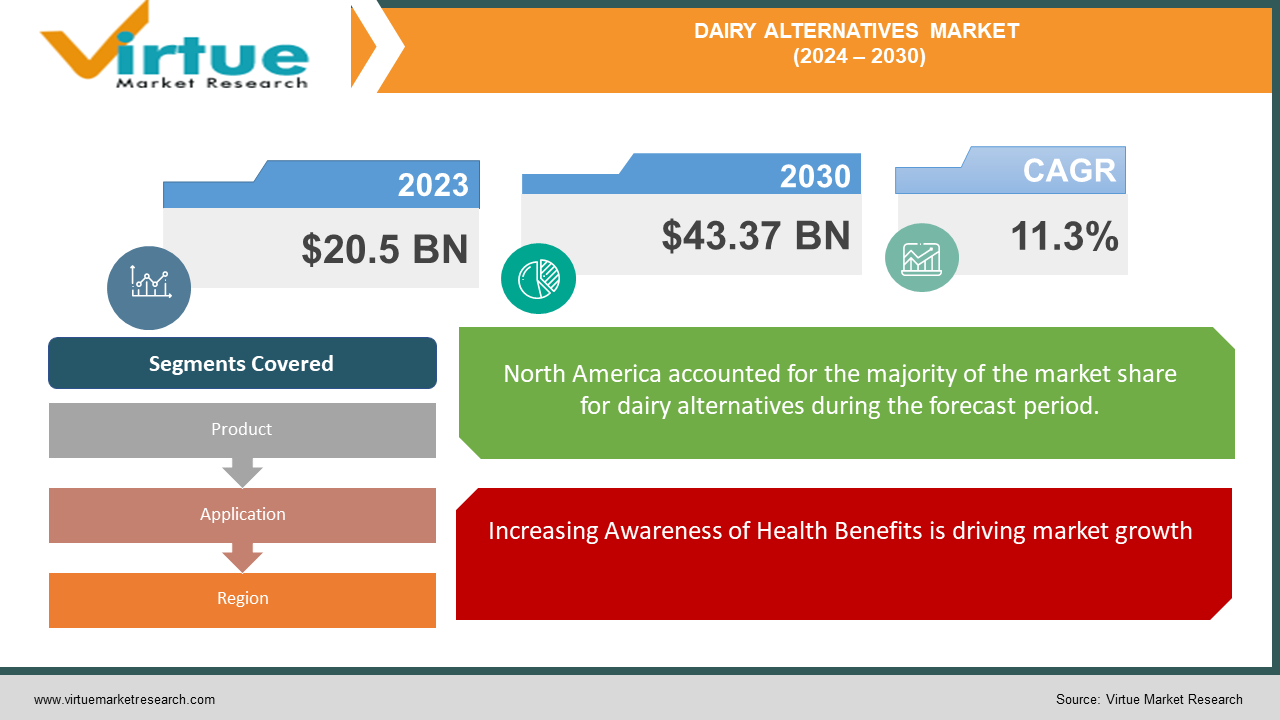

The Global Dairy Alternatives Market was valued at USD 20.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.3% from 2024 to 2030, reaching USD 43.37 billion by 2030.

Dairy alternatives, also known as non-dairy milk, are plant-based substitutes for traditional dairy products, primarily milk. These alternatives are derived from sources such as soy, almond, coconut, oat, rice, and hemp. The increasing prevalence of lactose intolerance, the rising vegan population, and the growing health consciousness among consumers are major factors driving the growth of the dairy alternatives market.

Key Market Insights

An estimated 65% of the global population has some degree of lactose intolerance. This high prevalence is pushing consumers towards dairy alternatives that do not cause digestive discomfort, boosting market growth.

Dairy alternatives are perceived to offer numerous health benefits, including lower calorie content, reduced cholesterol levels, and no saturated fats. These benefits are attracting health-conscious consumers, especially those looking to manage weight and heart health.

The environmental impact of dairy farming, including high water usage and greenhouse gas emissions, is leading consumers to opt for more sustainable plant-based alternatives. This shift is driving market expansion as consumers become more eco-conscious.

Global Dairy Alternatives Market Drivers

Increasing Awareness of Health Benefits is driving market growth:

The growing awareness about the health benefits associated with dairy alternatives is a major driver of market growth. Consumers are becoming more informed about the adverse effects of lactose and cholesterol found in traditional dairy products. Dairy alternatives, such as almond milk, soy milk, and oat milk, offer lower calories, reduced cholesterol levels, and no saturated fats, making them a healthier choice. Furthermore, these alternatives are rich in vitamins and minerals, such as calcium, vitamin D, and vitamin B12, which are essential for maintaining overall health. This increasing awareness is prompting consumers to shift towards dairy alternatives, thereby driving market growth.

