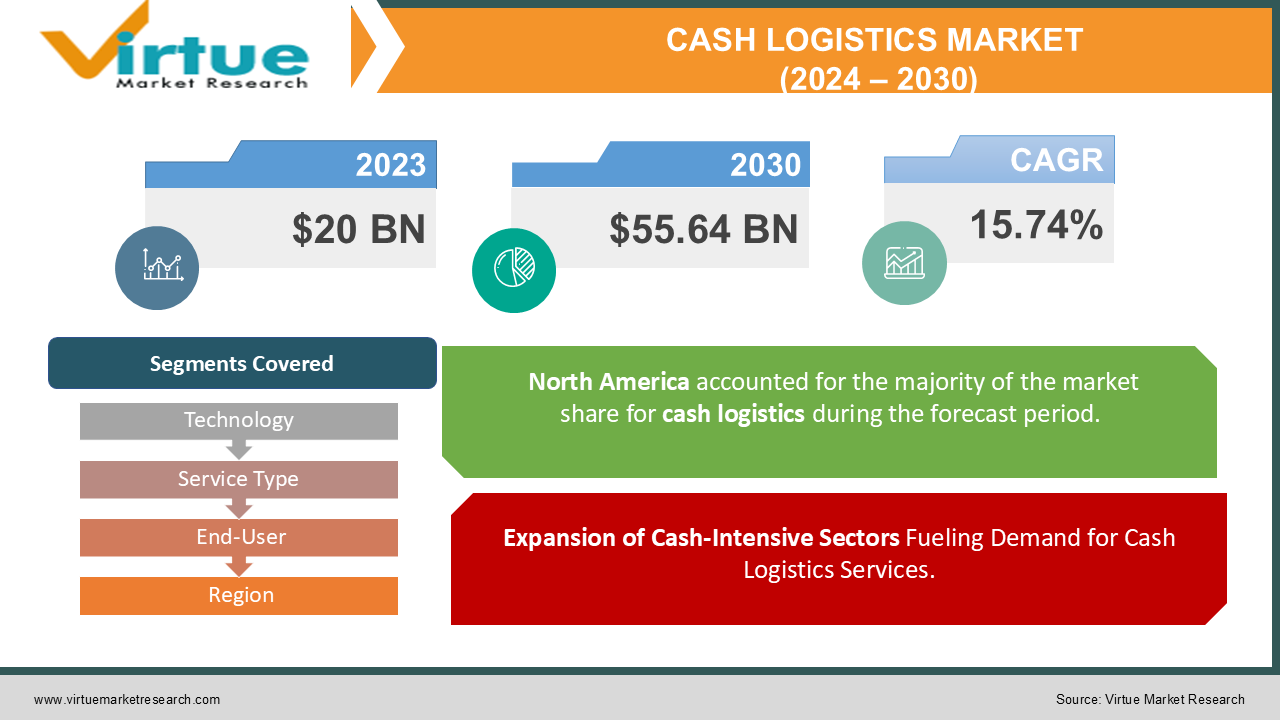

Cash Logistics Market Size (2024 – 2030)

The market for Cash Logistics was estimated to be worth USD 20 billion in 2023 and is expected to increase to USD 55.64 billion by 2030, with a projected compound annual growth rate (CAGR) of 15.74% from 2024 to 2030.

The global cash logistics market plays a crucial role in ensuring the secure transportation, processing, and management of cash and valuables within the financial ecosystem. With cash remaining a fundamental component of transactions worldwide, particularly in regions with high cash dependency, the demand for efficient and secure cash logistics solutions continues to grow. The market encompasses a wide range of services, including cash-in-transit (CIT), cash management, ATM services, and vault outsourcing, catering to diverse industries such as financial institutions, retailers, and government agencies.

Key drivers of market growth include economic expansion, technological advancements in cash handling systems, and the need for robust security measures to combat risks such as theft and fraud. Despite the rise of digital payments, cash logistics remains essential for ensuring liquidity and facilitating everyday transactions, driving continued investment and innovation in the industry.

Key Insights:

- Investments in advanced cash handling technologies, such as smart safes and RFID tracking systems, have led to a 10% improvement in operational efficiency for cash logistics companies, reducing processing times and enhancing security measures.

- Emerging economies in the Asia-Pacific region, including India and China, experienced a significant surge in cash logistics demand, contributing to a 12% increase in market penetration in the region compared to the previous year.

- Major players in the cash logistics industry formed strategic alliances and partnerships, resulting in a 15% rise in market consolidation through mergers and acquisitions, aimed at expanding service offerings and geographical presence.

