Asia Pacific Dairy Alternatives Market Size (2024-2030)

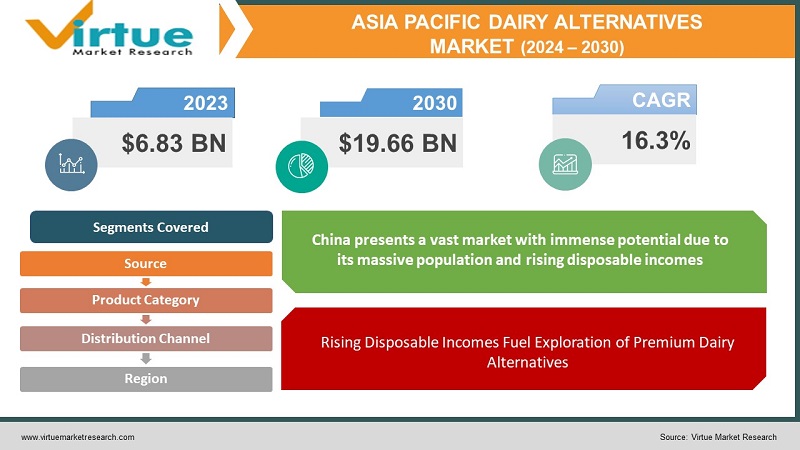

The Asia Pacific Dairy Alternatives Market was valued at USD 6.83 billion in 2023 and is projected to reach a market size of USD 19.66 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 16.3%.

The Asia Pacific dairy alternatives market is flourishing, fueled by a rise in veganism, lactose intolerance, and a general focus on health and wellness. Consumers are increasingly seeking plant-based alternatives to traditional dairy products, perceiving them as healthier due to lower fat and cholesterol content. Manufacturers are responding with a constant stream of innovative products, offering a wider variety of plant-based milks like soy, almond, oat, and coconut, that better replicate the taste and texture of dairy.

Key Market Insights:

The Asia Pacific dairy alternatives market growth presents exciting opportunities, but also some challenges. Understanding regional taste preferences is crucial. Local ingredients like coconut milk or brown rice milk can be key differentiators for brands. For instance, with nearly 70-100% of the population in some East Asian countries having lactose intolerance, incorporating lactose-free options tailored to these regions can be highly successful. Sustainability is another important factor. Consumers are increasingly environmentally conscious, and the lower environmental impact of plant-based alternatives compared to traditional dairy production is a significant advantage.

The distribution landscape is also evolving. While supermarkets remain the dominant channel, online grocery shopping and specialty stores are experiencing rapid growth, offering wider product selections and increased convenience. This shift towards online grocery shopping is particularly prominent in countries like South Korea, where a high percentage of the population utilizes e-commerce platforms for food and beverage purchases.

The Asia Pacific Dairy Alternatives Market Drivers:

Health-Conscious Consumers Drive Demand for Plant-Based Alternatives

At the heart of this market surge lies a significant shift in consumer preferences. This can be attributed to two major trends. Firstly, there's a growing vegan population across the Asia Pacific region. Additionally, a high prevalence of lactose intolerance, particularly in East Asian countries (where lactose intolerance affects up to 70-100% of the population in some areas), is creating a significant demand for dairy-free alternatives. Consumers are actively seeking plant-based options that align with their dietary restrictions and ethical stances on animal products.

A Wave of Innovation Creates Exciting New Plant-Based Options

Manufacturers in this dynamic market are constantly innovating and developing new products to meet the diverse needs and preferences of consumers. This focus on innovation manifests in two key areas. Firstly, the market is expanding beyond the traditional soy and almond milk options. Oat milk, pea protein milk, and unique blends are finding their way onto store shelves, catering to a wider range of taste buds and dietary requirements. This variety allows consumers to find plant-based milk options that suit their specific preferences and needs.