Rise in Vegan and Plant-Based Diets is driving market growth:

The rise in veganism and the adoption of plant-based diets are significantly contributing to the growth of the dairy alternatives market. Many consumers are transitioning to vegan or plant-based diets due to ethical concerns, environmental sustainability, and health reasons. As a result, the demand for plant-based milk and other dairy alternatives is increasing. According to the Vegan Society, the number of vegans in the UK alone quadrupled between 2014 and 2019. This trend is not limited to developed countries; it is also gaining traction in emerging markets. The growing acceptance and popularity of vegan and plant-based diets are driving the demand for dairy alternatives globally.

Technological Advancements and Product Innovation are driving market growth: Technological advancements and continuous product innovation are playing a crucial role in the growth of the dairy alternatives market. Manufacturers are investing in research and development to improve the taste, texture, and nutritional profile of dairy alternatives. Innovations such as the development of high-protein plant-based milk, fortified with vitamins and minerals, are gaining popularity among consumers. Additionally, the introduction of new flavors and blends, such as chocolate almond milk and vanilla soy milk, is attracting a broader consumer base. These advancements are making dairy alternatives more appealing and accessible, thereby driving market growth.

Global Dairy Alternatives Market Challenges and Restraints

High Cost of Dairy Alternatives is restricting market growth:

One of the significant challenges faced by the dairy alternatives market is the relatively high cost of these products compared to traditional dairy products. The production process of plant-based milk and other dairy alternatives is often more complex and expensive. For instance, the extraction of milk from almonds or soybeans involves additional processing steps, which increase the overall production cost. This higher cost is passed on to consumers, making dairy alternatives more expensive. The price difference can be a deterrent for price-sensitive consumers, particularly in emerging markets, thereby restraining market growth.

Taste and Texture Preferences is restricting market growth:

While there have been significant advancements in the taste and texture of dairy alternatives, some consumers still prefer the taste and mouthfeel of traditional dairy products. The flavor and texture of plant-based milk can vary significantly from cow's milk, which can be a barrier to adoption for some consumers. Additionally, certain dairy alternatives may not perform as well in specific culinary applications, such as baking or cooking, where the properties of cow's milk are preferred. These taste and texture preferences pose a challenge to the widespread adoption of dairy alternatives, limiting market growth.

Market Opportunities

The dairy alternatives market presents numerous opportunities for growth and expansion. One significant opportunity lies in the development of new and innovative products to cater to the diverse preferences of consumers. Manufacturers can explore unique plant-based sources such as hemp, quinoa, and flaxseed to create new dairy alternatives. Additionally, there is potential for growth in the fortified dairy alternatives segment, where products are enriched with vitamins, minerals, and probiotics to offer additional health benefits. Expanding distribution channels, particularly in emerging markets, is another opportunity. As awareness and demand for dairy alternatives grow in regions such as Asia-Pacific and Latin America, companies can tap into these markets through strategic partnerships and increased retail presence. Furthermore, the rising trend of personalized nutrition offers an opportunity for manufacturers to develop customized dairy alternative products tailored to individual dietary needs and preferences. By capitalizing on these opportunities, companies can enhance their market position and drive further growth in the dairy alternatives market.

DAIRY ALTERNATIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.3% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Danone, Blue Diamond Growers, SunOpta Inc., Vitasoy International Holdings Ltd., The Hain Celestial Group, Inc., Califia Farms, Ripple Foods, Daiya Foods Inc., Eden Foods, Inc., Valsoia S.p.A. |

Dairy Alternatives Market Segmentation - By Product

-

Soy Milk

-

Almond Milk

-

Coconut Milk

-

Oat Milk

-

Rice Milk

Soy Milk is the dominant segment in the dairy alternatives market. Its high protein content, versatility in culinary applications, and widespread availability contribute to its dominance. Soy milk's ability to closely mimic the texture and taste of cow's milk makes it a preferred choice among consumers seeking a nutritious and functional dairy alternative.

Dairy Alternatives Market Segmentation - By Application

-

Food & Beverages

-

Nutritional Products

-

Infant Formula

-

Personal Care

The Food & Beverages segment is the most dominant in the dairy alternatives market. The increasing consumer demand for plant-based options in everyday food and beverages, coupled with the growing trend of veganism and health consciousness, drives the dominance of this segment. Dairy alternatives in food and beverages offer versatile applications and are widely accepted by consumers across various demographics.