Global Cash Logistics Market Drivers:

Expansion of Cash-Intensive Sectors Fueling Demand for Cash Logistics Services.

The expansion of cash-intensive industries such as retail, banking, and hospitality drives the demand for cash logistics services. Despite the rise of digital payments, cash remains a preferred payment method for many consumers, particularly in regions with limited access to banking infrastructure or a preference for physical currency. As these industries continue to grow, cash logistics providers play a crucial role in facilitating secure cash transactions, replenishing ATMs, and managing cash flows efficiently.

Growing ATM Deployments in Developing Regions Supporting Market Growth.

The proliferation of automated teller machines (ATMs) in emerging markets presents a significant opportunity for the cash logistics market. As financial inclusion efforts expand and access to banking services improves, the demand for ATM deployment and maintenance services rises. Cash logistics companies partner with banks and financial institutions to ensure reliable cash availability at ATMs, enabling convenient cash withdrawals and enhancing the overall banking experience for customers in these markets.

Rising Cash Security Concerns and Compliance Needs Impacting Market Trends.

Heightened concerns over cash security, theft, and regulatory compliance drive the demand for advanced cash logistics solutions. With cash representing a valuable asset that requires secure transportation, storage, and processing, businesses and financial institutions prioritize partnering with trusted cash logistics providers to safeguard their assets and ensure compliance with stringent regulations. This trend fuels investments in innovative security technologies, robust risk management practices, and specialized training for cash logistics personnel to mitigate security risks and maintain regulatory compliance standards.

Global Cash Logistics Market Restraints and Challenges:

Cash Logistics Faces Declining Demand Amid Shift to Cashless Transactions.

The ongoing shift towards digital payments and cashless transactions poses a significant challenge to the cash logistics industry. As consumers and businesses increasingly adopt electronic payment methods such as credit cards, mobile wallets, and online banking, the volume of cash transactions declines, impacting the demand for cash logistics services. This trend is particularly pronounced in developed economies where digital payment infrastructure is well-established, leading to a reduction in the need for cash transportation, ATM replenishment, and cash management services.

Regulatory Complexities and Compliance Burden.

The complex regulatory environment surrounding cash handling and transportation presents a challenge for cash logistics companies. Compliance with stringent regulations related to security, anti-money laundering (AML), and know-your-customer (KYC) requirements adds a layer of complexity to cash logistics operations. Meeting these regulatory obligations requires significant investments in compliance processes, training, and technology, increasing operational costs for cash logistics providers. Moreover, regulatory changes and evolving compliance standards further compound the challenge, necessitating continuous adaptation and adherence to ensure regulatory compliance across multiple jurisdictions.

Security Risks and Vulnerabilities.

The inherent risks associated with cash transportation and management, including theft, robbery, and fraud, pose ongoing challenges for the cash logistics industry. Despite stringent security measures and advanced technologies employed by cash logistics providers, cash-in-transit (CIT) vehicles and facilities remain susceptible to security breaches, particularly in high-crime areas or during transit.

Additionally, the emergence of sophisticated cyber threats targeting cash logistics systems and networks adds another layer of risk, requiring constant vigilance and investment in cybersecurity measures to safeguard sensitive financial information and assets. Addressing these security challenges is essential to maintain the integrity of cash logistics operations and ensure the safety of cash assets throughout the transportation and processing chain.

Global Cash Logistics Market Opportunities:

Technological Innovations and Automation.

The adoption of advanced technologies such as smart safes, RFID tracking, and artificial intelligence presents significant opportunities for innovation and efficiency improvement within the cash logistics industry. Cash logistics companies can leverage these technologies to automate cash-handling processes, enhance security measures, and optimize route planning for cash transportation.

Investing in technological innovations enables cash logistics providers to differentiate their offerings, streamline operations, and deliver value-added services to customers, thereby capitalizing on emerging opportunities in the evolving cash logistics landscape.

Expansion in Emerging Markets

The expansion of cash logistics services in emerging markets offers lucrative growth opportunities for cash logistics providers. With increasing urbanization, economic development, and financial inclusion efforts underway in many emerging economies, there is a growing demand for secure cash transportation, ATM services, and cash management solutions.

By expanding their presence in these markets and catering to the unique needs of local businesses and financial institutions, cash logistics companies can tap into new revenue streams and establish themselves as trusted partners in facilitating cash transactions and liquidity management in emerging markets.

Diversification of Service Offerings.