Rising Disposable Incomes Fuel Exploration of Premium Dairy Alternatives

As disposable incomes rise across the Asia Pacific region, consumers are more willing to spend on premium food and beverage options, including dairy alternatives. This increased spending power allows consumers to explore and experiment with a wider variety of plant-based products, further fueling the growth of the market.

Environmental Concerns Push Consumers Towards Sustainable Plant-Based Choices

The rise in environmental consciousness is leading consumers to favor plant-based alternatives due to their lower environmental impact compared to traditional dairy production. Consumers are increasingly aware of the environmental footprint of animal agriculture, and plant-based alternatives offer a more sustainable option that aligns with their environmental values. This growing focus on sustainability is another factor driving the growth of the Asia Pacific dairy alternatives market.

The Asia Pacific Dairy Alternatives Market Restraints and Challenges:

While the Asia Pacific dairy alternatives market is flourishing, there are hurdles to overcome. Price remains a key challenge, especially in developing economies where consumers are highly price-sensitive. Plant-based alternatives are often viewed as premium products, and manufacturers need to find ways to make them more affordable for a wider audience. Another hurdle lies in taste and texture. While innovation is bringing exciting new options, some consumers still find plant-based alternatives lacking compared to traditional dairy. Continued innovation to create plant-based products that truly replicate the sensory experience of dairy is crucial. Brand awareness is another obstacle. Compared to established dairy brands, plant-based alternatives often have lower recognition. Building brand awareness will be essential to drive market growth and encourage consumers to discover and trust these new products. The regulatory landscape also presents challenges. Regulations around labeling and health claims for plant-based alternatives can vary significantly across countries in the region. This creates difficulties for manufacturers who want to expand their product offerings throughout Asia Pacific. Finally, competition from the traditional dairy industry cannot be ignored. The established players are actively investing in research and development to improve the sustainability of their products and address consumer concerns. This competition will put pressure on plant-based alternatives to maintain their competitive edge and continue innovating to meet the evolving needs and preferences of consumers.

The Asia Pacific Dairy Alternatives Market Opportunities:

The booming Asia Pacific dairy alternatives market offers a wealth of opportunities for companies positioned to capitalize on the region's surging demand for plant-based products. One key area lies in product diversification. By going beyond just milk and catering to regional tastes and dietary needs, manufacturers can develop innovative alternatives. Imagine coconut milk yogurt for Southeast Asia, brown rice milk ice cream catering to China, or even vegan cheese spreads tailored to local palates. Localization and sustainability are also key. Highlighting the local sourcing of ingredients and the lower environmental impact of plant-based production compared to traditional dairy can resonate with environmentally conscious consumers. Partnering with local farmers for ingredients strengthens sustainability efforts and builds brand reputation. Distribution channels also present exciting opportunities. The rise of online grocery shopping and specialty stores allows for wider product distribution and brand visibility. Partnering with these platforms can provide greater access to consumers, especially in urban areas. Additionally, offering value-added products caters to budget-conscious consumers. This could include larger pack sizes, multi-packs, or fortified plant-based milks with added vitamins and minerals. Finally, strategic collaborations with established food and beverage companies can leverage existing distribution networks and brand recognition to reach a wider audience. Partnering with cafes and restaurants that offer plant-based menu options can further increase brand exposure and product adoption. By capitalizing on these opportunities, businesses can carve a successful niche in the dynamic Asia Pacific dairy alternatives market.

ASIA-PACIFIC DAIRY ALTERNATIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

16.3% |

||

|

Segments Covered |

By Product Category, source, Distribution Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Danone S.A., Nestlé S.A., Vitasoy International Holdings Ltd., Coconut Palm Group Co. Ltd., The Hain Celestial Group Inc., Freedom Foods Group Limited, Blue Diamond Growers, Oatly |

Asia Pacific Dairy Alternatives Market Segmentation:

Asia Pacific Dairy Alternatives Market Segmentation: By Source:

- Soy-based

- Nut-based.