Dairy Alternatives Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the Dairy Alternatives Market, accounting for the largest share in 2023. The region's dominance can be attributed to the high prevalence of lactose intolerance, a growing vegan population, and increased consumer awareness about health and wellness. The U.S., in particular, leads the market with significant demand for plant-based milk and other dairy alternatives. Furthermore, strong retail infrastructure and the presence of major market players enhance product availability, contributing to North America's leading position. The market in North America is expected to continue its growth trajectory, driven by ongoing product innovation and rising consumer preference for sustainable and healthy food options.

COVID-19 Impact Analysis on the Dairy Alternatives Market

The COVID-19 pandemic has had a mixed impact on the Dairy Alternatives Market. Initially, the market faced disruptions in the supply chain due to lockdowns and restrictions, leading to temporary shortages of raw materials and finished products. However, as consumers became more health-conscious during the pandemic, the demand for dairy alternatives saw a significant boost. People started seeking nutritious and immune-boosting foods, which led to an increase in the consumption of plant-based milk and other dairy-free products. Additionally, the shift towards home cooking and baking during lockdowns further drove the demand for dairy alternatives. Online sales channels witnessed a surge, compensating for the reduced footfall in physical stores. Overall, the pandemic accelerated the trend towards healthier and sustainable food choices, benefiting the dairy alternatives market.

Latest Trends/Developments

The Dairy Alternatives Market is experiencing several key trends and developments that are shaping its growth trajectory. One prominent trend is the increasing innovation in product formulations, with manufacturers introducing new flavors, fortified products, and blends to cater to diverse consumer preferences. There is also a growing emphasis on clean-label products, with consumers demanding transparency in ingredient sourcing and processing methods. Additionally, the market is witnessing a rise in the use of novel plant-based sources such as peas, hemp, and quinoa for producing dairy alternatives, offering unique nutritional benefits. Another significant development is the expansion of distribution channels, with an increasing presence of dairy alternatives in mainstream retail outlets, specialty stores, and e-commerce platforms. Sustainable packaging solutions are also gaining traction, as companies strive to reduce their environmental footprint. These trends reflect the evolving consumer preferences and the dynamic nature of the dairy alternatives market.

Key Players

-

Danone

-

Blue Diamond Growers

-

SunOpta Inc.

-

Vitasoy International Holdings Ltd.

-

The Hain Celestial Group, Inc.

-

Califia Farms

-

Ripple Foods

-

Daiya Foods Inc.

-

Eden Foods, Inc.

-

Valsoia S.p.A.

Chapter 1. Dairy Alternatives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Dairy Alternatives Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Dairy Alternatives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Dairy Alternatives Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Dairy Alternatives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Dairy Alternatives Market – By Product

6.1 Introduction/Key Findings

6.2 Soy Milk

6.3 Almond Milk

6.4 Coconut Milk

6.5 Oat Milk

6.6 Rice Milk

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Dairy Alternatives Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Nutritional Products

7.4 Infant Formula

7.5 Personal Care

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Dairy Alternatives Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Dairy Alternatives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Danone

9.2 Blue Diamond Growers

9.3 SunOpta Inc.

9.4 Vitasoy International Holdings Ltd.

9.5 The Hain Celestial Group, Inc.

9.6 Califia Farms

9.7 Ripple Foods

9.8 Daiya Foods Inc.

9.9 Eden Foods, Inc.

9.10 Valsoia S.p.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Dairy Alternatives Market was valued at USD 20.5 billion in 2023 and is projected to reach USD 43.37 billion by 2030, growing at a CAGR of 11.3% from 2024 to 2030.

Key drivers include increasing health awareness, a rise in vegan and plant-based diets, and technological advancements leading to innovative product formulations.

The market is segmented by product type (soy milk, almond milk, coconut milk, oat milk, rice milk, and others) and by application (food & beverages, nutritional products, infant formula, and personal care).

North America is the most dominant region, driven by a high prevalence of lactose intolerance, a growing vegan population, and a strong retail infrastructure.

Leading players include Danone, Blue Diamond Growers, SunOpta Inc., Vitasoy International Holdings Ltd., The Hain Celestial Group, Inc., Califia Farms, Ripple Foods, Daiya Foods Inc., Eden Foods, Inc., and Valsoia S.p.A.