Diversifying service offerings beyond traditional cash logistics services presents an opportunity for cash logistics companies to expand their revenue streams and address evolving customer needs. This may include offering value-added services such as cash processing, currency exchange, and cash recycling solutions.

Additionally, cash logistics providers can explore opportunities in adjacent markets such as e-commerce logistics, last-mile delivery, and supply chain management to leverage their expertise in transportation, security, and logistics. By diversifying their service portfolio, cash logistics companies can enhance their competitiveness, strengthen customer relationships, and capture new growth opportunities in a rapidly evolving business environment.

GLOBAL CASH LOGISTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15.74% |

|

Segments Covered |

By Technology, Service Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Brink's Company, G4S plc, Loomis AB, Prosegur Compañía de Seguridad, GardaWorld, Securitas AB, Cash Logistik Security AG, CMS Cash Management Services, Paragon ID, SIS Group, Fortis Security, Armaguard Group |

MARKET SEGMENTATION ANALYSIS

Cash Logistics Market Segmentation: By Technology

-

Smart Safes

-

RFID and GPS Tracking

-

Biometric Authentication

In the global cash logistics market, smart safes have emerged as the most effective technology solution. Smart safes offer a comprehensive approach to cash management by integrating advanced features such as automated cash counting, authentication, and reporting capabilities. These safes provide real-time visibility into cash levels and transactions, enabling cash logistics companies to optimize cash handling processes, reduce operational costs, and enhance security measures.

With smart safes, businesses can streamline cash deposit and withdrawal procedures, minimize the risk of internal and external theft, and ensure regulatory compliance. The adoption of smart safes continues to grow rapidly as cash logistics providers recognize their ability to deliver efficient, secure, and technologically advanced solutions for managing cash in today's dynamic financial landscape.

Cash Logistics Market Segmentation: By Service Type

-

Cash-In-Transit (CIT)

-

Cash Management

-

ATM Services

-

Vault Outsourcing

Among the various service types in the global cash logistics market, Cash-In-Transit (CIT) services emerge as the most effective solution. CIT services are fundamental to the secure transportation of cash and valuables between locations, providing essential support to financial institutions, retailers, and other businesses that handle cash transactions.

With CIT services, cash logistics companies employ specialized vehicles, trained personnel, and stringent security protocols to ensure the safe and efficient movement of cash from one point to another. This includes cash replenishment for ATMs, cash pickups from retail stores, and interbank transfers.

The effectiveness of CIT services lies in their ability to mitigate the risk of theft, minimize cash shortages, and maintain the integrity of cash assets throughout the transportation process. By leveraging CIT services, businesses can optimize their cash flow management, improve operational efficiency, and enhance overall security measures, making CIT an indispensable component of the cash logistics ecosystem.

Cash Logistics Market Segmentation: By End-User

-

Financial Institutions

-

Retailers

-

Government Agencies

-

Others

Among the diverse end-users in the global cash logistics market, financial institutions stand out as the most effective segment. Financial institutions, including banks, credit unions, and investment firms, rely heavily on cash logistics services to facilitate their daily operations. These institutions require secure and efficient cash management solutions to handle cash deposits, withdrawals, and transfers, ensuring liquidity and operational continuity.

Cash logistics providers offer specialized services tailored to the unique needs of financial institutions, including cash vault management, ATM replenishment, and currency processing. The effectiveness of serving financial institutions lies in the critical role they play in the economy, acting as custodians of monetary assets and facilitating financial transactions for businesses and consumers. By partnering with cash logistics providers, financial institutions can streamline their cash handling processes, reduce operational risks, and focus on delivering value-added services to their customers, making them the cornerstone of the cash logistics market.

Cash Logistics Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The market share of the global cash logistics industry is distributed across various regions, with North America leading the pack at 40%. This dominance is attributed to the region's robust financial infrastructure, high cash circulation, and stringent security standards.

Following closely behind is Europe, capturing a significant 25% share of the market, driven by a mature banking sector and increasing demand for cash management services.

In the dynamic Asia-Pacific region, accounting for 20% of the market share, rapid economic growth, urbanization, and expanding retail markets contribute to the increasing adoption of cash logistics solutions.

South America holds an 8% market share, fueled by the region's growing economy and efforts to combat cash-related crimes.

Lastly, the Middle East and Africa account for 7% of the market share, with investments in modernizing banking systems and improving security measures driving the demand for cash logistics services. Overall, these regional dynamics underscore the global significance of the cash logistics industry and the diverse opportunities and challenges it faces across different geographical areas.