- Oat-based

- Other Plant Sources

The dominant segment in the Asia Pacific Dairy Alternatives Market by Source is still soy-based, particularly popular due to its established presence and affordability. However, the fastest-growing segment is oat-based. This segment is experiencing a surge due to its creamy texture, neutral flavor profile, and ability to cater to those with nut allergies.

Asia Pacific Dairy Alternatives Market Segmentation: By Product Category:

- Plant-Based Milk

- Plant-Based Yogurt

- Plant-Based Ice Cream

- Plant-Based Cheese

- Other Plant-Based Dairy Alternatives

Plant-based milk remains the dominant segment within the Asia Pacific dairy alternatives market due to its established presence and wide variety of options. However, the fastest-growing segment is plant-based yogurt, experiencing a surge in popularity as consumers seek delicious and dairy-free yogurt alternatives. This trend is fuelled by a growing health-conscious population and innovation in flavor profiles and textures.

Asia Pacific Dairy Alternatives Market Segmentation: By Distribution Channel:

- Off-Trade

- On-Trade

- Online Grocery Shopping

- Specialty Stores

The Asia Pacific dairy alternatives market can be segmented in several ways. By distribution channels, supermarkets, hypermarkets, and convenience stores (off-trade) remain the dominant force. However, online grocery shopping is experiencing the fastest growth, offering wider product selections and convenience, especially in regions with high e-commerce adoption like South Korea.

Asia Pacific Dairy Alternatives Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

China presents a vast market with immense potential due to its massive population and rising disposable incomes. However, price sensitivity remains a key hurdle. Soy milk is the traditional leader, a familiar and affordable option for many consumers. However, oat milk and other plant-based alternatives are gaining traction, particularly in urban areas with a growing health-conscious population. Manufacturers looking to tap into the Chinese market need to strike a balance between affordability and innovation.

Japan boasts a mature market for dairy alternatives, particularly soy milk, fueled by a long-standing focus on health and well-being. Consumers here are receptive to new products, and innovation in fermentation techniques is leading to unique flavor profiles like matcha lattes. This market rewards established brands with a reputation for quality and a commitment to exciting new offerings.

South Korea stands out as a leader in online grocery shopping, making it a prime market for convenient access to a wide variety of plant-based products. Almond milk is a popular choice alongside local favorites like brown rice milk. This tech-savvy region offers exciting opportunities for brands that can leverage online platforms and cater to the growing demand for convenient plant-based options.

India presents a unique case with a large lactose-intolerant population and diverse dietary restrictions. The market is poised for significant growth, with a focus on affordable plant-based alternatives like fortified milk to cater to budget-conscious consumers. Understanding the specific dietary needs and cultural preferences of this region will be crucial for success.

Australia & New Zealand are developed economies that boast high disposable incomes and a strong focus on sustainability. Oat milk and other alternative milk are popular choices, and plant-based yogurt and ice cream are gaining momentum. Sustainability-conscious consumers here respond well to brands that prioritize eco-friendly practices throughout the production chain.

COVID-19 Impact Analysis on the Asia Pacific Dairy Alternatives Market:

The COVID-19 pandemic's impact on the Asia Pacific dairy alternatives market has been a double-edged sword. Lockdowns and movement restrictions disrupted supply chains, leading to temporary shortages of ingredients and finished products. Additionally, some consumers shifted their priorities towards essential items, potentially impacting sales of premium plant-based alternatives. The closure of restaurants and cafes that offered plant-based options further dampened demand.

However, the pandemic also presented unexpected opportunities. Heightened awareness of health issues during the pandemic may have led some consumers to adopt plant-based alternatives perceived as healthier options. The surge in online grocery shopping due to lockdowns and social distancing benefitted the distribution of these products, readily available through e-commerce platforms. Furthermore, increased home cooking could have driven demand for plant-based cooking ingredients like milk for various recipes.

Overall, while the pandemic brought initial challenges, the long-term trends driving the market, like health consciousness and sustainability concerns, are likely to remain strong post-pandemic. The rise of e-commerce and the potential shift towards more home cooking could further benefit the market in the long run. As the full impact of COVID-19 continues to unfold, businesses that adapt to the changing consumer landscape and capitalize on e-commerce and home cooking trends can navigate these challenges and thrive in the post-pandemic era.

Latest Trends/ Developments:

The Asia Pacific dairy alternatives market is buzzing with exciting new developments. Manufacturers are focusing on local ingredients like coconut milk and brown rice milk to cater to regional preferences and reduce their environmental impact. This resonates with eco-conscious consumers who appreciate sustainable practices throughout the production chain.

Innovation is particularly hot in the plant-based cheese segment, with manufacturers working tirelessly to replicate the taste, texture, and reliability of traditional cheese. This caters to a growing demand for dairy-free cheese options for various dishes and snacks. The market is also expanding beyond just milk alternatives, with a surge in plant-based yogurt, ice cream, and even cheese spreads. These offerings combine the benefits of a plant-based diet with digestive health support. Additionally, strategic partnerships and acquisitions are occurring as established food and beverage companies collaborate with or acquire plant-based startups. This leverages existing distribution networks and brand recognition for plant-based alternatives.

Looking ahead, research and development are exploring alternative protein sources beyond soy, such as pea protein, mung bean, and chickpeas. This caters to consumers with soy allergies or those seeking a wider variety of plant-based protein options.

Key Players:

- Danone S.A.

- Nestlé S.A.

- Vitasoy International Holdings Ltd.

- Coconut Palm Group Co. Ltd.

- The Hain Celestial Group Inc.

- Freedom Foods Group Limited

- Blue Diamond Growers

- Oatly

Chapter 1. Asia Pacific Dairy Alternatives Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Dairy Alternatives Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Dairy Alternatives Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Dairy Alternatives Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Dairy Alternatives Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Dairy Alternatives Market– By Source

6.1. Introduction/Key Findings

6.2. Soy-based

6.3. Nut-based.

6.4. Oat-based

6.5. Other Plant Sources

6.6. Y-O-Y Growth trend Analysis By Source

6.7. Absolute $ Opportunity Analysis By Source , 2023-2030

Chapter 7. Asia Pacific Dairy Alternatives Market– By Product Category

7.1. Introduction/Key Findings

7.2. Plant-Based Milk

7.3. Plant-Based Yogurt

7.4. Plant-Based Ice Cream

7.5. Plant-Based Cheese

7.6. Other Plant-Based Dairy Alternatives

7.7. Y-O-Y Growth trend Analysis By Product Category

7.8. Absolute $ Opportunity Analysis By Product Category , 2023-2030

Chapter 8. Asia Pacific Dairy Alternatives Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2 Off-Trade

8.3. On-Trade

8.4. Online Grocery Shopping

8.5. Specialty Stores

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Dairy Alternatives Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Source

9.1.3. By Product Category

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Dairy Alternatives Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Danone S.A.

10.2. Nestlé S.A.

10.3. Vitasoy International Holdings Ltd.

10.4. Coconut Palm Group Co. Ltd.

10.5. The Hain Celestial Group Inc.

10.6. Freedom Foods Group Limited

10.7. Blue Diamond Growers

10.8. Oatly

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia Pacific Dairy Alternatives Market was valued at USD 6.83 billion in 2023 and is projected to reach a market size of USD 19.66 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 16.3%.

Soy-based, Nut-based, Oat-based, Other Plant Sources

Compost, Manure, Biofertilizers, Plant and Animal Residues

China and Japan lead the Asia Pacific Dairy Alternatives Market due to their large market size, established plant-based consumption, and diverse consumer base.

Danone S.A., Nestlé S.A., Vitasoy International Holdings Ltd., Coconut Palm Group Co. Ltd., The Hain Celestial Group Inc., Freedom Foods Group Limited, Blue Diamond Growers, Oatly.