COVID-19 Impact Analysis on the Global Cash Logistics Market:

The COVID-19 pandemic has had a significant impact on the global cash logistics market, reshaping operational strategies and highlighting the industry's resilience amidst unprecedented challenges. With lockdown measures and social distancing protocols in place, cash usage saw a temporary decline as consumers shifted towards digital payments, leading to reduced ATM withdrawals and cash transactions. This decrease in cash circulation posed challenges for cash logistics providers, resulting in lower demand for cash transportation and management services during the peak of the pandemic.

However, the pandemic also underscored the enduring importance of cash as a trusted and reliable form of payment, particularly in times of uncertainty. As economies gradually reopen and cash usage rebounds, cash logistics companies are adapting to new norms by implementing enhanced safety protocols, leveraging technology for contactless transactions, and exploring opportunities for diversification into adjacent markets such as e-commerce fulfillment and last-mile delivery.

Despite short-term disruptions, the long-term outlook for the cash logistics market remains positive, driven by the resilience of cash as a payment instrument and the industry's ability to innovate and adapt to evolving customer needs and market dynamics.

Latest Trends/ Developments:

In the ever-evolving landscape of the cash logistics industry, several noteworthy trends and developments are shaping its trajectory. One significant trend is the increasing adoption of technology-driven solutions to enhance operational efficiency and security. Cash logistics providers are leveraging advancements such as smart safes, RFID tracking, and biometric authentication to streamline cash handling processes, minimize errors, and mitigate risks associated with cash transportation and management. Additionally, there is a growing emphasis on sustainability and environmental responsibility within the industry, with companies exploring eco-friendly alternatives for cash packaging, transportation, and disposal.

Another notable development is the rising demand for integrated cash management solutions that offer end-to-end visibility and control over cash flows. These solutions encompass cash processing, forecasting, and optimization, enabling businesses to optimize their cash holdings, reduce costs, and improve liquidity management.

Furthermore, the COVID-19 pandemic has accelerated the digital transformation of the cash logistics sector, spurring investments in contactless payment technologies, remote monitoring capabilities, and cloud-based platforms to support remote workforce management and real-time decision-making. As the industry continues to evolve, cash logistics providers are embracing innovation and collaboration to address emerging challenges and capitalize on new opportunities in the dynamic and ever-changing cash ecosystem.

Key Players:

Chapter 1. Cash Logistics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cash Logistics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cash Logistics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cash Logistics Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cash Logistics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cash Logistics Market – By Technology

6.1 Introduction/Key Findings

6.2 Smart Safes

6.3 RFID and GPS Tracking

6.4 Biometric Authentication

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Cash Logistics Market – By Service Type

7.1 Introduction/Key Findings

7.2 Cash-In-Transit (CIT)

7.3 Cash Management

7.4 ATM Services

7.5 Vault Outsourcing

7.6 Y-O-Y Growth trend Analysis By Service Type

7.7 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 8. Cash Logistics Market – By End-User

8.1 Introduction/Key Findings

8.2 Financial Institutions

8.3 Retailers

8.4 Government Agencies

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Cash Logistics Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.3 By Service Type

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology

9.2.3 By Service Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology

9.3.3 By Service Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology

9.4.3 By Service Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology

9.5.3 By Service Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cash Logistics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Brink's Company

10.2 G4S plc

10.3 Loomis AB

10.4 Prosegur Compañía de Seguridad

10.5 GardaWorld

10.6 Securitas AB

10.7 Cash Logistik Security AG

10.8 CMS Cash Management Services

10.9 Paragon ID

10.10 SIS Group

10.11 Fortis Security

10.12 Armaguard Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for Cash Logistics was estimated to be worth USD 20 billion in 2023 and is expected to increase to USD 55.64 billion by 2030, with a projected compound annual growth rate (CAGR) of 15.74% from 2024 to 2030.

The primary drivers of the global cash logistics market include the continued reliance on cash for transactions, expansion of banking and retail sectors, and increasing concerns regarding security and regulatory compliance.

The key challenges facing the global cash logistics market include the decline in cash usage, increasing competition from digital payment alternatives, regulatory complexities, and security risks associated with cash transportation and management.

In 2023, North America held the largest share of the global cash logistics market.

Brink's Company, G4S plc, Loomis AB, Prosegur Compañía de Seguridad, GardaWorld, Securitas AB, Cash Logistik Security AG, CMS Cash Management Services, Paragon ID, SIS Group, Fortis Security, Armaguard Group are the main players.